Bitcoin’s value action in excess of the previous handful of weeks has barely supplied traders with insights into its quick-phrase trend.

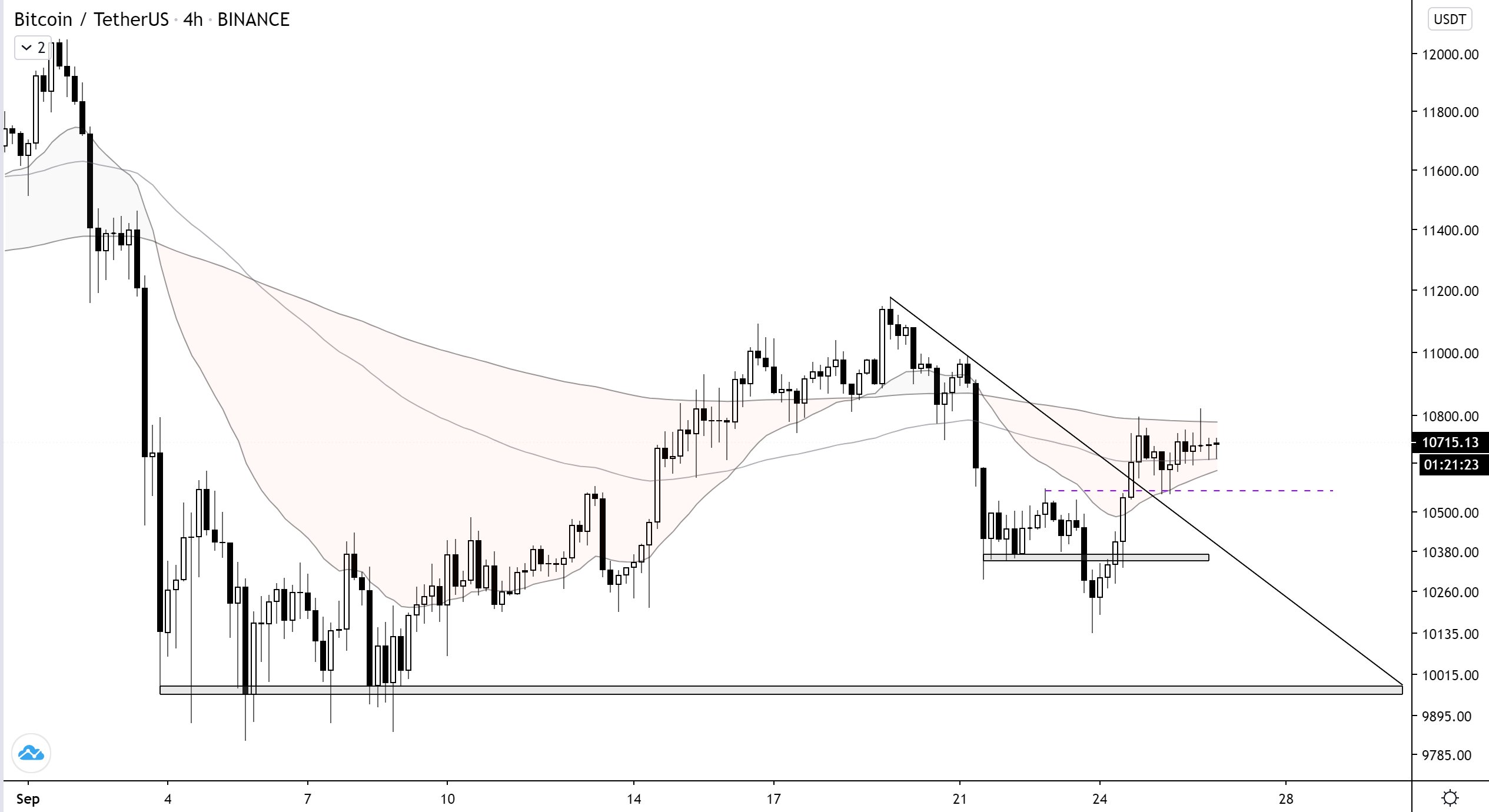

BTC has formed a comparatively broad trading variety amongst $ten,200 and $eleven,200, with each of these ranges confirmed as locations of greater getting/offering action.

The quick-phrase outlook for the aggregate market place stays a bit foggy, as all eyes are closely viewing to see what comes about to BTC. This has triggered altcoins to trend decrease later on this yr.

One analyst is at the moment pointing to Bitcoin’s 21-week EMA, explaining that a continued hold over this important degree is exceptionally bullish.

Here’s How Bitcoin’s 21 Week EMA Could Start Its Next Bullish Rally

This consolidation has taken spot over Bitcoin’s weekly 21 EMA, which is a constructive signal that looks to propose that an uptrend may possibly be imminent for the cryptocurrency.

Wolf, a well-known analyst note that this could indicate that BTC will by no means near under $ten,000 and will quickly start its subsequent massive rally.

“During the last bull market, BTC continued to hold the 21 weekly EMA. Has the bull market started yet? If this were the case, we would never close below 10k.”

Bitcoin Still Stuck Below Its Key MA-200

Continuous swings over or under this degree have contributed to assets like Bitcoin trending for many years.

“Bitcoin’s only enemy is the cloud 200ema resistance. Please break above, I miss the smell of financial freedom”, he tweeted.

Where the complete market place trend in excess of the subsequent handful of days and weeks may possibly solely rely on Bitcoin’s response to this important technical degree.

Follow us on Telegram