Project Notional (NOTE) what?

notional is a protocol on Ethereum with two merchandise Lending and Borrowing for crypto-assets that use a fixed curiosity charge (Fix-charge), with a fixed maturity by means of a new monetary instrument known as fCash.

In the 3 months due to the fact its launch in mid-January 2021, the protocol has been a big achievement, attracting above $ 17 million into TVL and generating a $ ten million loan.

What is fcash?

fCash presents Notional consumers with a uncomplicated and dependable mechanism to commit to transferring worth at particular occasions in the potential. FCash transactions permit consumers to effectively move worth back and forth in time. This versatility opens up a new dimension in the monetary style and design room on Ethereum.

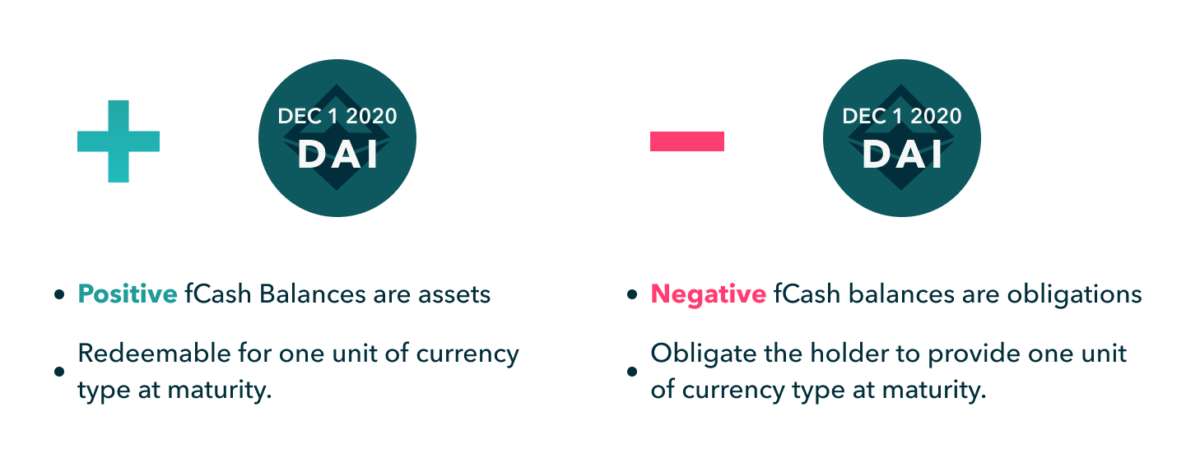

The fCash tokens are the creating blocks of the Notional technique. fCash are transferable tokens that signify a demand for favourable or unfavorable income movement at a particular time in the potential.

FCash tokens are constantly developed in pairs: assets (assets) and liabilities (liabilities). The complete of assets and liabilities ought to constantly be in the notional technique.

FCash tokens are constantly developed in pairs: assets (assets) and liabilities (liabilities). The complete of assets and liabilities ought to constantly be in the notional technique.

Liquidity Pool – (Liquidity Pool / Pool)

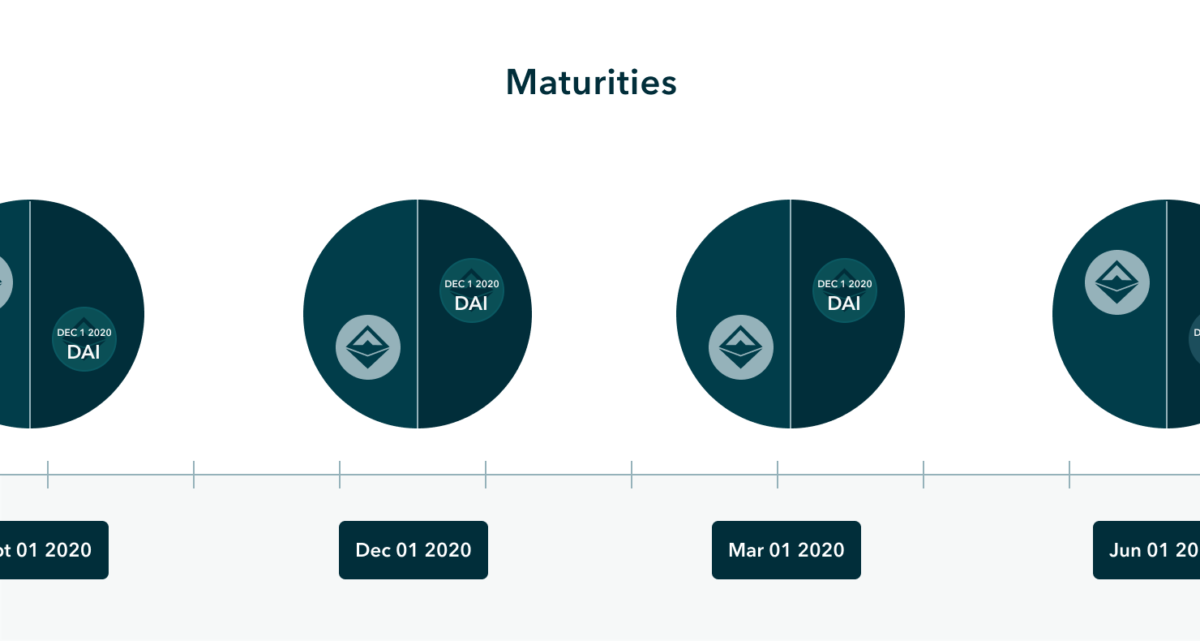

Notional tends to make fCash tokens out there for trading in its AMM-enabled integrated liquidity pools. A Liquiditiy Pool consists of fCash and its currency (eg Dai and fDai). Cash pool refers to maturity: one December 2020 Pools hold fCash on one December 2020.

Deadlines – Maturity time

The payment time period of the liquidity pools at a provided time is topic to the settings of the administrative parameters. For instance, a quarterly pool will expire every single three months.

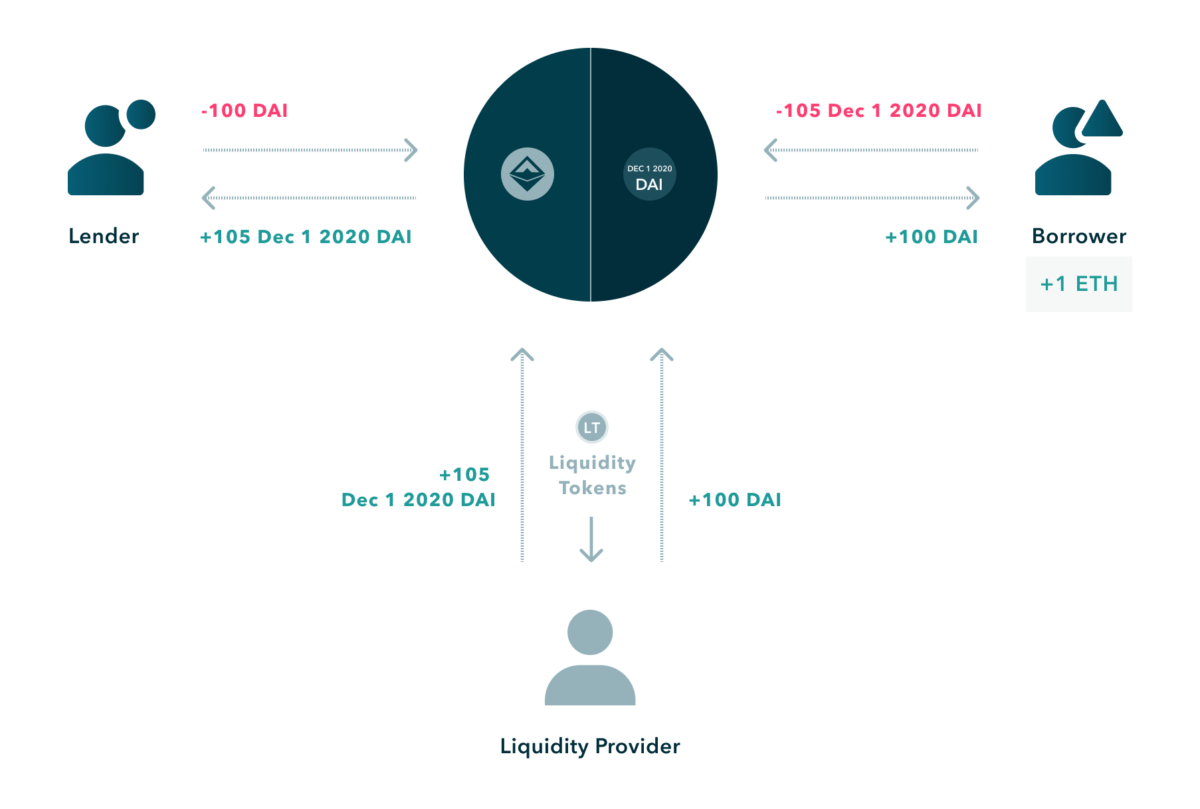

Three sorts of consumers interact with Liquidity Pool: lenders, borrowers, and liquidity suppliers. Lenders deposit DAI tokens in the Pool and acquire fDai tokens (as a dedication to acquire a fixed sum of DAI at a potential date). Borrowers get the DAI token from the pool and aim for the fDai token (the guarantee to shell out a fixed sum to Dai at a potential date). The liquidity supplier adds Dai and fDAI linked to December one, 2020 to the pool which can be loaned or loaned by each events.

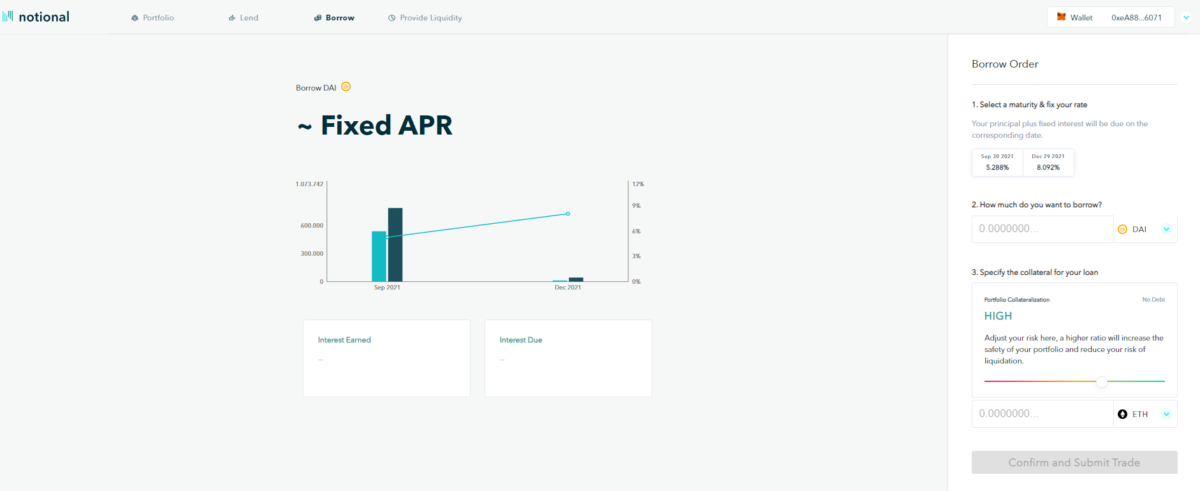

loan

Users who want to lend their currency at a fixed charge can acquire fCash. Lenders exchange their currency at the time of the transaction for a fixed sum higher than that currency at a particular time in the potential. The exchange charge acquired by the consumer implies a fixed curiosity charge on the loan involving the time of the transaction and the maturity of his income.

For instance, a loan provider lends a hundred DAI to a income pool at a fixed charge of five% for three months. Upon loan maturity on December one, 2020, the loan of a hundred DAI plus a fixed curiosity charge of five DAI will be returned to the loan provider.

borrow

Users who want to borrow at a fixed charge have their fCash mint token and promote it for the currency. By promoting fCash in exchange for currency, the borrower receives the currency in exchange for an obligation to repay a fixed sum of the currency at a specified time in the potential.

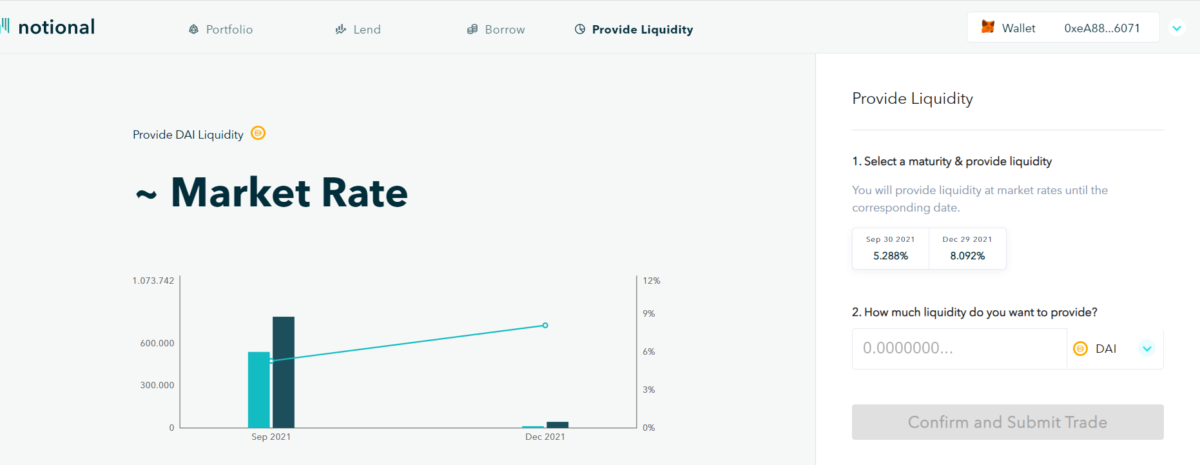

Liquidity supplier

Liquidity suppliers leverage Notional’s liquidity pools. They contribute currency and fCash to liquidity pools and act as a counterparty for lenders and borrowers lively on the protocol. In exchange for their contribution, liquidity suppliers earn commissions every single time a loan provider or borrower trades involving the currency and fCash.

What is the notional token (NOTE)?

NOTE is the token of the Notional platform, it plays a function in the governance of the platform. Note holders will have total management of the on-chain treasury / spending budget, the threat and ensure parameters of the protocol and any updates to the intelligent contract.

In the quick phrase, the group will temporarily keep the technique shutdown perform to manage emergencies.

Some primary details about the token NOTE

- Token title: notional

- Ticker: NOTE

- Blockchain: Ethereum

- Standard tokens:

- Contract deal with:

- Circulation provide: updating

- Total provide: a hundred,000,000 NOTE

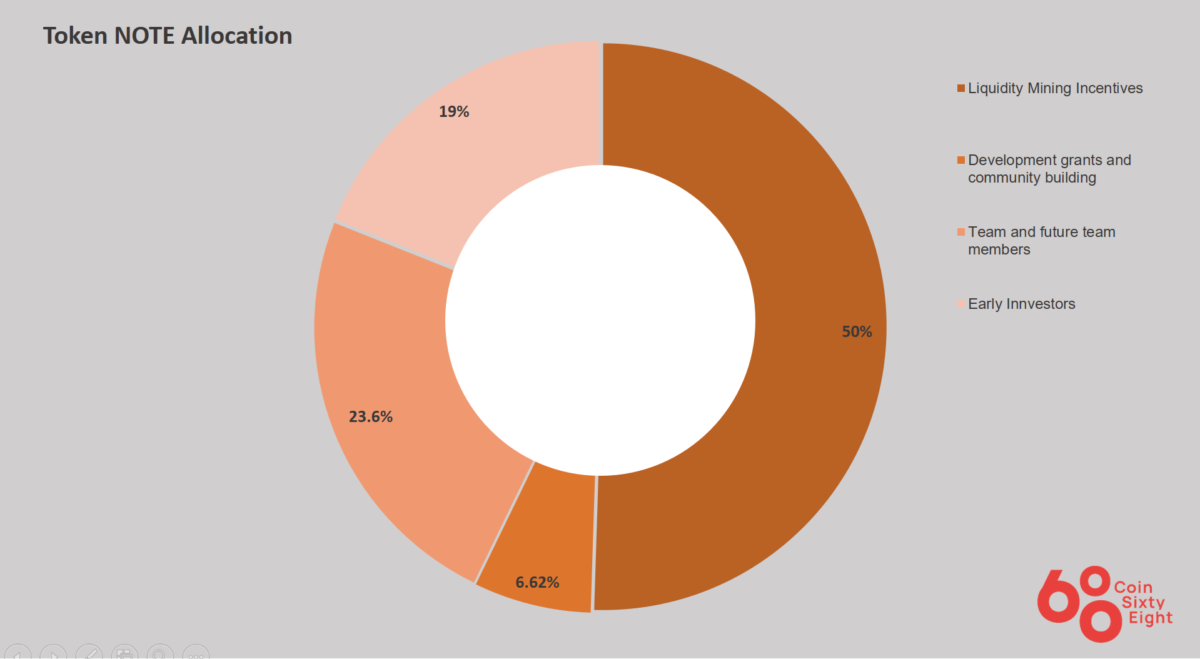

Notional Token Allocation (NOTE)

The complete provide of a hundred,000,000 NOTES is distributed as follows:

- Liquidity incentives (Liquidity incentive): 50,000,000 (50%)

- Community Development and Building Grants (Funding for neighborhood growth and building): six,620,000 (six.62%)

- Team and potential group (Future group and group): 23,600,000 (23.six%)

- First traders (First traders): 19,780,000 (19.78%)

Airdrop plan:

All consumers who have borrowed, lent or offered liquidity in an sum higher than or equal to 50 DAI / USDC at 00:00 GMT on July 4th 2021 (e.g. seven:00 Vietnam) will be capable to acquire it. NOTE.

This airdrop will signify .75% of the complete NOTE sources and will come from a neighborhood creating allocation. Airdrop principle

- The earlier consumers interact with Notional, the a lot more they contribute to the achievement of the undertaking and the a lot more they are rewarded. We decide that consumers who initially use the protocol in October 2020 will acquire 3 occasions a lot more airdrop assignments than these who initially use the protocol in July 2021.

Investors

Notional Finance not too long ago closed a $ ten million Series A funding round from institutional traders, led by Pantera Capital with participation from Parafi Capital, 1Confirmation, Spartan Group, Nascent, Nima Capital and other people.

Where to obtain and promote notional tokens (NOTE)?

Currently consumers join the Airdrop plan as described over to earn NOTE tokens. No particular details on the listing but.

Notional Token Storage Wallet (NOTE)

NOTE is an ERC-twenty typical token capable of storing most of today’s typical wallets this kind of as Metamask Wallet, Trust Wallet, ..

In the potential of Notional (NOTE), ought to I invest in NOTE coins?

notional is a fixed charge loan application, with a duration of up to numerous many years and very low curiosity charges to minimize the threat for borrowers when the cryptocurrency industry usually has huge rate fluctuations. Currently the platform supports two sorts of tokens DAI and USDC, 1 issue is that the Ethereum network is really high priced so it is not ideal for microloans, it is much better for huge loans. All details in this write-up is researched by Coinlive and does not constitute investment guidance. Coinlive is not accountable for any direct and indirect hazards. Good luck!