Finbloxa crypto financial savings platform for emerging markets, closed a $ three.9 million seed round to simplify the creation of crypto assets in extra than a hundred markets.

So far the task has been invested by quite a few huge firms this kind of as Sequoia Capital India, Dragonfly, Three Arrows Capital, OrangeDAO, Saison Capital, Venturra Discovery …

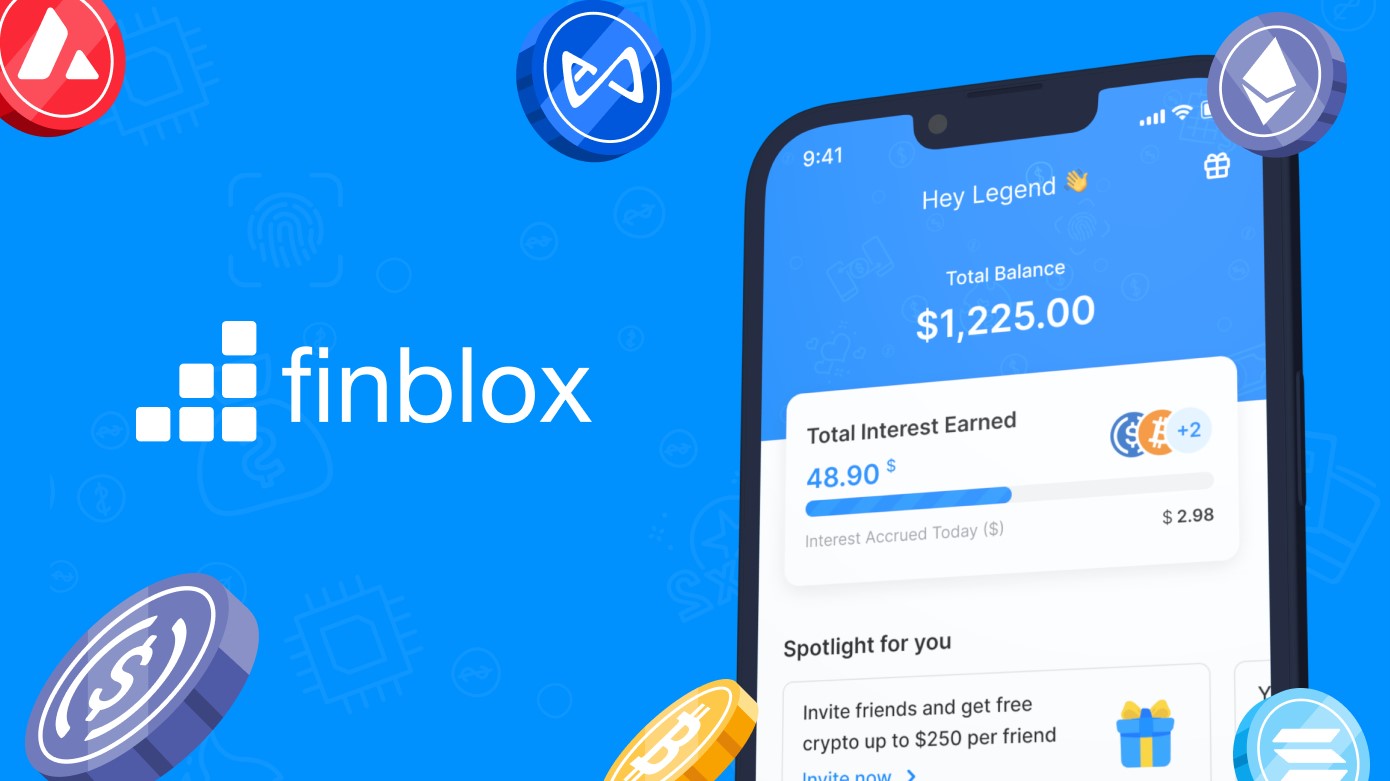

Unlike other platforms, Finblox focuses on supplying uncomplicated and safe accessibility to stablecoins and cryptocurrencies in emerging markets this kind of as Axie Infinity and Polygon. The platform lets customers to passively revenue from their assets and does not demand a minimal stability or withdrawal time.

Strategic traders like fintech and crypto money this kind of as Dragonfly Capital, Sequoia Capital India, Three Arrows Capital, Saison Capital, MSA Capital, Coinfund, Venturra Discovery, Kyros Ventures, First Check Ventures, Ratio Ventures, founder of Coins.ph Ron Hose, Xfers founder Tianwei Liu and other angelic traders.

The money raised will be employed to accelerate the advancement of the platform, like the recruitment of technical and products advancement teams. A important portion of the funding will also be employed to accelerate regulatory compliance processes, advertising and marketing initiatives and consumer coaching.

Rising inflation and very low curiosity costs on financial institution deposits have had a good impact on cryptocurrencies about the planet, reaching more than 880% in 2021 alone. Vietnam, India, Philippines, Brazil and other emerging markets ranked amongst the highest in the international cryptocurrency adoption index final yr. However, only a compact portion of the world’s population is exposed to cryptocurrencies. This is a big development possibility for crypto applications like Finblox in emerging economies.

The platform was launched in December 2021 and is readily available to customers in extra than a hundred nations. The variety of assets managed by Finblox has quadrupled because the starting of 2022 and 90% of registered customers come mostly from emerging economies, particularly Southeast Asia. Finblox customers can earn 15% yearly curiosity on USD Coin, a USD pegged stablecoin. The app also gives returns of up to 90% on other flagship cryptocurrencies this kind of as Bitcoin, Ethereum, Solana, Avalanche, and Axie Infinity.

Finblox was founded in May 2021 by Peter Hoang and Dmitriy Paunin. Peter was co-founder of the Singapore-based mostly Gotrade app. Dmitriy Paunin was previously Chief Technology Officer of Coins.ph, the greatest cryptocurrency exchange in Southeast Asia based mostly in the Philippines with more than sixteen million customers.

Peter Hoang, co-founder and CEO of Finblox mentioned: “Our vision is to assist one billion customers improve their passive revenue with cryptocurrency. Finblox lets people today from more than 180 nations to very easily participate in cryptocurrency investments by developing a lucrative products for traders who hold extended-phrase assets. Finblox’s principal purpose is to construct a present day and very easily available products to assist customers accumulate extended-phrase wealth and construct a economic basis for their potential. ”

Your assets will be protected by Fireblock Inc.a digital asset custodian that holds SOC two Class II certification for financial institution-grade protection.

With intensive knowledge in data protection in the area of fintech, Finblox has created a platform that can resolve most of the difficulties clients may well experience when making use of cryptocurrencies. Finblox sets itself apart from its rivals in the sector thanks to its chance management course of action based mostly on global specifications (this kind of as ISO-27001, PCI-DSS). Additionally, Finblox normally chooses to companion with the world’s top firms to assure protection and offer clients with a assortment of distinct cryptocurrencies.

Mia Deng, companion of Dragonfly Capital shared: “Southeast Asia has turn out to be a single of the most dynamic markets in the previous yr, but the products infrastructure is nonetheless restricted to help quickly rising demand. We feel that what Peter and Dmitriy are creating in Finblox will make a big contribution to cryptocurrencies in Southeast Asia.

“Chris Siris, Partner of Saison Capital, mentioned: “In emerging areas like Southeast Asia, it is vital that wealth management options align with buyer conduct – that is Finblox. Peter and Dmitriy are founders with a extended track record in each common fintech and cryptocurrency and have proven they know what can drive market place good results.

About Finblox

Finblox is a startup task with workers from Vietnam, Russia, Indonesia, Hong Kong and Singapore. Finblox’s core products is a very simple and safe application that lets customers to passively revenue from cryptocurrencies. The title Finblox is inspired by the phrases “Financial” and “Blockchain”, reflecting the worth that the task desires to deliver to clients searching for a steady supply of revenue from cryptocurrencies in a way, the easiest and safest. Finblox is at this time supported by quite a few top organizations in the sector this kind of as Sequoia, Coinfund, MSA, Venturra, Saison …

Find out extra about Finblox right here: Website | Telegram | Twitter | Instagram | Facebook

Maybe you are interested:

Note: This is sponsored articles, Coinlive does not right endorse any data from the over report and does not promise the veracity of the report. Readers must perform their very own analysis prior to producing selections that have an impact on themselves or their firms and be ready to consider obligation for their very own alternatives. The over report must not be viewed as investment information.