What is the GT protocol (GTP)?

GT Protocol is a venture offering options for DeFi investment pool management and copy trading on DEX. GT Protocol’s technologies is a decentralized, transparent and safe resolution that will allow any organization / person to make a DeFi wise contract pool to increase cash and collaborate with traders based mostly on blockchain revenue sharing. Investors’ money are securely protected by wise contracts managed transparently by pool owners on the DeFi industry with no withdrawal selection.

GT Protocol Products:

- DeFi investment pool

- Trading platform for DEX

- Copy trading platform for CEX

- Leveraged trading platform for DEX

- DAO government

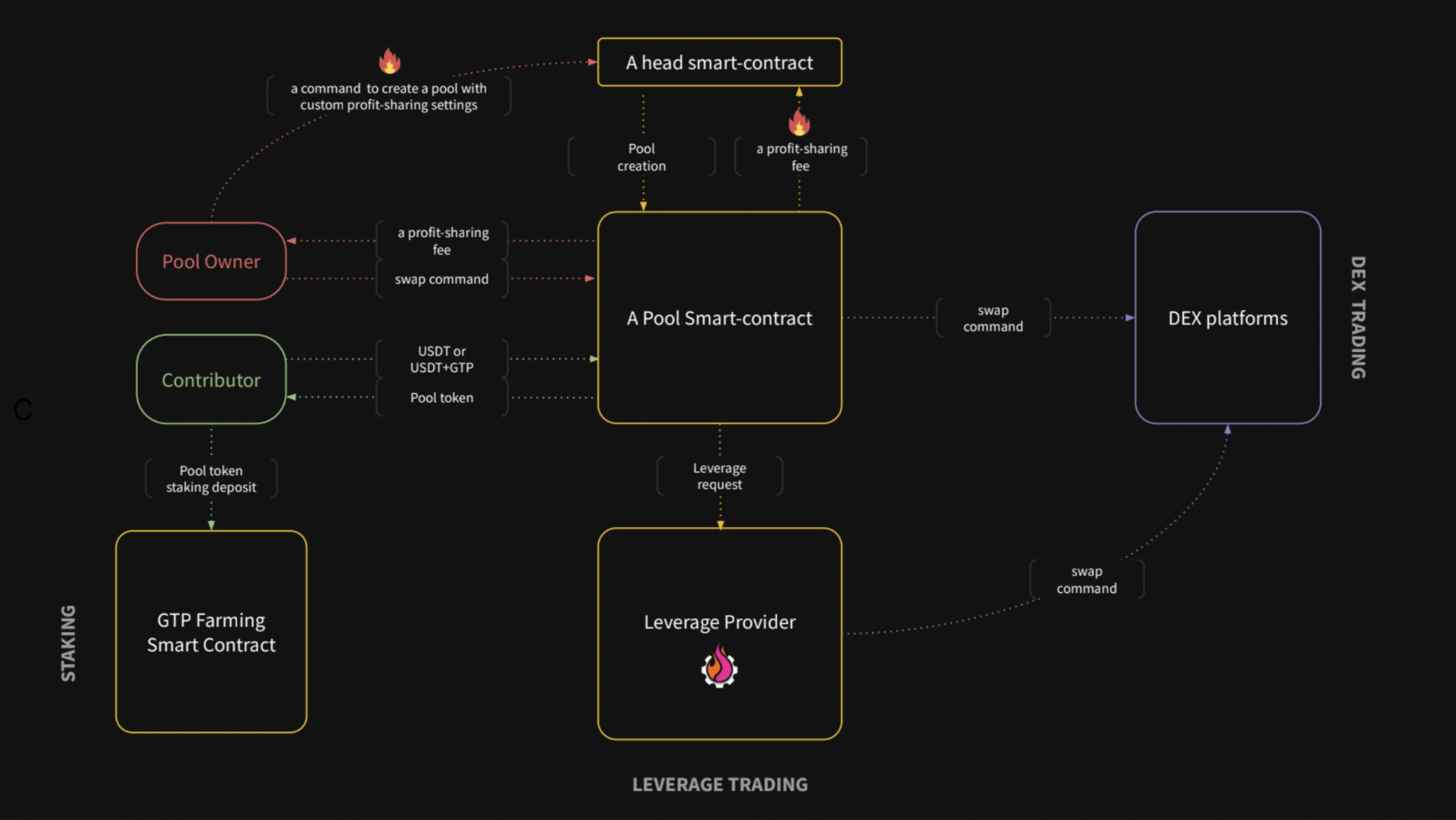

Operating model of the GT protocol

The GT Protocol working model will have two most important participants: Pool Owner (proprietor of the pool), Contributor (contributor).

The pool proprietor will be capable to pool and control the pool sources offered by Contributor and get pool management bonuses and revenue. The proprietor of the pool can trade assets on the DEX or trade with leverage.

The contributor can contribute USDT or USDT + GTP to the pool to retrieve the pool token. This pool token can be detached in GTP Farming Smart Contract to obtain rewards.

Types of pools that the pool proprietor can control:

-

Cryptocurrency trading pool

Cryptocurrency traders will be capable to make pools for their subscribers and acquire commissions from the revenue earned by consumers.

-

Long-phrase portfolio investment pool

Long-phrase traders will be capable to make pools for portfolio management or yield farming providers.

Investors and skilled NFT traders will be capable to make pools of NFT portfolios.

-

Allocation pool of IDO tasks

Pool to invest in new tasks in the course of IDO, pre-IDO, pre-sale.

Gaming guilds will be capable to make money pools to deliver NFT scholarships to members.

Join collectively to increase cash to set up crypto nodes and share long term node management rewards.

Highlights of the GT protocol

High safety

All pools will be protected by wise contracts.

transparent

Users can pick out a pool, send their USDT to the pool’s wise contract handle, and keep track of the profitability of the transaction by means of blockchain and Telegram notifications.

Withdraw cash at any time

The consumer can request the withdrawal of the deposit and the sum of revenue earned.

Rose

The wise contract will charge consumers from their earnings an sum equal to the sum of money they contribute to the pool.

Basic details about the GTP token

- Token title: GT protocol

- Ticker: GT

- Blockchain: Binance chain

- Token common: BEP-twenty

- To contract: Updating…

- Token variety: Utility, Governance

- Total provide: a hundred,000,000 GTP

- Circulating provide: Updating…

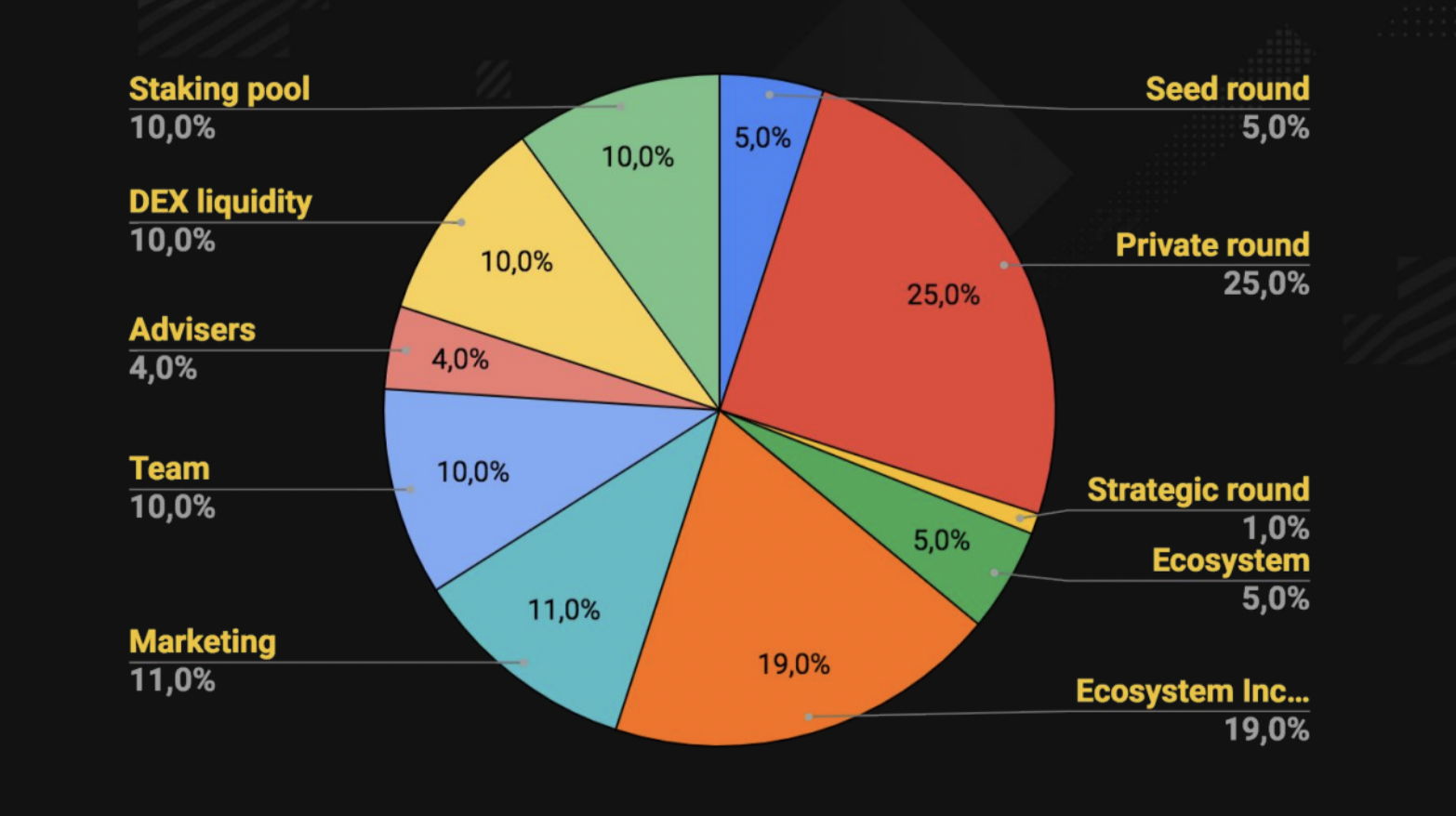

GT protocol for token allocation

- Round Seed: five%

- Private tour: 25%

- Strategic round: to start with%

- IDO Round: five%

- Ecosystem: 19%

- Marketing: eleven%

- Squad: 10%

- Counselor: four%

- DEX liquidity: 10%

- Staking pool: 10%

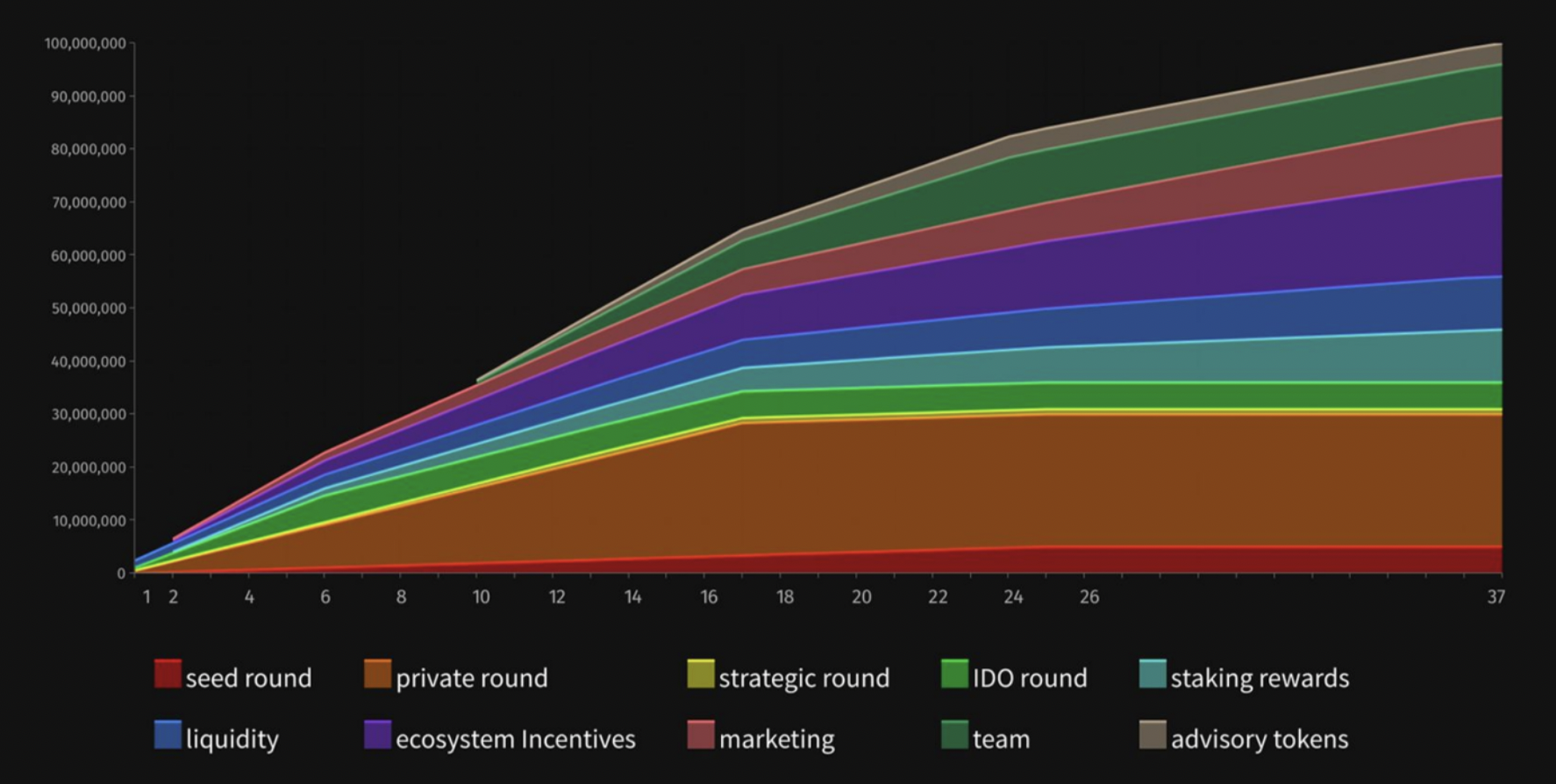

GT protocol for organizing the release of tokens

What is the GTP token for?

- Vote on the governance proposals of the venture.

- The pool proprietor should spend a GTP token charge to make a pool.

- Investors can aim for GTP tokens to spend commissions to pool managers.

- Investors should spend a charge to register to use the copy trading support.

GTP Token Storage Wallet

You can keep this token on: Coin98 Wallet, Trust Wallet, Metamask, supported exchange wallet.

How to earn and very own GTP tokens

Updating…

Where to purchase and promote GTP tokens?

Updating…

Roadmap

3rd quarter 2022

- Updated trading resources with CEX and DEX assistance.

4th quarter 2022

- GT Protocol DeFi Pools v2. launched.

1st quarter 2023

- Launch the DAO protocol for international traders.

2nd quarter 2023

- Launch Global Traders Protocol Insurance.

3rd quarter 2023

- GT Protocol DeFi Pools v2. launched.

Company

GT protocol advisor

The advisor for the GT Protocol venture comes from the Magnus Capital investment fund, Excavo Team (group of trading authorities).

summary

GT Protocol is an asset management and copy trading resolution for traders in the cryptocurrency industry.

Through this report, you should have by some means grasped the primary details about the venture to make your investment choices. Coinlive is not accountable for any of your investment choices. I want you good results and earn a great deal from this likely industry.