According to confidential facts from CoinDesk, FTX ahead of the bankruptcy encouraged staff to deposit income in the exchange like a financial institution. Now they can get rid of every thing.

Investment money and institutions are not the only ones impacted by FTX’s magnificent crash final week. In addition to dropping their jobs on the stock exchange, numerous FTX staff have deposited a quantity of personalized assets at this time locked into the platform, at danger of remaining swept away by the gravity of the black hole named “FTX”.

According to sources of CoinDeskFTX has an inner policy, dedication Discounts up to 50% to inspire staff to place their cost savings or invest in FTX. Furthermore, numerous staff did not gather their salary and bonus (paid by FTT) but left it on the floor for the reason that they deemed it handy, only exchanging it for income when essential.

Now the ones that are caught on the floor can only resell the house for ten occasions much lessdue to the “ownership claim”, buyers’ evaluation of FTX’s debt repayment potential is comparatively lower.

Losing the two the lead and the fishing rod, this time appears dark for these who have worked in FTX. Former FTX Chief Marketing Officer Nathaniel Whittemore stated he and most other staff had been unaware of the use of consumer money for unauthorized functions.

“To me, all I feel is anger and rage because Sam and his colleagues did this and they’re not going to provide their employees with a polite text to explain their displeasure. They’re not going to talk about things to come.”

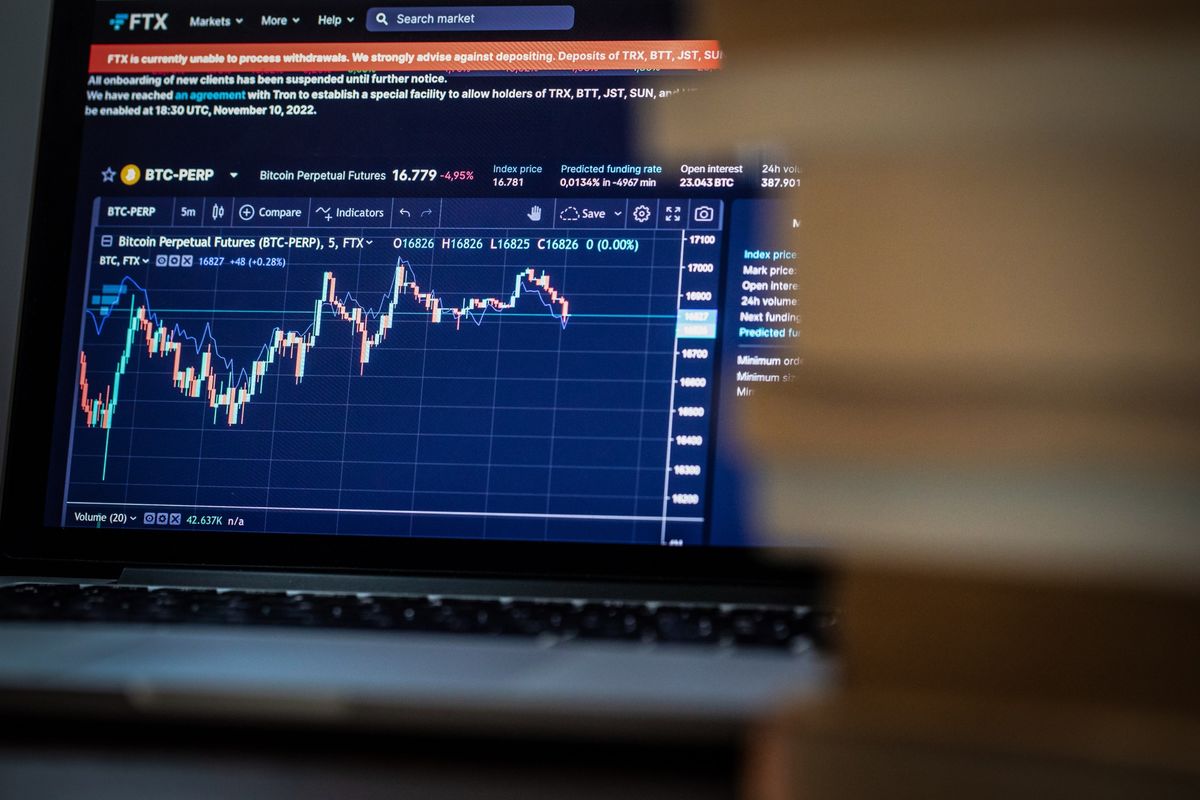

Before filing for bankruptcy on eleven/eleven, Many FTX staff have resigned 1 by 1. Chief of Institutional Clients Zane Tackett stated on Twitter Nov. ten that he had deactivated his company’s Slack and Gmail accounts without having warning and that its staff had been at this time “underwater” in the dark. are voiced and have agreed with Zane Tackett that they are in a related condition.

Currently, FTX is undergoing corporate restructuring, converted into bankruptcy. As lately as Nov. 15, new CEO John J. Ray III held an inner meeting to reshape the company’s apparatus, prepared for total Chapter eleven bankruptcy setting up.

Synthetic currency68

Maybe you are interested: