When we speak about the Big Shorts of the century, we will certainly promptly feel of Michael Burry, who single-handedly went towards the marketplace and reaped a great deal of revenue right after the 2008 true estate bubble. However, if we say that Michael Burry is a “short selling genius”, so when speaking about George Soros, folks have to use the title “short selling lord”. Because his brief offering not only manufactured him $one billion, but also triggered the British pound to fluctuate and even triggered British Prime Minister John Major to reduce his seat.

Who is George Soros? Biography of the guy who manufactured the British pound collapse

Who is George Soros?

George Soros (total title Dzichdzhe Shorak) was born on August twelve, 1930 in Hungary to a relatives of Jewish origin. His childhood was fairly peaceful right up until 1939, when the Second World War took location below the leadership of fascism, in which excessive anti-Semitic ideology was most revered and promoted by Hitler.

And no matter what, Soros, then 15, had to observe as his compatriots have been deported to Nazi concentration camps, set up to torture and destroy innocent Jews. The Soros relatives was one particular of the fortunate number of who managed to escape this genocide.

Portrait of George Soros

Portrait of George Soros

The occupation of George Soros

Two many years right after the finish of the World War, the younger George Soros landed in England to give existence to his fiscal dream. To earn a residing he started out his occupation at Quaglino, a luxury restaurant in London. Realizing that guide operate did not deliver him substantially information, he determined to enroll at the London Institute of Economics.

After graduation, thanks to his connections, he was accepted at Singer & Friedlander. However, he quit the task since he felt he was not appropriate. After a particular time period, thanks to his acquaintances, he was accepted as an apprentice to a stock broker. Since then, hundreds of thousands of bucks have flowed into George Soros’ pockets by profitable bargains.

George Soros and his historic brief movie

To speak about this historical brief movie, we have to go back a very little to the financial background of Europe in common and England in unique.

Situation in Europe

After World War II, most European nations have been economically devastated, only the United States was the winner thanks to the sale of arms to each sides. Seeing America’s growth, European nations determined to join forces to produce a popular marketplace robust ample to counter threats from the United States.

However, it was not right up until 1979 that European nations officially met to examine it. And the consequence of this was the predecessor of the Euro – ERM (European exchange price). We can approximately recognize that the ERM is a mechanism developed to stabilize the worth of all nationwide currencies of the nations participating in the ERM as a substitute of letting the marketplace set the exchange prices. At the time, the Deutsche Mark was utilised to peg charges with a one:±6% mechanism, that means that nations accepting the ERM would peg the worth of their nationwide currency neither over nor under under six% in contrast to the worth of the mark.

The problem in England and the incorrect move of the Major Prime Minister

At the time of the creation of the ERM, the “Iron Lady” Margaret Thatcher, then Prime Minister of the United Kingdom, resolutely refused to agree to join the ERM. The cause is easy: letting the marketplace set the exchange price towards the pound was substantially extra productive at the time, and participation in the ERM would only weaken the pound even further.

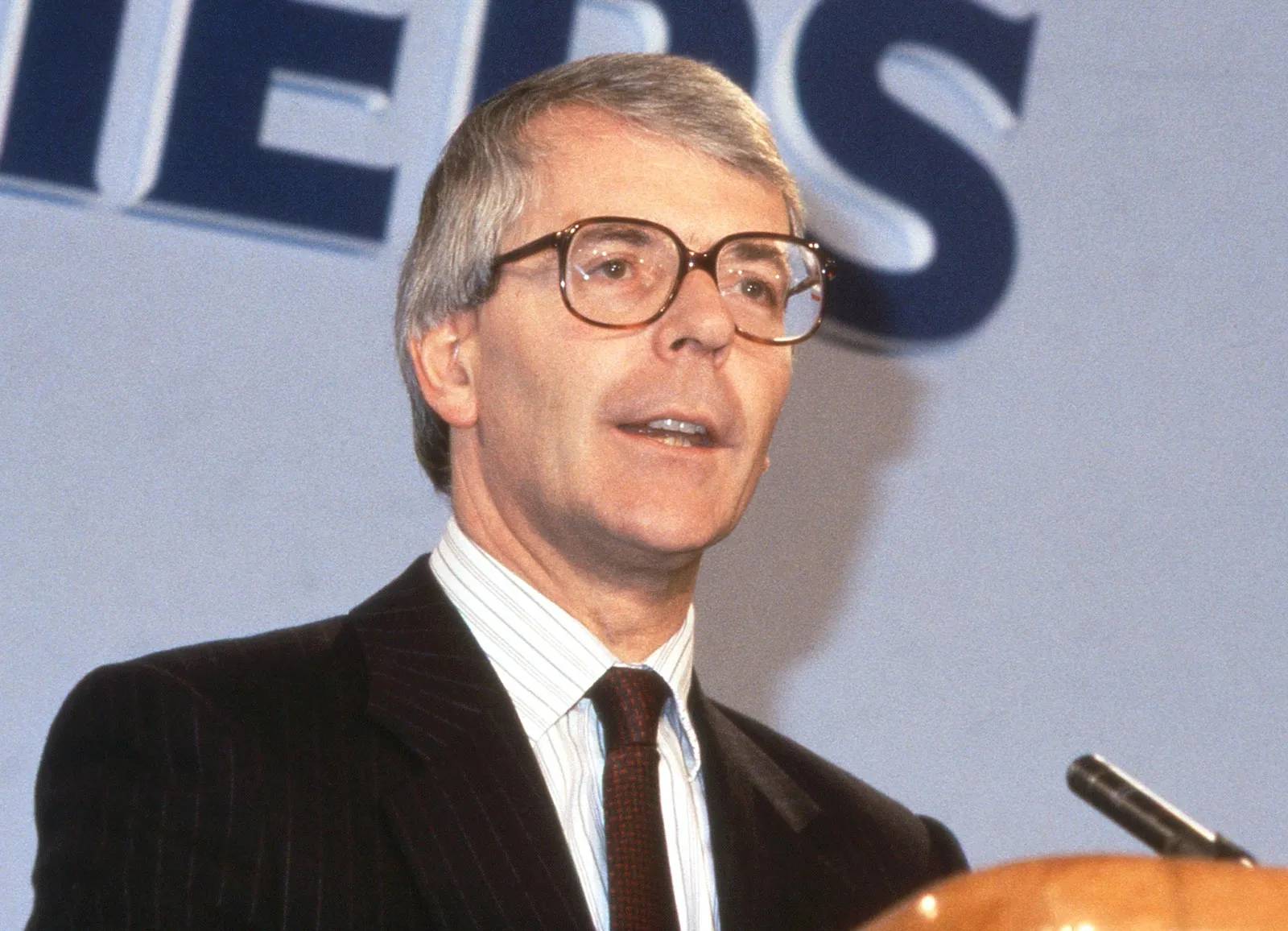

However, right after Mrs Thatcher left ten Downing Street, her successor, John Major, promptly brought Britain into the ERM and this was viewed as a move that turned him into an incompetent prime minister, the best in background of the foggy island nation.

In reality, Major’s choice was not totally incorrect and really paid off by now in the very first time period. Inflation was lower, employment prices have been increasing and at very first the British economic system was definitely commencing to prosper. That is right up until Germany determined to “betray” its ally.

Portrait of Giovanni Maggiore

Wrong financial policy led to George Soros’ enterprise accomplishment

One of the fatal weaknesses that the ERM brings to the British pound is that it inflates the worth of this currency also substantial, especially two.95 occasions its true worth. Major’s cabinet and each events observed this but chose to disregard it due to the results it was owning on the economic system.

However, it was this that later on punished them. In an interview, Reimu Jochemsen, member of the board of directors of the Bundesbank, shared with the newspaper New York Times AND Wall Street Journal that: “It is very likely that the ERM will restructure and therefore the pound will weaken and devaluation is inevitable.”

Following his counterpart, the Bundesbank president explained: “It is possible that even after the reorganization and reduction of interest rates in Germany, one or two currencies will come under pressure.”

Starting in early August 1992, George Soros and his fund opened a brief place really worth $one.five billion betting on the depreciation of the British pound. The cause for this is explained to be since the articles of the over interview was viewed by Stanley Druckenmiller, George Soros’ suitable-hand guy at the Quantum Fund. In addition to listening to the information, Quantum also evaluates the opposite problem, i.e. if the pound does not depreciate, it is unlikely to boost in rate. They then went on to bet an additional $eight.five billion, bringing the complete worth of the purchase to $ten billion.

Moreover, even Soros himself borrowed lbs all over the place, everybody who could borrow from him borrowed. On September sixteen, 1992, or “Black Wednesday,” George Soros and Quantum concurrently shorted and shorted the British pound. The British government then attempted to obtain back 28 billion lbs but it was not ample when the entire planet was offering. In an try to decrease the effect, the British government continued to boost curiosity prices from ten% to 15%, equivalent to 500 factors.

As a consequence, the following day Britain announced its withdrawal from the ERM and triggered the worth of the pound to fluctuate. As a consequence, George and Quantum Fund manufactured $ten billion and pocketed ten% of the revenue. John Major has gone down in British background as the most incompetent prime minister in background and for his bad choices.

summary

Above is intriguing info about George Soros, a talented investor and the guy who brought down the banking process of one particular of the richest nations in the planet. His investment philosophy is incredibly easy: self-self-assurance has manufactured his investments a accomplishment.