One of the world’s main fiscal empires, Goldman Sachs, explained Bitcoin will proceed to get industry share from gold in 2022, creating its $ a hundred,000 rate target conveniently achievable.

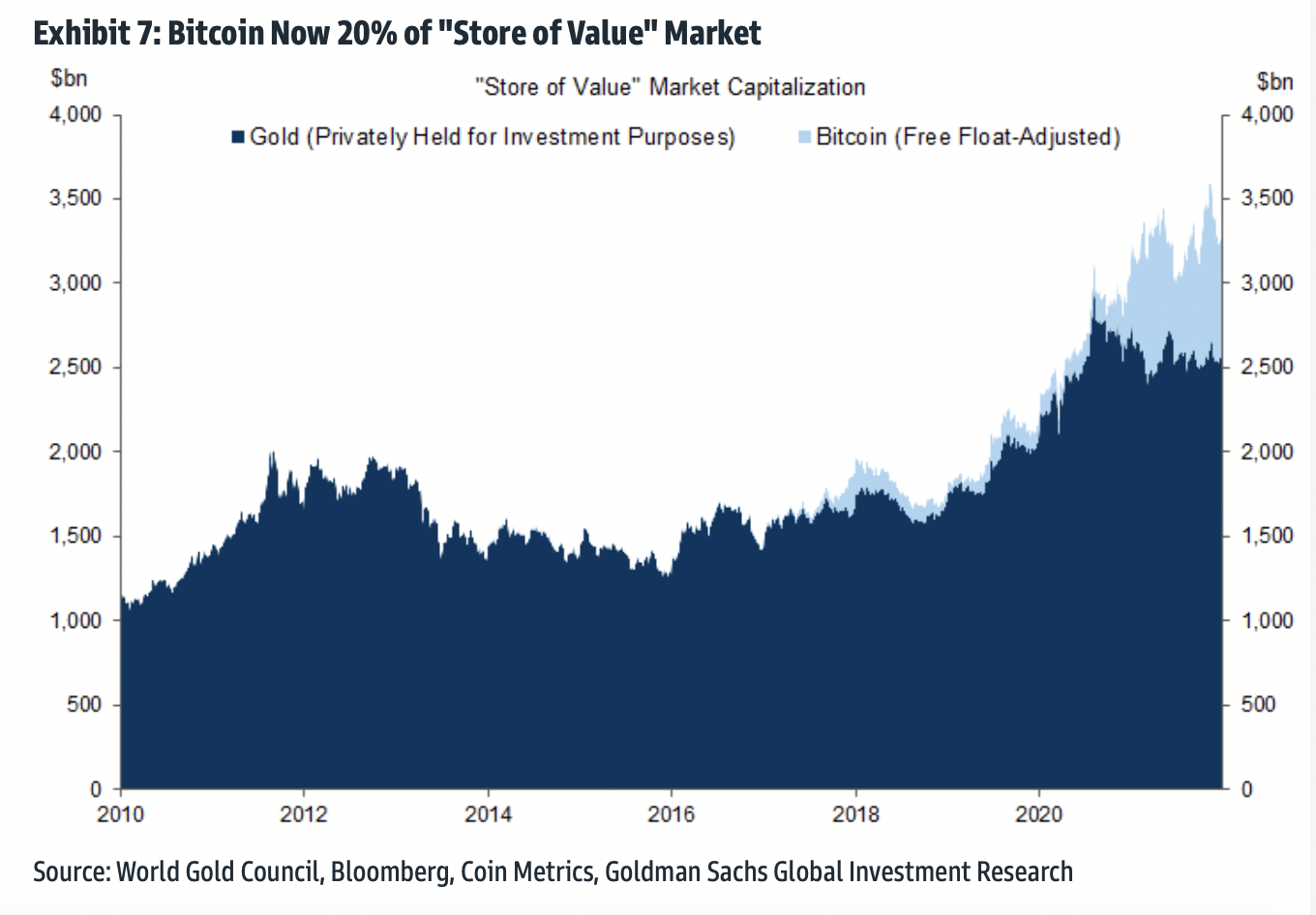

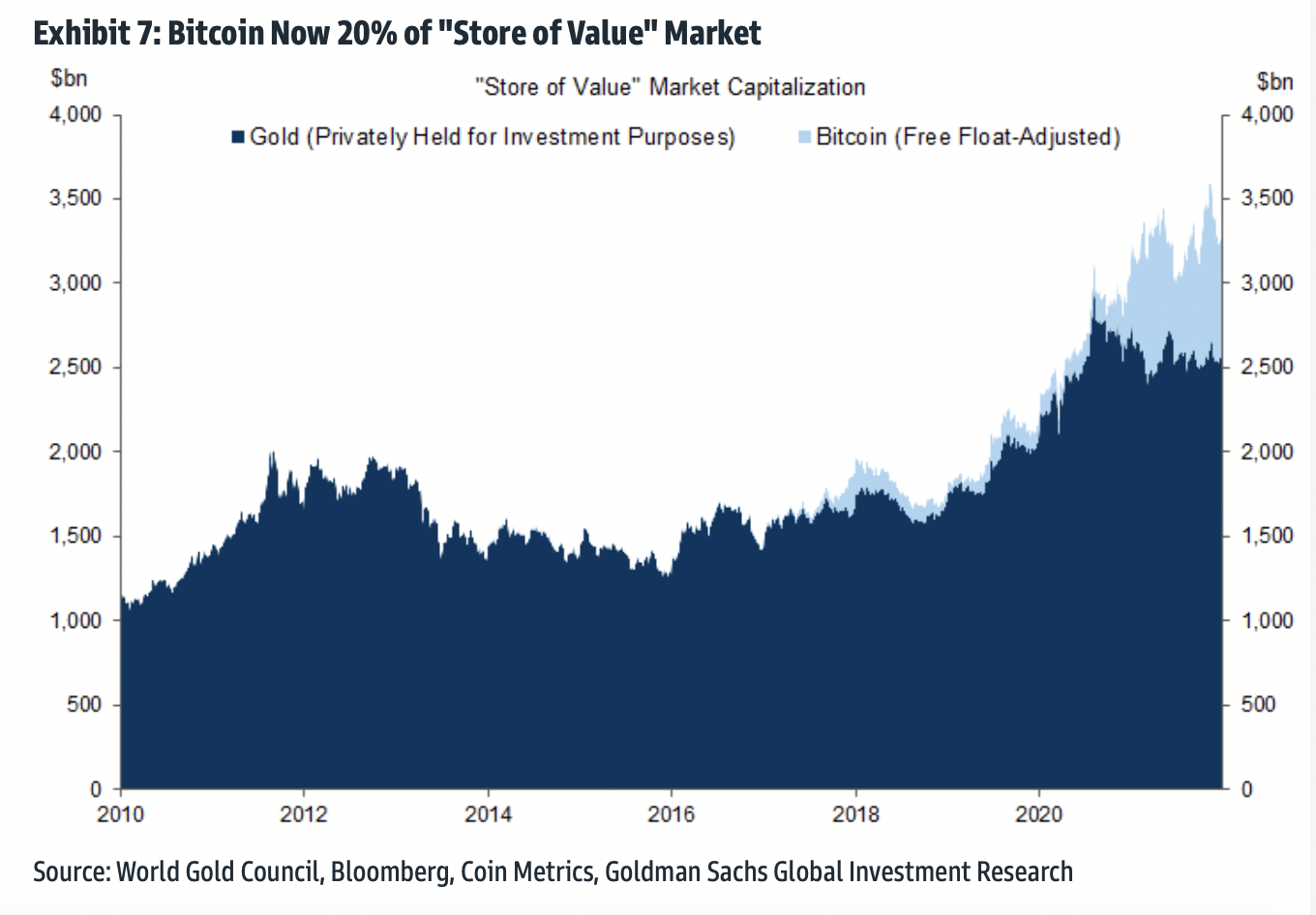

Considering the no cost-float adjusted industry capitalization of Bitcoin, BTC represents about twenty% of the complete industry in terms of “store of value”, presently dominated by gold. Goldman Sachs believes that the rate of Bitcoin could rise to far more than USD a hundred,000 if BTC continues to hit the 50% verify mark of the aforementioned index. The bank’s forecast is 5 many years, with an yearly return of 17% to 18%.

The financial institution says use circumstances past a retailer of worth could advantage the total cryptocurrency industry as a complete.

“Bitcoin has quite a few far more makes use of than this, not basically a prolonged-phrase asset haven, and the cryptocurrency industry is a great deal bigger than Bitcoin. But we imagine evaluating BTC’s industry cap to that of gold can assistance give affordable effectiveness metrics for Bitcoin’s returns. “

Additionally, Goldman Sachs explained that whilst consuming the genuine sources of the Bitcoin network can be a important challenge for institutional adoption, it will not quit demand for the resource. For instance, investment money paid $ 9.three billion in cryptocurrencies by 2021, the highest milestone in historical past.

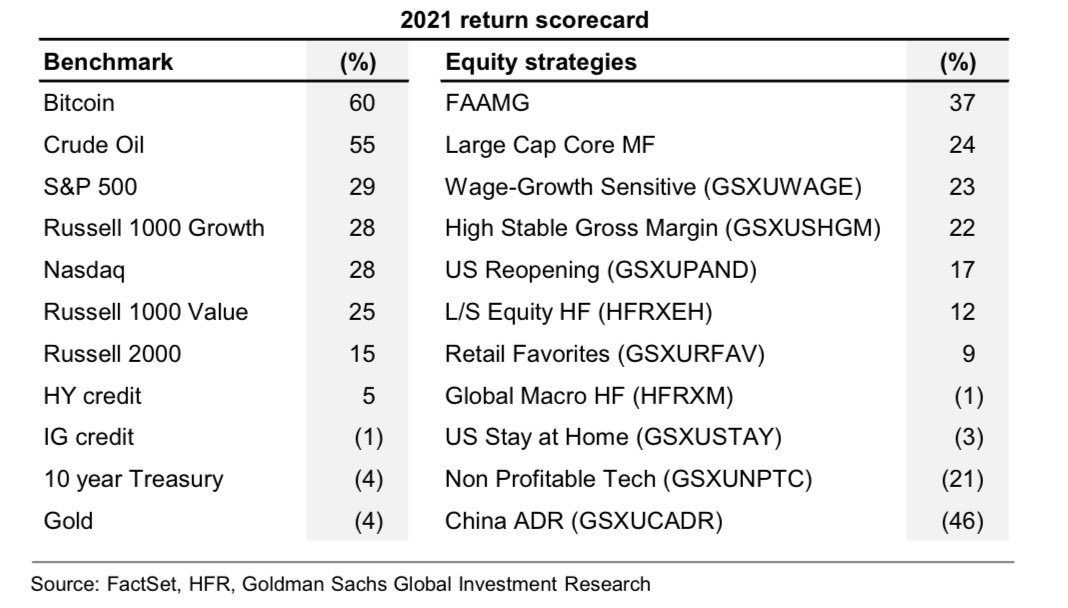

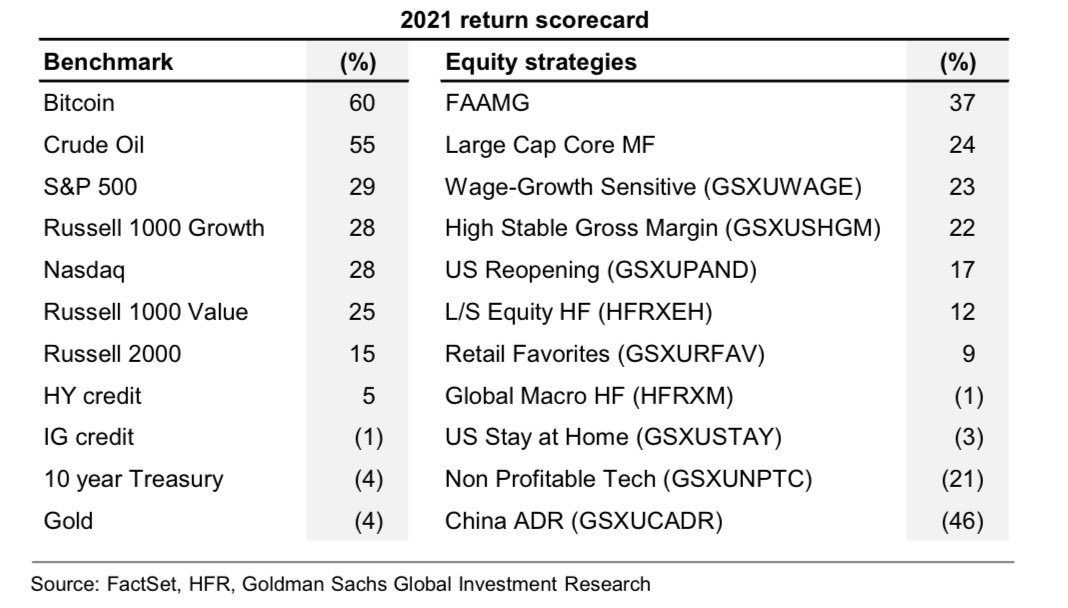

The Goldman Sachs report also pointed out that Bitcoin is the very best carrying out asset in 2021. BTC returned to a more powerful 60% rise in October, whilst crude oil was only fifty five%. The S&P 500 stock index was up 29%, along with the major 5 finished by the Russell one thousand Growth and Nasdaq, the two to 28%.

The effectiveness of the biggest tech stocks, this kind of as Facebook, Apple, Amazon, Microsoft and Google, returned 37%. This improvement is fairly robust, but nevertheless pales in comparison to Bitcoin. On the other side of the battle line, gold seems to be shedding its “limelight”, with a return of just four% in 2021.

However, Goldman Sachs’ daring argument about Bitcoin’s very optimistic long term is not surprising, as the financial institution acknowledged Bitcoin as a accurate asset class in May, soon after a time period of criticism, and doubted BTC for a whilst. time in the previous.

The up coming couple of many years may well be even far more crucial for Bitcoin, as adoption charges rise and nations progressively type mass regulation. As a “big brother” in the industry, Bitcoin will normally be the initially asset that most traders method at first, hence advertising growth into other possible parts this kind of as DeFi, NFT or metaverse.

Synthetic Currency 68

Maybe you are interested:

One of the world’s main fiscal empires, Goldman Sachs, explained Bitcoin will proceed to get industry share from gold in 2022, creating its $ a hundred,000 rate target conveniently achievable.

Considering the no cost-float adjusted industry capitalization of Bitcoin, BTC represents about twenty% of the complete industry in terms of “store of value”, presently dominated by gold. Goldman Sachs believes that the rate of Bitcoin could rise to far more than USD a hundred,000 if BTC continues to hit the 50% verify mark of the aforementioned index. The bank’s forecast is 5 many years, with an yearly return of 17% to 18%.

The financial institution says use circumstances past a retailer of worth could advantage the total cryptocurrency industry as a complete.

“Bitcoin has quite a few far more makes use of than this, not basically a prolonged-phrase asset haven, and the cryptocurrency industry is a great deal bigger than Bitcoin. But we imagine evaluating BTC’s industry cap to that of gold can assistance give affordable effectiveness metrics for Bitcoin’s returns. “

Additionally, Goldman Sachs explained that whilst consuming the genuine sources of the Bitcoin network can be a important challenge for institutional adoption, it will not quit demand for the resource. For instance, investment money paid $ 9.three billion in cryptocurrencies by 2021, the highest milestone in historical past.

The Goldman Sachs report also pointed out that Bitcoin is the very best carrying out asset in 2021. BTC returned to a more powerful 60% rise in October, whilst crude oil was only fifty five%. The S&P 500 stock index was up 29%, along with the major 5 finished by the Russell one thousand Growth and Nasdaq, the two to 28%.

The effectiveness of the biggest tech stocks, this kind of as Facebook, Apple, Amazon, Microsoft and Google, returned 37%. This improvement is fairly robust, but nevertheless pales in comparison to Bitcoin. On the other side of the battle line, gold seems to be shedding its “limelight”, with a return of just four% in 2021.

However, Goldman Sachs’ daring argument about Bitcoin’s very optimistic long term is not surprising, as the financial institution acknowledged Bitcoin as a accurate asset class in May, soon after a time period of criticism, and doubted BTC for a whilst. time in the previous.

The up coming couple of many years may well be even far more crucial for Bitcoin, as adoption charges rise and nations progressively type mass regulation. As a “big brother” in the industry, Bitcoin will normally be the initially asset that most traders method at first, hence advertising growth into other possible parts this kind of as DeFi, NFT or metaverse.

Synthetic Currency 68

Maybe you are interested: