After the USDC depeg occasion in March 2023, traders in the cryptocurrency industry started off having to pay focus to stablecoins yet again. GHO is the personal stablecoin of Aave, the primary Ethereum lending protocol, which launched earlier this 12 months and has obtained a good deal of focus. Let’s obtain out about the GHO stablecoin with Coinlive as a result of the posting beneath!

You might be interested in:

What is the GHO stablecoin?

Household it is a decentralized stablecoin, backed by a wide variety of cryptocurrencies and pegged to the US dollar. This stablecoin venture was initial launched in July 2022 and authorized by the Aave DAO local community for implementation.

GHO will be backed by a selection of consumer-picked tokens, and most importantly, owned and operated by the whole Aave local community, not owned by any single personal or organization. GHO’s decentralization will be what sets it apart from most stablecoins out there.

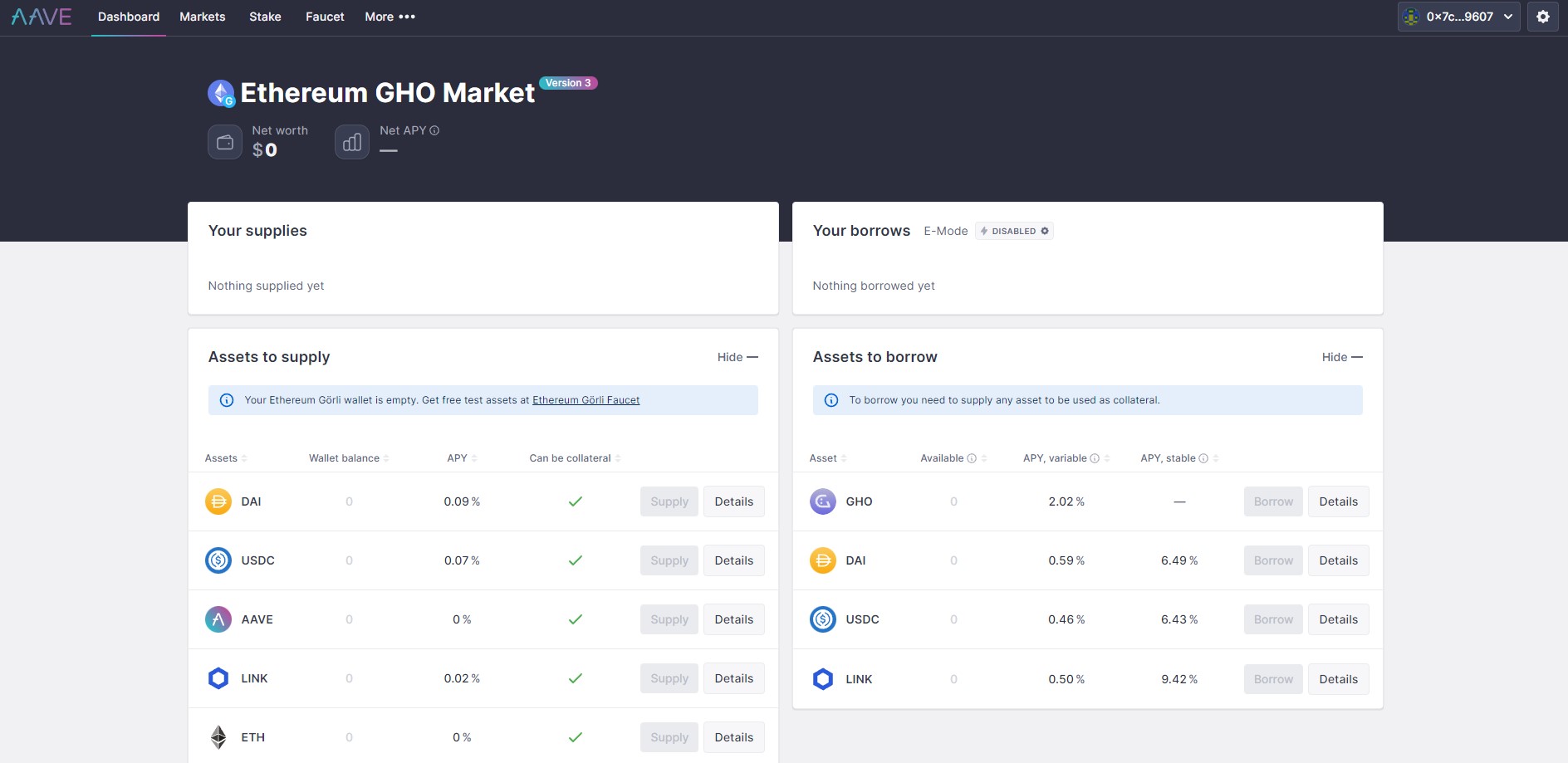

GHO’s existing site makes it possible for DeFi end users to mortgage loan cryptocurrencies together with DAI, USDC, AAVE, Website link, and ETH to borrow GHO, DAI, USDC, and Website link.

Learn a lot more about Aave

Aave Is 1 loan protocol primarily based on the creation of a liquidity pool. Lenders deposit a pool of authorized assets and borrowers borrow from the pool. This is even further formulated in Aave V2 and V3 by characteristics this kind of as isolated pools for threat management, which offer various modes of efficiency when making use of capital. These qualities, collectively with the degree of popularity and growth, have assisted propel Aave to be the need to-have lending platform and also the biggest now in the whole DeFi ecosystem.

You can see a lot more at: What is Aave (AAVE)? Discover the Aave venture

How GHO functions

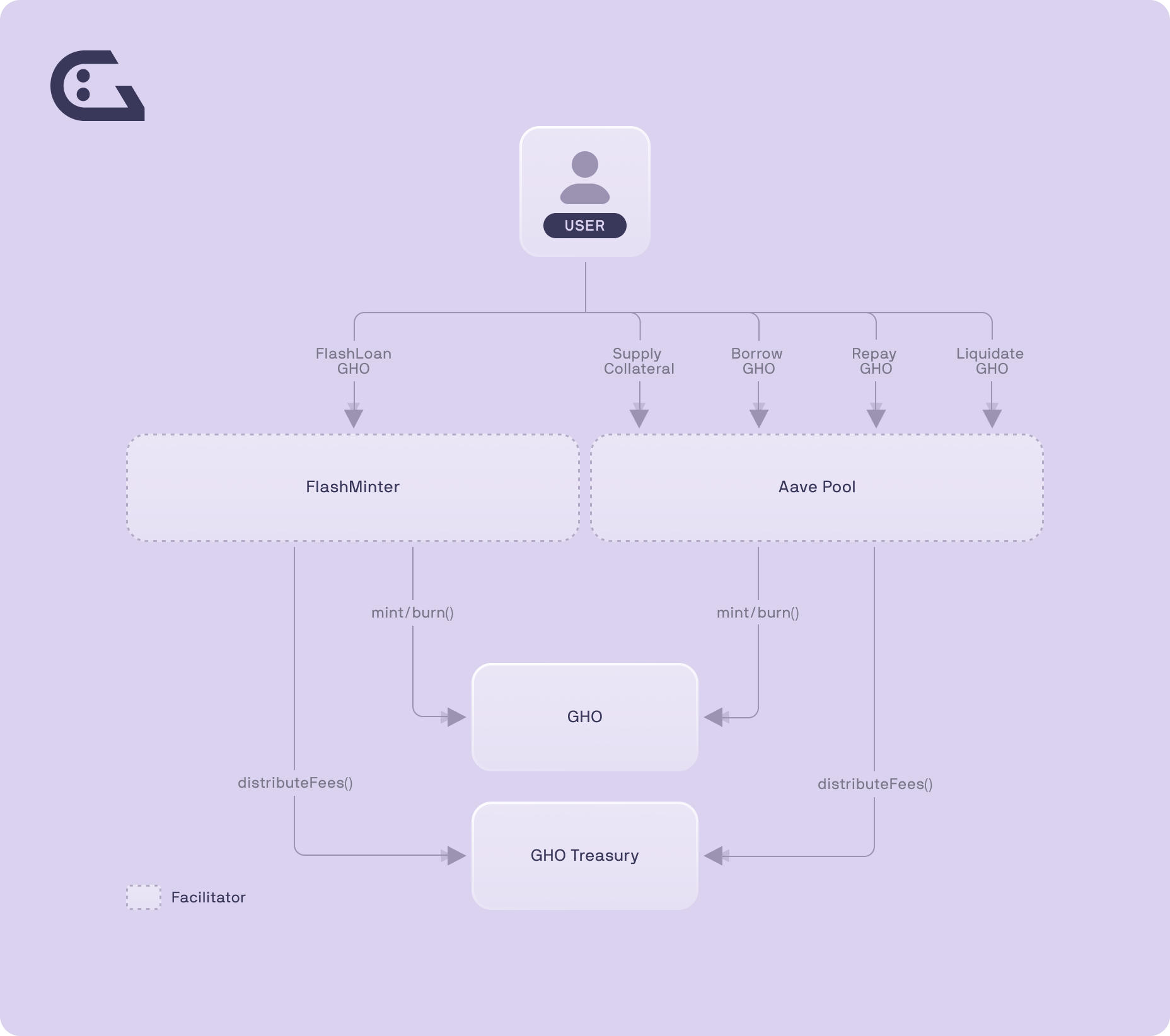

Excellent stablecoins they will be developed or issued when end users (or borrowers) use the assets as collateral in a particular proportion. When the consumer repays the loan, The GHO protocol will burn up the sum of GHO be refunded. The curiosity produced by the borrowed assets is transferred to the DAO treasury. Cryptocurrencies applied as collateral create income for borrowers.

In standard, the working model of GHO is primarily based on the Mint & Burn mechanic As mentioned over. Moreover, steady coins There is also a rate balancing mechanism to maintain the rate at one USD towards the industry.

The course of action of balancing the rate of Household takes place as follows:

- If GHO > $one: Users mint one GHO on Aave and promote them for a lot more than one USD on the industry, raising the provide of GHO on the industry and reducing the rate of GHO.

- If GHO < $1: Users buy 1 GHO on the marketplace for less than $1 and burn it for $1 at Aave, reducing the supply of GHO on the marketplace and raising its price.

Features of the GHO stablecoin

Location-based stablecoin issuance

The GHO stablecoin has similar characteristics to DAI (stablecoin created by MakerDAO). Both tokens are decentralized and use excessive collateral (overcollateralization) to keep the exchange rate against the US dollar fixed.

However, GHO has the distinct advantage of using location-based minting instead of the collateral-specific issue function used by DAI. A location-based minting GHO problem seems fairer than a treasury problem. It also allows for better optimization of the gas charge.

Over-collateralized with multiple crypto assets

The GHO stablecoin will be backed by a wide range of cryptocurrencies accepted on the Aave platform and chosen by the user. To issue GHO, users will need to deposit more cryptocurrency value than GHO by a specific percentage, this system is known as overcollateralization. Excessive collateral ensures that the risk of GHO losing its USD fixed rate is minimized.

Integration with Aave

In GHO’s development proposal there are plans to integrate GHO with the Aave ecosystem by launching a specific GHO “aToken” and a GHO Debit Token. This system will use the same mechanism as other assets already on the Aave platform. The Aave-GHO integration will accelerate the development of GHO on the Ethereum network.

Basic information about GHO Stablecoin

GHO Token Specifications

- Token Name: GHO stable coin

- Tickers: HOME

- Blockchains: Ethereum

- Token Contract: Updating…

- Type of token: Stablecoins

- Total supply: Circulation depends on market demand

- Circulating supply: Updating…

How GHO Stablecoin affects Aave

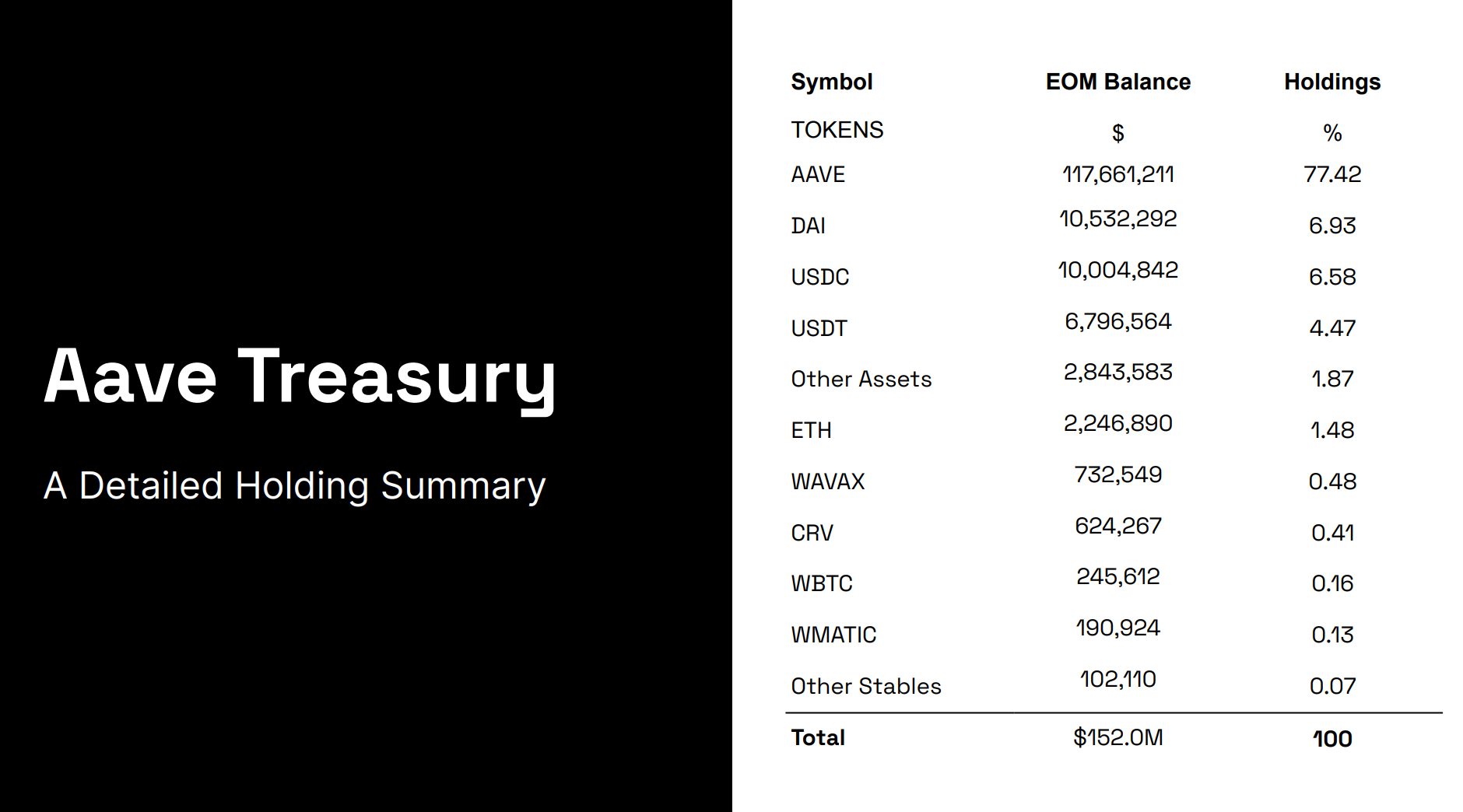

GHO loan fees will create a new revenue stream for the Aave ecosystem. Loan fees are paid to the Aave DAO Treasury, which then allows the DAO to execute and finance new features for Aave.

In a bear market, this is all the more important as the developers are paid by the Aave DAO Treasury. Therefore, a larger DAO treasury means a longer runway for the protocol.

Total protocol revenue is up 32% and the treasury holds up to $152 million as of January 2023.

summary

Asset-backed stablecoins can provide more security than algorithm-based stablecoins, but it should be remembered that they are not fiat-backed coins. Cryptocurrencies are highly volatile which means that the value of this collateral can drop dramatically in a very short period of time. This causes an exchange of groups of assets that can separate a token from its pegged price (1 USD). However, at the moment Aave is still the largest lending protocol in the cryptocurrency market and $GHO is one of the stablecoins likely to bring about a breakthrough for the platform. Either way, Aave will need to prepare for a very different stablecoin market than we saw last year.

Through this article, you have somehow grasped the basic information about the project to make your investment decisions. Coinlive is not responsible for any of your investment decisions. I wish you success and earn a lot from this potential market.