Recently, digital asset management giant Grayscale has released the latest update on its altcoin portfolio because of its next investment product.

On February 26, Grayscale Investments revealed a draw record of cryptocurrencies of the decision to create new ideas for future plan. Grayscale reviewed 23 altcoins for new investment goods.

We’re always seeking ways to better meet growing investor demand for exposure to electronic assets through comfortable, secure, and controlled investment solutions. That’s why we are contemplating several new electronic resources for potential new product offerings. https://t.co/U3fTKIb5SG

— Grayscale (@Grayscale) February 26, 2021

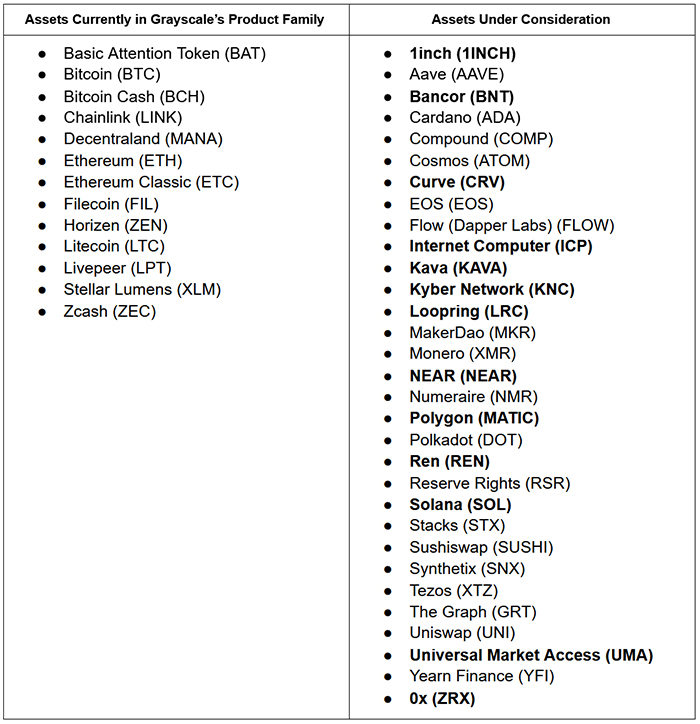

On June 18, the business continued to update the list with 13 additional assets such as: 1inch (1INCH), Bancor (BNT), Curve (CRV), Internet Computer (ICP), Kava (KAVA), Kyber Network (KNC), Loopring (LRC), NEAR (NEAR), Polygon (MATIC), Ren (REN), Solana (SOL), Universal Market Access (UMA) and 0x (ZRX).

At the exact same time we could see all of the altcoins being discovered by Grayscale in the appropriate column based on the table below.

One caveat is that not each asset under consideration will translate into one of Grayscale’s investment solutions. The procedure of creating an investment product like the ones Grayscale has to provide is a complex, multifaceted one. Requires significant consideration and consideration, is subject to significant internal controls, sufficiently protected custody arrangements, and regulatory approvals.

Maybe you’re interested:

Join our station to upgrade the most useful news and knowledge at:

According to Coinlive

Compiled by ToiYeuBitcoin