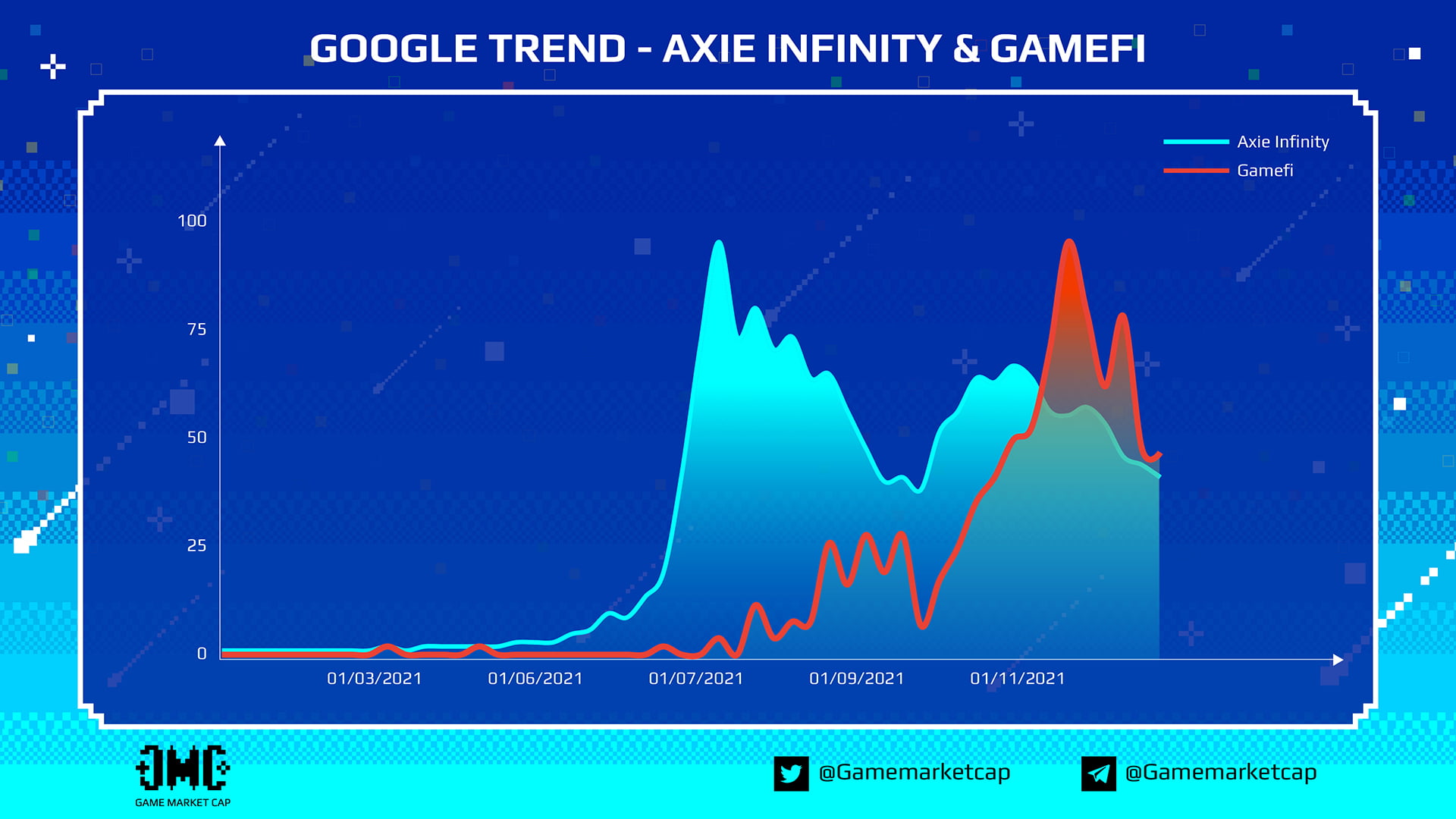

Before Axie Infinity exploded onto the scene this summer season, the GameFi notion had been all around for a lengthy time in the crypto area, but did not get significantly consideration from the local community. However, this summer season is the time when GameFi confirms its place as Axie Infinity completes the transition to Ronin sidechain and refines its Play-to-Earn model suitable at the time of the COVID-19-19 pandemic. All of the over occasions have turn out to be pieces of the puzzle in the suitable location at the suitable time, setting the stage for the accurate boom of GameFi in 2021.

Through GameFi Market Report 2021, GameMarketCap and Ancient8 Team hope to provide readers an overview of GameFi in 2021 by way of an overview of GameFi in ecosystems, investments and advancement of crucial solutions in this niche, namely the Launchpad and Gaming Guild model.

one. Overview

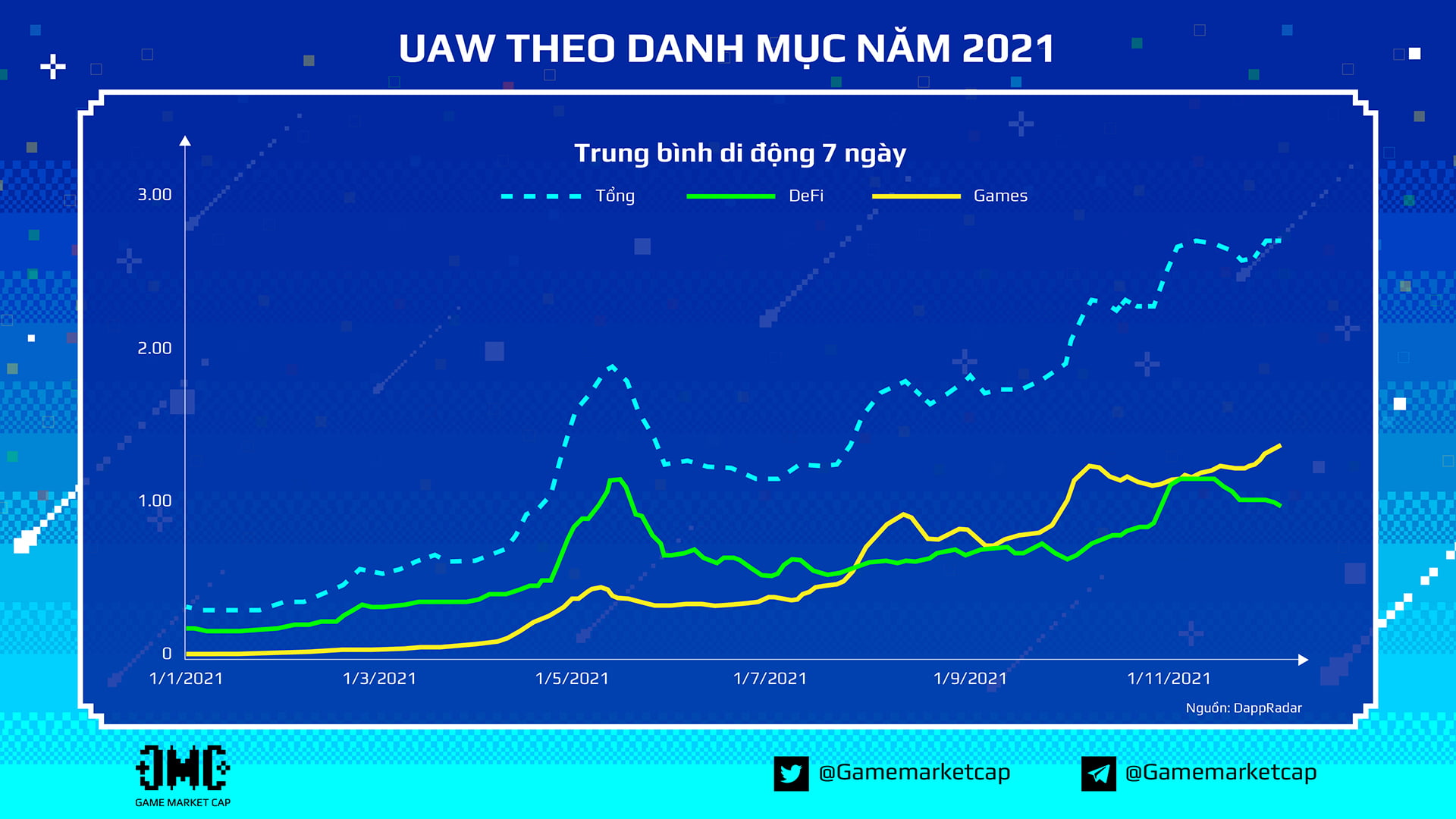

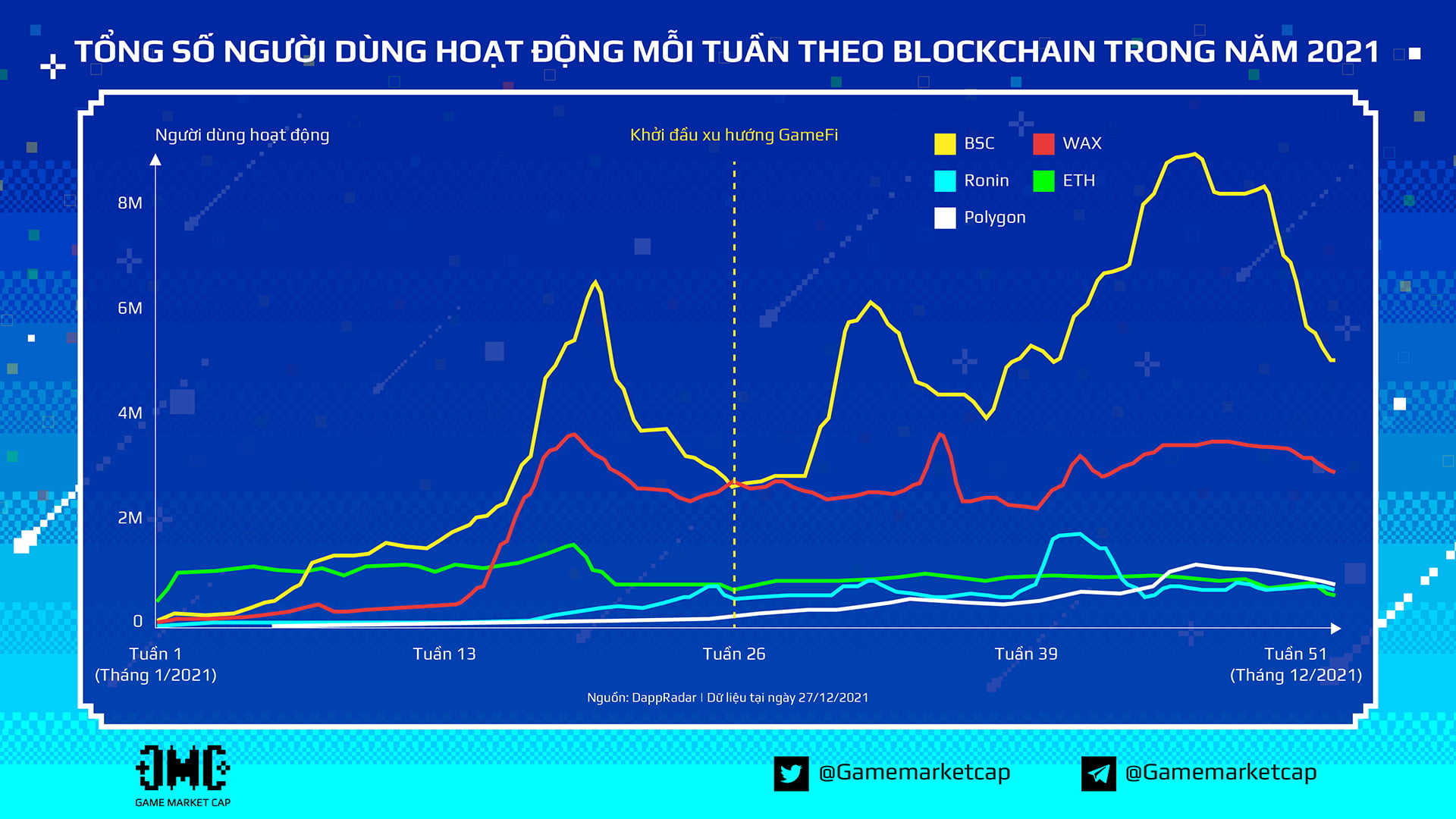

In 2021 and particularly in the third quarter, the GameFi market place sector professional powerful development when the Unique Active Wallets – UAW (wallet) index lively on GameFi applications crossed the one million consumer milestone for the very first time. At the starting of the fourth quarter of 2021, the UAW index professional a exceptional development of 318% in contrast to the starting of the third quarter of this yr (in accordance to statistics from DappRadar). Despite posting an ATH UAW of one.five million on November thirty, the UAW index ended 2021 modestly with somewhere around one.two million lively customers on GameFi applications, down six% from the starting of the quarter. of the earlier yr.

According to statistics from DappRadar, the quantity of folks lively on GameFi applications represents 49% of the complete quantity of folks working on decentralized applications with sizeable website traffic development in the GameFi group in the coming months. Q2 2021 when Axie Infinity effectively sidechain Ronin transitions and Alien Worlds trillium mining is activated. This index even surpassed the DeFi niche index in August, when a quantity of blockchain gaming apps set the trend, sparking a actual boom in the GameFi niche.

Axie Infinity deserves the consideration of the GameFi local community and cryptocurrency in basic for staying a pioneer in taking benefit of the perform-to-earn model to increase consumer income just in May, when the market place The cryptocurrency market place started to decline. , as very well as the complex predicament of the epidemic in the nations of Southeast Asia. This occasion has been likened to a “butterfly effect”, indirectly triggering the GameFi era and once again in 2021, shaking the complete cryptocurrency market place.

two. Axie Infinity

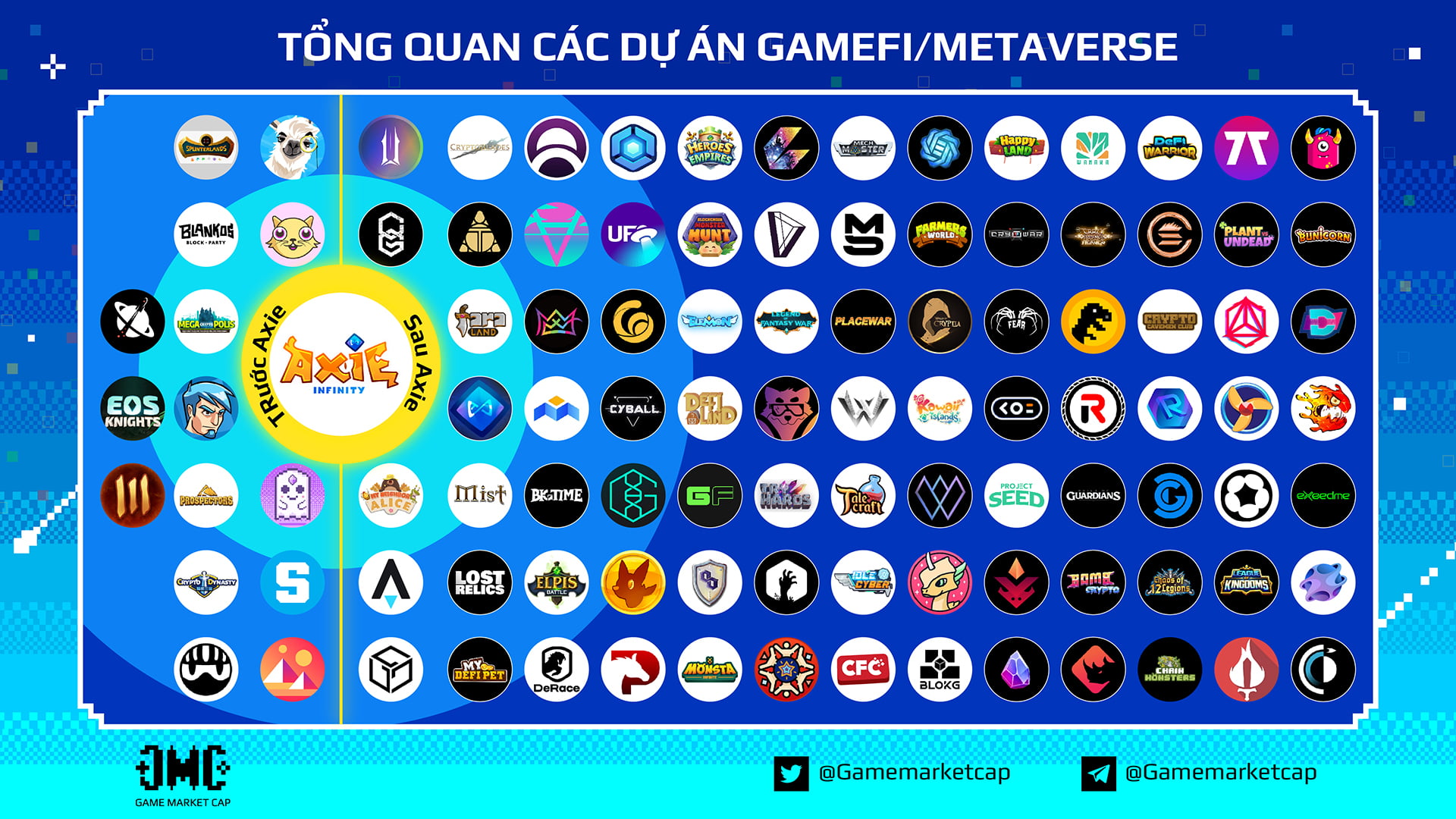

Undeniably, Axie Infinity is the beacon that carried the GameFi ship by way of the fog of the DeFi storm and the market place crash in May 2021. As the on-chain information displays, Axie Infinity holds the third place in terms of protocol income for itself. at the finish of 2021, just behind Filecoin and the L1 blockchain predecessor of this undertaking, Ethereum. Notably, the rise of Axie has brought a new breath to the market place, setting the stage for the advancement of a quantity of other GameFi tasks, establishing an fully new place for the blockchain application., For the very first time, capable of challenge the classic area.

🚀 @AxieInfinity is the pioneer who pushes the #blockchain space for mass adoption, verified to be the third greatest protocol revenue.

Starting with the very first Axie Infinity championship, @ Ancient8_gg is right here to guidebook you by way of this ambitious journey in Lunacia.❤️🔥# P2E pic.twitter.com/EgRXQB23Noi

– Ancient8 (@ Ancient8_gg) December 14, 2021

With a lot more than $ one.26 billion in protocol income, of which almost 98.five% was accumulated in the final 180 days alone, Axie Infinity deserves to be the winner of the 2021 crypto area airline’s prestigious “Golden Globe” award. With this phenomenal development, the perform-to-earn leader has closed a memorable 2021 with benefits that go past some of the most preferred video games customers have ever heard ahead of. For illustration, Fortnite finished reaching its very first million customers in August 2017, two many years right after the launch of the Closed Beta (in accordance to Statista). Since then, this “golden egg” game from Epic Games has dominated the battle royale genre with 350-fold development in excess of the up coming three many years. Meanwhile, Axie only wants to transition to the Alpha phase to attain its very first milestone of two million customers, even if the Free-to-perform edition was not launched by Sky Mavis.

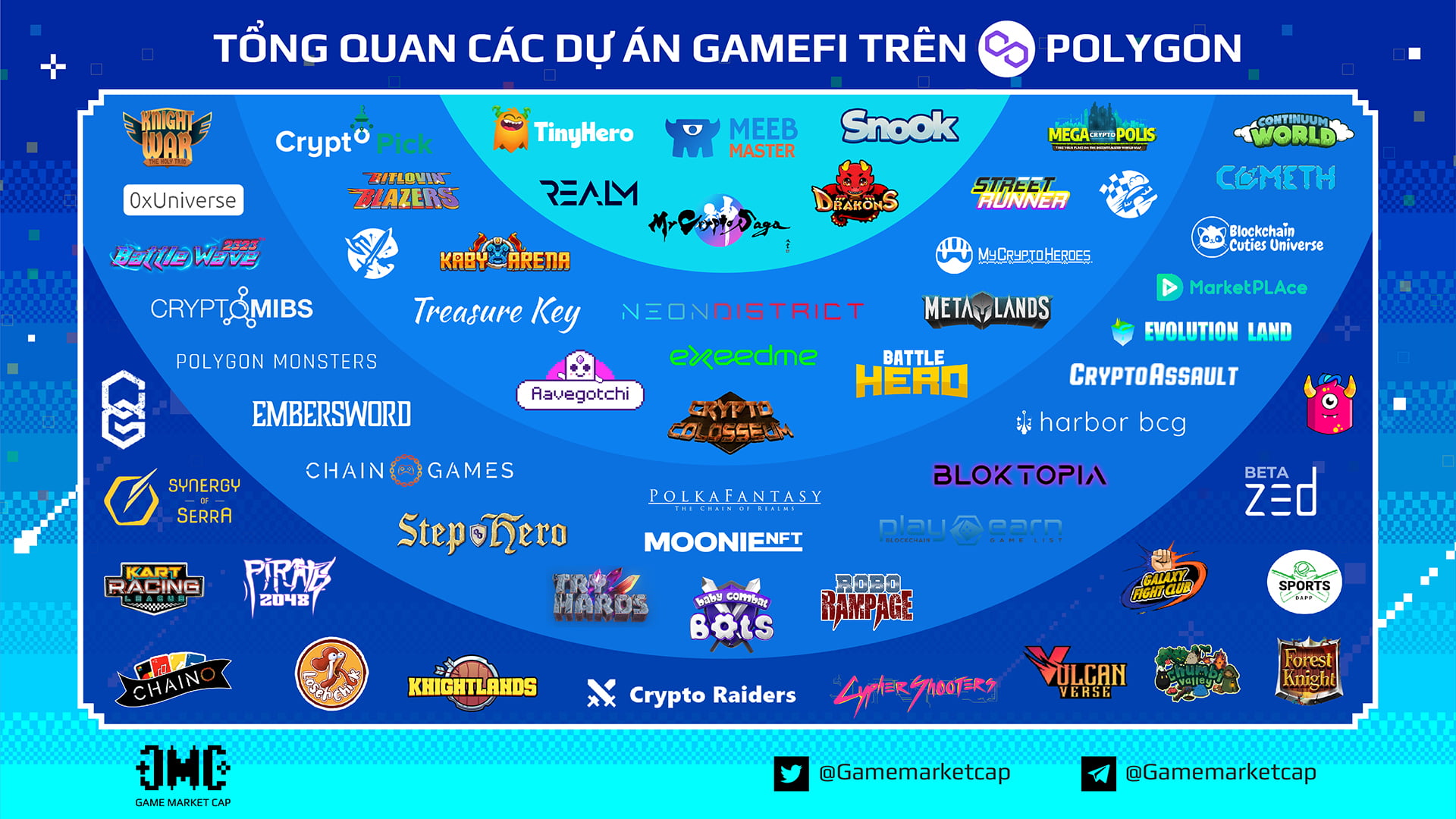

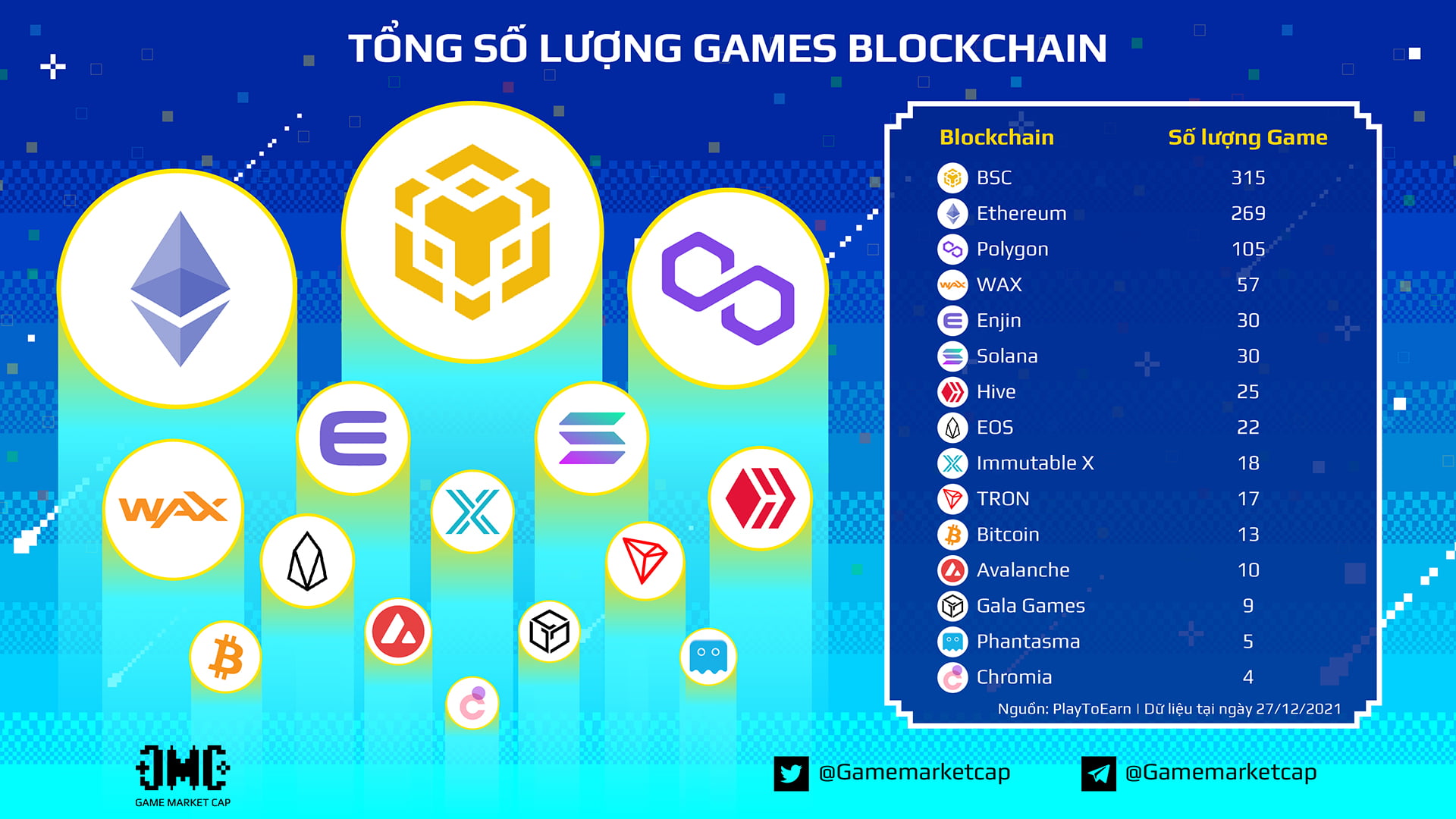

The Axie phenomenon has spread an inspirational story for up coming-generation GameFi tasks, following in the footsteps of this title by conquering even more milestones in the budding land of GameFi. In the pre-Axie era, it was really hard to come across GameFi tasks or even the phrase “play-to-earn” appeared to by no means have existed in the Blockchain globe at that time. So far the quantity of GameFi tasks has exceeded a thousand tasks, with magnificent development in the two amount and high quality on quite a few blockchain platforms this kind of as Ethereum, BSC, Polygon, Solana, and so forth.

With information from Google Trend, Axie Infinity has been the creator and disseminator of the phrase GameFi to the local community considering that its peak in between June and July. Since then, the GameFi notion has steadily acquired a lot more consideration, ahead of reaching ATH in November.

However, with every development comes a new challenge: blockchain network congestion. Witnessing the Ethereum network congestion brought on by the Crypto Kitties app in 2018, the Sky Mavis group prioritized Ronin as the company’s major objective to survive in the GameFi niche. The L2 resolution not only aided Axie stay clear of the scalability challenge of the Ethereum network, but, even superior, incubated the GameFi tasks to flourish afterward. However, not all GameFi tasks are capable of producing their personal blockchain. Many tasks opt for other L2 remedies or build on large functionality blockchain networks this kind of as Solana, Avalanche, WAX, … foremost to an raise in the require to create gaming applications on option Ethereum networks.

three. GameFi by way of ecosystems

Despite Axie Infinity’s good results story on Ethereum, the issues and problems of constrained scalability, large transaction charges and network congestion are the moment once again current as significant obstacles, avoiding the long term advancement of GameFi applications on this blockchain. As a end result, the cryptocurrency local community has witnessed an spectacular raise in the quantity of large-functionality blockchain-primarily based GameFi tasks as an option to Ethereum in the 2nd half of 2021.

It can be stated that GameFi plays a sizeable function in strengthening the place of large-functionality blockchains in the third and fourth quarters of 2021. On-chain information displays that the quantity of customers per week on the most vital blockchains for GameFi has risen to 482% stars from the very first week of 2021. According to DappRadar, GameFi represents an regular of forty% of complete on-chain customers per blockchain in the 2nd half of 2021 in contrast to other classes of DeFi, Exchange, Gambling, and so forth. Among these, BSC and WAX acquired the most curiosity from the local community, from two.69 million and two.58 million weekly customers in June 2021 to ATH of eight.97 million and three.four million respectively in the 2nd half. of 2021. Ronin Network, a sidechain resolution linked to the Ethereum network, applied for blockchain applications by Sky Mavis (presently Axie Infinity) is a concrete illustration of the boom of GameFi with an raise of about 300 customers in January to nearly 740,000 customers per week at December 2021 (in accordance to DappRadar information). .

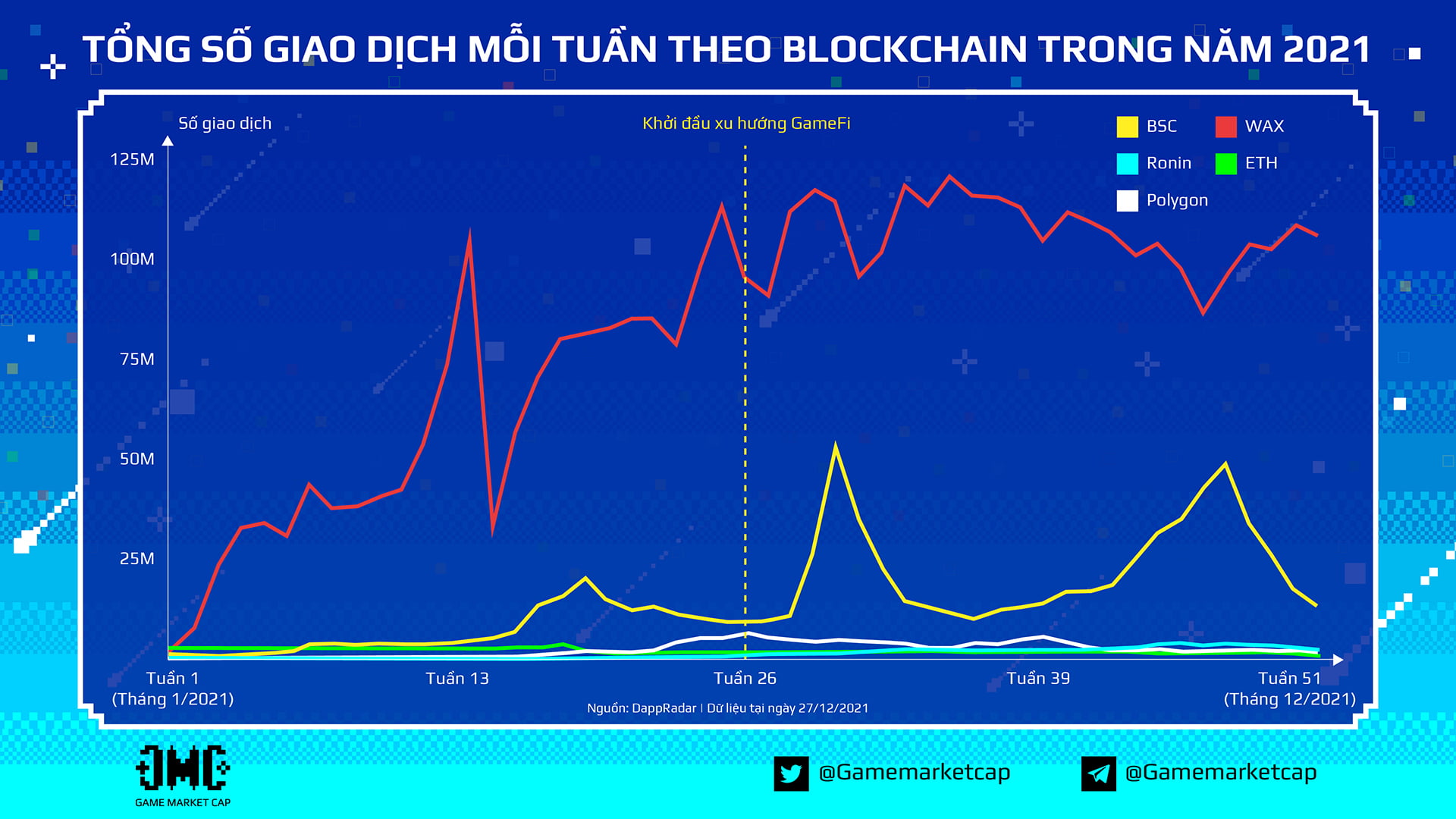

In reality, GameFi accounts for 77% of all transactions on all blockchain platforms on regular, fully outperforming DeFi (in accordance to Dapp Radar). The information also displays an raise in complete transactions in the GameFi group alone in contrast to the very first half of 2021 as the metric greater by 98% to an regular of 135.eight million weekly transactions in the 2nd half of the yr in contrast to the regular of 68. five million in the very first half of 2021. Thus, the moment once again demonstrating the fantastic function of the GameFi market place niche for these blockchain platforms.

With enhancements in functionality and scalability, up coming-generation blockchains allow GameFi applications to get rid of technological limitations, assisting video games increase gameplay and tokenomics. With an obtainable consumer base, BSC has overtaken Ethereum as the favored blockchain platform for GameFi tasks and infrastructure advancement with a complete of 315 video games created on this platform in May-December 2021.

three.one. Binance Smart Chain

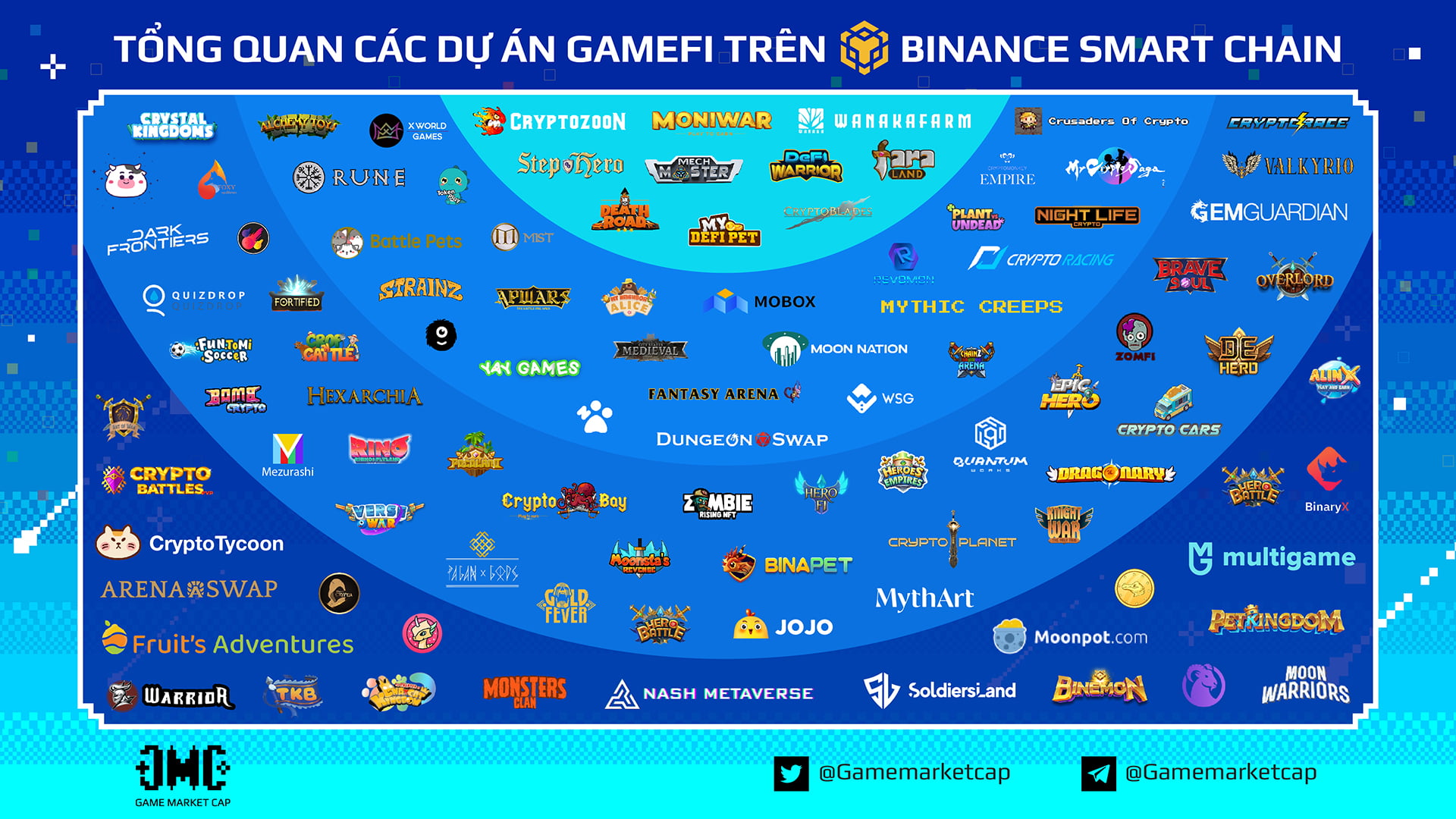

Binance Smart Chain has closed a total yr 2021 with quite a few milestones recorded thanks to the advancement of this GameFi ecosystem on this blockchain, alternatively of focusing on constructing DeFi infrastructure like the approach outlined over. According to Token Terminal, complete income created on Binance Smart Chain broke a record $ 600 million in contrast to $ two.two million in June 2021.

Since then, Binance Smart Chain has been regarded by the local community as the “land of GameFi” with excellent tasks that have stimulated the crypto local community this kind of as CryptoZoon, CryptoBlades and Mobox with information in the two customers and transaction volumes. However, there are nonetheless a sizeable quantity of tasks with unfavorable selling price movements, which result in person traders to have a unfavorable see of the high quality of GameFi tasks on this blockchain platform.

three.two. Polygon