Favorably utilized by Binance just after the “drop” of BUSD, the marketplace capitalization of FDUSD has constantly improved. However, the degree of reliance on a CEX exchange and the lack of an on-chain presence make the local community not also “salty” with this stablecoin.

FDUSD capitalization has improved by 51% in thirty days, practically “squeezing” amongst the major ten stablecoins

FDUSD capitalization has improved by 51% in thirty days, practically “squeezing” amongst the major ten stablecoins

While the rest of the marketplace has not noticed also numerous fluctuations, the stablecoin section continuously attracts awareness with a whole lot of competitors amongst rivals.

In addition to Binance’s choice to finish BUSD, there is also the exchange’s “clear” preference for the new stablecoin, First Digital USD (FDUSD).

And as a required consequence, the marketplace capitalization of FDUSD continues to increase, progressively gaining the marketplace share that BUSD is dropping.

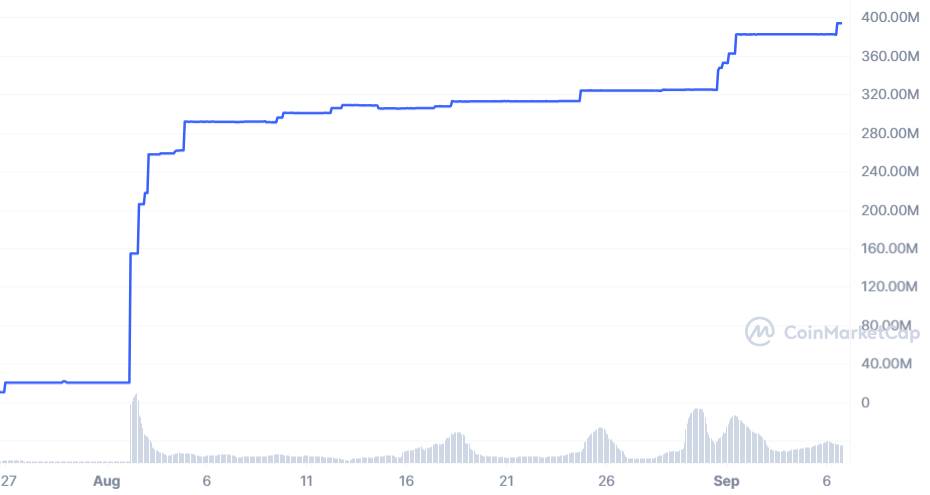

Market capitalization of FDUSD from inception to date. Source: CoinMarketCap

Market capitalization of FDUSD from inception to date. Source: CoinMarketCap

According to information from CoinGeckothe capitalization of FDUSD has 51% maximize. in the final thirty days, registered to 394 million bucks. Put aside this emerging stablecoin eleven total array or hectic .32% marketplace share pie.

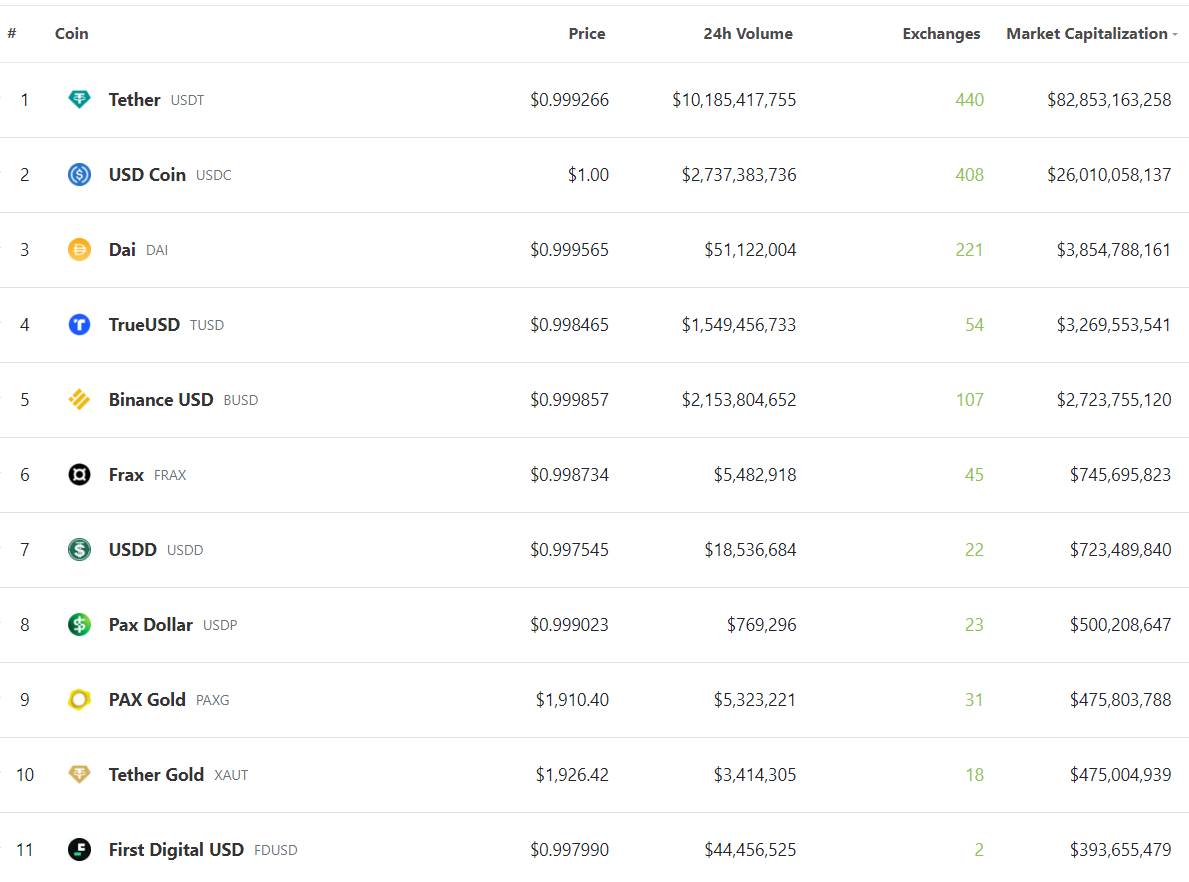

The greatest stablecoins by marketplace capitalization. Source: CoinGecko

The greatest stablecoins by marketplace capitalization. Source: CoinGecko

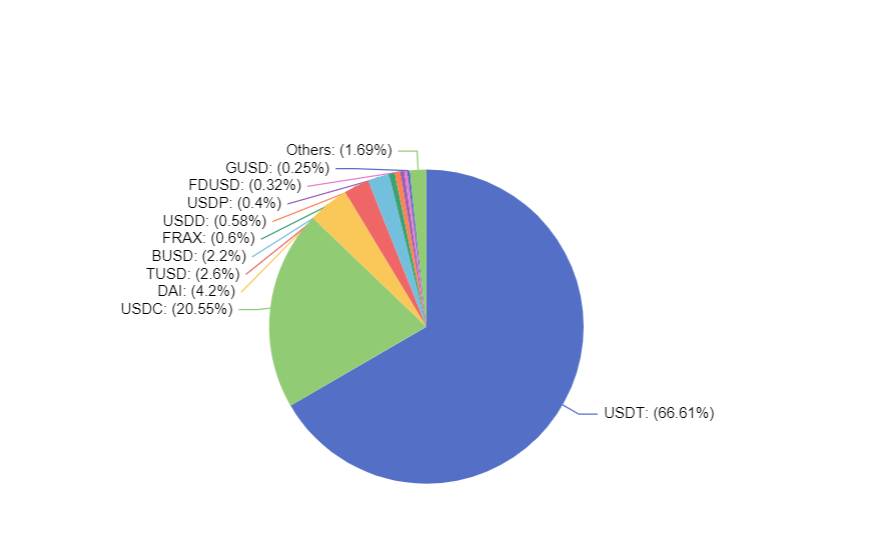

Market share of stablecoins. Source: DefiLlama

Market share of stablecoins. Source: DefiLlama

Naturally, the title occupying the initially place is Tether (USDT) with a capitalization of $82.eight billion, far more than three instances that of the 2nd location, USDC.

Although there are constantly numerous doubts about transparency, Tether appears to be ahead of the stablecoin game when it constantly receives optimistic information, this kind of as a revenue of more than $one billion in the 2nd quarter of 2023, currently being a single of the greatest holders of BTC. Treasuries are the 22nd greatest in the planet.

Meanwhile, USDC is also searching to regain its momentum by expanding to six new blockchains together with Optimism, Base, Polygon PoS, Polkadot, Close to, and Cosmos in September and October to maximize utilization.

Returning to FDUSD, regardless of its capitalization currently being in the major eleven, it is practically totally centered on Binance and has no on-chain presence. Analyst Martin Lee of Nansen recognize:

“There are more 90% The supply of FDUSD is held on Binance with no physical presence in DeFi or any on-chain application. Nothing really exciting at this point.”

Being absolutely dependent on this kind of a centralized exchange considerably diminishes the status of FDUSD. It is challenging for the local community to location their believe in and assets in a stablecoin that can only be utilized on CEX. If withdrawn into a wallet to be utilized on DEX or DeFi, the loan is practically “worthless”.

Therefore, the FDUSD issuer requires to even further boost the performance of its product or service to adapt to the continuously transforming atmosphere of the international cryptocurrency marketplace.

Coinlive compiled

Join the discussion on the HOTTEST troubles of the DeFi marketplace in the chat group Coinlive Chats with the administrators of Coinlive!!!