Surely the Crypto brothers lately skilled one of many worst days in historical past with the worth of Bitcoin dropping from a peak of $ 65,000 to over 50% in lower than 2 months. The financial uncertainties of the Covid-19 pandemic and the drop in liquidity have prompted large gross sales of Bitcoin and different cryptocurrencies. The Altcoin and DeFi platforms are additionally experiencing related issues. However, not all hopes fall based mostly on the worth of Bitcoin, the alternative Bear Market will deliver many alternatives, particularly for many who are able to seize.

Last time Coinlive printed a tutorial on how you can handle capital and generate income within the Uptrend market. So in a downtrend, what to do? Let’s be taught some methods to maintain your account “green” throughout bearish pattern season!

Efficient capital administration

To make sure that your cash stays in your pockets and might survive available in the market for a very long time, you might want to observe efficient capital administration habits. Some ideas that senior merchants all the time comply with will be talked about:

- Discipline: In a nutshell, it’s a matter of clearly defining the take revenue and cease loss factors earlier than opening a place and following it.

- Don’t trade too aggressively: This is the largest mistake new merchants make. This consists of overly random entries and exits, utilizing arbitrary leverage. You simply want a flash to obtain the alternate e-mail.

- Reasonable division of capital: Measuring and limiting threat is a vital side of capital administration. The first rule is to not make investments with borrowed cash. Don’t use greater than 15% of your financial savings to enter the market. Before opening any trade, it’s essential to calculate its threat. Your complete trading capital is a think about figuring out the utmost restrict for place measurement.

- Create a wise funding portfolio: When the market is down I feel you should not threat investing in shitcoin, small cap junk cash. This is extraordinarily harmful as you can not predict when it can evaporate. For the perfect cash, potential cash, you possibly can spend 20-30% of the overall capital to purchase your self some to organize for the “bull run” that may occur at any second.

Short promoting

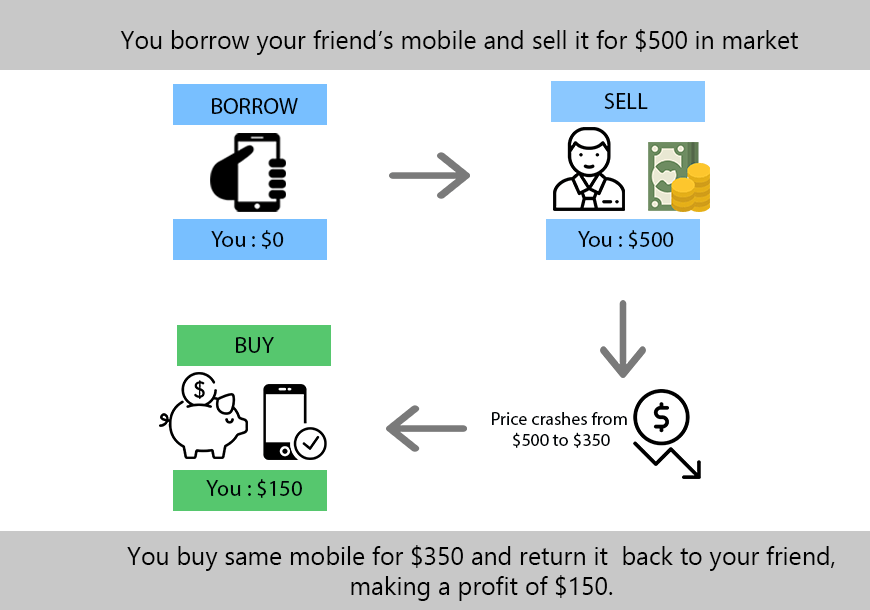

Short promoting will be seen as the alternative of shopping for a coin and hoping that its value will go up. This is without doubt one of the hottest methods to revenue in a declining market.

Simply understanding the way it works is:

When you place a brief promote order, you borrow cash from the alternate and promote the asset on the present market value. For instance: if the worth of Bitcoin continues to be in a bearish pattern, you are able to do a brief sale of Bitcoin, when the worth continues to fall deeply, you shut your place and purchase it again at a less expensive value, thus profiting from the distinction. .

This is one technique to higher perceive brief promoting.

However, in case your guess is wrong and the worth of that coin rises, you’ll have to purchase again the coin at a better market value, leading to a unfavourable account. This isn’t what anybody desires.

To revenue from brief promoting, you might want to discover traits that predict that the market value will fall. Some methods to know are based mostly on the next 2 sorts of evaluation:

- Technical evaluation: Find assist and resistance factors by finding out the BTC chart.

- Fundamental Analysis: Understanding market sentiment and investor reactions based mostly on a sequence of ongoing occasions.

Cryptocurrencies are a extremely unstable asset class, this technique can produce enormous income, however it may well additionally result in equally extreme losses.

Invest in tokens that go in opposition to the market

Sometimes, there are some tokens available in the market which might be difficult the Bear Market. When issues go down, these tokens appear to wish to go in opposition to the grain. You can spot tokens which might be behaving unusually in opposition to the pattern by intently monitoring the market and evaluating pricing patterns.

Notable examples of such cash have garnered a big following resulting from their surprising habits. Typically, the Molecular Future coin has the MOF token. This is without doubt one of the few cash that made a revenue in the course of the latest bear market. When the worth rose practically 50% whereas BTC plummeted.

Swing Trading

In the bull market, the technique of shopping for or holding any cryptocurrency will be worthwhile. But when the market is down, it is best to make the most of the pattern and make the most of the short-term value actions of various asset courses. Experienced merchants will typically enhance their portfolio throughout this era by shopping for extra altcoins when costs are low and promoting them after they hit the pattern excessive.

The benefit of swing trading is to cut back the entry frequency, thus lowering the strain that the market is inflicting, and on the similar time it may well catch massive waves with massive market income.

However, to achieve success in swing trading, it is best to first begin understanding the fundamentals of technical evaluation by understanding the perfect entry and exit factors available in the market.

You can consult with Coinlive’s Trading 101 part to solidify your data earlier than attempting swing trading. Details on Here.

Earn further revenue from Airdrops

The downtrend interval is when customers lose curiosity available in the market. So Airdrop is a technique to entice customers for the aim of promoting the product. By giving free tokens to customers who’ve supported the venture for the reason that early days, this may be seen as a technique to earn extra sustainable and long-term revenue even when the market is in an uptrend.

Popular types of airdrops embody:

- Retroactive: This module is widespread as Uniswap distributes its UNI token at no cost to customers who’ve used and interacted with the venture. This will be stated to be a fairly good airdrop, when every pockets can obtain as much as $ 1,600 at the moment.

- Run airdrop actions: This module requires you to work laborious to do duties akin to answering questions, filling out varieties, coming into contests to earn tokens as a reward.

- Keep important tokens: Host tokens are the native tokens of blockchains. This method, customers who solely want to carry tokens validly can be airdrop.

To discover out in regards to the initiatives that may Airdrop customers, see extra on Here.

Switch to passive revenue

If you do not really feel assured sufficient to speculate or trade short-term traits, then you may have another choice. It is investing in platforms that may deliver passive revenue. To do that, there are two varieties to attempt:

- Loan of cryptocurrencies: Loan of cryptocurrencies. This method you’ll both take your belongings to lend them on widespread exchanges or by way of suppliers like Celsius or Aave, or you possibly can lend your cryptocurrencies to different customers and earn curiosity regularly.

- Cryptocurrency Staking: Cryptocurrency deposit. You can spend money on Proof-of-Stake (PoS) cash and lock your belongings on the network to obtain a reward for staking. While the upcoming transfer of ETH to PoS is very anticipated by the group, many different cash already assist staking rewards akin to: EOS, ATOM and DASH. However, on the subject of Staking rewards, totally different cash could have totally different returns. At first look, the deposit bonus seems very engaging by way of rates of interest, however there are dangers you might want to take into account particularly when the market is very unstable, which is able to simply trigger costs to slip. Also, when new cash are minted, their provide is diluted, resulting in inflation, which additionally impacts the precise return you obtain.

Epilogue

Many individuals assume that you simply should not spend money on Crypto when the market goes down. This is just not true, because the bear market is commonly the perfect time to develop your portfolio in preparation for the subsequent bull market. However, earlier than making any funding selections, get within the behavior of DYOR and efficient capital administration.

Above are some strategies I feel you should use to make extra income throughout final week’s bear market. I hope you possibly can protect your capital and seize the alternatives provided by the market.

.