Although it claims to nevertheless hold assets equal to the volume of liabilities, the real volume owned by FTX might be much less due to illiquidity.

On the evening of eleven/twelve, newspaper Financial Times exposed much more specifics about the monetary problem of the cryptocurrency exchange FTX at the time of the bankruptcy.

Previously, in accordance to the bankruptcy filing filed in the court on the evening of Nov. eleven, FTX had stated that the exchange’s remaining assets had been amongst $ten billion and $50 billion, even though the debt obligation was also incorporated in this. band.

Even so, in accordance to the facts obtained Financial Times Gathered from an asset disclosure document sent to FTX traders at the time of bankruptcy, FTX’s real assets can be as considerably as ten instances much less.

Initial draft of what the asset side appears like.. almost certainly missing some inaccuracies/missing items

It appears SBF was also the accountant (two.1b SRM? Lol) pic.twitter.com/yo5SJFcrus

– minigrogu (@minigrogu) November 11, 2022

Notably, FTX at the moment has only $ 900 million in “highly liquid” assets, which include $ 472 million in Robinhood stock, $ 200 million in Ledger Prime stock, and $ 228 million in USD, DAI, DOT and PAXG cryptocurrencies. .

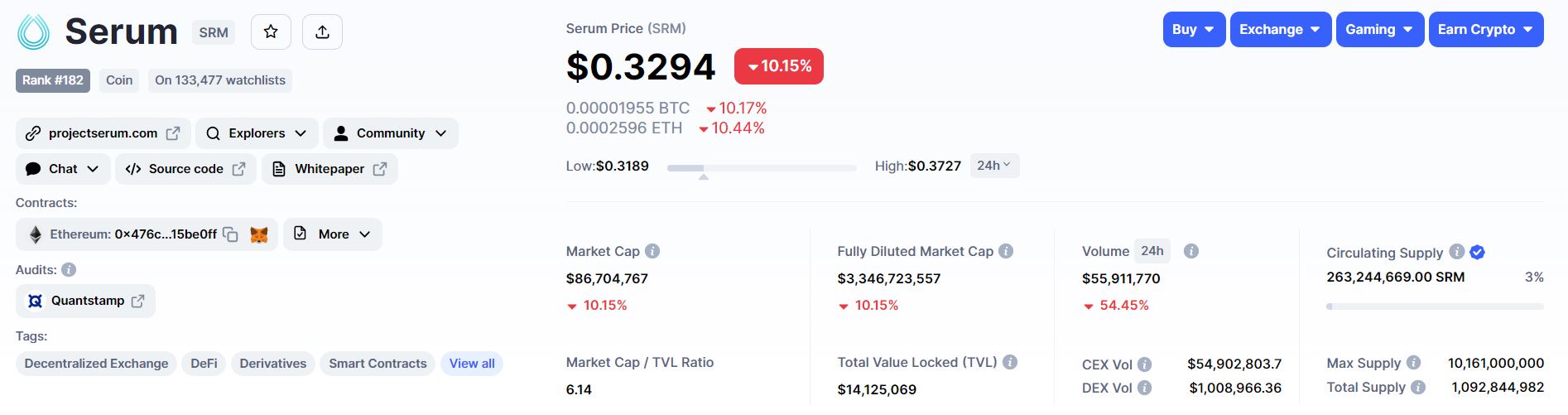

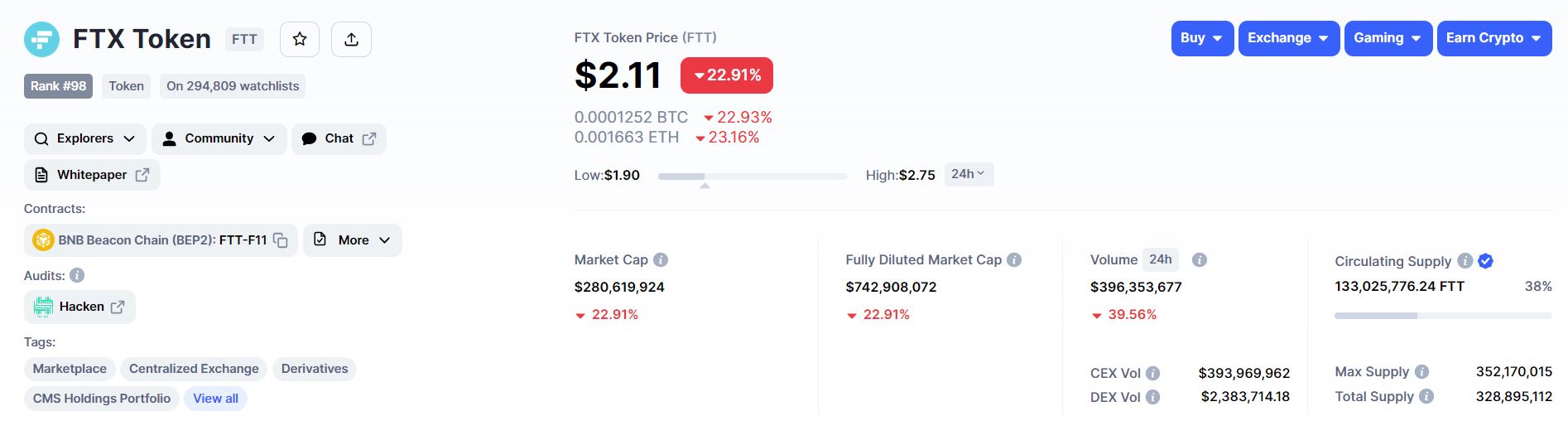

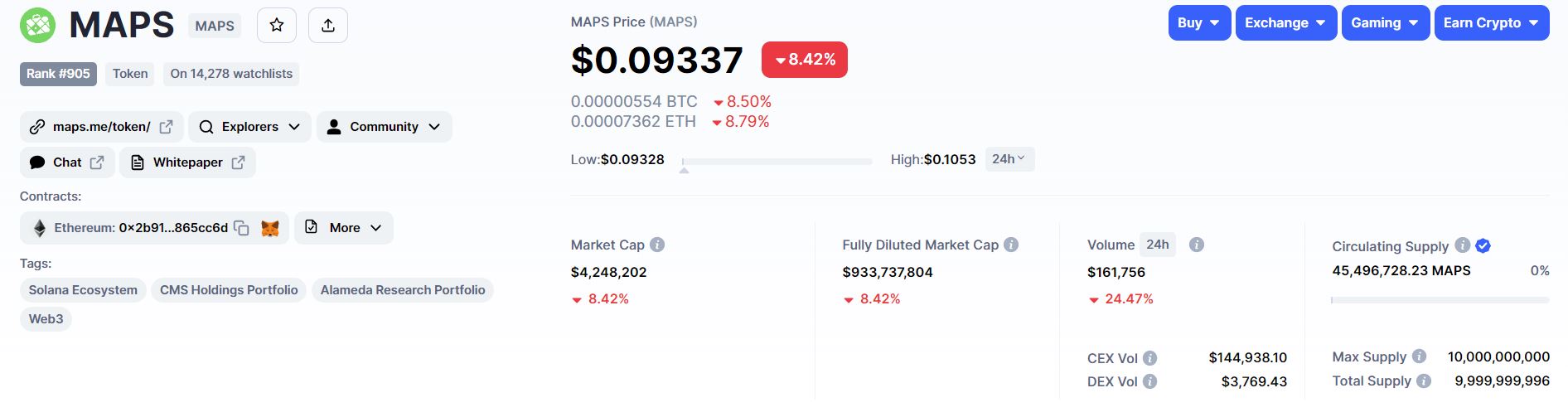

Then there are the “medium liquid” assets, which include $two.1B in Serum (SRM), $981M in SOL, $543M in FTT, $616M in MAPS, 500M in locked USDT and $312M in Aptos (APT), 54 million OXY and lots of hundreds of thousands of bucks in currencies this kind of as FIDA, wSOL, ETHE, and so forth. – for a complete of five.three billion bucks.

However, this amount prospects to a great deal of dubious queries as SRM at the moment has a industry cap of just $88 million, even though FTT is $276 million and MAPS is $four million. Therefore, assuming FTX can promote and liquidate the aforementioned token, it will not be capable to acquire the worth as stated over. The price tag of most of the tokens in this class belong to the Solana ecosystem, which has plummeted due to the fact FTX was reported to crash as the exchange has lengthy been recognized to be Solana’s greatest supporter.

Additionally, FTX also lists $three.two billion in “illiquid” assets as funds invested in other money and assets. Notably, the exchange also bet that Donald Trump will shed the US presidential election in 2024 well worth $seven.three million.

Financial Times Based on the facts over, FTX’s real assets should really only be calculated at $ 900 million in really liquid portfolios, fully ignoring the medium and minimal liquidity classes. Therefore, FTX’s assets can be up to ten instances much less than the $ 9.four billion reported by the exchange.

As for the debt, FTX paperwork present that it is demanded to shell out up to $ eight.9 billion, of which $ five.one billion is payable in US bucks.

Financial Times disclosed that FTX recorded up to $five billion in asset withdrawals amongst Nov. six and seven, as effectively as an $eight billion reduction due to “a mislabeled ‘fiat@’ account.” This is the motive utilised by CEO Sam Bankman-Fried to justify the motive for blocking withdrawals, due to “mislabeling” which led to customers’ remaining money remaining incorrectly calculated.

Answer the interview Financial Timesthe CEO also stated he “accidentally” transferred $eight billion to investment fund Alameda Research, but did not offer additional explanations.

Mr. Sam Bankman-Fried admitted:

“There are a lot of things I wish I had done differently, but the biggest were: The bill was mislabeled and the amount of money a customer could withdraw in one bank run.”

As reported by Coinlive, there have been allegations that FTX intentionally took away consumer deposits for Alameda trading, major to a chain collapse when the fund misplaced funds. According to the Wall Street Journal, people who knew and authorized of the transaction incorporated FTX CEO Sam Bankman-Fried, Chief Technical Officer Nishad Singh and FTX Chief Technology Officer Gary Wang, and Alameda Reserach CEO Caroline Ellison. These are the persons who have been with FTX – Alameda from the starting and have been deemed “Sam’s confidants.

On the morning of November twelve, the newspaper Reuters Quoting an within supply at FTX, stating that the exchange has a “backdoor” mechanism, which will allow Sam Bankman-Fried to transfer users’ funds at will. The volume of funds that was “payable” was ten billion bucks, of which eight billion was offered to Alameda for use, and the remaining one-two billion disappeared devoid of a trace.

Subsequently, FTX continued to be embroiled in chaos when much more than $500 million well worth of assets on the exchange had been out of the blue transferred, followed by a battle amongst the two sides as “black hat hackers” deliberately withdrew funds from the exchange and “the hackers from the white hat” locate techniques to secure that funds.

Synthetic currency68

Coinlive has published a series of articles or blog posts summarizing the Binance – FTX – Alameda drama, readers can see much more right here:

– Binance liquidates its total investment of $580 million in FTX tokens

– Users massively withdraw from FTX

– The complete industry was heavily dumped, FTT misplaced 22 USD

– Binance has reached an agreement to obtain back FTX – Market promote-off

– FTX CEO’s assets fell by $ 14.six billion, wrote a letter apologizing to traders

– CZ urges exchanges to offer evidence of consumer deposit

– The Solana process “endures the battle”

– Binance cancels FTX acquisition and most up-to-date updates

– Continuously lots of organizations declare “in solidarity” from FTX

– Sam Bankman-Fried writes apology letter and updates on FTX-Alameda catastrophe

– Update FTX problem on the morning of eleven/eleven/2022

– FTX declares bankruptcy, Sam Bankman-Fried resigns as CEO

– Update FTX problem on the morning of eleven/twelve/2022

– FTX has transferred a huge volume of funds from the exchange, which is suspected of remaining hacked

– Reuters: FTX has a “backdoor” for Sam Bankman-Fried to withdraw funds