FTX CEO Sam Bankman-Fried has published a “guideline” for regulating the cryptocurrency market, with a lot of claims that have not been appreciated by the local community.

On the morning of October twenty, FTX CEO Sam Bankman-Fried published “The Feasibility Standards for the Digital Asset Industry,” a extra than three,800-word posting that he describes as a “legal manual” for the cryptocurrency market.

The posting stated a lot of legal “hot spots” that the cryptocurrency section has witnessed in the previous, such as issuing US sanctions, hacking, cryptography, asset tokenization, safety, traders, DeFi, and stablecoins.

one) As promised:

My existing ideas on cryptocurrency regulation.https://t.co/O2nG1VrW1l

– SBF (@SBF_FTX) October 19, 2022

Coinlive will summarize the most important highlights of Sam Bankman-Fried’s posting.

About US sanctions

One of the cryptocurrency industry’s pivotal occasions in the third quarter of 2022 was the US government’s purchase to “block” Tornado Cash, the Ethereum trading mixer platform allegedly made use of by hackers to launder cash by way of cryptocurrencies. The Tornado Cash situation produced a great deal of controversy in the cryptocurrency market just after a lot of big DeFi platforms blocked the wallets of consumers who made use of to interact with Tornado Cash to prevent legal consequences, primary to a major query mark about the fundamental decentralized nature of this. . discipline.

On the over subject, mentioned Sam Bankman-Fried in favor of sanctions and black lists to block terrible habits in the blockchain array. FTX CEO wrote:

“Maintaining a black list brings balance to the market: prohibits unauthorized transactions and freezes criminal funds, but at the same time allows legitimate business to continue normally.”

Even Mr. Sam Bankman-Fried believes all people should comply with the OFAC sanctions listing beneath the US Treasury Department, due to the fact this is currently the law anyway. It also proposes to website link the offense to trading accounts with objects in the sanctions listing.

Companies in the cryptocurrency market must retain a checklist for terrible actors or suspected criminals to make certain compliance with OFAC. This will assistance when authorities challenge sanctions or a hacker assault happens, the units concerned can quickly talk with each and every other and block the suspicious tackle prior to the cash is leaked.

Sam Bankman-Fried’s over arguments can be observed as agreeing to comply with the U.S. government specifications for reporting and monitoring blockchain transactions, as properly as freezing addresses on the sanctions listing. Therefore, a lot of figures in the cryptocurrency local community have criticized the CEO of FTX for going towards the spirit of decentralization and anonymity of cryptocurrencies, so that now, when laws apply, the cryptocurrency market gets no unique from regular monetary markets.

Ryan Sean Adams, founder of the well-known Bankless podcast series in the Ethereum local community, writes:

Sam.

With respect.

This definitely sucks.

You’re saying DeFi must be OFAC.

You’re saying chain lock must be regular.

You’re saying DeFi front-ends require to register as a broker-dealer.

No, this is not realistic.

This would get the US out of the cryptocurrency rush. pic.twitter.com/AtlvHgaAkL

– RYAN SΞAN ADAMS – rsa.eth 🦇🔊 (@RyanSAdams) October 19, 2022

“Sam, with all my respect.

This proposal sucks. He needs DeFi to comply with OFAC laws. He needs individuals to accept that any transaction on the blockchain can be blocked, he needs DeFi interfaces to be registered for a monetary broker license.

It is not realistic. It will, having said that, eliminate the US from the cryptocurrency race. “

About hacks and cryptographic attacks

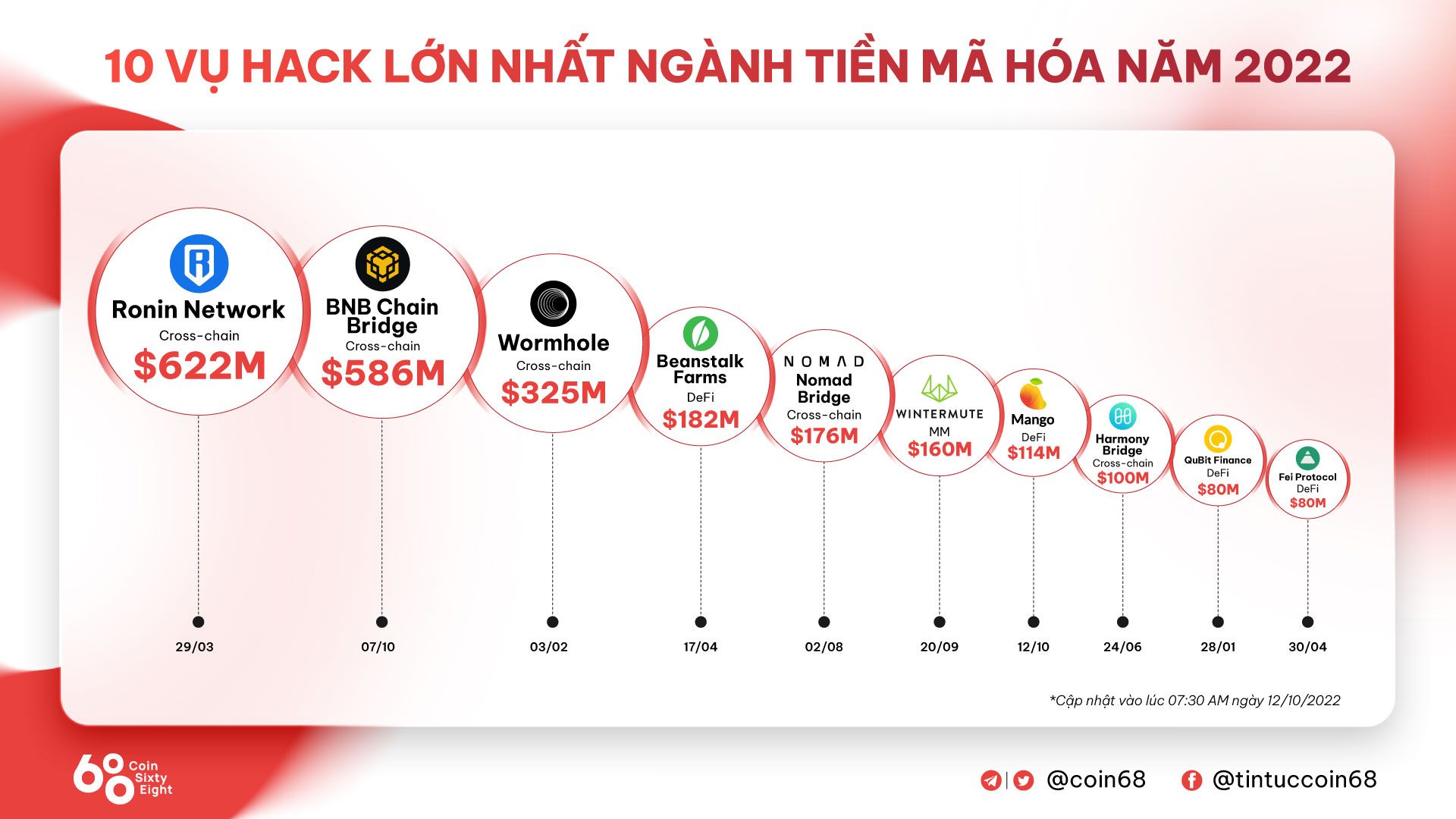

Subsequently, the head of the FTX exchange turned to the challenge of hacks and attacks in the discipline of cryptocurrency, which brought on losses of up to three billion bucks in October 2022 and broke the 2021 record.

Sam Bankman-Fried admits that this is 1 of the greatest and most noticeable inadequacies of the cryptocurrency market. However, in the opposite course, there are also a lot of units on the marketplace that stand out for identifying and tagging addresses that steal cash from a undertaking, creating hackers not generally capable to efficiently spread.

Therefore, the CEO of FTX proposed to construct a standard rule standardize operations Monitor and stop safety vulnerabilities. Also, in the occasion that it can not be prevented and the assault happens, negotiation with the hacker must stick to the guidelines so that the consumer is completely compensated. The quantity that hackers can withhold will stick to the five-five rule, which is five% of the quantity withdrawn or $ five million, whichever is much less.

About properties and titles

This is also at the center of controversy in the cryptocurrency legal challenge of the previous, particularly when the United States Securities and Exchange Commission (SEC) in 2022 continually has lawsuits towards crypto organizations that have been banned. of unregistered securities, while it does not give an official document outlining the criteria for evaluating cryptographic securities.

See extra:

In this regard, Sam Bankman-Fried believes that Bitcoin (BTC) and Ethereum (ETH) must not be deemed securities, but tokens that act as “investment contracts” must be classified.

Since there is no particular legislation but, FTX’s course in this regard would be to confirm that listed assets meet the “Howey Test” made use of by US law to worth securities, but comply with new laws launched by the SEC.

Information on tokenized assets

Tokenized assets are 1 facet of combining the regular monetary sector with the cryptocurrency sphere, the place a true asset can be tokenized and traded by way of the blockchain.

Sam Bankman-Fried believes that blockchain technologies has the possible to significantly increase monetary markets as a result of the over application, particularly in facets this kind of as shortening transaction occasions, getting rid of pointless intermediaries and creating markets extra productive.

The only obstacle that prevents this is the lack of particular laws, this kind of as: who will participate in the payment, custody, registration, issuance, provision of info, and so forth. for AMNZ shares it is tokenized.

On investor safety

According to the CEO of FTX, the easiest way to defend traders in the crypto room is to give transparency and stop rogue habits.

Investors must obtain enough info about the assets they are about to invest in as plainly and understandably as probable, and regulators can prosecute individuals who knowingly misrepresent, mislead or encourage this kind of info.

In the opposite course, Sam Bankman-Fried also proposed to impose an asset / earnings restrict that an investor should very own prior to participating in cryptocurrency investments, or at least pass a expertise check.

About DeFi

This is a central challenge and can be mentioned to be as significant as the proposed US sanctions in the posting.

Specifically, Sam Bankman-Fried mentioned that DeFi is the element that brings the best advances and innovations in the discipline of cryptocurrencies and managing it is a really complicated trouble due to the fact it should make certain a stability concerning the qualities. Decentralized (decentralized) e Finance (finance). He advised:

– If the action is in the nature of the expression of no cost speech and mathematical reasoning – this kind of as programming, implementing on a decentralized blockchain or validating transactions in accordance to blockchain laws – then it belongs to the Decentralized facet, there is no require for regulation.

– If the action is in the nature of creating a centralized monetary support – this kind of as producing a site that enables US traders to interact with DeFi protocols or advertising monetary goods – then it will fall beneath the Finance facet. , calls for registration and beneath the manage of the authorities.

The over argument from the FTX CEO implies that scheduling routines can go on usually, but DEXs like Uniswap will require to apply for a US license if he wishes to operate and encourage goods with US consumers, he will be expected to KYC and acquire consumer info like any US monetary enterprise, and is obligated to comply with info reporting if required, as properly as block transactions that are blacklisted by the US .

Sam Bankman-Fried admits that this is a trade-off and not excellent for DeFi, but it will strike a stability concerning permitting DeFi consumers to nonetheless have some degree of decentralization, even though also making certain that the regulator stays capable to properly manage the marketplace. and check it.

About stablecoin

Since the collapse of the LUNA-UST which wiped $ forty billion off the cryptocurrency marketplace in May 2022, stablecoins have come to be the topic of focus from international authorities, especially the United States. The current US Congressman’s stablecoin regulation bill even proposes banning UST-sort decentralized stablecoins for two many years, requiring stablecoin issuers to apply for a license.

The CEO of FTX also agrees with this request, stating that stablecoins provide a fantastic chance to modernize the payments sector, requiring regulation to assistance its growth, but beware of systemic dangers.

He argues that stablecoins that market themselves as secure towards the US dollar (USD) should be backed by an equivalent quantity of USD (funds or treasury payments) and give an audit report on a normal basis. Users of this kind of stablecoins must also be KYC on the deposit and withdrawal portals and convert to funds.

In essence, Sam Bankman-Fried’s statement is extra in favor of regular stablecoins like Tether (USDT), USD Coin (USDC) and Binance USD (BUSD) rather than decentralized stablecoins like Dai (DAI) and Frax (FRAX), which is backed by one more crypto asset.

Crypto local community response

It’s straightforward to see the …