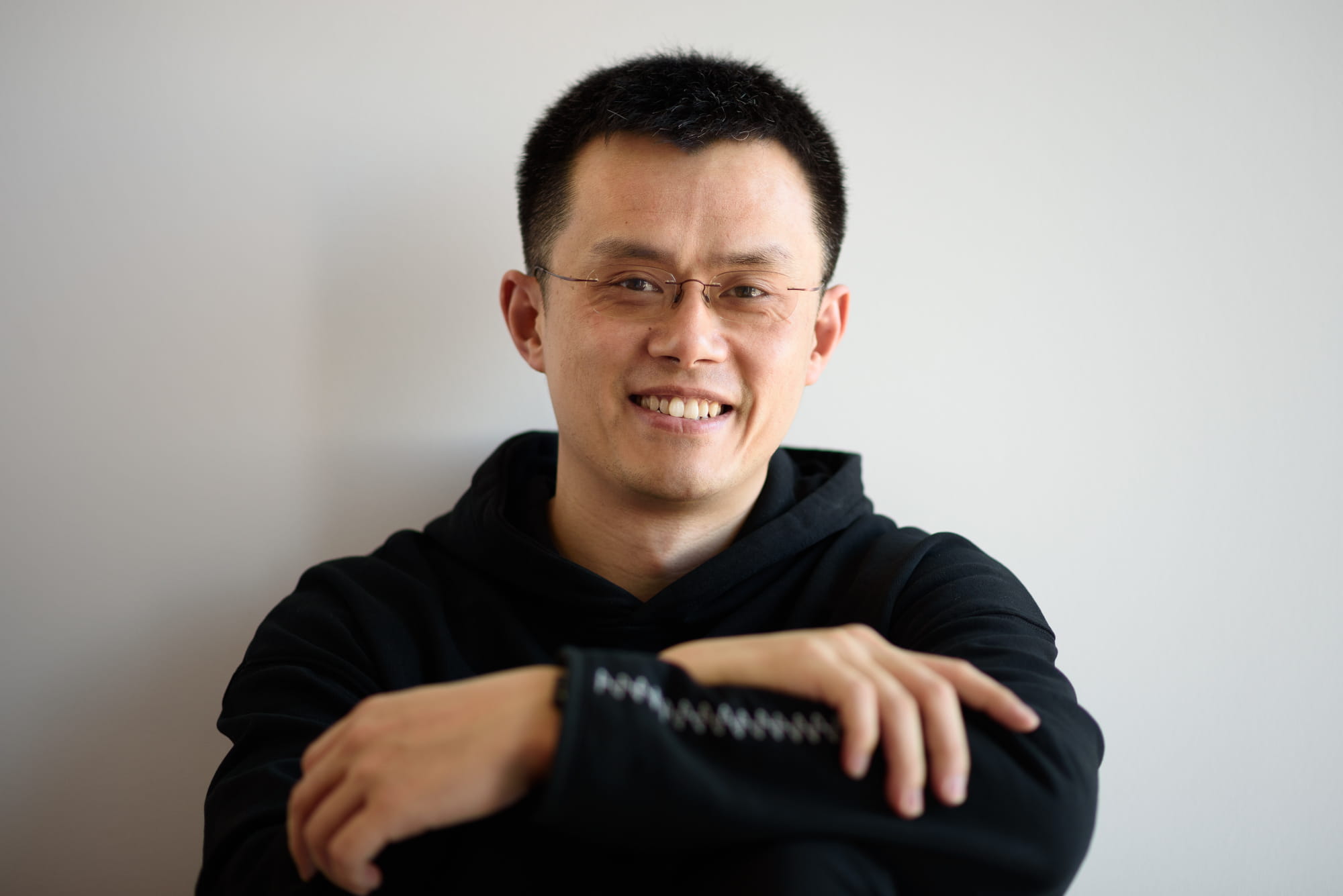

According to Forbesthe outflow from Binance is appreciably extra significant than CEO Changpeng Zhao predicted final month.

It appears that the problems have not nevertheless allow go of Binance, the greatest cryptocurrency exchange in the globe. Before the collapse of rival FTX, traders massively withdrew their money from the exchanges. Despite CEO Changpeng Zhao’s reassurance and reassurance, the money outflow from the exchange continued to raise.

According to Defillamaprospects manufactured a net withdrawal of USD 360 million on January 6th. nansen also reported that Binance had misplaced $three billion in assets in the past week, representing four% of the company’s complete assets at the time.

Binance Netflow 7D ($) -three,660,311,347

eight.783.380.428 – Outflow

five.123.069.081 – InfluxExchange Flow Dashboard ️https://t.co/CYrBQLryQ0 pic.twitter.com/vV6vcqoWKK

— Nansen (@nansen_ai) December 13, 2022

At that time, Binance experiences a surge in withdrawals following the series of FUD exposed quite a few of the holes in the floor. Since Binance’s impeachment Violation of anti-cash laundering laws, avoidance of embargoes to action end withdrawing USDCthere is not sufficient reserve for consumers to withdraw cash, a refusal to cooperate by the auditing companies…

After the over incidents, Binance boss CZ launched a forum Official response media and the public, concerning the fiscal health and fitness of the enterprise.

From twelve/twelve to 14/twelve, up to $six billion in assets have left Binance and Binance CEO Changpeng Zhao I even now take into consideration it a “stress-test” Simple.

Forbes explained Binance has, in reality, misplaced 15% of its assets considering the fact that then send of Zhao at the similar time Nansen launched the withdrawal report. Nearly a quarter of the organization, ie Binance’s $twelve billion in reserves evaporated in much less than two months.

Things look to have stabilized. Yesterday was not the highest withdrawals we processed, not even the leading five. We processed the most in the course of LUNA or FTX crashes. Now the deposits are returning. ♂️💪 https://t.co/WLK2KyCym0

—CZ Binance (@cz_binance) December 14, 2022

Binance is the exchange with the most withdrawal strain in the month. Other CEXs this kind of as Crypto.com, Bitfinex, Bitmex and OKEX are also impacted but only deal with little orders.

Forbes also observed distinctions in exchange fee statistics in between analytics platforms. Take BNB as an illustration. On CoinMarketCap, Binance had 57 million BNB on Jan. four. While on Nansen, DefiLlama and Arkham only have in between 22 and forty million BNB. Even the independent examination of Forbes by way of Etherscan he observed only sixteen million BNB on the exchange.

Disparities had been also uncovered in Binance’s Bitcoin (BTC) holdings, ranging from $four.eight billion (CoinMarkeCap) to $9.six billion (CER.Reside), and extra than double the sum held displayed by glass node. This could be due to incorrect queries from some information organizations.

However, the information gap in between analytics platforms, with vulnerabilities up to tens of billions of bucks, also raises significant doubts and it will be tough to trace back the information.

Investor self confidence is most evident in the cost lines of BNB and BUSD, two Binance-named tokens that have failed to hold their personal amidst the turmoil. BNB is down 29% in the final two months. Forbes there are about 29 million BNB remaining on Binance, which is 51% much less than as of November ten.

While, BUSD stablecoin provide also plunges by almost $six billion following series of crashes. Up to $five.five billion was traded (redeemed) by BUSD in just a single month, dropping the stablecoin’s capitalization from $22 billion to all over $sixteen billion.

Forbes explained that Binance is slowly dropping its footing in the industry. While net well worth has dropped 24% considering the fact that November, traders in coins like MATIC, APE and GALA have lowered their net well worth by forty-50% on the exchange.

According to Binance, the exchange’s organization model is extremely uncomplicated, revenue largely come from transaction costs. Binance does not “misappropriate” consumer money for any transaction or investment, is not indebted to any individual, nor is it on the creditor record of any institution that has just gone bankrupt. Binance’s fiscal condition is now extremely excellent, and there is sufficient reserve capital to deal with day-to-day operations, even if all consumers log into the similar withdrawal.

Synthetic currency68

Maybe you are interested: