Users caught with dollars on the FTX exchange discover it complicated to wait for bankruptcy proceedings from the court. On the other hand, they can get their dollars back swiftly by “reselling the right to claim the property” to customers, but at a “cheap” selling price of only one/10th the worth.

The Cherokee Acquirition, an organization that specializes in obtaining the suitable to declare assets from corporations filing for bankruptcy, provides rates from $.08 – $.twelve for one USD of assets on FTX (with a minimal buy of one hundred,000 USD). That is, up to ten instances significantly less than the worth the consumer can declare if “FTX adjusts successfully”.

But this is not an quick issue, when customers contemplate the means to shell out as properly as the money standing of FTX at the minute to set an satisfactory selling price. It would seem that the comparatively minimal selling price of USD .08 – .twelve signifies that the probability of customers receiving sufficient dollars on FTX has been lowered.

Compared to when Celsius went bankrupt, the liquidated assets had a selling price of .two/one USD. While with Voyager Digital, customers can resell .four/one USD for the suitable to reclaim ownership.

Thomas Braziel, founder of 507 Capital, a company that specializes in financing insolvent and bankrupt institutions, mentioned “these prices are still high and nobody will buy them.” It provides a much more practical selling price than it provides $.03 – $.05.

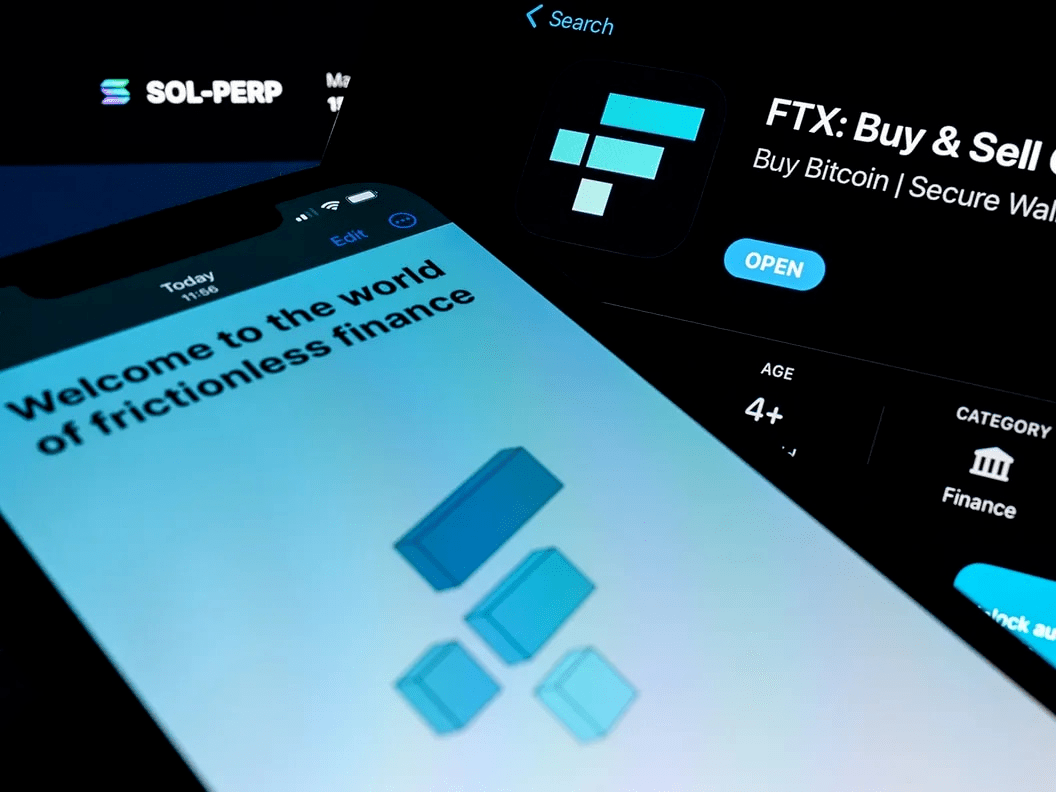

FTX, a extremely common exchange and above 130 branches, filed for bankruptcy safety on eleven/eleven. After the former SBF CEO was identified to be illegally making use of consumer deposits for loans and investments, at this time FTX was exposed to a $ten billion hole in its stability sheet, customers massively withdrew dollars and from right here it began to spread the liquidity crisis.

Countless customers and institutions, like main corporations this kind of as Genesis Trading, Galois Capital and Ikigai Asset Management, are all locked into the trading platform. A Telegram group was designed final week to “sell off” FTX accounts following the exchange blocked the withdrawal support for the initially time.

Readers could refer to the posting summarizing the organizations concerned in the FTX crash as up to date by Coinlive by November 16th.

Synthetic currency68

Maybe you are interested: