The Fed announced to hike curiosity prices by .25%, temporarily not transforming the hike when the US is dealing with the possibility of a banking crisis, assisting Bitcoin to sharply climb.

The most latest US Federal Reserve (Fed) curiosity price hike was .25%, with the price of raise unchanged from the January adjustment.

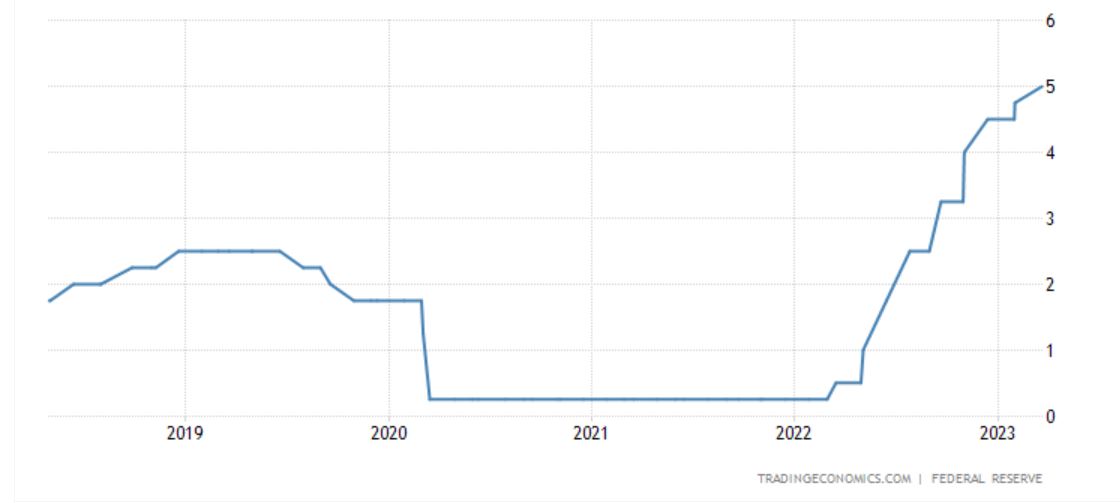

The latest Fed curiosity price is five%, four.five% greater than this time final yr, and also the highest curiosity price considering that the 2008 monetary crisis.

With the most recent developments, US monetary watchers count on the target curiosity price at the finish of 2023 to be just five.one% and four.three% in 2024, indicating that the time period of curiosity price hikes may well be drawing to a near. .

With the US dealing with the possibility of a crisis in the banking sector immediately after the collapse of three main banking institutions this March (Silvergate, Silicon Valley, Signature), observers have concluded that the Fed is underneath stress. to management US inflation.

The Fed has also pumped up to $300 billion much more into the US monetary process in the previous week to shore up liquidity, foremost quite a few to feel that the time period of quantitative tightening is above or at least stopped.

At the exact same time, US inflation noticed its eighth consecutive month of decline in February 2023, falling to its lowest degree considering that November 2021 at six%, but nevertheless over the Fed chairman’s two% target.

Bitcoin has benefited enormously from the latest macro uncertainty, surging 37% considering that mid-March and continuing to hit new 2023 highs. BTC on the evening of March 22 surged from $28,200 to a new 2023 higher at $28,868 and it now hovers about $28,600.

The Fed will have much more curiosity price changes in 2023 on May four, June 15, July 27, September 27, October or November, and December 14 (Vietnam time).

Synthetic currency68

Maybe you are interested: