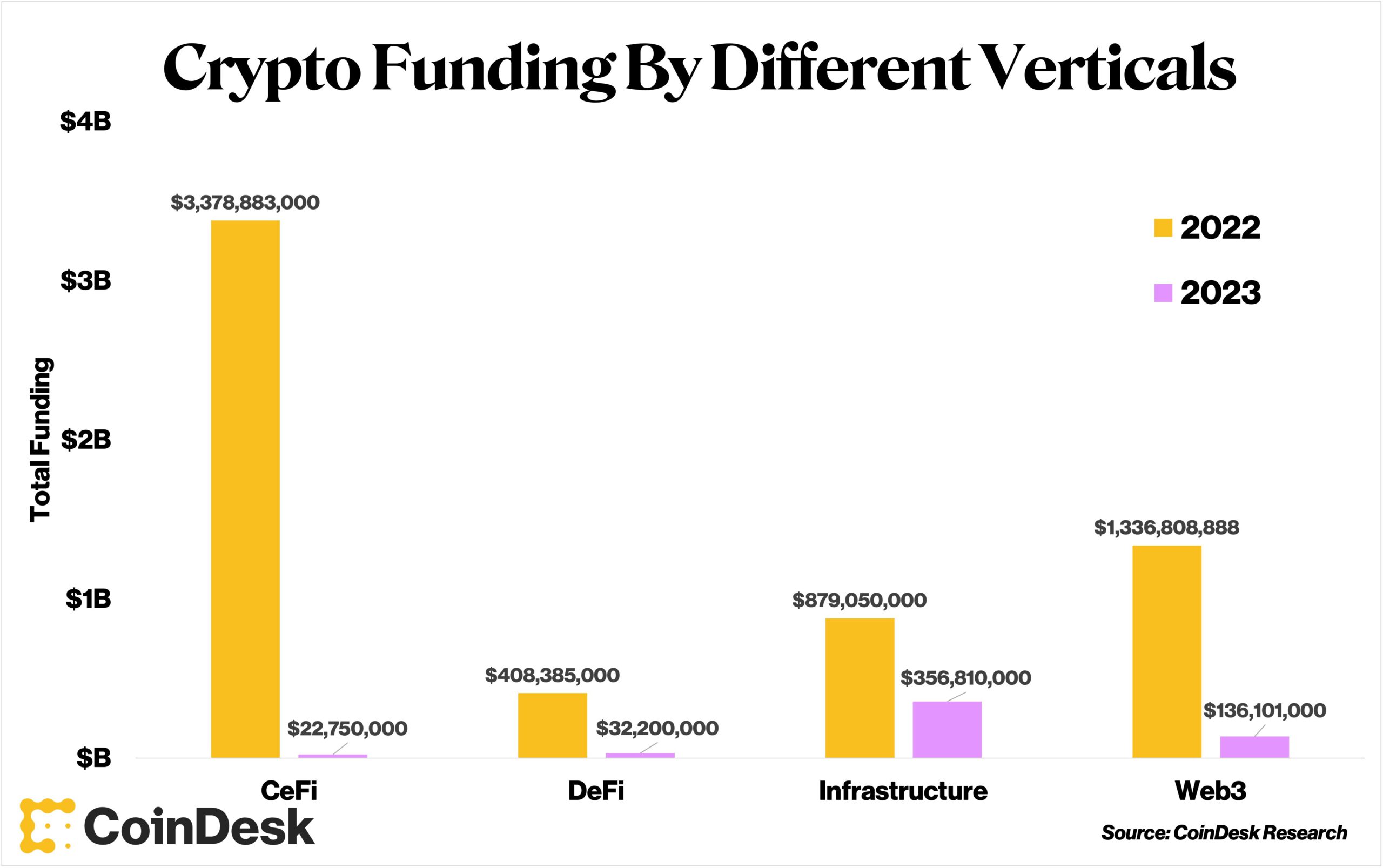

Statistics from CoinDesk demonstrates that cryptocurrency investment took a “major slump” in January 2023, down 91% 12 months-on-12 months.

According to information offered by the information web-site CoinDesk Overall, Venture Capital poured into crypto platforms has plummeted 91% in January 2023 if the exact same time period final 12 months. In complete, there had been 548 million bucks invested in the final month, down sharply from the figure six billion won in January 2022. The amount of investment discounts also decreased from 166 to 62.

Data of CoinDesk it also showed that infrastructure tasks had the “lightest” lag, down 59% to $357 million, and also the most beautiful investment section in the portfolio. For illustration, there are infrastructure startups like Blockstream And QuickNode raised $125 million and $60 million, respectively, as reported by Coinlive.

To be honest, this can be viewed as a bad comparison simply because January 2022 is when traders catch the bullish wave of the complete business, with 17 investment rounds logging above $a hundred million in 1 month.

January 2023 even now has aftershocks from The collapse of the FTX exchange in November of final 12 months the consequences persisted and took a prolonged time to stabilize. Funding rounds can consider quite a few months to finish, but right after that Scandal FTX When it came to light, investment money had been additional or much less concerned and steadily ran out of capital, top to the latest reduction of funds movement.

Synthetic currency68

Maybe you are interested:

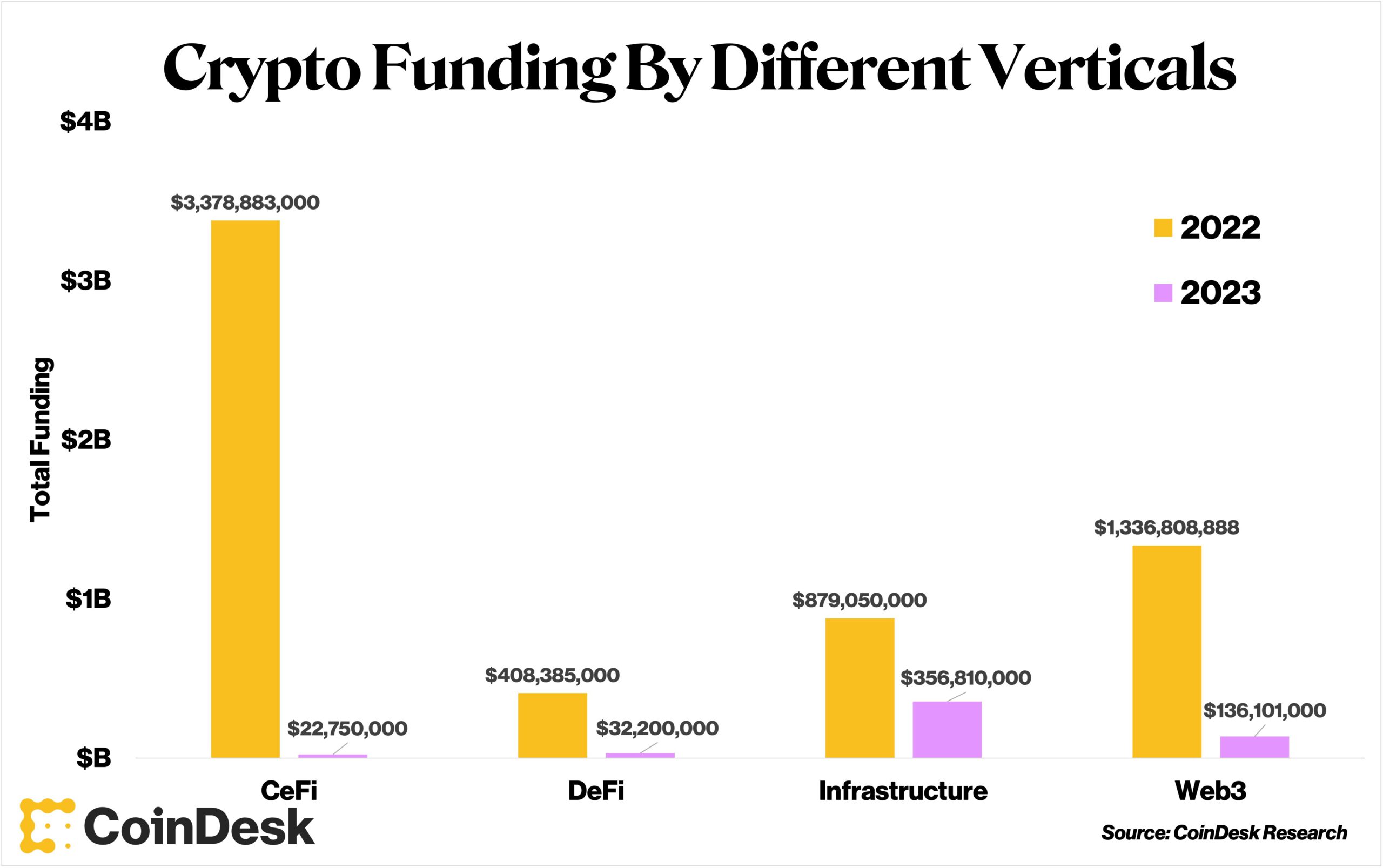

Statistics from CoinDesk demonstrates that cryptocurrency investment took a “major slump” in January 2023, down 91% 12 months-on-12 months.

According to information offered by the information web-site CoinDesk Overall, Venture Capital poured into crypto platforms has plummeted 91% in January 2023 if the exact same time period final 12 months. In complete, there had been 548 million bucks invested in the final month, down sharply from the figure six billion won in January 2022. The amount of investment discounts also decreased from 166 to 62.

Data of CoinDesk it also showed that infrastructure tasks had the “lightest” lag, down 59% to $357 million, and also the most beautiful investment section in the portfolio. For illustration, there are infrastructure startups like Blockstream And QuickNode raised $125 million and $60 million, respectively, as reported by Coinlive.

To be honest, this can be viewed as a bad comparison simply because January 2022 is when traders catch the bullish wave of the complete business, with 17 investment rounds logging above $a hundred million in 1 month.

January 2023 even now has aftershocks from The collapse of the FTX exchange in November of final 12 months the consequences persisted and took a prolonged time to stabilize. Funding rounds can consider quite a few months to finish, but right after that Scandal FTX When it came to light, investment money had been additional or much less concerned and steadily ran out of capital, top to the latest reduction of funds movement.

Synthetic currency68

Maybe you are interested: