What is the Fi Training Project (FORM)?

Training Fi is an asset administration system that enables customers to take part in investments by means of Formation Fi methods to maximise returns and reduce danger in accordance with their wants, private danger preferences, protocol platform referred to as Risk Parity Protocol.

A set of encrypted index, algorithmic rollover affords an open and democratized strategy to constructing a risk-adjusted cryptocurrency portfolio.

Users personal their very own mixture of consultant index token for various property throughout a number of chains, lowering danger and saving money and time.

Risk Equality Protocol

Risk Parity is a portfolio allocation technique that makes use of danger calibration to find out a balanced allocation between the completely different parts of a portfolio. Risk parity was launched by a number of the largest hedge funds on the planet and has been used to handle and develop tons of of billions of {dollars} of portfolios with nice success.

To convert the Risk Parity strategy into crypto and DeFi, it’s important to first decide which components underlie this technique and whether or not they are often replicated in an algorithmic and decentralized means.

The most well-known and profitable danger portfolio was designed by Ray Dalio, founder and CIO of Bridgewater Associates, the most important hedge fund on the planet. He calls his fund All Weather as a result of it’s designed to achieve success in all circumstances.

Risk Equality Strategy Design Principles, you’ll be able to learn extra right here: https://docs.formation.fi/introduction/risk-parity

Training methods Fi.

By adapting three core rules from Bridgewater’s All Weather to the Yield Farming setting, the Risk Parity Protocol gives 4 kinds of cross-chain Yield Farming methods within the type of the next co-indices:

- ALPHA is an index token that represents aggressive yield breeding methods with liquidity extraction applications with the most effective performing protocols on the primary networks. Alpha property are high-growth, high-risk tasks. The protocol makes use of modest leverage to extend productiveness within the bullish cycle.

- BETA is an index token representing market indices designed to trace main Web3 infrastructure tasks in key segments reminiscent of DeFi (Loan / Loan, DEX, Derivatives, Asset Management). ), Layer 1 and a pair of venture, open knowledge market, oracles, AI and storage on giant mạng networks

- RANGE is an index token that generates a considerable month-to-month revenue. They are sometimes based mostly on stablecoins positioned in the most effective lending protocols on the primary networks. This produces stable and predictable income with no influence on money extraction.

- EQUALITY is an index token that tracks a balanced and risk-adjusted portfolio of ALPHA, BETA and GAMMA throughout the network to create APYs which can be higher protected against environmental modifications. It is the kind of portfolio yield farming technique, the place you let the robotic advisor handle your portfolio throughout all financial seasons (rise, fall, growth and contraction). It focuses on long-term progress. It could have each somewhat leverage to extend returns and a few perpetual futures and hedging choices.

How to make use of Training Fi

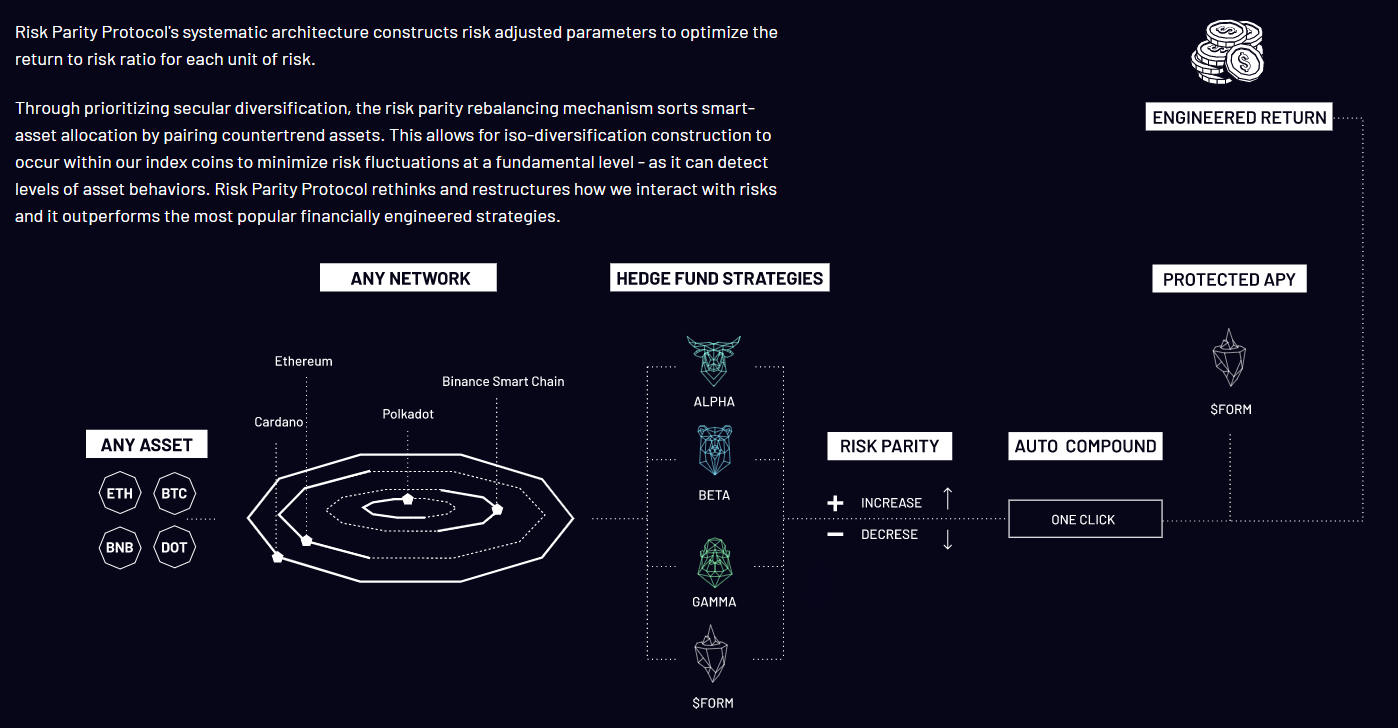

The systematic structure of the Risk Parity Protocol is constructed risk-adjusted parameter for optimize the danger return per unit of danger.

By prioritizing portfolio diversification, the danger rebalancing mechanism intelligently organizes asset allocation for affiliate property with reverse tendencies. This permits iso-diversification in index currencies to reduce danger volatility on the elementary stage, as it might probably detect asset habits ranges.

The Parity Risk protocol revisits and refactoring the best way we work together with danger and surpasses essentially the most generally designed monetary methods.

Currently, the platform has not launched the applying, please comply with the venture for updates within the close to future

Roadmap

First quarter of 2021

- Tokenomics

- White paper

- Website launch (beta model)

Second quarter of 2021

- ERC-20. sensible contract token

- Smart contract indexing

- Presale and strategic sale

- Create a group on Telegram and Twitter

- Security audit

- BSC. Bridge growth

- IDO / LBE (TGE and Uniswap checklist)

third quarter 2021

- Token trade perform between networks

- ALPHA launches ERC + BSC

- Liquidity provision occasion

- Develop administrative options

- Development of the HECO chuỗi chain bridge

- Listing on a centralized inventory trade

Quarter 4/2021

- Add the HECO chain to ALPHA

- BETA launched on ERC + BSC + HECO

- Development of the POLYGONG chain bridge

- Listing on a centralized inventory trade

1st quarter 2022

- Added POLYGON to ALPHA and BETA

- GAMMA launches ERC + BSC + HECO + POLYGON

- Integration of the MoonBeam chain

- Listing on a centralized inventory trade

2nd quarter 2022

- Added MoonBeam to ALPHA, BETA and GAMMA

- PARITY is launched on ERC + BSC + HECO + POLYGON + MB

- New growth of bridges on the nối chain

- Listing on a centralized inventory trade

What is the Fi Training Token (FORM)?

The Fi Training (FORM) issued by the Parity Risk Protocol is predicted for use for the next functions:

- Director’s vote: The house owners of tFORM vote on the funds proposals for the 12 months.

- Staking + Cash extraction: FORM rewards customers for depositing to goal as digital property to mint Alpha, Beta, Gamma and Parity and trade numerous index cash.

- Dark swimming pools: FORM affords entry to funding liquidity swimming pools, crowdsourcing swimming pools to incubate and finance essentially the most promising new DeFi tasks.

Some primary details about the Training Fi (FORM) token

- Token title: Training Fi Token

- Ticker: MODULE CODE

- Blockchain: Ethereum

- Standard tokens: ERC20

- Contract deal with: updating

- Circulation provide: updating

- Total provide: 1,000,000,000 FORM

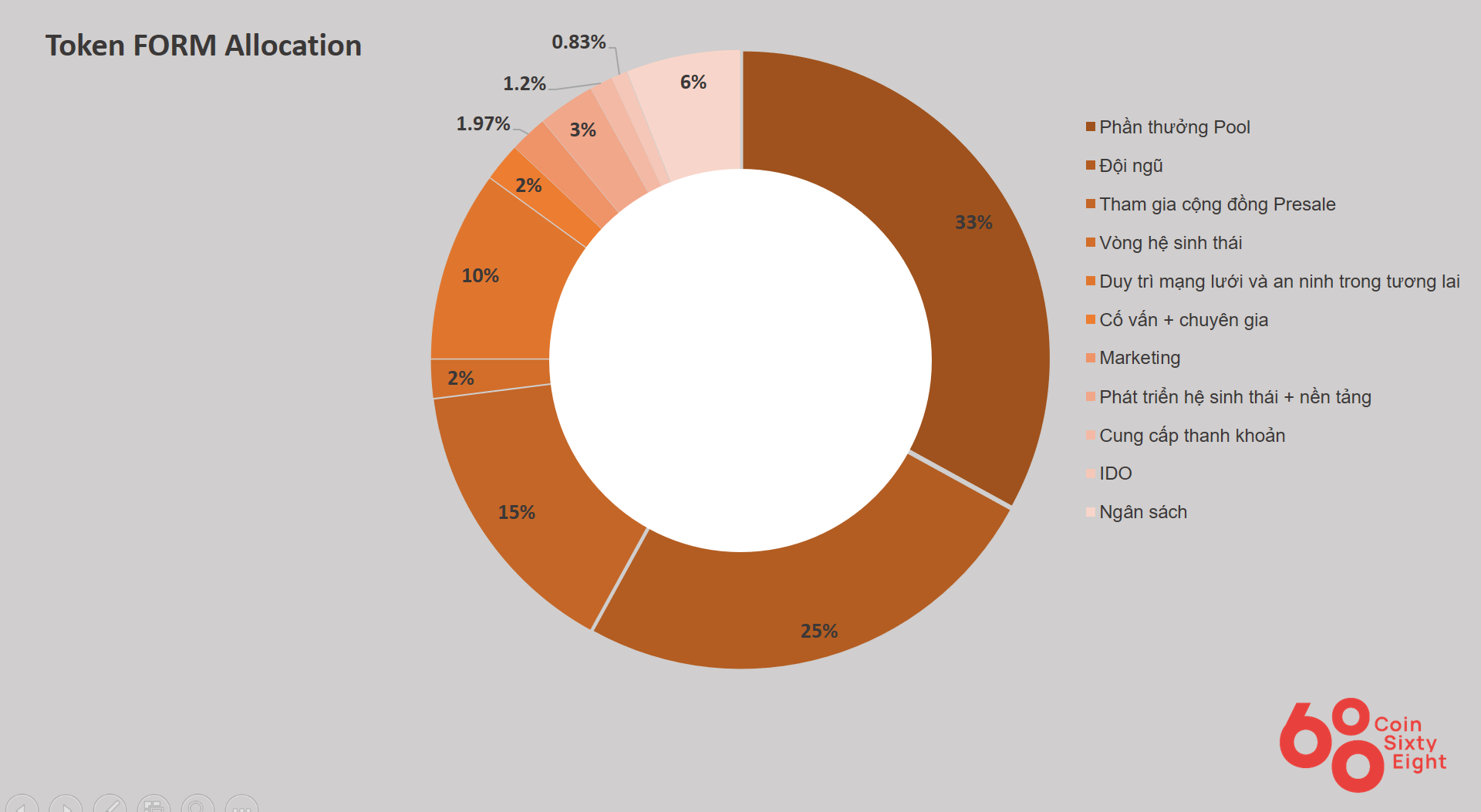

Training Fi Token Assignment (FORM)

- Pool Rewards: 33%

- Team: 25%

- Join the presale group: 15%

- Ecosystem circle: 2%

- Maintain the network and future safety: ten%

- Consultant + professional: ten%

- Marketing: 1.97%

- Ecosystem and platform growth: 3%

- Provide liquidity: 1.2%

- I WANT IT: 0.83%

- Balance: 6%

- Inflationary: Expansion of the supply by 2% per 12 months after the discharge of the 250,000,000 FORM token

- The remaining 70% can be launched algorithmically over the subsequent 5 years

- After the issuance of 250 million FORM tokens, 2% routinely per 12 months can be algorithmically launched endlessly. This may be topic to a group vote

Use the method:

- 65% for technical and industrial growth

- 15% for advertising

- 15% for authorized

- 5% per exercise

Fi Training Project Development Team (FORM)

Currently the venture staff remains to be nameless, particulars can be up to date within the close to future

Partners and buyers

Earn and personal Formation Fi (FORM) tokens

FORM is at present trading on the Kucoin trade. The easiest way is to create an account to trade on this trade.

Formation Fi (FORM) Token Storage Wallet

FORM is ERC-20 normal token, you’ll be able to retailer two common wallets right now:

- Metamask pockets

- Trusted portfolio

- Coin wallet98

Formation Fi is a DeFi software that manages on-chain sources by means of algorithms, methods constructed by the mechanism of Ray Dalio, founder and CIO of Bridgewater Associates, the most important hedge fund on the planet. With Parity Risk Protocol permitting index token holders as a substitute of getting to handle property strategically. Now all administration duties are easy, danger discount and reimbursement are protected. All data on this article is researched by Coinlive and doesn’t represent funding recommendation. Coinlive will not be chargeable for any direct and oblique dangers. Good luck!

.