HBAR has finally broken its month-long consolidation below $0.33, a level that has caused many failed breakout attempts.

The recent surge, backed by broader market optimism, has pushed altcoin prices up 20%, opening the door for further gains if the positive momentum continues.

HBAR Stands Strong

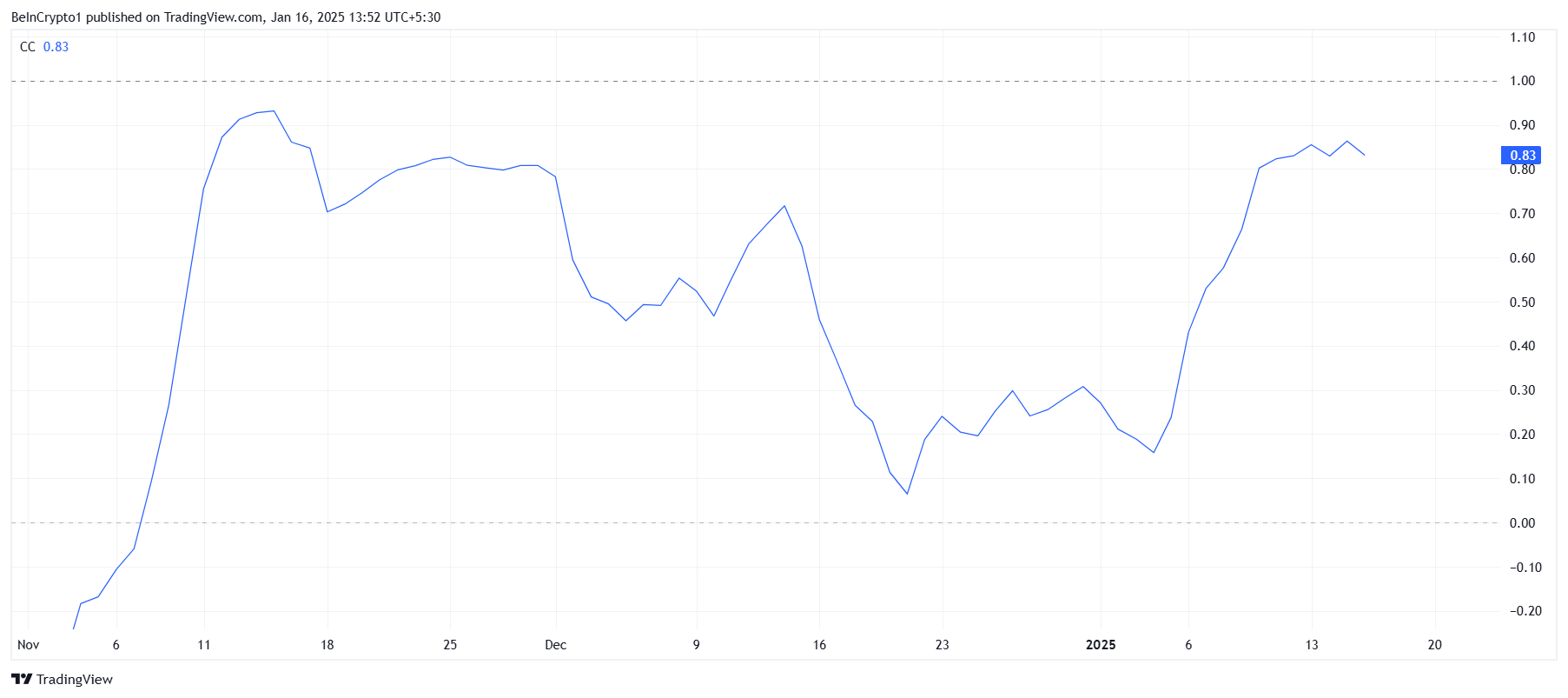

HBAR’s correlation with Bitcoin remains high at 0.88, showing that the altcoin’s price movement is closely related to Bitcoin’s trajectory. This is a promising sign as Bitcoin is getting closer to recovering the key $100K level, which could amplify the bullish sentiment for the broader crypto market, including HBAR.

With Bitcoin’s potential breakout as a catalyst, HBAR could benefit from renewed investor confidence. A positive move in Bitcoin price is likely to increase HBAR’s upward trajectory, making correlation a key factor in the altcoin’s future performance.

HBAR’s Relative Strength Index (RSI) is approaching the overbought zone at 70.0, which is often considered a sign of a price correction. However, the HBAR has shown persistence as the RSI entered this zone, suggesting it could challenge the conventional bearish view associated with overbought conditions.

This persistence, coupled with sustained market support, could allow HBAR to maintain its current positive momentum. Even when RSI is high, broad market sentiment and historical performance provide a cushion against immediate, sharp downward pressure.

HBAR Price Prediction: Maintaining Performance

HBAR is up nearly 20% in the past 24 hours, breaking out of a consolidation range between $0.25 and $0.33. This breakout marks an important milestone for the altcoin, potentially establishing a foundation for further jumps.

The next major resistance for HBAR lies at $0.39. If this level is successfully overcome, the altcoin could move towards $0.40 and beyond. However, this optimistic scenario depends on HBAR securing $0.33 as a support floor to maintain the upward momentum.

If broad market conditions turn bearish, HBAR is at risk of losing key support at $0.33. Such a development could take the altcoin back to its previous consolidation range above $0.25, delaying price growth and potentially invalidating the bullish outlook.