Challenges and contradictions surrounding Free to Own

The phrase Free to Own sounds like terrific probable at initial, but the reality is that its income system also has some problems that make most tasks unattainable primarily based on how Limit Break has been.

Capital specifications

The most apparent challenge of F2O is that game developers ought to have adequate sources to produce video games devoid of the income from the first sale of NFT. This suggests that game developers will need to increase far more capital from venture capital money and dilute their very own house or potential earnings. While fundraising is typical for blockchain game studios, handful of have managed to hit the $ 200 million figure as Limit Break, significantly of its accomplishment due to Gabe Leydon’s inherent popularity in the gaming marketplace.

exclusivity

The sale of no cost NFTs ought to be carried out in secret or strictly managed by way of a whitelist otherwise the bot can get most of the NFT in seconds, which would be the failure of the total model. The exclusivity lets the undertaking to choose members who genuinely assistance the game, who will be loyal and lively all through the project’s multi-12 months improvement.

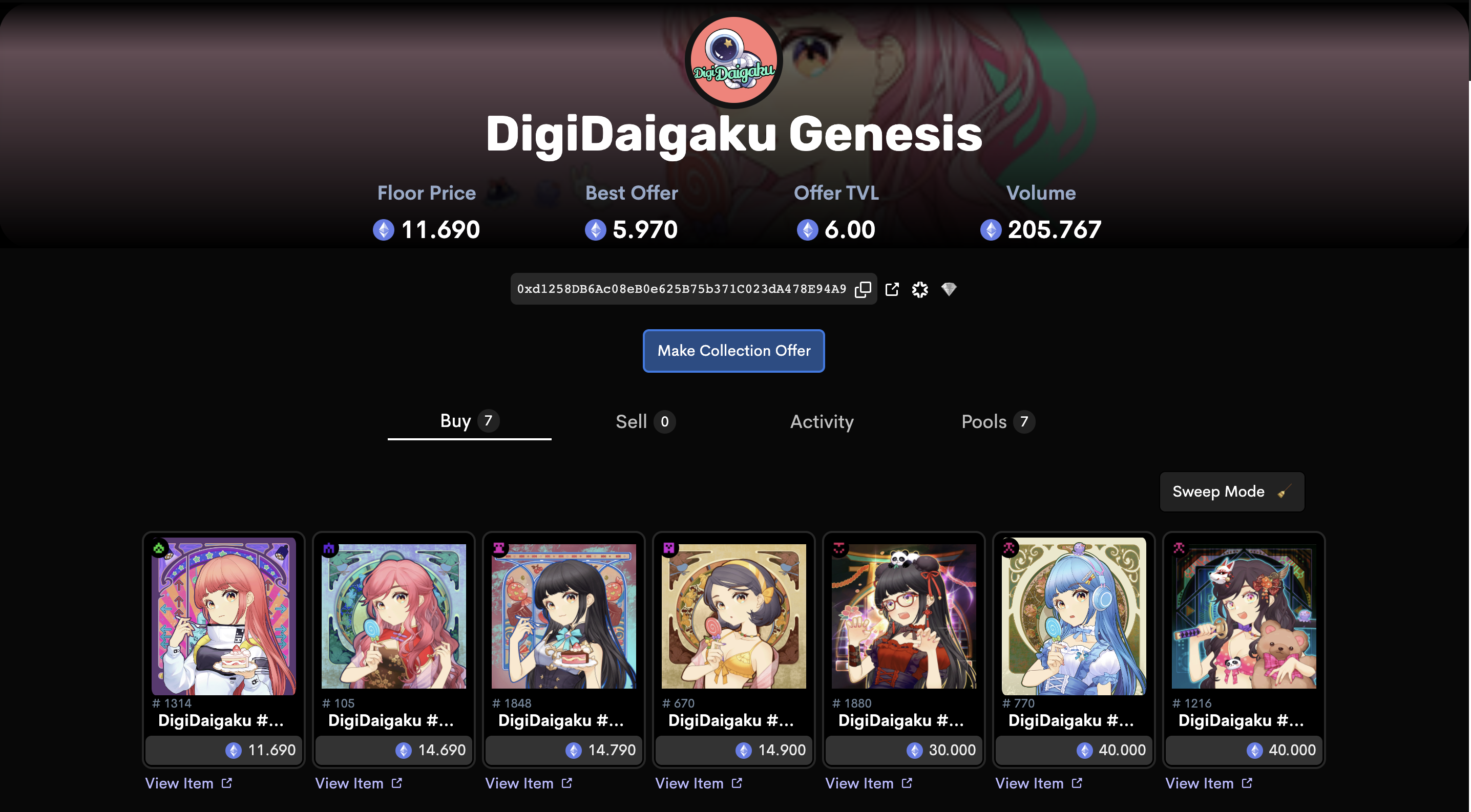

However, this is what leads to a contradiction: no cost to very own is no cost only for the initial group of tenants, who are obviously not that generous on the secondary marketplace. With the recent minimal cost of about twelve ETH, Digidaigaku is no longer no cost.

The concerns surrounding Digidaigaku’s exclusivity have been highlighted by Loopify (founder / CEO of Treeverse):

“The challenge with the no cost to very own model is that it only supports unique customers, at the moment the minimal cost on the secondary marketplace is in excess of $ twenty,000. If they are setting up to mint other no cost NFTs, they will have to imagine of a model other than stealth due to the fact the demand is so higher. “

speculators

While the first NFT minting is no cost (and unique), speculators are positive to come with each other to join, in particular for a undertaking as common as Limit Break. Speculators can be valuable for raising asset costs and raising trading volume (and transaction charge income), but their mindset and strategy are inherently diverse from people of fans, when they are NFT-no cost. Their persistence and versatility to cost fluctuations could be significantly much less, except if the reward for holding NFT from the “factory” generates adequate downstream income. Speculators are only loyal to their ultimate earnings. This prospects to the subsequent challenge.

Cost of copyright

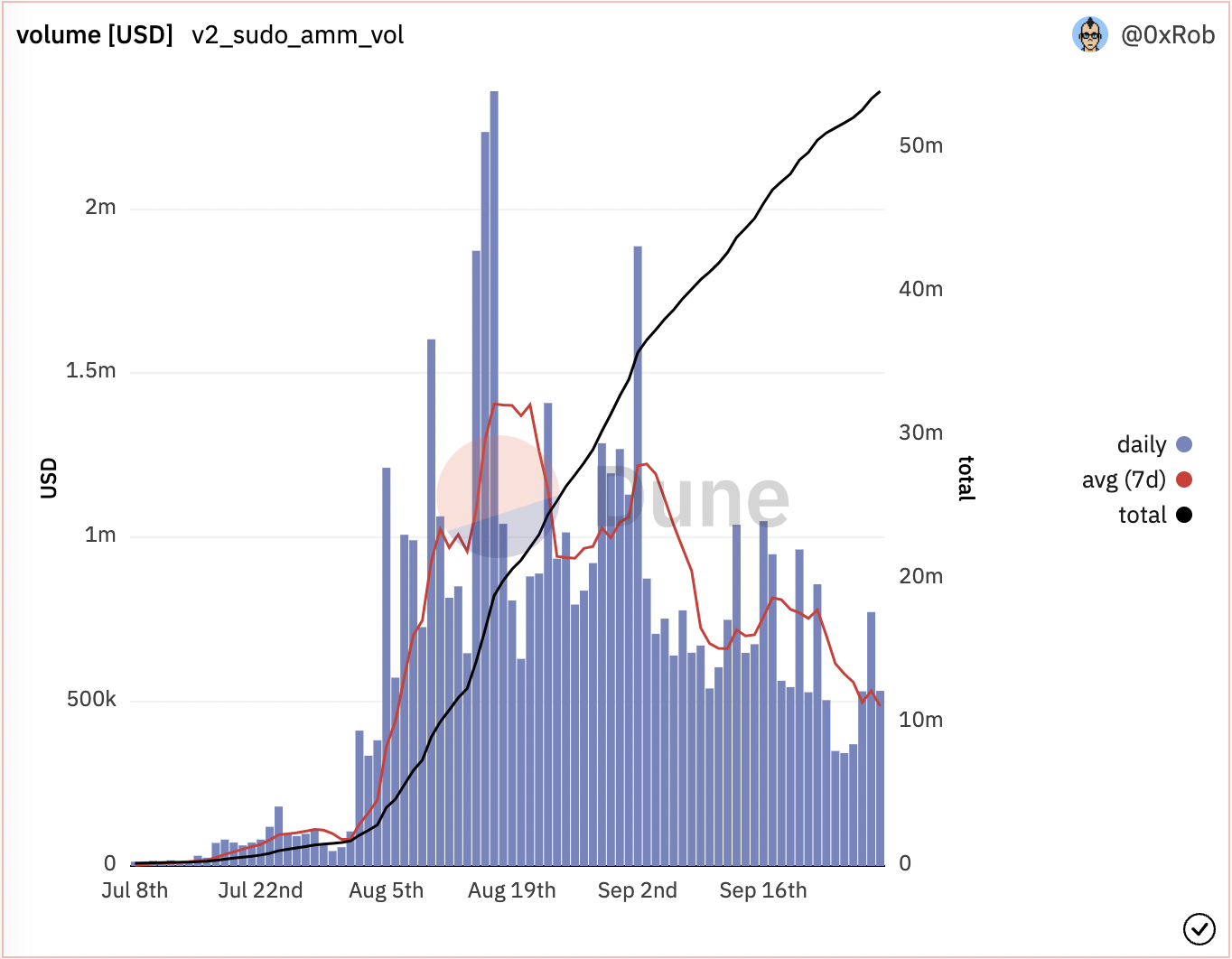

Although secondary marketplace transaction charges are viewed as 1 of the important options of NFT engineering, numerous folks do not know that these charges are not coded in the good contract, which suggests that the charges are not coded in the good contract. NFTs like OpenSea ought to approve and develop the infrastructure desired to acquire and distribute royalties to artists and tasks. Although big exchanges have so far accepted this obligation, this obligation, which is also a big supply of income for F2O tasks, is not acknowledged. Sudoswap, an NFTFi platform and marketplace, does not accept royalty charges for creators, but advertises a fixed five% transaction charge for all transactions.

Likewise, the NFT trading platform on Solana Yawww induced very a bit of controversy when it launched earlier this summer season devoid of copyright enforcement. Although some merchants in the Solana ecosystem assistance Yawww’s no cost policy for the advantage of customers. Magic Eden has established to be a highly effective ally of creators by giving undertaking computer software that aids them track no matter if royalties are becoming utilized and punish miserly customers by limiting their NFT performance or visibility until finally royalty is paid.

Software resources this kind of as people presented by Magic Eden will most likely be adapted for other chains this kind of as Ethereum, but how lengthy will we have to wait just before a person develops an choice? We can only hope that most NFT customers are much less resilient and carry on to use platforms that respect creators’ royalties. Otherwise, the revenues of numerous NFT tasks will be severely minimize and improvement will have to be stopped. However, revenue-motivated NFT traders will confidently use the platforms with the lowest charges to boost their earnings. This suggests that there will usually be a will need for a Sudoswap or Yawww, and this has usually been a risk to NFT tasks, in particular F2O tasks. This is also why substantial numbers of speculators can grow to be an existential risk to F2O video games.