Grayscale desires to transform the ETHE fund, with assets below management really worth pretty much $five billion, into a spot ETF on Ethereum.

Grayscale file application to convert ETHE fund to Ethereum spot ETF with SEC. Photo: CryptoSlate

Grayscale file application to convert ETHE fund to Ethereum spot ETF with SEC. Photo: CryptoSlate

On the evening of October two, cryptocurrency investment management company Grayscale stated it has filed an application with the U.S. Securities Commission (SEC) to convert the Grayscale Ethereum Trust (ETHE) into an Ethereum spot ETF.

The trading companion for Grayscale’s Ethereum spot ETF will be the NYSE stock exchange.

📣We are proud to announce it @NYSE Arca has filed Form 19b-four with the SEC to convert Grayscale Ethereum Trust $ETHE at a single level #Ethereum ETFs. https://t.co/IAHDHTdeqp

🧵(one/four) https://t.co/IAHDHTdeqp— Grayscale (@Grayscale) October 2, 2023

As explained by Coinlive, comparable to Grayscale Bitcoin Trust (GBTC), Grayscale Ethereum Trust is a fund-like investment product or service in Ethereum (ETH), the world’s 2nd biggest cryptocurrency. This fund was established by Grayscale in 2019, enabling traders with stock brokerage accounts in the United States to obtain publicity to ETH but devoid of immediately holding this coin.

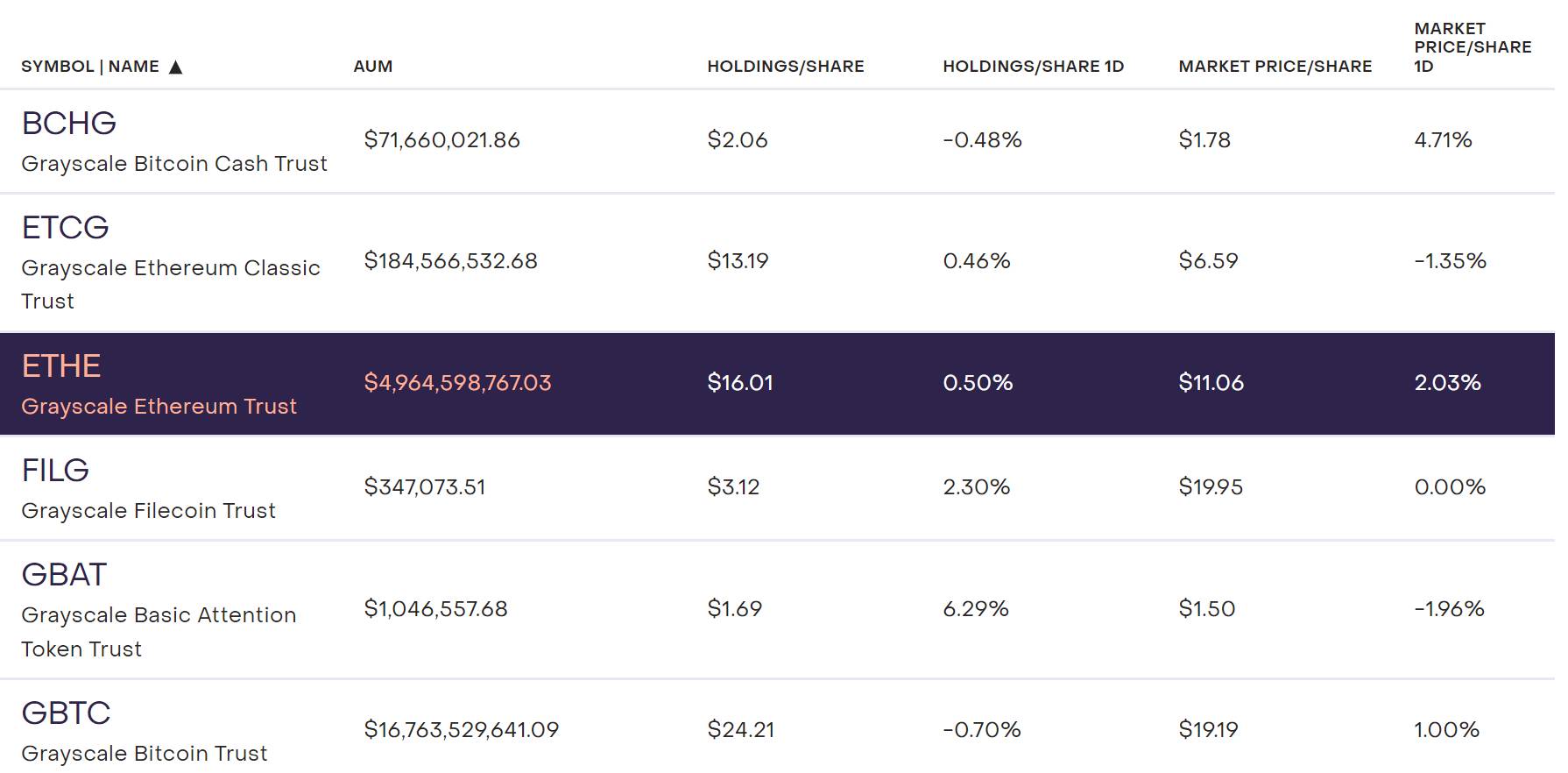

ETHE is the biggest Ethereum investment product or service in the globe, with complete assets held by the fund reaching virtually $five billion.

Parameters on Grayscale Ethereum Trust. Source: Grayscale (thirty September 2023)

Parameters on Grayscale Ethereum Trust. Source: Grayscale (thirty September 2023)

However, because ETHE does not have a direct conversion mechanism from stocks to ETH so that traders can arbitrage, so when the cryptocurrency marketplace collapsed in 2021-2023, the rate of ETHE deviated a whole lot from the rate of Ethereum on the cryptocurrency marketplace. When the marketplace bottomed in December 2022, the price reduction amongst ETHE and ETH at instances reached virtually 60%, just before falling to thirty% at the time of creating.

ETH price reduction in contrast to ETH rate. Source: yCharts (September 29, 2023)

ETH price reduction in contrast to ETH rate. Source: yCharts (September 29, 2023)

Grayscale hopes that converting ETHE into an Ethereum spot ETF will assistance open up a way for traders to immediately trade stocks for ETH, therefore generating arbitrage trading possibilities and solving arbitrage.

Grayscale filed an application with the SEC in 2022 for permission to convert GBTC into a spot Bitcoin ETF, but it was rejected by the Securities Commission. After a legal battle, an appeals court in the United States awarded the firm victory and forced the SEC to reconsider Grayscale’s Bitcoin spot ETF proposal.

However, the US Securities Commission has by no means licensed any spot cryptocurrency ETFs, fearing that the cryptocurrency marketplace is nonetheless rife with fraud and marketplace manipulation, which threatens to influence traders in ETF items.

The SEC a handful of days in the past announced a delay in generating a choice on eight spot Bitcoin ETF proposals from Wall Street giants, together with BlackRock, Invesco, VanEck, Fidelity, Bitwise, Valkyrie, WisdomTree and ARK Invest.

Similarly, the committee also postponed the evaluate of two Ethereum spot ETF proposals by ARK Invest and VanEck to the finish of December 2023.

However, the SEC has authorized trading of Ethereum futures ETFs, with the probability of launching up to 9 money this week, led by VanEck and Valkyrie.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!