Google’s mother or father enterprise, Alphabet, has invested $ one billion in shares in the Chicago Mercantile Exchange Group (CME), the world’s foremost cryptocurrency derivatives exchange.

In a November four announcement to traders, CME Group announced a $ one billion investment from Alphabet along with a ten-12 months strategic partnership with Google Cloud to accelerate its transformation of cloud trading and alter the way business enterprise performs. worldwide derivatives markets. Google invested by the company’s irrevocable favored stock.

Today we announced a ten-12 months strategic partnership with @CMEGroup enhance market place entry, produce client rewards and produce new merchandise and providers for the economic providers market. Read a lot more right here https://t.co/IVW9cajSsn

– Google Cloud (@googlecloud) November 4, 2021

Through this prolonged-phrase partnership with Google Cloud, CME Group will transform the derivatives market place by engineering, broadening accessibility and generating efficiencies for all market place participants. CME Group President and CEO Terry Duffy mentioned the partnership will enable CME Group to deliver new merchandise and providers to market place a lot quicker.

CME Group is behind the initially Bitcoin (BTC) futures contract launched in December 2017. Since that time, the exchange has continued to broaden its derivative offerings to contain Micro Bitcoin, Ethereum (ETH) and Micro Ether futures. hybrid.

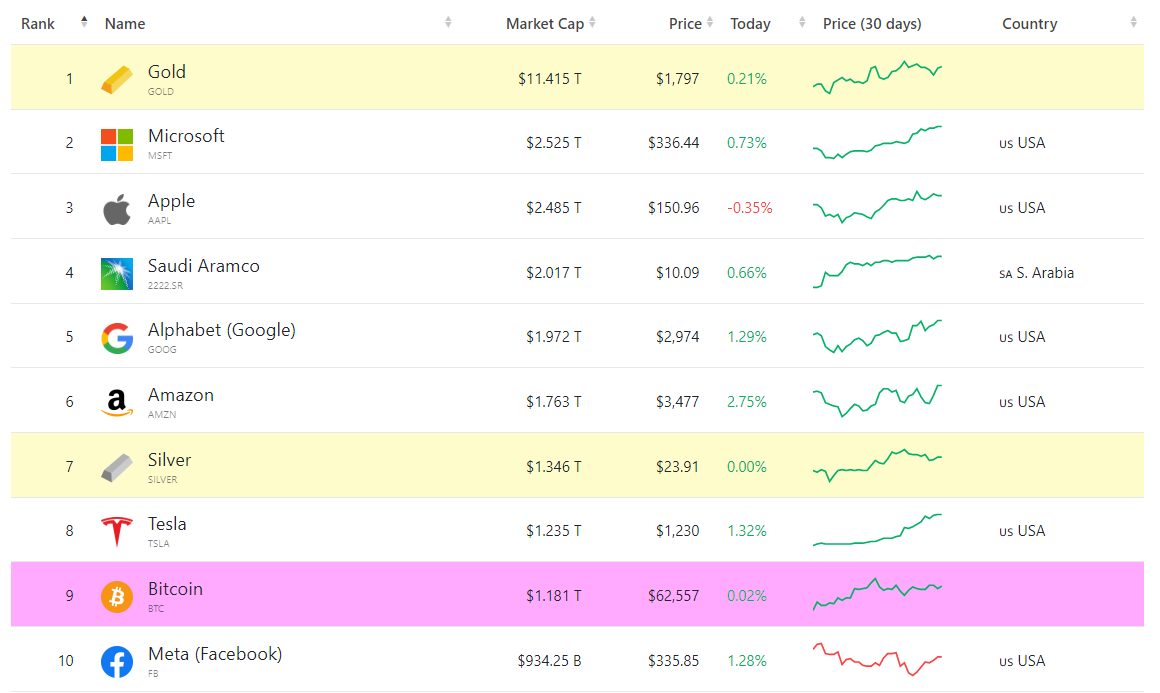

However, the current inflow of cash from Google is confident to enhance the world’s most significant tech giant’s curiosity in the cryptocurrency area. If there is deeper involvement in the long term, it will certainly produce an unprecedented “blockbuster” in Bitcoin background, as Google is at present the fifth biggest enterprise in the world’s most worthwhile assets, with $ one.972 billion.

A essential level to note is that CME is typically observed as the key “gateway” for massive US-primarily based institutional traders to begin getting into the market place and acquire publicity to Bitcoin. At the exact same time, the Bitcoin ETFs that have just been accredited by the SEC are primarily based on CME rate contracts.

Synthetic Currency 68

Maybe you are interested: