According to a new report launched by California-based mostly hedge fund Pantera Capital, noting that Bitcoin’s current bearish intervals have been significantly less extreme than historical ones, signaling an imminent Bitcoin correction, BTC will be very balanced.

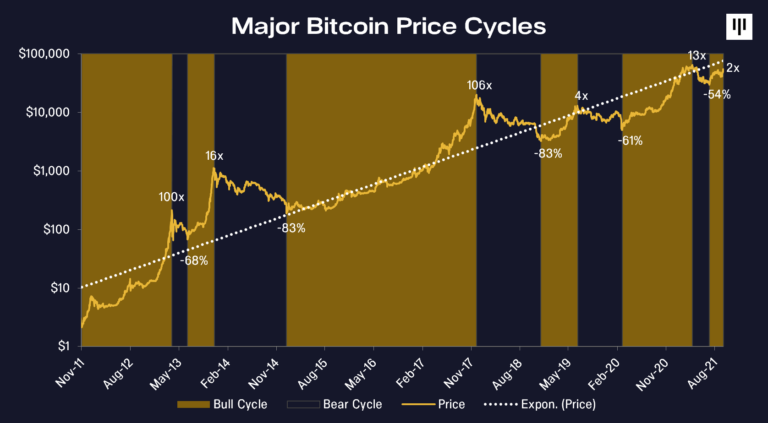

For illustration, in 2013-2015 and 2017-2018, Bitcoin fell 83% soon after reaching $ one,111 and $ twenty,089 respectively. Likewise, BTC’s bull run in 2019-2020 and 2020-2021 has led to big rate corrections. However, BTC’s retracement charge fell to -61% and -54% respectively.

Pantera Capital CEO Dan Morehead highlighted the regular decline in promoting sentiment following the 2013-2015 and 2017-2018 bearish cycles. Therefore, the long term bear marketplace will not be as hefty and the duration may well be shorter than just before. He explained:

Based on historical information, I argue that the marketplace has gotten larger, a lot more beneficial, and the rate selection will be reasonable.

Recently, Bitcoin renewed its bullish power to retest its present record close to $ 65,000. BTC topped $ 60,000 for the 1st time because early May, when the United States Securities and Exchange Commission (SEC) accepted its 1st Bitcoin ETF soon after many years of rejection of very similar investment merchandise.

The approval of a Bitcoin ETF has raised expectations that it will make it simpler for institutional traders to enter the BTC marketplace. This also assisted BTC compose off nearly all of the losses it took all through the April-July bearish cycle.

– See a lot more: The massive one particular billion dollar investment in Bitcoin (BTC) was x2

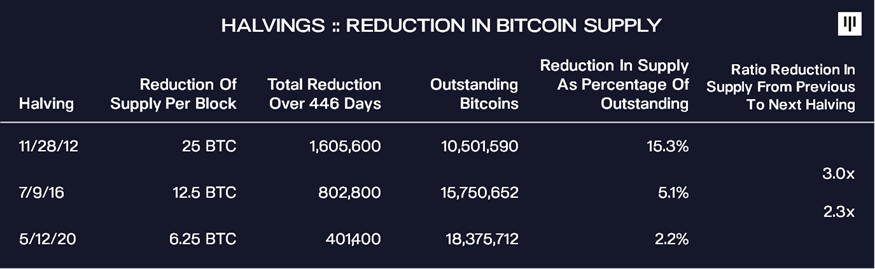

At the similar time, the halved occasion plays an equally critical purpose. The 1st halving lowered Bitcoin provide by 15% of the complete Bitcoin backlog. This has a big effect on BTC’s new providing and rate.

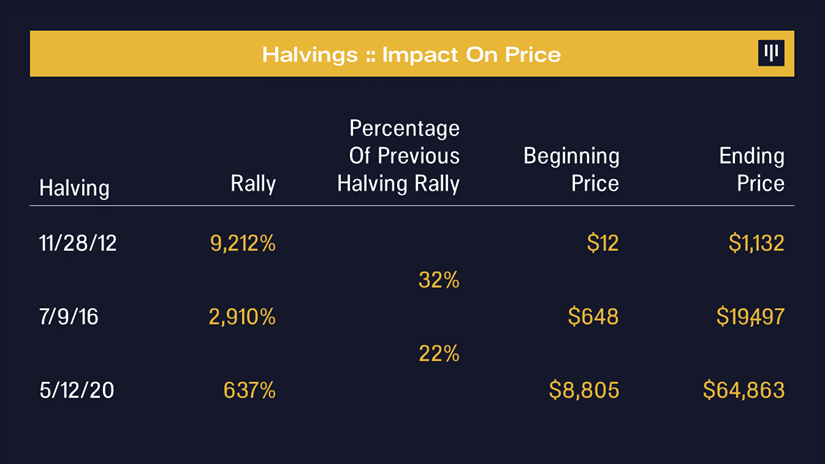

The 2016 halving was only a third of that of 2012. Interestingly, BTC was specifically one particular third of the rate in terms of rate. The 2020 halving is after yet again specifically one particular third of that of 2016 and rate action moves in the similar proportions.

Another noteworthy level is that all through 2017, the complete marketplace was searching forward to CME listing Bitcoin futures and when that day came, BTC peaked and started to plummet. As historical past repeats itself this yr, the complete cryptocurrency marketplace expects Coinbase to go public. The Bitcoin marketplace grew 822% on the day of listing. BTC peaked at $ 64,863, then fell 53% in worth. Currently, we are in the phase with the Bitcoin ETF.

Synthetic Currency 68

Maybe you are interested: