With the existing condition of geopolitical and money instability, former BitMEX CEO Arthur Hayes believes the time for the cryptocurrency industry is approaching.

In a blog site submit on the morning of April eleven, former BitMEX exchange CEO Arthur Hayes summarized several observations from the worldwide stock industry, worldwide geopolitical tensions, and even inflation in the US to predict the approaching outlook for the cryptocurrency sector.

Watch out for “The Q Trap” … Read on to uncover out when to start out dumpster diving #bitcoin And #ether.https://t.co/VhDodqhNd8 pic.twitter.com/bU1QfYykIX

– Arthur Hayes (@CryptoHayes) April 11, 2022

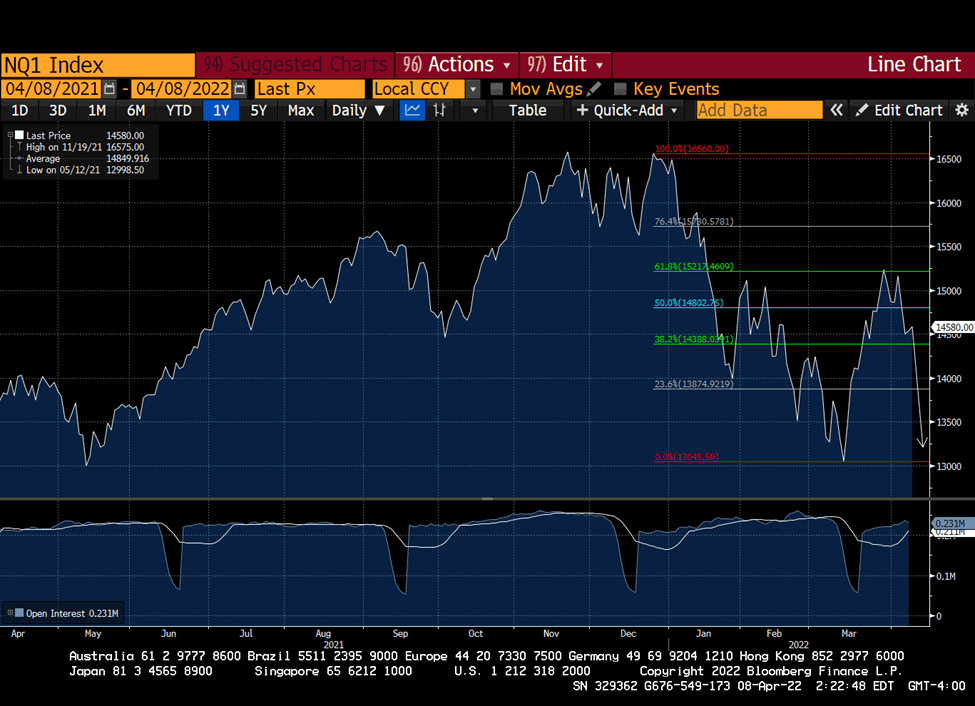

As a consequence, Hayes believes that big cryptocurrencies this kind of as Bitcoin (BTC) and Ether (ETH) have a enormous degree of correlation with big US stock indices, most notably the Nasdaq one hundred (NDX). Any detrimental movements by NDX will especially impact these two currencies and the cryptocurrency industry in common.

At the minute, neither technical nor macro components help NDX. This index has just broken help at the 61.eight% Fibonacci retracement and will need to have to uncover new help in the close to potential. Furthermore, the truth that the US Federal Reserve (Fed) is moving to increase curiosity prices in the close to potential will make issues worse, as substantial curiosity prices negatively influence the volatility of the money markets of the Nasdaq one hundred group shares.

Another unpredictable externality is the conflict among Russia and Ukraine. Mr. Hayes explained that just after failing with the “hit fast – win fast” tactic, Russia is slowly turning to applying the “war of attrition” to erode Ukraine. Russian troops are prepared to lay siege to big cities in Ukraine for a prolonged time and to exert huge logistical strain on the government in Kiev. The former CEO explained the EU and the US will not be ready to completely support Ukraine in the context wherever they even now struggle to uncover an alternate to vitality sources from Russia, and thus will be forced to request Ukraine to uncover a request for peace. If this situation takes place, it will be a big blow to the Western stock industry.

However, in the opposite path, Hayes also did not rule out the probability that the financial isolation measures imposed on Russia will sooner drain the Russian economic system and force Moscow to ease tensions.

The Russian-Ukrainian conflict is top to the inevitable consequence that the charges of critical commodities, not only oil and gasoline, but also meals and minerals, rise significantly. The longer the war drags on, the higher its influence and the additional damaging it will be on the stock industry, incorporating but yet another strain to NDX and cryptocurrencies.

Therefore, Mr. Arthur Hayes explained the condition will get worse and worse in the foreseeable potential, top to a sharp decline in the 2nd quarter of 2022. The former BitMEX CEO even produced a minimum forecast for the two of the greatest cryptocurrencies, with BTC which goes up to $ thirty,000 and ETH to $ two,500. Mr. Hayes admits he is relying on sentiment to give these two price tag targets as these are the two the lowest worth thresholds reached by Bitcoin and Ether in the course of early 2022 product sales.

On the morning of April eleven, the cryptocurrency industry recorded its most up-to-date correction, bringing BTC and ETH charges to $ 41,755 and $ three,175 respectively.

However, as cryptocurrencies are an field that usually overreacts to worldwide macroeconomic volatility, Hayes believes these will be the ultimate lows, there is no need to have to wait for the Fed to announce a halt on price hikes. Therefore, the former CEO of BitMEX explained that he will “bottom out” the two Bitcoin and Ether if they attain the two larger amounts.

In early April, Arthur Hayes also launched a lengthy examination explaining why the Ether occasion just after The Merge will “evolve” into a new kind of digital bond and set a intention for ETH to hit the worth threshold of up to $ ten,000.

#ETH five DIGITS DUCKS … Holla a it!https://t.co/tieRFWZjSz pic.twitter.com/PEtrva6ZBm

– Arthur Hayes (@CryptoHayes) March 31, 2022

Summary of Coinlive

Maybe you are interested: