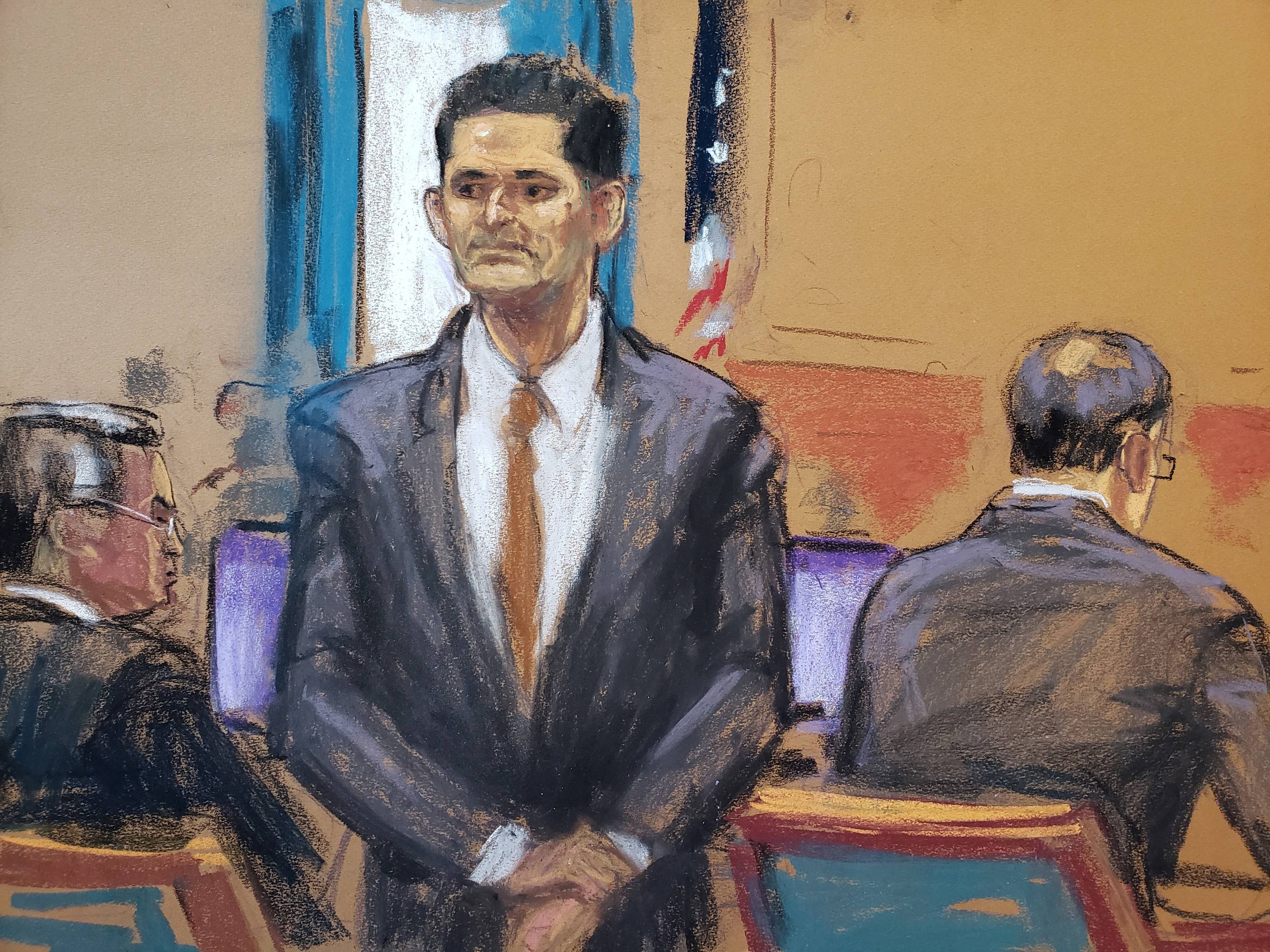

The trial of former FTX CEO Sam Bankman-Fried is steadily coming to a shut with last arguments amongst the plaintiff and the defendant.

After concluding the three-week witness interrogation, with the final witness Sam Bankman-Fried, the trial towards the former CEO of FTX enters the last statements and discussions amongst the prosecutor, the member of the Department of Justice of the United States and the defense lawyer.

Statement from the public prosecutor

Opening the 17th day of the trial, the US Department of Justice prosecutor summarized the proof and witness testimonies collected in current days, so convincing the jury that seven counts of fraud had been committed and that the alleged fraud to Sam Bankman-Fried is accurate. .

The prosecutor stated that Sam Bankman-Fried, in testifying, “created a new story and lied to the court.” The consequence of the defendant’s “pyramid built on lies and false promises” was that “billions of dollars of FTX customer assets were lost.”

The prosecutor repeatedly reminded the court of 3 issues the jury must bear in mind when seeking back on the situation, namely “where did the money go?”, “what happened?” and “who is responsible?”. After examining all the proof and listening to testimony, the prosecution confidently stated that Sam Bankman-Fried was the man or woman behind almost everything, accountable for the collapse of the FTX exchange. Sam Bankman-Fried is the head of each FTX and Alameda Research, is the direct selection maker and has entry to within facts.

The prosecutor also highlighted Sam Bankman-Fried’s “duplicity” in the course of court testimony. The former FTX CEO typically applied the phrase “I don’t remember, I don’t know” when questioned by the prosecutor, but was in a position to react in detail and plainly when asked by his defense attorney.

“He made up a different story,” the prosecutor stated. To feel this we should discard all the proof brought to court.”

The prosecutor also advised the jury 6 instances that Sam Bankman-Fried abused his energy to support Alameda Research acquire trading privileges at FTX and then withdrew consumer money, just about every time sinking each firms deeper into depth. That dollars is then applied to invest and commit up to billions of bucks well worth.

Other details crucial to the former FTX CEO’s criminal actions highlighted in court have been the truth that Sam Bankman-Fried ordered the withdrawal of FTX consumer money to repay Alameda’s debt when the cryptocurrency industry collapsed in June 2022, as properly as producing economic statements that falsify information to hide investment fund losses.

Finally, in the days ahead of the collapse of FTX, Sam Bankman-Fried reassured end users that almost everything was fine, in spite of being aware of complete properly that his platform no longer had adequate liquidity to satisfy their clients’ withdrawal requests.

The statements of the defense attorney

Sam Bankman-Fried’s defense lawyer opened his client’s defense by implying that the plaintiff was intentionally portraying the former FTX CEO as a “Hollywood movie villain” by striving to coordinate the trial in an unfavorable route of the law for this man or woman.

The attorney stated that the accusation that FTX has engaged in fraudulent and deceptive habits due to the fact its early days is incorrect. The attorney admitted that the space must have had a lot more productive chance management mechanisms, but assured that all of Sam Bankman-Fried’s actions and choices have been based mostly on “good intentions” and wished to refute them all. The crime was blamed on him. The attorney stated that even proof that the prosecution viewed as constituted the most egregious criminal act, this kind of as the truth that FTX gave Alameda a $65 billion lending restrict and had a detrimental account, was all designed for business functions and to serve clients. without having damaging them.

The defense lawyer then pointed out inconsistencies in the testimony of essential witnesses named by the prosecution, like former Alameda CEO Caroline Ellison, former FTX CTO Gary Wang and former Chief Technical Officer Nishad Singh. According to the attorney, all of these folks have confessed to the US government and have purpose to give unfavorable testimony to Sam Bankman-Fried in hopes of in search of clemency.

Another argument raised is that if Sam Bankman-Fried was the mastermind of the fraud and deception in Alameda, then why in the proof presented by the very same prosecutor was the former CEO of FTX the to start with man or woman to propose that the fund ceased operations, both for the reason that Sam constantly appeared in the media, agreed to testify ahead of the US Congress, or even did not run away with the dollars but nonetheless paid the debt to Alameda’s creditors.

The defense lawyer concluded the defense by stating that the errors produced by Sam Bankman-Fried could be viewed as unforeseen dangers in the small business procedure.

“Sam did his very best to concurrently deal with two enterprises well worth tens of billions of bucks in a fully new area. Some choices operate properly, even though some others never.

The defense asked the jury to come across that Sam Bankman-Fried acted with “good intentions” even though operating FTX and Alameda, and hence could not be charged with fraud and racketeering. FTX’s downfall was due to miscommunication, mistakes and delays, rather than fraud and fraud.

According to journalists current at the trial, Sam Bankman-Fried was “almost in tears” as his defense attorney produced his last statements.

After hearing arguments from the prosecutor and defense attorney, the twelve-member jury is anticipated to hold a closed-door discussion on November two to make your mind up which side is proper and which side is incorrect, and then concern a verdict on the state of the situation. ‘defendant. Bankman-fried.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi industry in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!