The bankruptcy unit that took above FTX fired people who knew about the connection of FTX lending funds to Alameda Research to Alameda Research.

According to sources of Wall Street JournalFTX’s new CEO John J. Ray III, who took above the exchange to deal with the platform’s failure following Sam Bankman-Fried’s resignation, has terminated the contract with three of Sam Bankman-Fried’s trusted managers.

Specifically, FTX fired FTX Chief Technology Officer and Co-Founder Gary Wang, Chief Technical Officer Nishad Singh, and Alameda Research CEO Caroline Ellison. All 3 are explained to know that FTX will take consumer deposits to Alameda Research and invests at a reduction, resulting in a deficit of up to $eight-ten billion. These are all characters thought of “confidants” of Sam Bankman-Fried, who have accompanied FTX and Alameda considering that the two have been founded in 2019.

Follow also Wall Street JournalIn a meeting with FTX personnel on Nov. 9, Caroline Ellison, CEO of Alameda Research, admitted that Alameda has been borrowing a great deal of funds in 2022 to invest in venture capital, as nicely as paying on other organizations. When the industry crashed due to the LUNA-UST situation in May, people loans have been reclaimed by creditors, forcing the investment fund to request FTX for funds, and FTX moved consumer deposits to Alameda. Aside from Ellison and Sam Bankman-Fried, only FTX Chief Technology Officer Gary Wang and Chief Technical Officer Nishad Singh knew about the transaction. Ellison explained he was sorry for bringing the whole organization into the recent predicament.

As exposed by Sam Bankman-Fried in a current interview, the two Gary Wang and Nishad Singh had “run away” simply because they “felt guilty,” regardless of not being aware of in which Caroline Ellison’s recent place is.

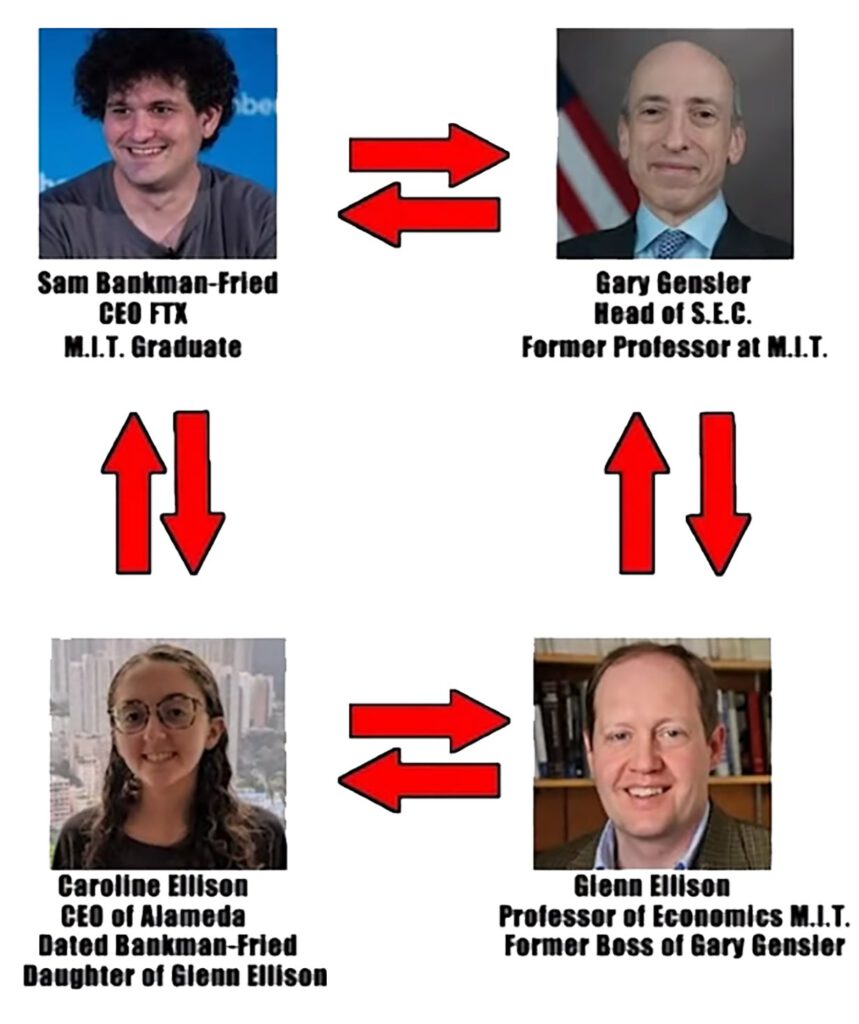

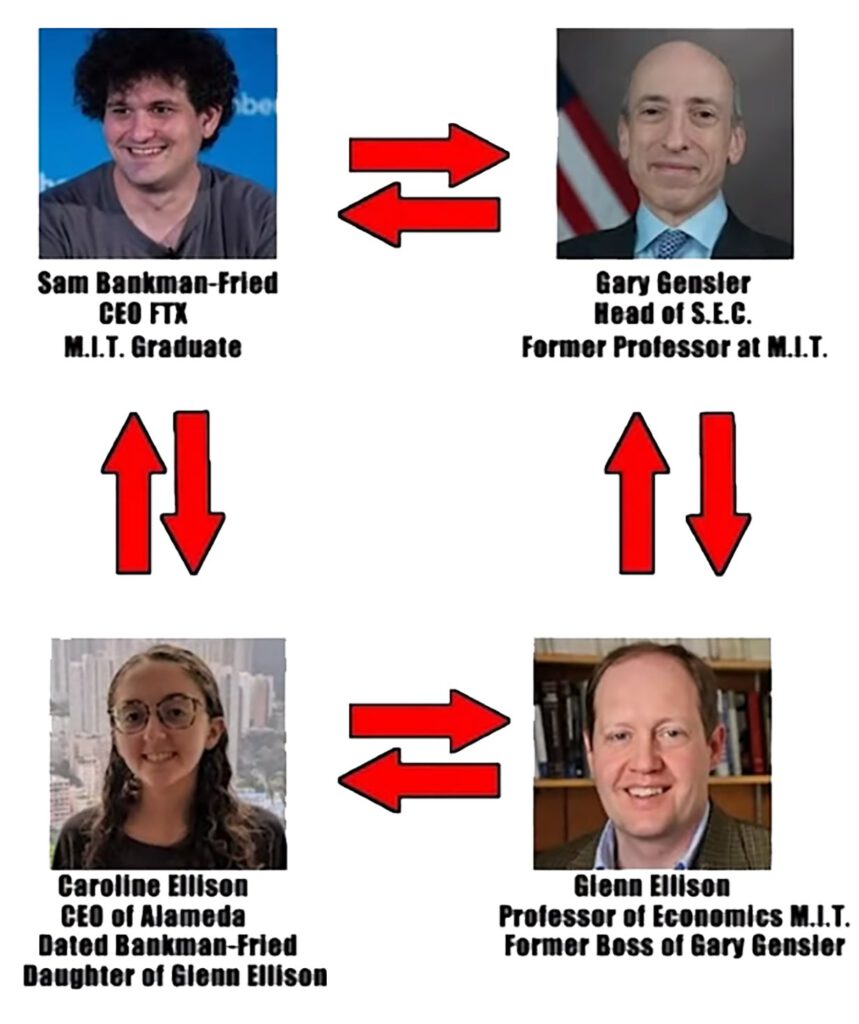

In addition, a “conspiracy theory” about the collusion amongst FTX and US monetary regulators is staying spread on Twitter, deliberately ignoring FTX’s problems to lead to “disaster”. As a outcome, Caroline’s father is a professor at Stanford University, who was the former boss of recent SEC Chairman Gary Gensler. The SEC has been in frequent dialogue with FTX above the many years and is explained to be committed to not interfering in the operation of the exchange.

In the preliminary report sent to the court a week following the detection and evaluation of the predicament of FTX, Mr. John J. Ray III, famed in the US legal sector for possessing dealt with the bankruptcy of Enron, also had to comment the following:

“Never in my occupation have I witnessed this kind of a finish failure of corporate management and this kind of a lack of reputable monetary data. From the breach of technique integrity and legal oversight, to the concentration of manage in the hands of a little group of inexperienced and perhaps malicious personnel, the company’s recent predicament is unprecedented.”

The new CEO’s report also pointed to numerous surprising findings this kind of as that FTX has a mechanism to avert the liquidation of Alameda, Alameda has loaned FTX directors up to $two.three billion, FTX has no identify No financial institution accounts and with no deposit consumer data, all energy is concentrated in the hands of a little group of Sam Bankman-Fried confidants.

Therefore, Mr. John J. Ray suggests that the court not use FTX’s preceding monetary statements as a basis for evaluation, simply because the dependability is not higher.

One character wholly absent from the FTX-Alameda crash is former CEO Sam Trabucco, who accompanied Alameda Research from 2019 until eventually his sudden resignation in September 2022, shortly ahead of the exchange’s issues came to light.

Synthetic currency68

Maybe you are interested:

The bankruptcy unit that took above FTX fired people who knew about the connection of FTX lending funds to Alameda Research to Alameda Research.

According to sources of Wall Street JournalFTX’s new CEO John J. Ray III, who took above the exchange to deal with the platform’s failure following Sam Bankman-Fried’s resignation, has terminated the contract with three of Sam Bankman-Fried’s trusted managers.

Specifically, FTX fired FTX Chief Technology Officer and Co-Founder Gary Wang, Chief Technical Officer Nishad Singh, and Alameda Research CEO Caroline Ellison. All 3 are explained to know that FTX will take consumer deposits to Alameda Research and invests at a reduction, resulting in a deficit of up to $eight-ten billion. These are all characters thought of “confidants” of Sam Bankman-Fried, who have accompanied FTX and Alameda considering that the two have been founded in 2019.

Follow also Wall Street JournalIn a meeting with FTX personnel on Nov. 9, Caroline Ellison, CEO of Alameda Research, admitted that Alameda has been borrowing a great deal of funds in 2022 to invest in venture capital, as nicely as paying on other organizations. When the industry crashed due to the LUNA-UST situation in May, people loans have been reclaimed by creditors, forcing the investment fund to request FTX for funds, and FTX moved consumer deposits to Alameda. Aside from Ellison and Sam Bankman-Fried, only FTX Chief Technology Officer Gary Wang and Chief Technical Officer Nishad Singh knew about the transaction. Ellison explained he was sorry for bringing the whole organization into the recent predicament.

As exposed by Sam Bankman-Fried in a current interview, the two Gary Wang and Nishad Singh had “run away” simply because they “felt guilty,” regardless of not being aware of in which Caroline Ellison’s recent place is.

In addition, a “conspiracy theory” about the collusion amongst FTX and US monetary regulators is staying spread on Twitter, deliberately ignoring FTX’s problems to lead to “disaster”. As a outcome, Caroline’s father is a professor at Stanford University, who was the former boss of recent SEC Chairman Gary Gensler. The SEC has been in frequent dialogue with FTX above the many years and is explained to be committed to not interfering in the operation of the exchange.

In the preliminary report sent to the court a week following the detection and evaluation of the predicament of FTX, Mr. John J. Ray III, famed in the US legal sector for possessing dealt with the bankruptcy of Enron, also had to comment the following:

“Never in my occupation have I witnessed this kind of a finish failure of corporate management and this kind of a lack of reputable monetary data. From the breach of technique integrity and legal oversight, to the concentration of manage in the hands of a little group of inexperienced and perhaps malicious personnel, the company’s recent predicament is unprecedented.”

The new CEO’s report also pointed to numerous surprising findings this kind of as that FTX has a mechanism to avert the liquidation of Alameda, Alameda has loaned FTX directors up to $two.three billion, FTX has no identify No financial institution accounts and with no deposit consumer data, all energy is concentrated in the hands of a little group of Sam Bankman-Fried confidants.

Therefore, Mr. John J. Ray suggests that the court not use FTX’s preceding monetary statements as a basis for evaluation, simply because the dependability is not higher.

One character wholly absent from the FTX-Alameda crash is former CEO Sam Trabucco, who accompanied Alameda Research from 2019 until eventually his sudden resignation in September 2022, shortly ahead of the exchange’s issues came to light.

Synthetic currency68

Maybe you are interested: