The Bitcoin market is prone to rise in worth within the close to future when the Grayscale fund’s GBTC shares are formally launched this July.

According to some crypto analysts, traders can enter the common cryptocurrency market to purchase Bitcoin (BTC). This is to repay the earlier crypto loans that the investor used to buy Grayscale Bitcoin Trust (GBTC) inventory.

Amber Group, a significant cryptocurrency trade, launched its Twitter assertion on July 2 as follows:

“There is quite a lot of discuss in regards to the drop in costs surrounding the GBTC launch. Meanwhile, they ignore the issue that requiring the acquisition of debt-financed GBTCs will ultimately result in the acquisition of Bitcoin on the spot market. “

According to the Amber Group, traders who entered the transaction by blocking borrowed cryptocurrencies now need to redeem them to repay their debt. Likewise, those that deposit Bitcoin to carry inventory should purchase again Bitcoin to return to their unique wallets.

So, if supply-side components stay fixed, the buybacks related to unlocking the Grayscale Bitcoin Trust may ultimately create a powerful shopping for drive within the Bitcoin market.

Earlier, analysts at JPMorgan, a number one US monetary establishment, had mentioned that Bitcoin will come below nice promoting strain when GBTC is unlocked in July 2021. As a outcome, analysts at JPMorgan assume Bitcoin may drop to $ 25,000.

“The sale of GBTC after 6 months of non permanent blocking has grow to be a sizzling subject in recent times. This transfer may put downward strain on GBTC particularly and the Bitcoin market usually, “shared JPMorgran strategist Nikilaos Panigirtzoglou.

However, the unlock pace is now set to extend, inflicting many analysts not to consider the sharp drop in Bitcoin costs. Because whereas the sale of GBTC inventory may result in a deep decline and lack of new capital, its unfavourable influence will be mitigated by shopping for again BTC on the spot market.

Jeff Dorman, Chief Investment Officer of Arca, a cryptocurrency administration firm, additionally expressed his private opinion:

“The greatest breakouts are occurring within the subsequent couple of months, which may result in quite a lot of GBTC gross sales on the open market. When funds scale back trading, it would successfully create shopping for strain on Bitcoin, not promoting. Because those that promote GBTC must purchase again Bitcoin to pay for the transaction within the quick time period. “

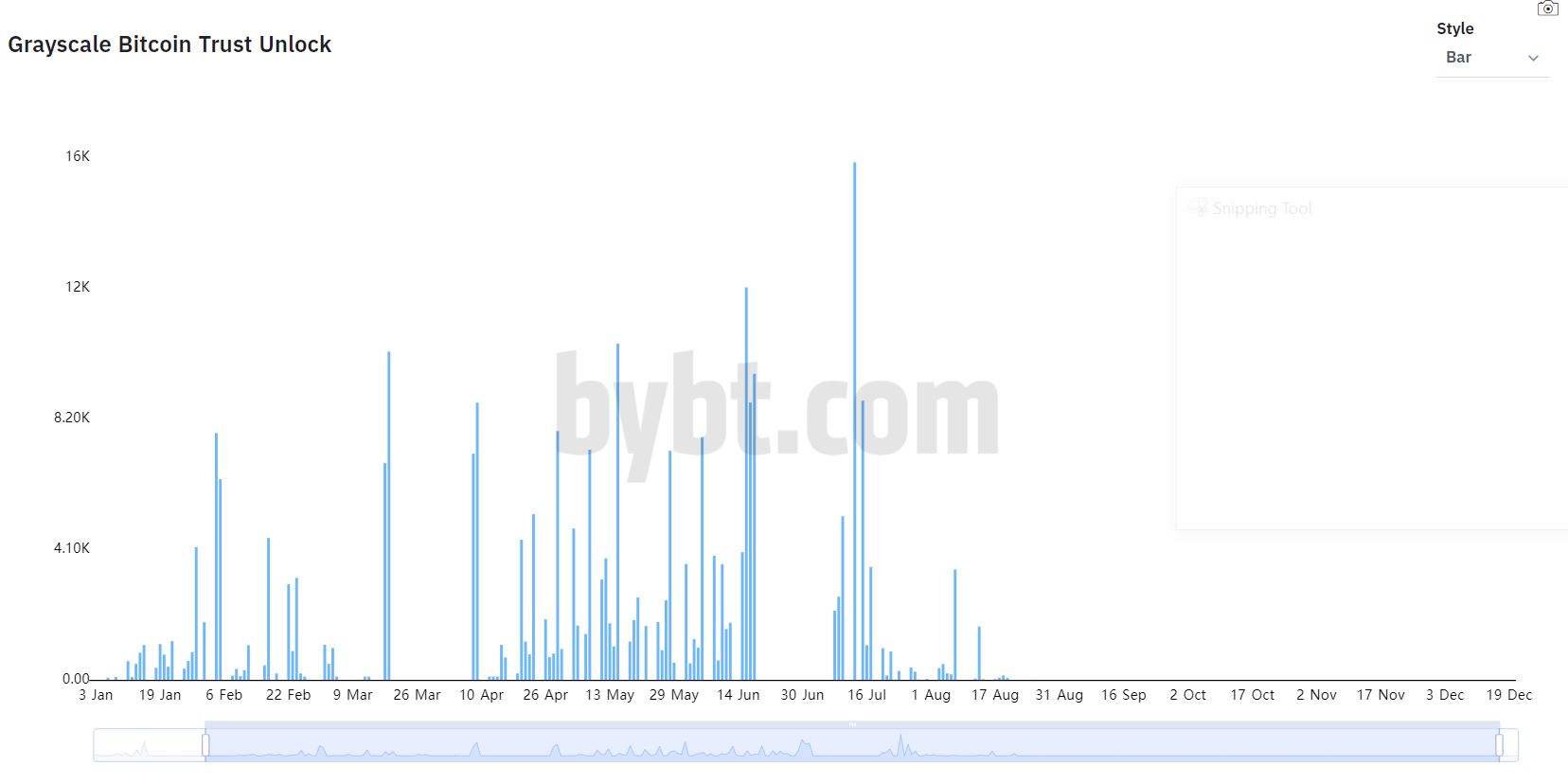

According to information from bybt.com as proven within the picture, the discharge of GBTC shares, scheduled for January, will formally happen in July 2021. Grayscale is predicted to problem practically 40,000 GBTC shares.

In which, July 18 is the day to unlock the most important quantity with the issuance of shares value 16,000 BTC. Once unlocked, merchants can take Bitcoin from the spot market to repay loans or return to their unique pockets. This is the transfer that may assist the BTC / USD worth rise extra strongly.

For a very long time, for varied causes, GBTC shares have been trading 40% or extra above the spot market worth of Bitcoin. Therefore, for big traders, this looks as if a surefire solution to make a revenue, particularly when market sentiment is moderately optimistic. There is at present little concern a few sharp decline in premiums or a transfer to reductions, which may scale back internet returns on precise transactions.

However, the Bitcoin market has taken a nasty flip up to now few months. Recently, in February 2021, GBTC Premium had quite a lot of reductions, which created fewer incentives for brand spanking new traders to take part within the transaction. According to information from Skew, as of July 1, GBTC shares are trading at a reduction of 10.5%.

Synthetic Currency 68

Maybe you have an interest:

.