Mr. Jihan Wu also launched Singapore, in which the present Matrixport enterprise is primarily based, as a sturdy competitor to serve as a “hub for cryptographic innovations”.

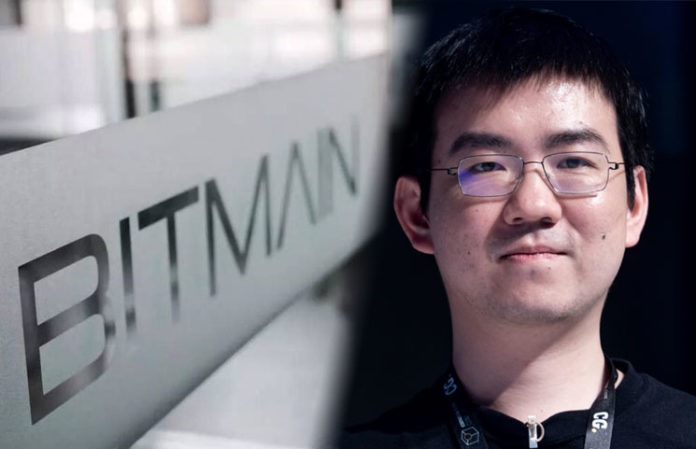

Jihan Wu, a cryptocurrency billionaire, co-founder and former CEO of mining giant Bitcoin (BTC) Bitmain, believes the present wave of regulatory interference in the cryptocurrency business could be “a good thing in the long run.”

Speaking to CNBC at this week’s Asia Tech x Singapore conference, Wu mentioned that the business has just about grown to be a “trillion-dollar market cap industry”, with a lot more than ten% of US citizens tied to the new. asset class. Under these disorders, he argued that higher regulatory involvement would be a net return for cryptocurrencies in excess of time:

“I imagine the regulatory strain is more powerful than prior to, but it will continue to keep a good deal of terrible gamers out of the business and guarantee that the industry’s popularity is significantly much better than it would have been devoid of it. So I imagine this sort of crackdown could be a great factor for the business in the extended run. “

The current crackdown on cryptocurrencies is the most prominent in China, which has a extended track record of attempting to severely restrict and even avert trading in decentralized digital currencies. However, other developments, together with current actions by various jurisdictions towards the operations of the main cryptocurrency exchange Binance, indicate the gradual achievement of a a lot more motivated interventionist strategy all around the globe.

Today, Caitlin Long, cryptocurrency-targeted founder and CEO of Avanti Bank & Trust, tweeted that the regulatory crackdown on cryptocurrencies “has begun” in the US. Long stated regulators are probable to observe “intermediaries” and “entry points” for US bucks in the business, rather than right focusing on assets like Bitcoin and Ethereum.

However, Mr. Wu recommended that higher engagement amongst regulators, governments and corporations in the cryptocurrency business is vital and probable optimistic for his final result. He pointed to Singapore as a situation in level, describing his government as “reasonable”, very effective and “accessible” when it comes to dealing with business.

Especially in a smaller nation like Singapore, he stated, as extended as cryptocurrency business actors do not harm neighborhood citizens, the authorities are probable to depart them alone and consider no legislative action towards them. He has declared:

“There are many good reasons why Singapore is a hub for crypto innovations.”

After Wu’s relatively controversial departure from Bitmain, in which he laid the basis for his estimated $ one.eight billion fortune, the former CEO went on to uncovered a digital asset economic companies platform known as Matrixport, which he at first had. headquartered only in Singapore, but has considering the fact that expanded to set up an workplace in Zurich dealing with Europe.

Synthetic currency 68

Maybe you are interested:

.