The world’s biggest cryptocurrency investment fund Grayscale is arranging to transform into a Bitcoin (BTC) indirect investment ETF underneath strain from the SEC.

On February two, Grayscale announced a new ETF, entitled “Future of Finance”, which will be listed on the New York Stock Exchange (NYSE) underneath the symbol GFOF.

Ready for anything new? Encounter $ GFOFGrayscale Investments’ initial ETF. https://t.co/2c0Ot0Rne7 pic.twitter.com/ZLHf23xkWj

– Grayscale (@ Grayscale) February 2, 2022

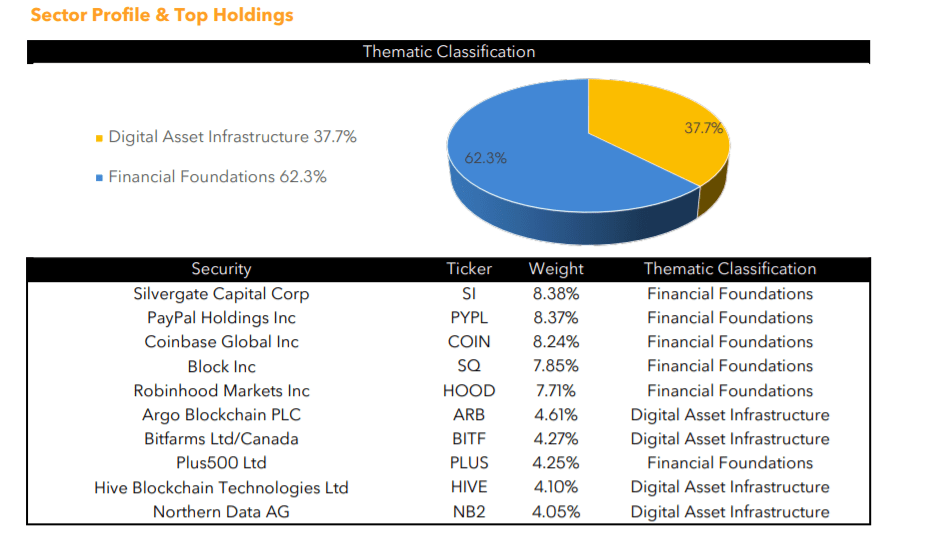

The fund will reference the stock values of 22 monetary institutions with shut ties to cryptocurrencies, such as well-known payment and technologies providers this kind of as PayPal, Block (formerly Square), the Coinbase exchange and the Silvergate Capital investment fund.

The launch of the new ETF comes as Grayscale is engaged in a fierce legal battle with the United States Securities and Exchange Commission (SEC) in excess of the agency’s refusal to approve an application for a new ETF, the company’s Bitcoin spot ETF.

Grayscale stated it could sue on the matter, primarily because the SEC has accredited a far more sophisticated model of Bitcoin as an ETF merchandise tied to the derivatives market place. The investment fund says the SEC violated the Administrative Protection Act (APA) by not treating two Bitcoin ETF items equally.

Additionally, Grayscale cited proof that when the SEC permitted Bitcoin futures ETFs to be enforced, the company ignored the needs of Section six (five) (b) of the Securities Act, that providers applying for a Bitcoin spot ETF will have to respect. Therefore, it is seriously unfair, with the articles expressly stated as follows:

“Section 6 (5) (b) is designed to protect investors and the public interest by preventing fraud and market manipulation, while not allowing unfair discrimination between customers, issuer, intermediary or agent.”

On the other hand, Jerry Brito, a properly-recognized crypto lobbyist in the United States, also shared his professional-Grayscale views for the over argument.

two / How @Greyscale states in their letter, the way the SEC discriminated concerning spot and futures-based mostly Bitcoin ETFs unquestionably would seem like an “arbitrary and capricious” selection prohibited by the APA. https://t.co/LCawziES4v pic.twitter.com/F9x1oUcOHr

– Jerry Brito (@jerrybrito) November 30, 2021

“I am delighted to see small business people today get action to shield traders ahead of the SEC requires action.

As Grayscale states in their letter, the way the SEC discriminates concerning spot and futures Bitcoin ETFs unquestionably would seem like the ideal selection, as outlined in the APA. “

Although U.S. lawmakers have in the previous asked SEC Chairman Gary Gensler to approve a spot ETF on Bitcoin, the SEC nevertheless rejected VanEck’s application on the grounds that it did not comply with the needs of the Act. Stock Exchange in November 1934. . and the tricky response are for that reason fairly understandable.

Synthetic currency 68

Maybe you are interested: