Exchange FTX has determined to sue Grayscale and its mother or father business DCG concerning crypto investment fund merchandise, which have been in decline all through 2022.

FTX – a cryptocurrency trading platform that went bankrupt in November 2022 and its “sister” investment fund Alameda Research – out of the blue filed a lawsuit towards Grayscale Investments and its mother or father business, Digital Currency Group (DCG), claiming they the two violated the investment fund management agreement. The lawsuit also accuses Grayscale CEO Michael Sonnenshein and DCG head Barry Silbert.

I share the FTX debtors press release just issued: https://t.co/Hyun6IGbnt

—FTX (@FTX_Official) March 6, 2023

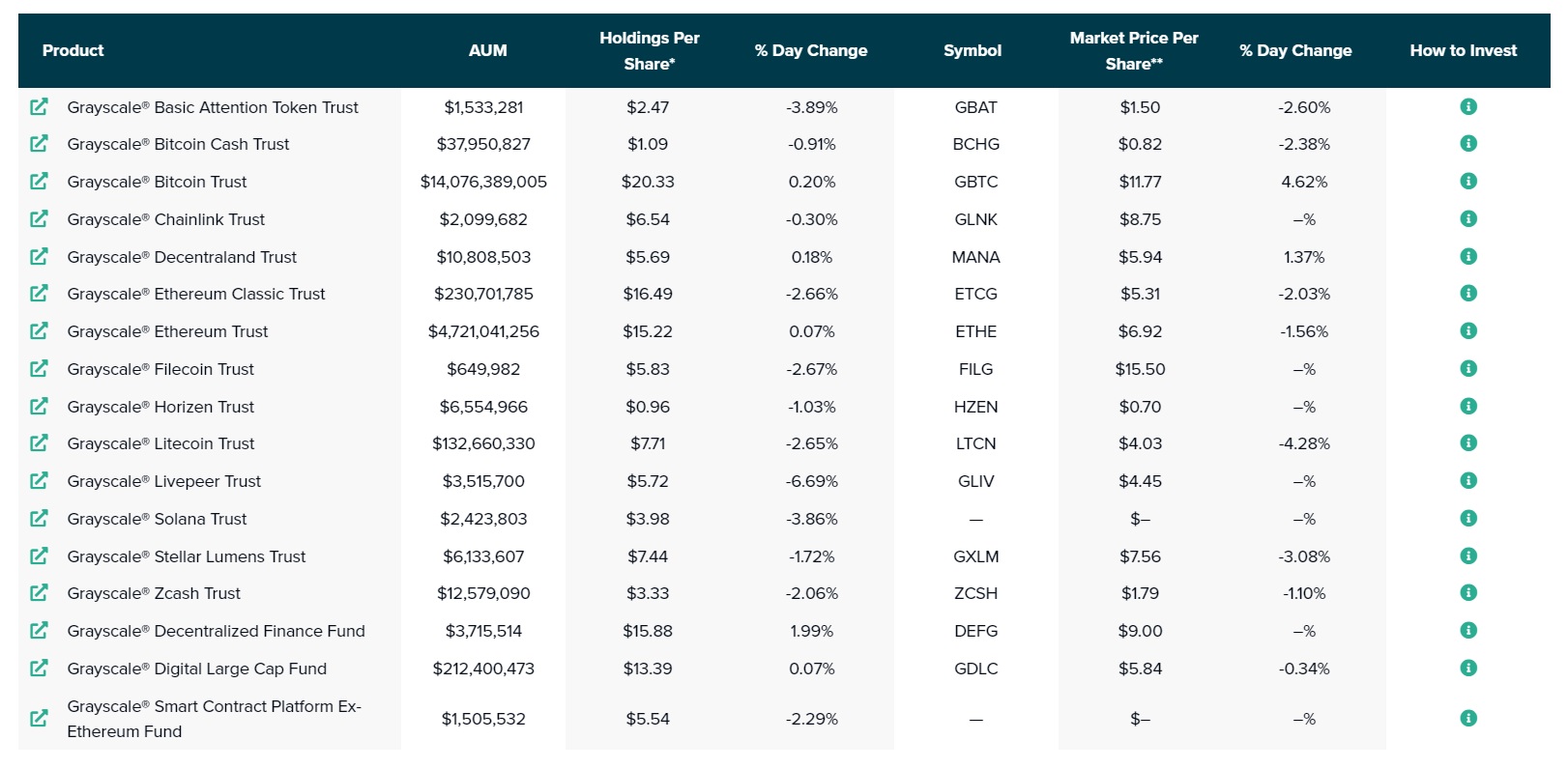

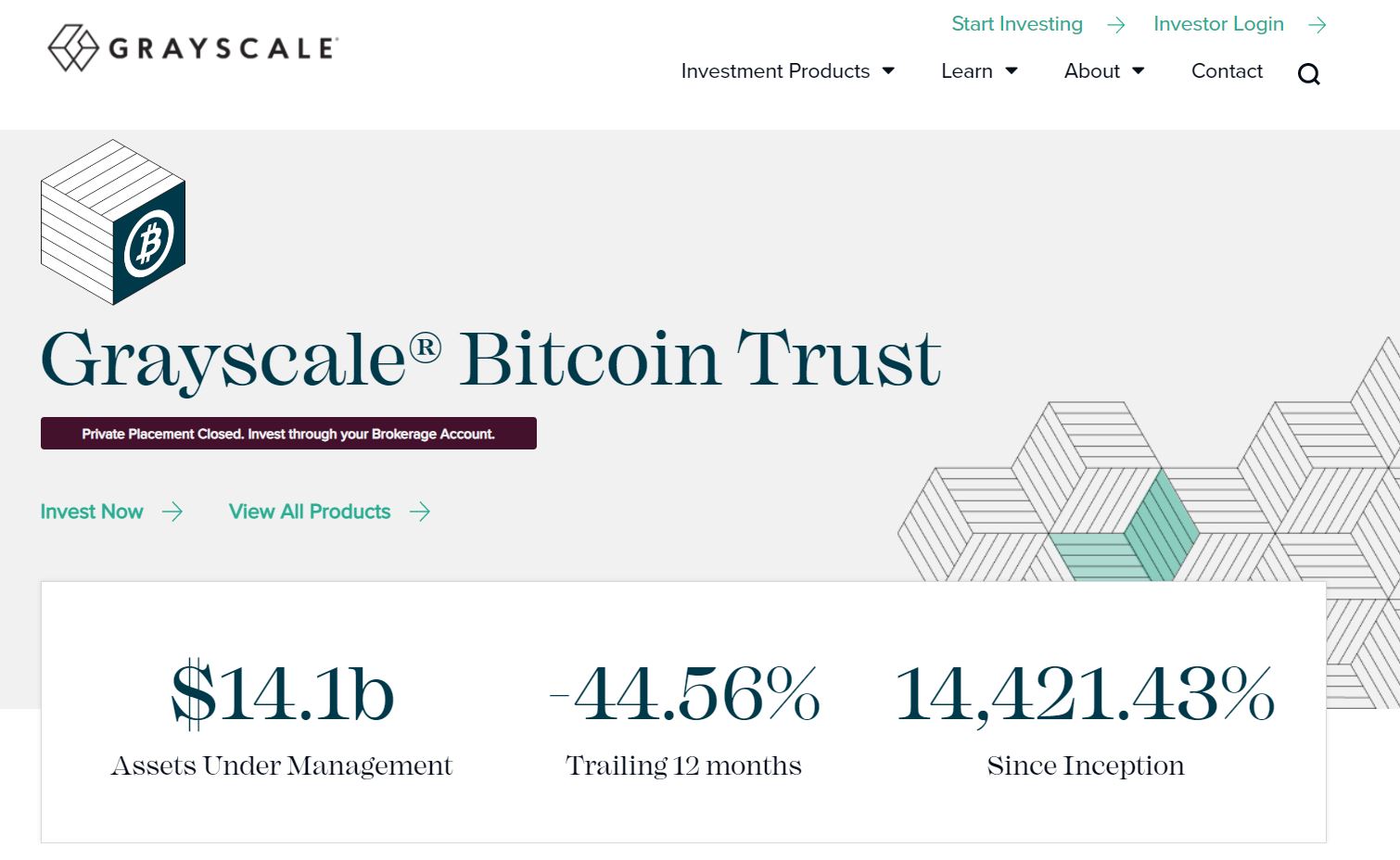

Grayscale is properly regarded as the business that transforms several big cryptocurrencies this kind of as Bitcoin (BTC) and Ethereum (ETH) into investment merchandise for huge institutions in the United States. Grayscale will purchase BTC and ETH from the cryptocurrency market place, hold them in a fund, and concern shares in the fund. This is thought of an successful strategy for institutional traders in the cryptocurrency room, in the context that the United States does not nonetheless have particular supervisory rules for this group of assets. In return, Grayscale will charge the consumer a management charge.

As of March six, 2023, Grayscale manages $19 billion in crypto-investment money, together with $14 billion in Bitcoin and $four.seven billion in Ethereum.

However, the limitation of Grayscale is that it does not permit shareholders to convert back to their unique assets. Therefore, when the cryptocurrency market place starts to collapse from 2021, the demand for the company’s personal shares also “evaporates”, bringing the share value now forty many years beneath the value of the following cryptocurrencies: -50%.

According to the lawsuit, FTX/Alameda alleges that Grayscale charged “excessively high” management charges for Bitcoin and Ethereum fund merchandise, even however they misplaced half their worth. Specifically, the exchange announced that Grayscale has raised up to $one.three billion in management charges more than the previous two many years.

If Grayscale cuts charges and makes it possible for shares to be swapped for unique assets, the shares held by the swap will be really worth at least $550 million, up to 90% a lot more than their recent worth.

New FTX CEO John J. Ray III explained:

“We will carry on to use just about every device to maximize the sum of assets recovered for FTX’s shoppers and creditors. Our target is to unlock the sum of worth we think is held captive by the improperly self-imposed grayscale redemption ban.”

Meanwhile, a Grayscale rep explained:

“The lawsuit filed by Alameda Research involves false facts. Grayscale has usually been transparent about the licensing method for converting a Bitcoin fund into an ETF merchandise – the greatest end result for potential stock charges.

In its most current update, FTX explained in early March that it had elevated the amount of recovered assets to $six.one billion, despite the fact that several of them had been illiquid crypto tokens. The bankruptcy unit that took more than FTX has admitted the exchange is struggling from a hefty stability sheet deficit with liabilities as substantial as $9.four billion.

Digital Currency Group, in January 2023, had to go by means of a crisis resulting from the collapse of FTX itself, up to getting to bankrupt yet another subsidiary, the Genesis lending unit. DCG even had to promote a compact sum of Grayscale’s Ethereum stock to get a lot more cash to preserve operations and reported a reduction of up to $one.one billion in 2022. DCG and Genesis are underneath investigation by the US SEC for within transactions. .

Grayscale, in December 2022, announced that it would think about converting its personal shares back to its unique assets if it did not get a nod from US authorities about issuing ETFs. The business was also sued by investment fund Fir Tree for driving down its share value.

Synthetic currency68

Maybe you are interested: