The penultimate week of November 2023, Coinlive invites readers to observe some on-chain occasions relating to the movement of dollars in Blast and the developments of two key hacks throughout the week.

Outstanding On-Chain Events Last Week (Nov twenty – Nov 25)

Outstanding On-Chain Events Last Week (Nov twenty – Nov 25)

one. Cash flows in Blast

On the morning of November 21st, layer-two option Gust on Ethereum was officially launched and attracted the focus of traders by raising $twenty million from Paradigm, Standard Crypto and eGirl Capital.

The undertaking claims that Blast is a layer two based mostly on Optimistic Rollups technologies, compatible with EVM so that traders and dApps on Ethereum can conveniently connect to it.

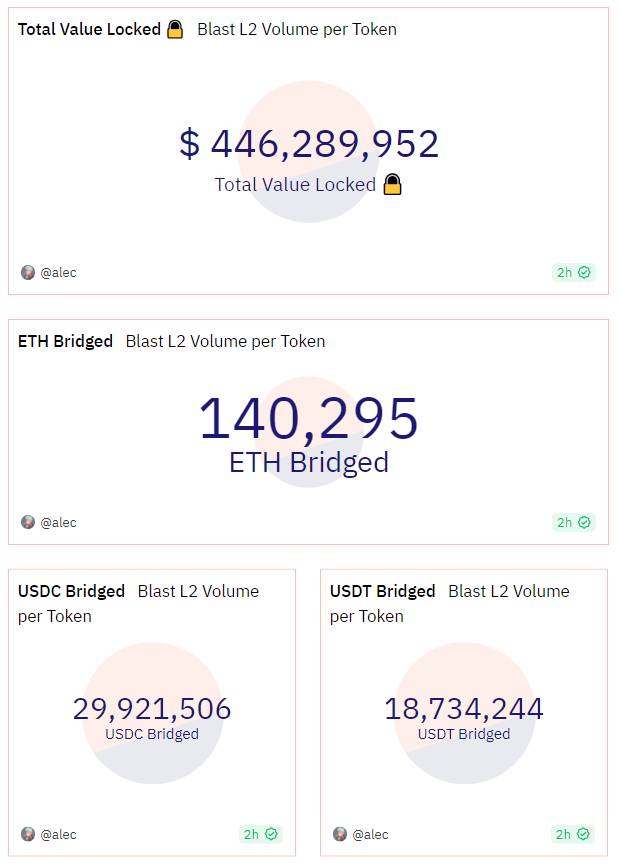

Even however the Bridge to Blast asset will be blocked right up until up coming year’s mainnet, it nonetheless attracted good inflows in just a handful of days. Assets that traders connect to Blast incorporate ETH and USDC, USDT.

Resources utilized to connect to Blast. Source: alec on Dune Analytics (November 25, 2023)

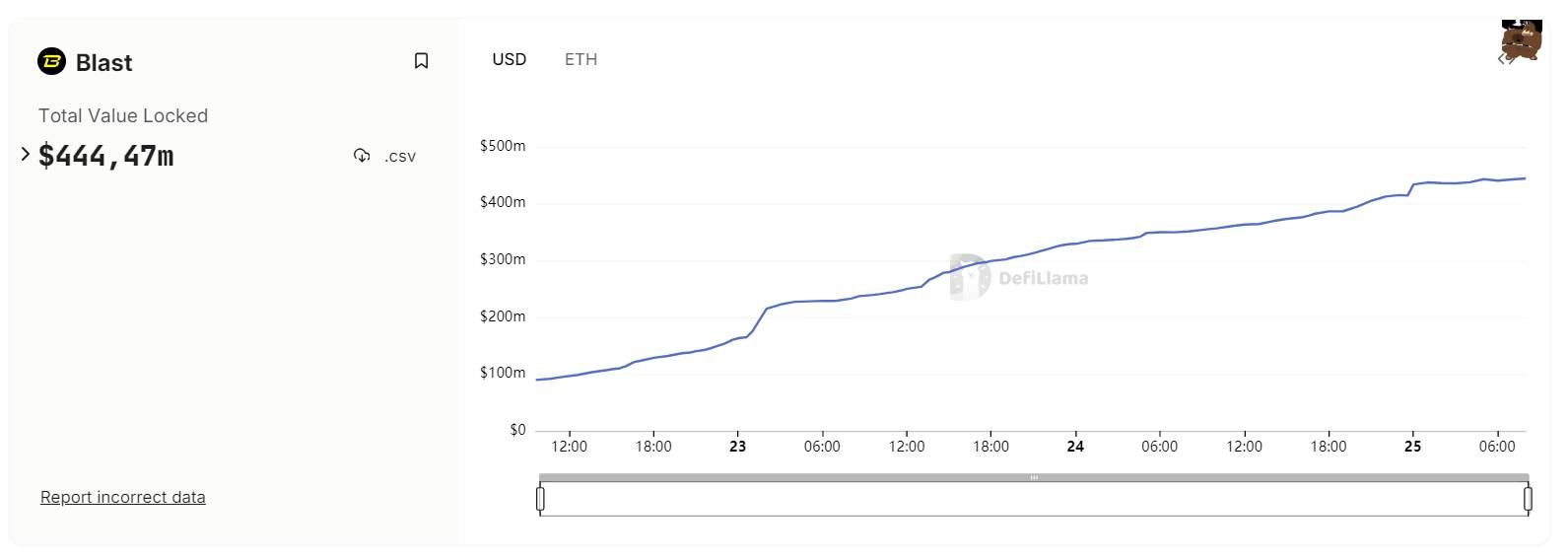

After roughly four days, Blast attracted much more than $440 million in TVL worth. The motive may well be since there is no layer two option that delivers further curiosity prices to encourage holding ETH.

Blast ascending TVL. Source: DefiLlama (November 25, 2023)

Blast ascending TVL. Source: DefiLlama (November 25, 2023)

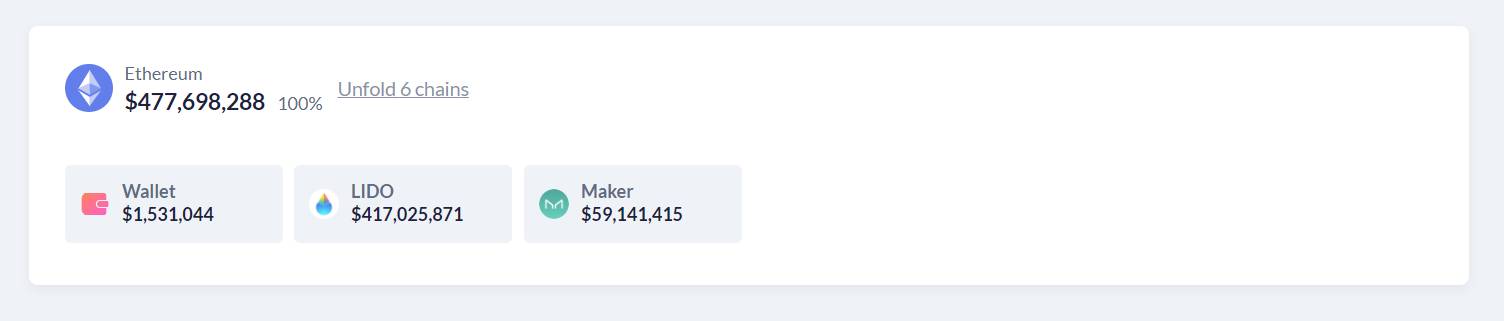

Based on Blast’s mechanism, the dollars staked by end users continues to be staked elsewhere to create much more curiosity and distribute it to end users.

Of the $477.seven million blocked, $417 million really worth of ETH was sent to stake on Lido, turning into the 3rd biggest ETH staking holder in the market place $59 million DAI sent to Maker DAO the rest one.five million bucks resident in the protocol portfolio.

Assets are deposited in Blast and staked in Lido and MakerDao. Source DeBank

Assets are deposited in Blast and staked in Lido and MakerDao. Source DeBank

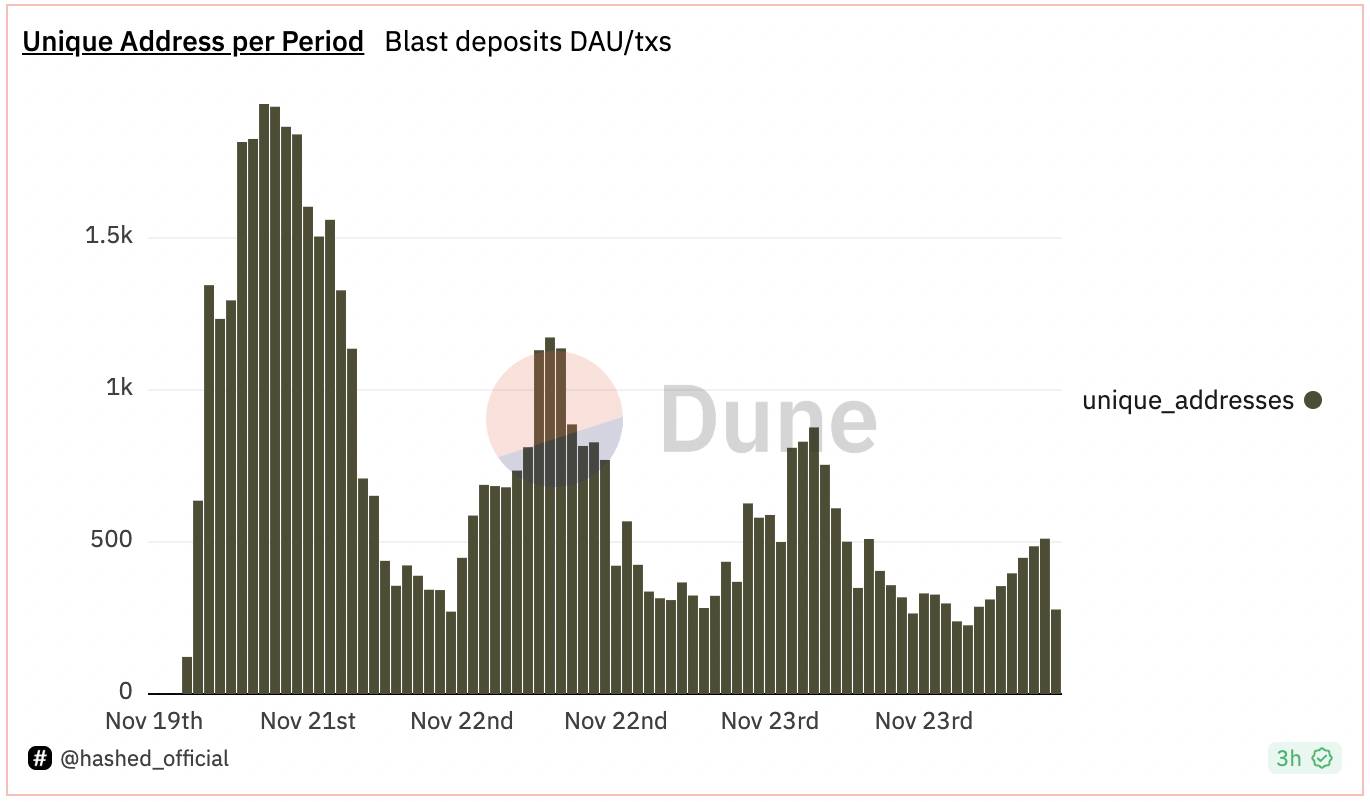

Regarding the amount of wallets participating in the asset bridge to Blast, it can be witnessed that the highest hype occurred at the time of the undertaking announcement and then progressively decreased, while the trend of TVL greater substantially .

Number of bridge wallets coming into Blast each and every day. Source: hash on Dune Analytics

Number of bridge wallets coming into Blast each and every day. Source: hash on Dune Analytics

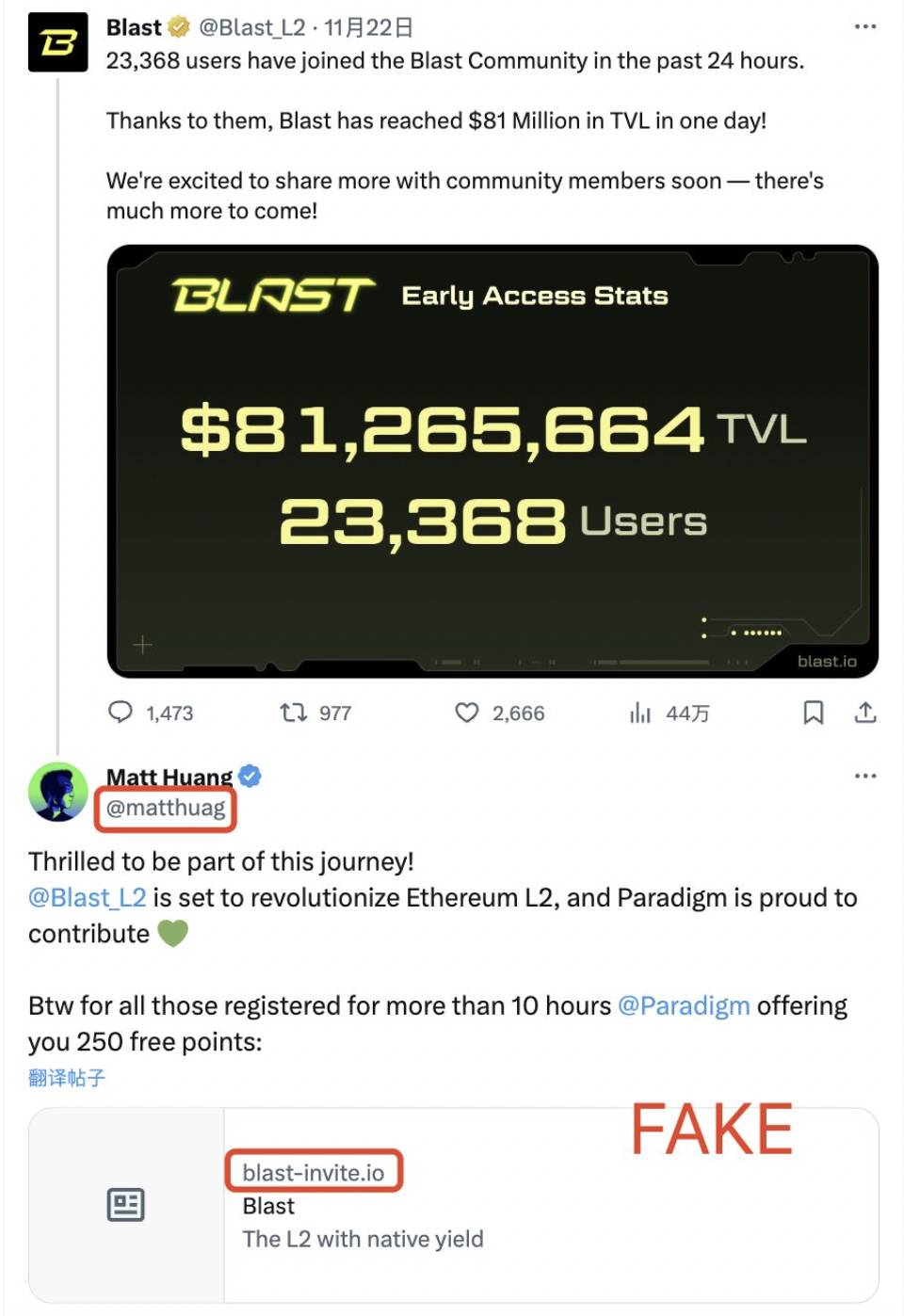

Taking benefit of Blast’s recognition, a scammer impersonated Paradigm founder Matt Huang’s account to send fraudulent backlinks and induce more monetary losses. $130,000. However, the impostor’s message contained in the official tweet has not nonetheless been processed.

Impersonation messages. Source: Bitrace X account

Impersonation messages. Source: Bitrace X account

two. Hacking Developments on HECO Chain and Cooperative

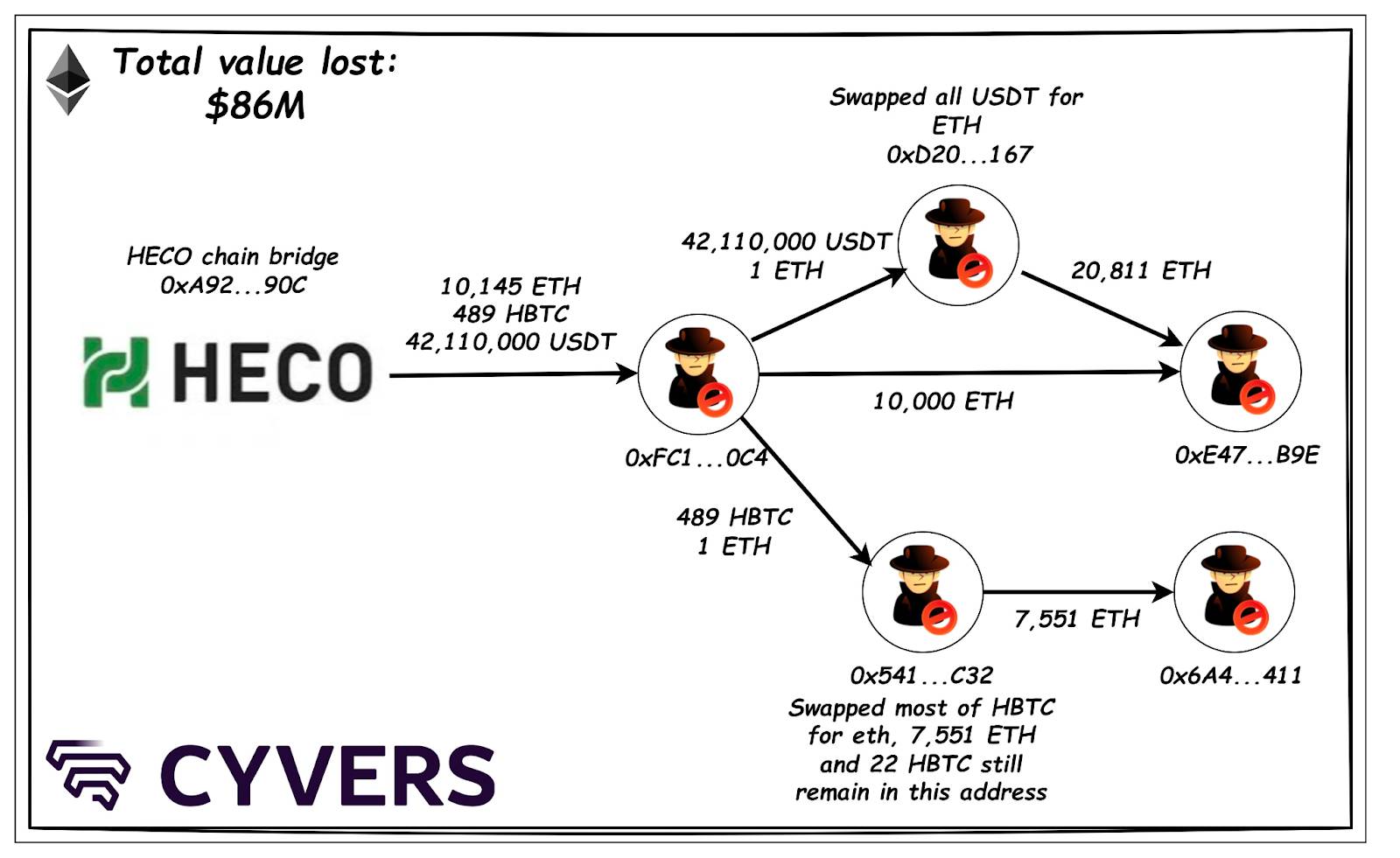

On the afternoon of November 22, Cyvers Alerts issued a warning about a series of uncommon transactions on HECO Chain, the personal blockchain of the Cooperative (formerly Huobi) exchange.

There have been approx 86.six million bucks Cryptocurrencies are withdrawn from the HECO chain bridge by the wallet 0xFc1of which 346,994 TUSD, 42,399 Hyperlink (roughly 601,641 USD), 619,000 USDC, 173,200 UNI (931,816 USD), 346.9 million SHIB (two.eight million USD), 489 HBTC (18.eight million USD), 42 million USDT and ten,145 ETH ($19 million) .

Amount of money withdrawn from HECO Chain. Source: Arkham Intelligence

Amount of money withdrawn from HECO Chain. Source: Arkham Intelligence

The dollars was then dispersed across several wallets. Currently, the vast majority of assets withdrawn on HECO Chain are discovered in two most important wallets: 0xe47 AND 0x6A4. The attacker, owning collected the items, speedily exchanged them 42.one million US bucks in the direction of ETH to prevent the threat of becoming frozen by Tether.

Diagram of a hacker’s dollars dispersion. Source: Cyvers Alerts

Diagram of a hacker’s dollars dispersion. Source: Cyvers Alerts

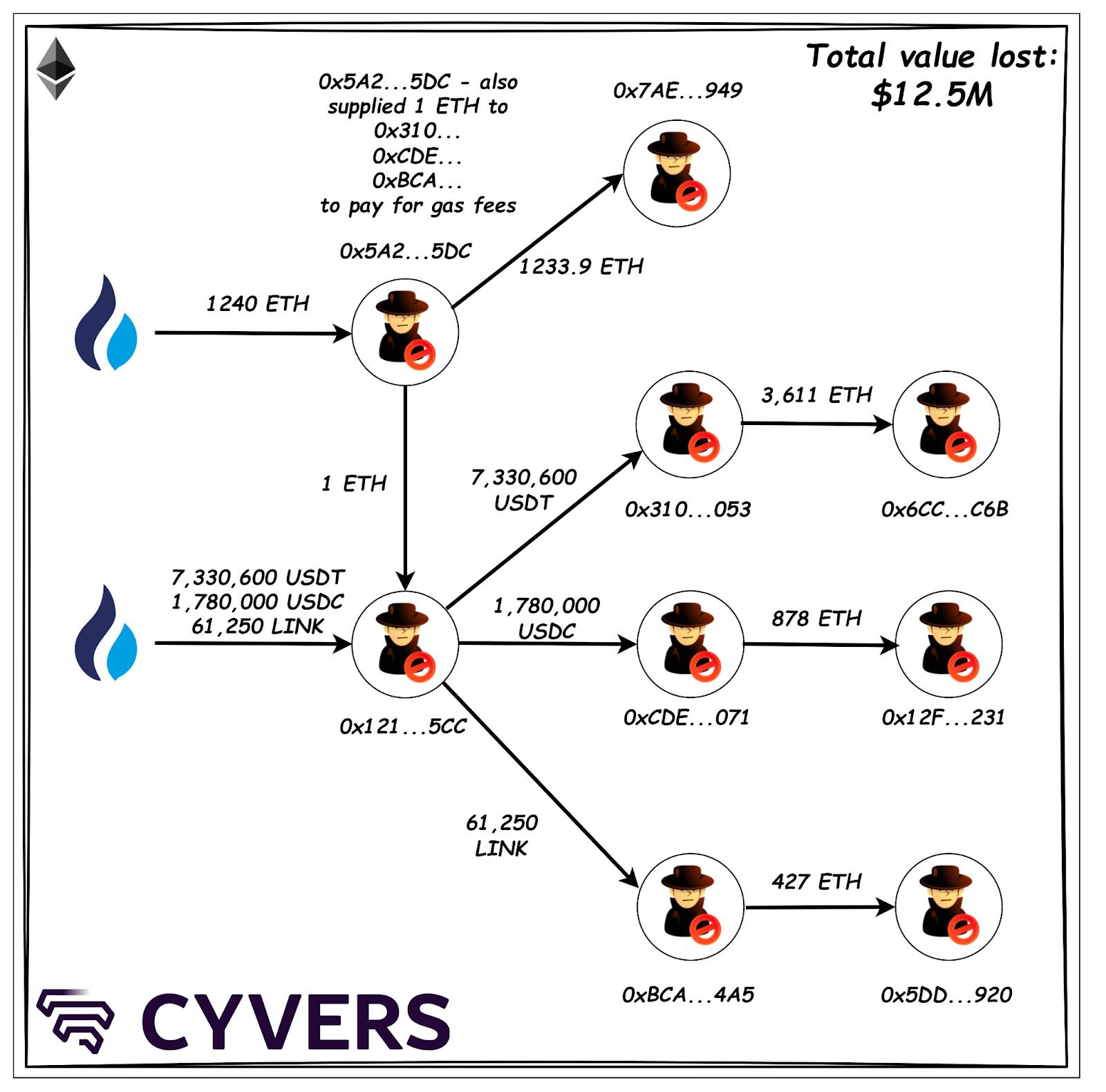

The sum of attacks did not halt there, as has been reported, the complete harm greater 110 million bucks when there are more vulnerabilities on the cooperative’s element. Cyvers Alerts mentioned it reported several suspicious transactions linked to the HTX exchange’s scorching wallet, and the hack was confirmed by Justin Sun.

Two scorching wallets of the Cooperative have been impacted by this incident one,240 ETH (two.five million USD), seven.three million USDT, one.78 million USDC and 62,200 Hyperlink been withdrawn. The attacker distributed all the assets to distinctive EOA addresses with an further one USD ETH as a fuel charge. Currently, all stolen items are stored in four distinctive addresses.

Diagram of a hacker’s dollars dispersion. Source: Cyvers Alerts

Diagram of a hacker’s dollars dispersion. Source: Cyvers Alerts

This is not the to start with incident of hacking linked to the cooperative. Previously, on September 25, the Cooperative’s prepare was withdrawn seven.9 million bucks resource. Subsequently, on November ten, money really worth up to have been stolen from Poloniex 125 million bucks. The exchange continues to inquire hackers to shell out with a reward of up to $ten million, but nonetheless no response.

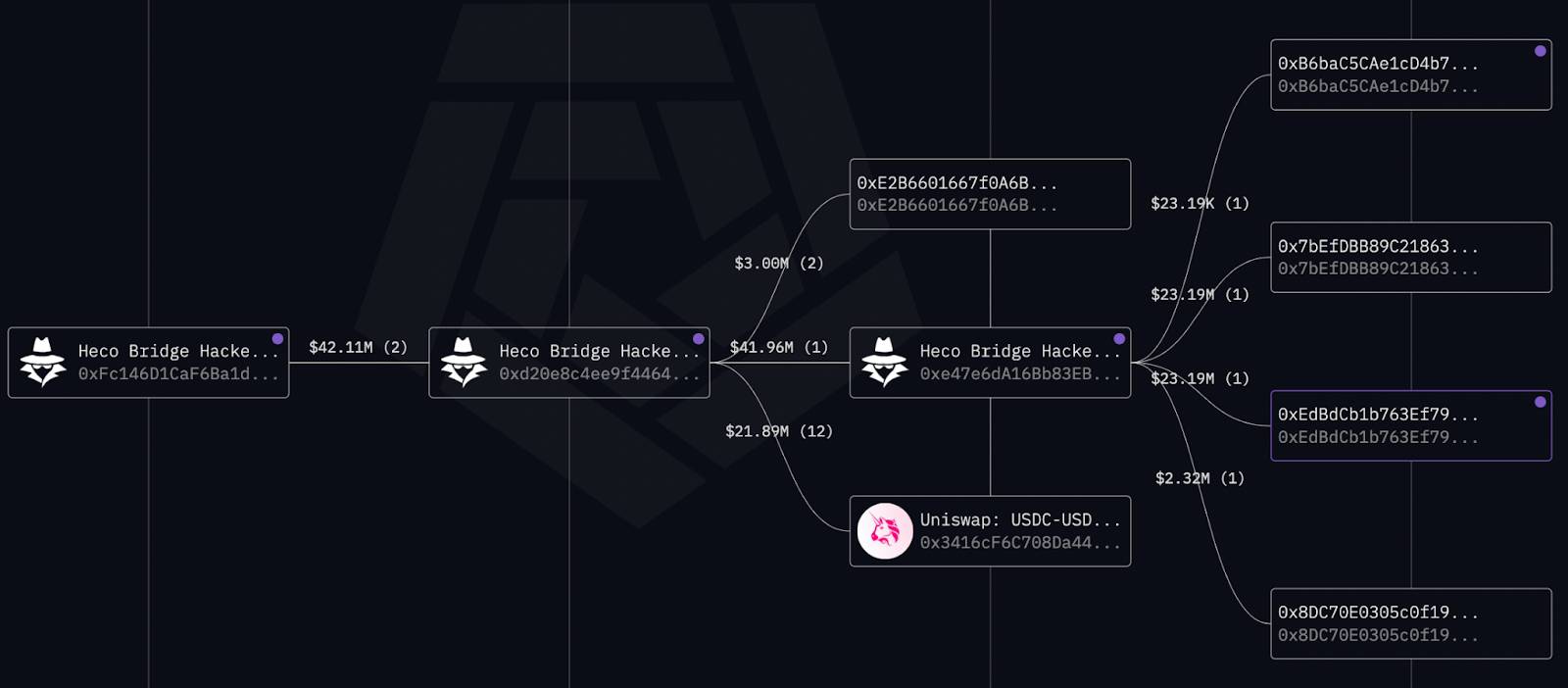

A day immediately after the assault on HECO Chain, hackers started moving assets. Heco Bridge Exploiter two moved approx eleven.22 ETH to a new tackle is 0xB6b, eleven,220 ETH ($23.two million) arrive 0x7bE AND eleven,220 ETH(23.two million bucks) Give 0xEdB. The sum of ETH transferred was to commemorate HECO and HTX’s effective hack day on November 22nd.

ETH Transfers. Source: Arkham Intelligence

ETH Transfers. Source: Arkham Intelligence

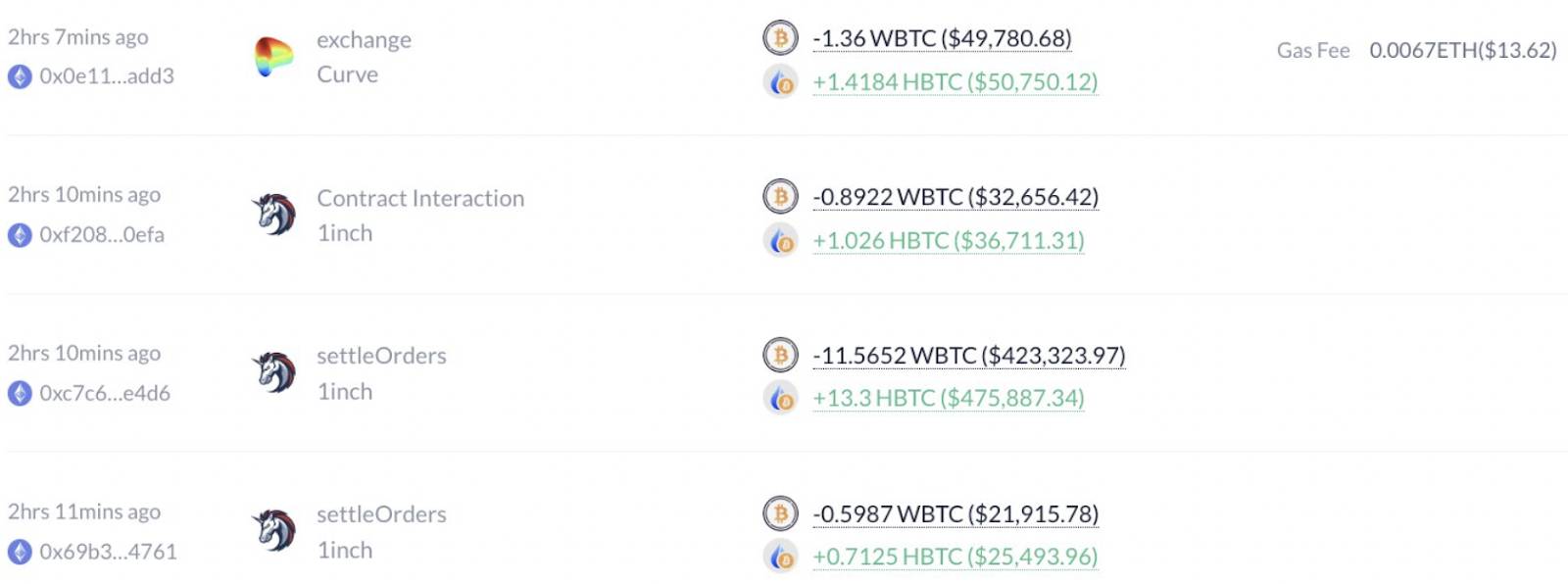

During the asset dispersion method, the HECO Bridge hacker offered HBTC, and an investor took benefit of the drop in HBTC cost to withdraw 50.64 WBTC from Binance and trade 57.51 HBTC. Next, this wallet modifications 56.51 HBTC to 50.47 WBTC and transfers it back to Binance. This investor manufactured a big difference of pretty much .83 BTC in one hour.

Exchange transaction on HBTC. Source: DeBank

Exchange transaction on HBTC. Source: DeBank

three. KyberSwap Hacking Progress

In the early morning hrs of November 23, the cryptocurrency neighborhood on X (Twitter) continued to create curiosity in the newest DeFi assault towards the KyberSwap DEX.

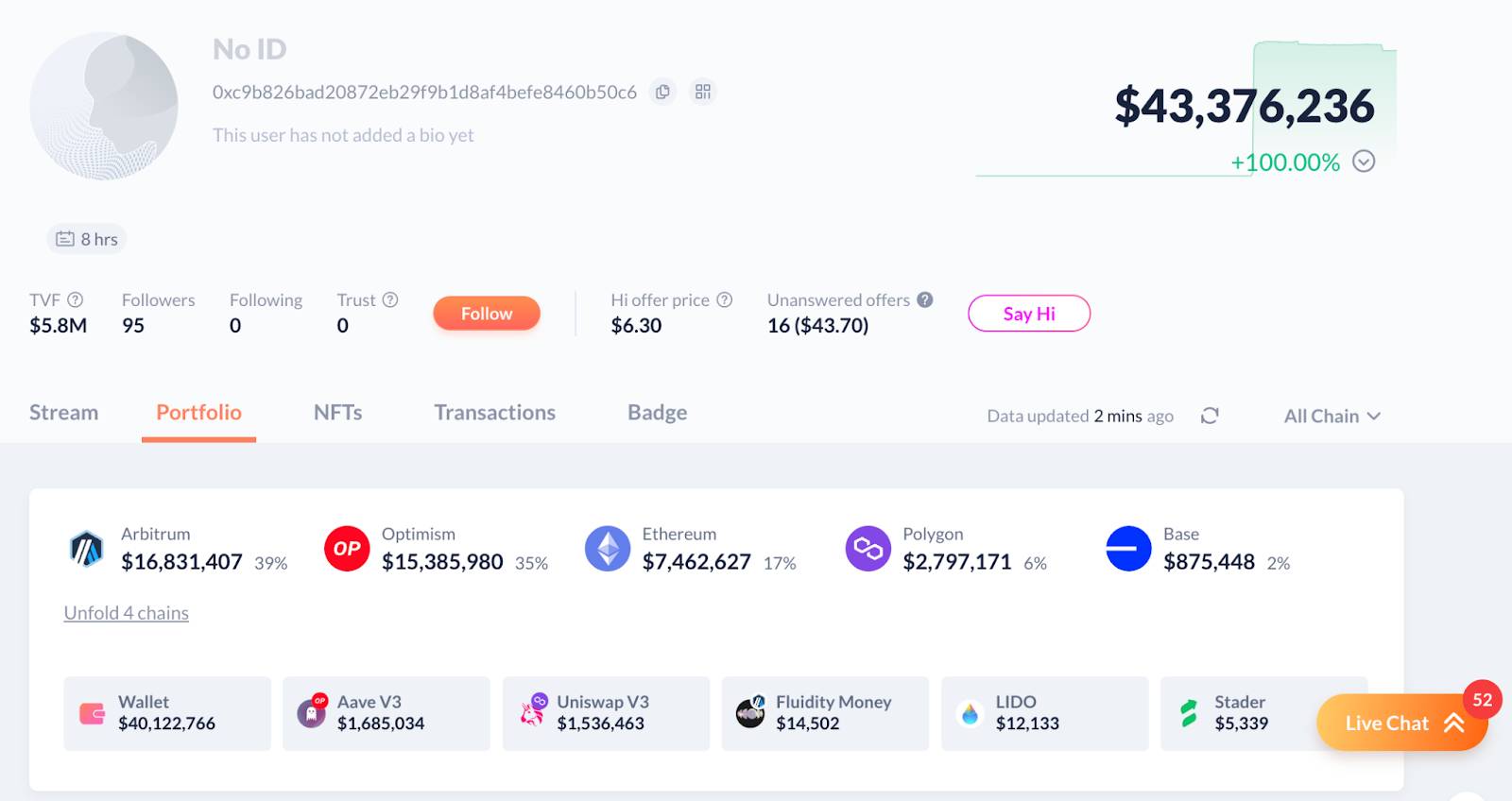

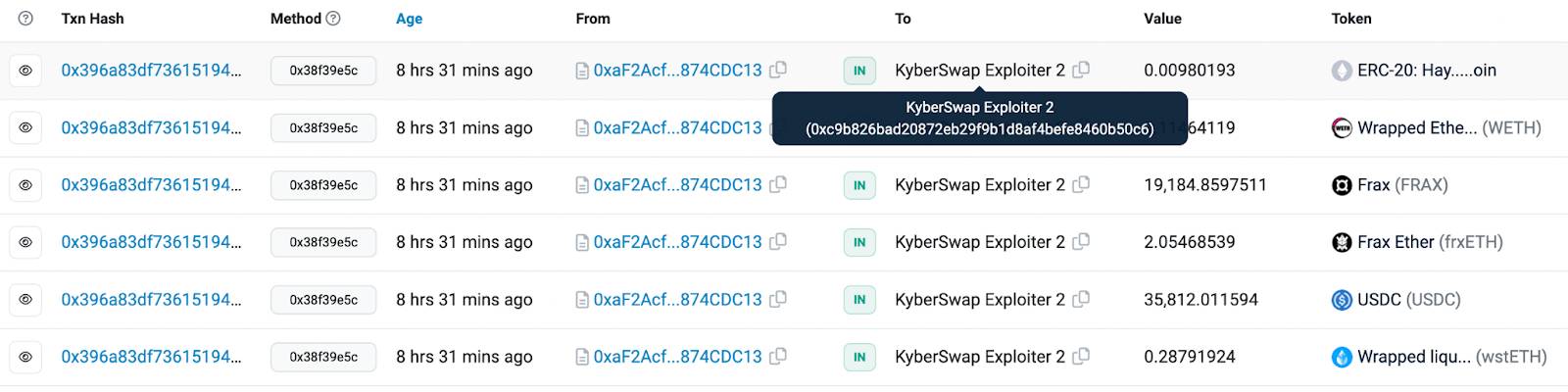

As a end result, this protocol’s elastic liquidity pools have been stolen a significant sum of dollars by lousy actors, with an estimated worth of 47 million bucks. Hackers stole assets on several KyberSwap-backed blockchains to open liquidity pools, like USD seven.five million ETH, USD two million Polygon, USD 875,000 BASE, USD twenty million ARB, USD 15 million OP. The withdrawn sum is stored in the wallet tackle 0xc9b.

The wallet outlets hacked coins from KyberSwap. Source: DeBank

The wallet outlets hacked coins from KyberSwap. Source: DeBank

However, the hacker appears to have forgotten about the pool on Scroll as there is nonetheless $five million in assets left intact.

Hacker wallet tackle consists of two wallets:

- 0x50275E0B7261559cE1644014d4b78D4AA63BE836

- 0xC9B826BAD20872EB29f9b1D8af4BefE8460b50c6

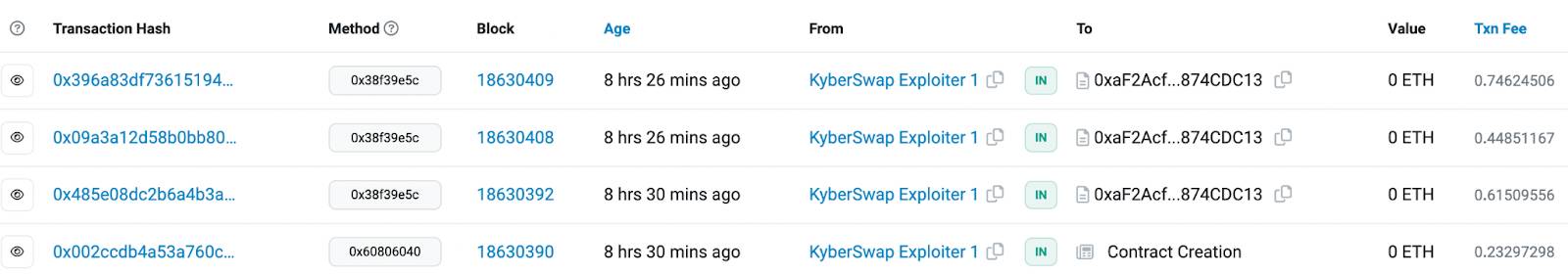

Wallet 0x502 Perform intelligent contract creation 0xF2 to 11pm on November 22nd. This intelligent contract is then activated to make withdrawals to KyberSwap liquidity pools by three transaction hashes.

Smart Contract creation transaction and three withdrawal transactions. Source: Etherscan

Smart Contract creation transaction and three withdrawal transactions. Source: Etherscan

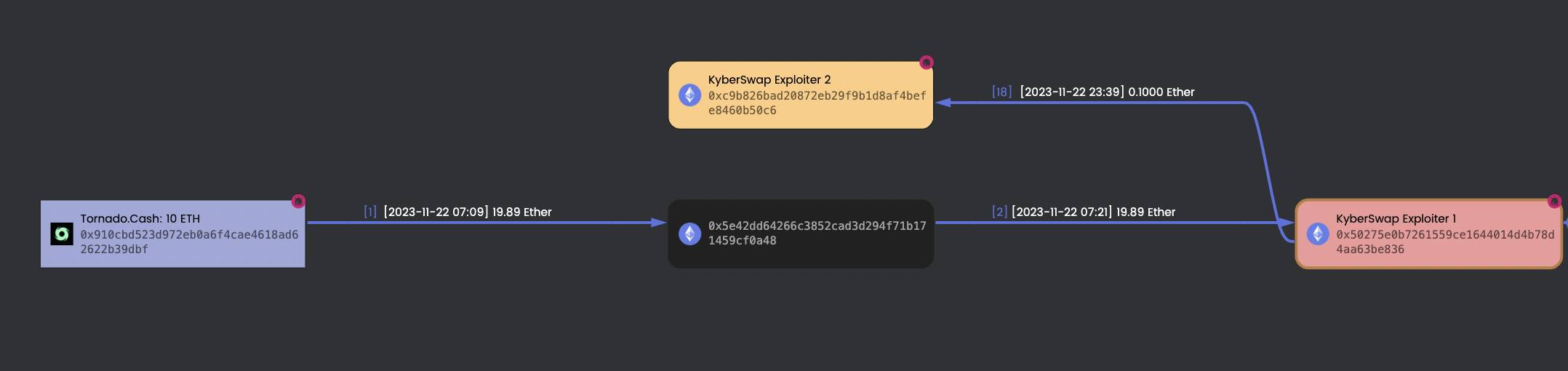

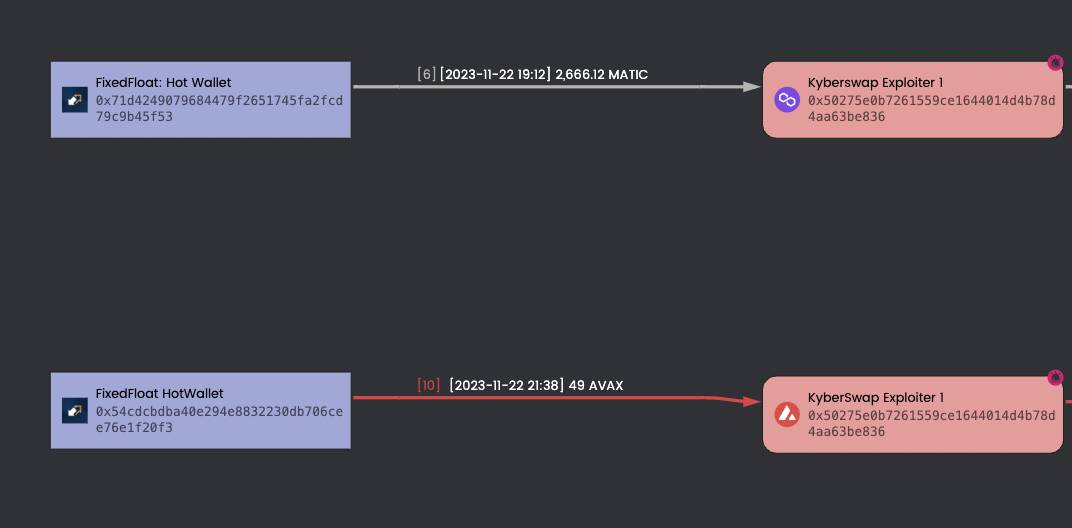

Wallet 0x502 at first obtained money from Tornado Cash. Then, 0x502 took benefit of bridges and Fixed Float to transfer money to other chains to perform the assault.

0x502 at first obtained funding from Tornado Cash. Source: MetaSleuth

0x502 at first obtained funding from Tornado Cash. Source: MetaSleuth

0x502 at first receives funding from FixedFloat. Source: MetaSleuth

0x502 at first receives funding from FixedFloat. Source: MetaSleuth

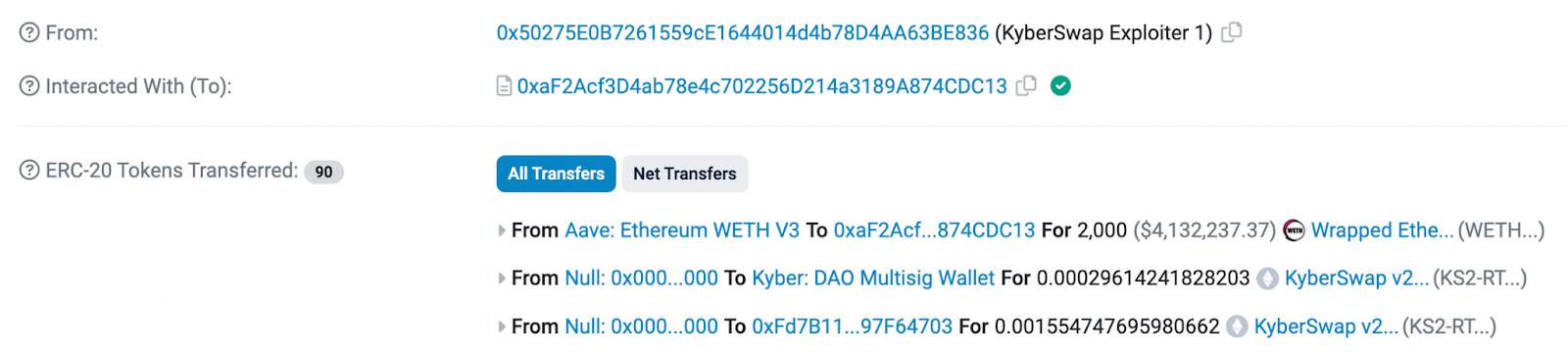

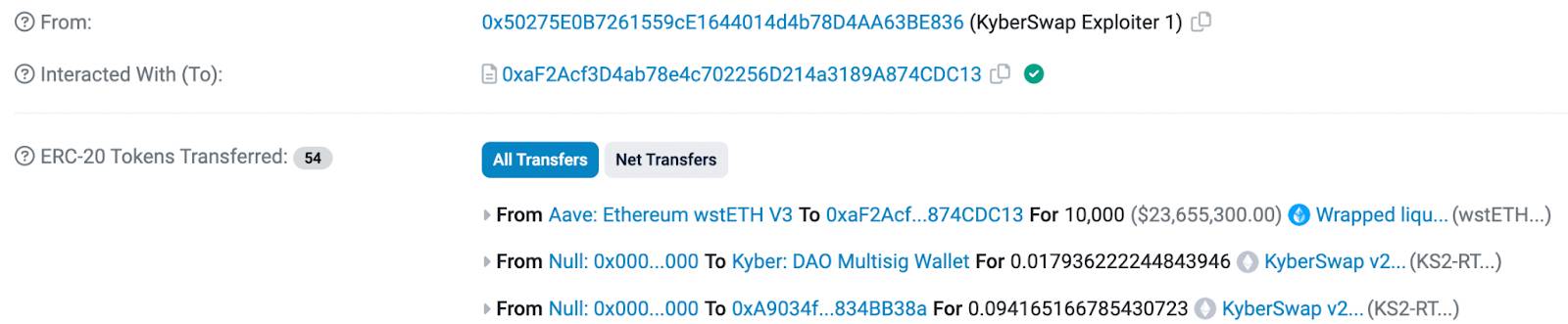

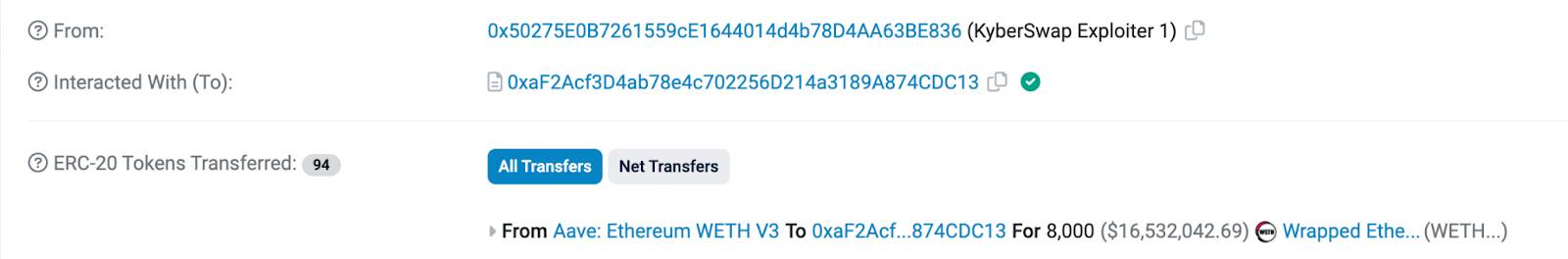

When monitoring the attacker’s transactions, with each and every transaction, at the starting, the intelligent contract often obtained a significant sum of dollars from Aave, proving that only the liquidity pool of KyberSwap was attacked by way of flash lending.

All attacking transactions acquire dollars from Aave. Source: Etherscan

All attacking transactions acquire dollars from Aave. Source: Etherscan

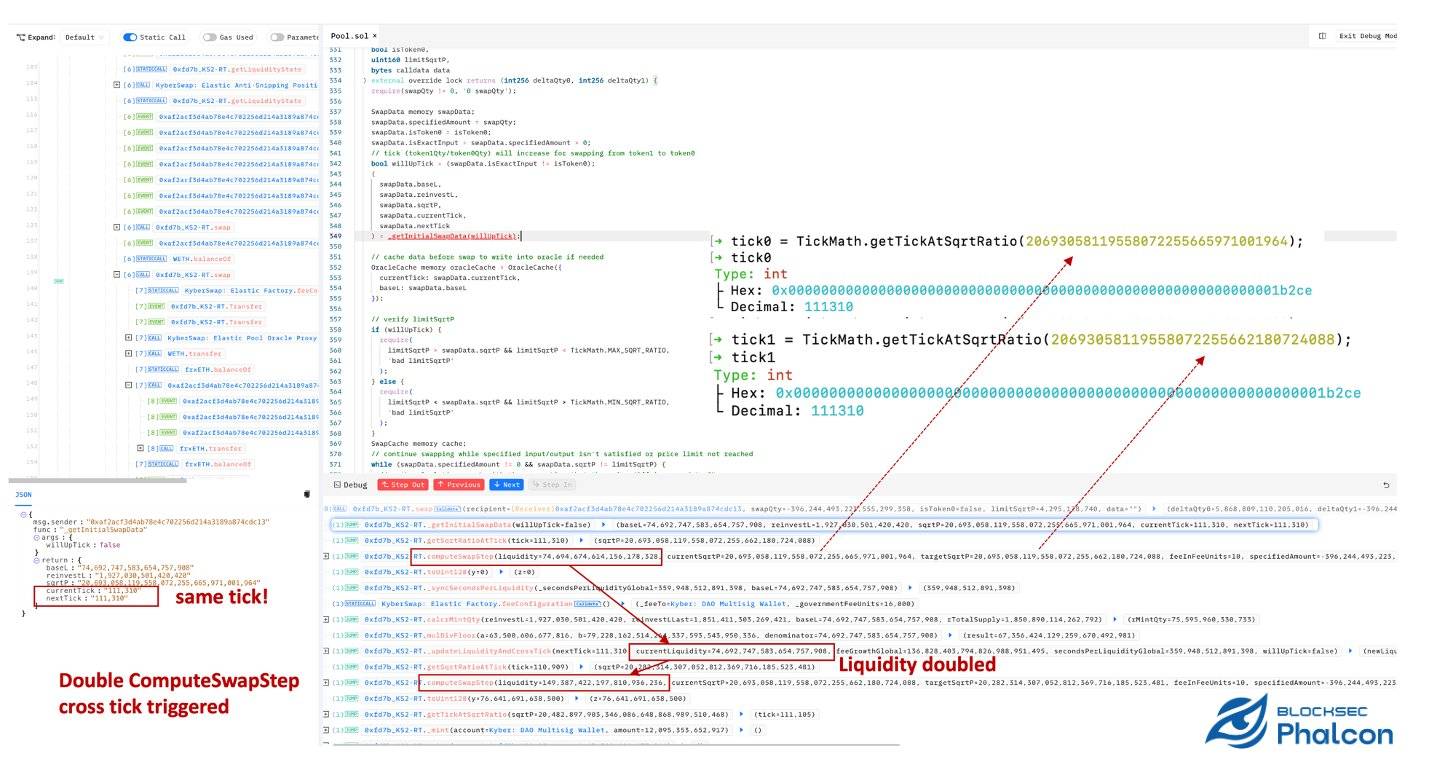

According to Blocksec’s evaluation, KyberSwap was attacked since hackers manipulated pool ticks and had a double liquidity vulnerability. The attacker borrowed a flash loan and drained pools with lower liquidity. By executing trades and place modifications, the hackers manipulated the costs and ticks of the pools. Finally, the attacker triggers many phases of swaps and cross-tick operations, resulting in the intelligent contract double-counting liquidity and then withdrawing money from the pools.

Explain the vulnerability of intelligent contracts. Source: Blocksec

Explain the vulnerability of intelligent contracts. Source: Blocksec

26/ And this is since the “cover quantity” was the upper restrict to attain the tick restrict calculated as …22080000, though the exploiter set a trade amount of …220799999

This exhibits how very carefully this exploit was created. Check failed by <0.00000000001% pic.twitter.com/1MYodAaVtd

— Doug Colkitt (@0xdoug) November 23, 2023

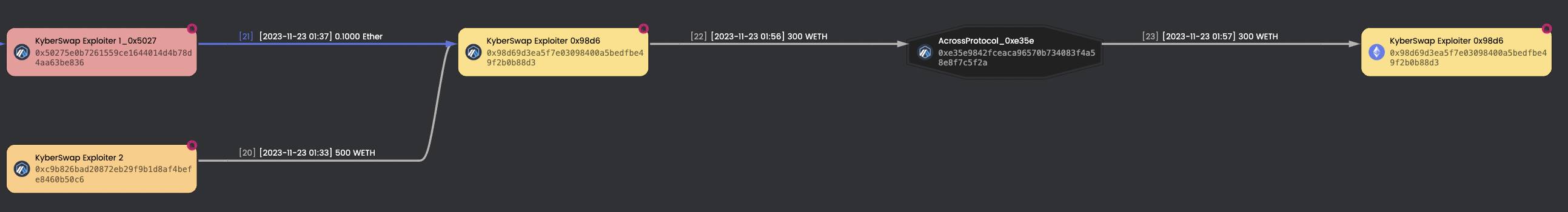

Currently, most of the proceeds are held at the address 0xc9b. Specifically, yes 500 MET was delivered to the address 0x98d on Arbitrum, so the portfolio has moved 300 MET to the Ethereum chain via the Across Protocol bridge.

Money transfer transaction to wallet 0xc9b. Source: Etherscan

Money transfer transaction to wallet 0xc9b. Source: Etherscan

The transaction transfers WETH to Arbitrum and bridges to Ethereum. Source: MetaSleuth

The transaction transfers WETH to Arbitrum and bridges to Ethereum. Source: MetaSleuth

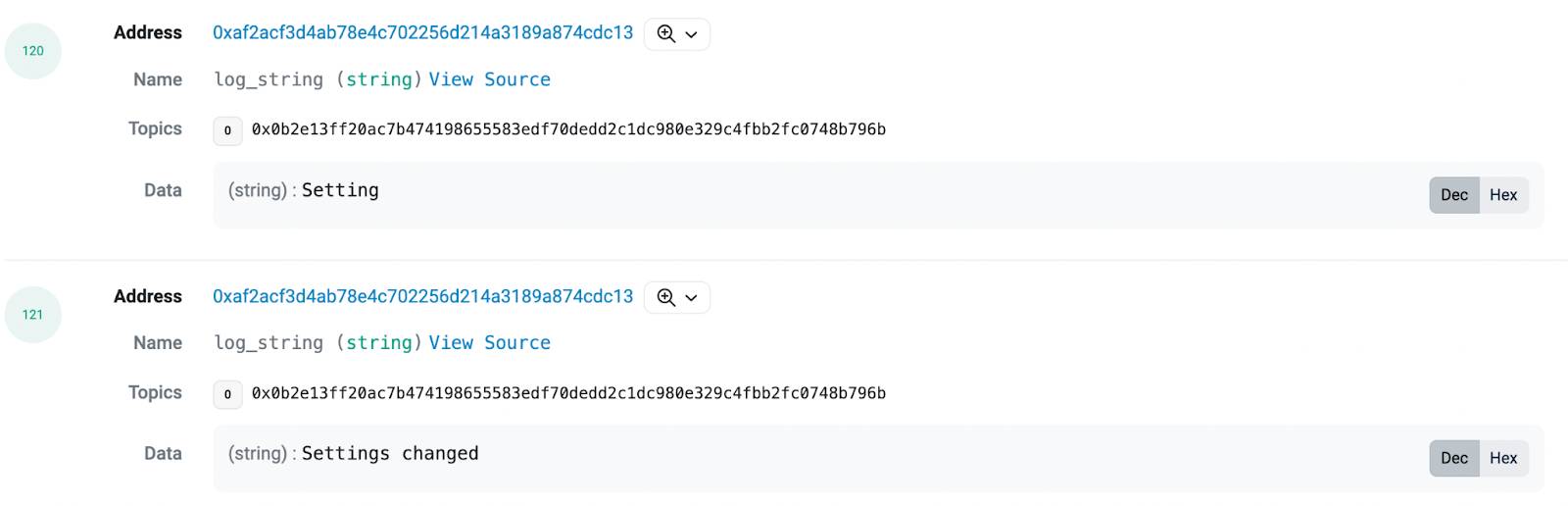

The funny thing is that when carrying out the attack, the hacker is very “thoughtful” in taking note of his hacking steps and this information can be read in the logs of each hash.

Hacker Notes. Source: Etherscan

Hacker Notes. Source: Etherscan

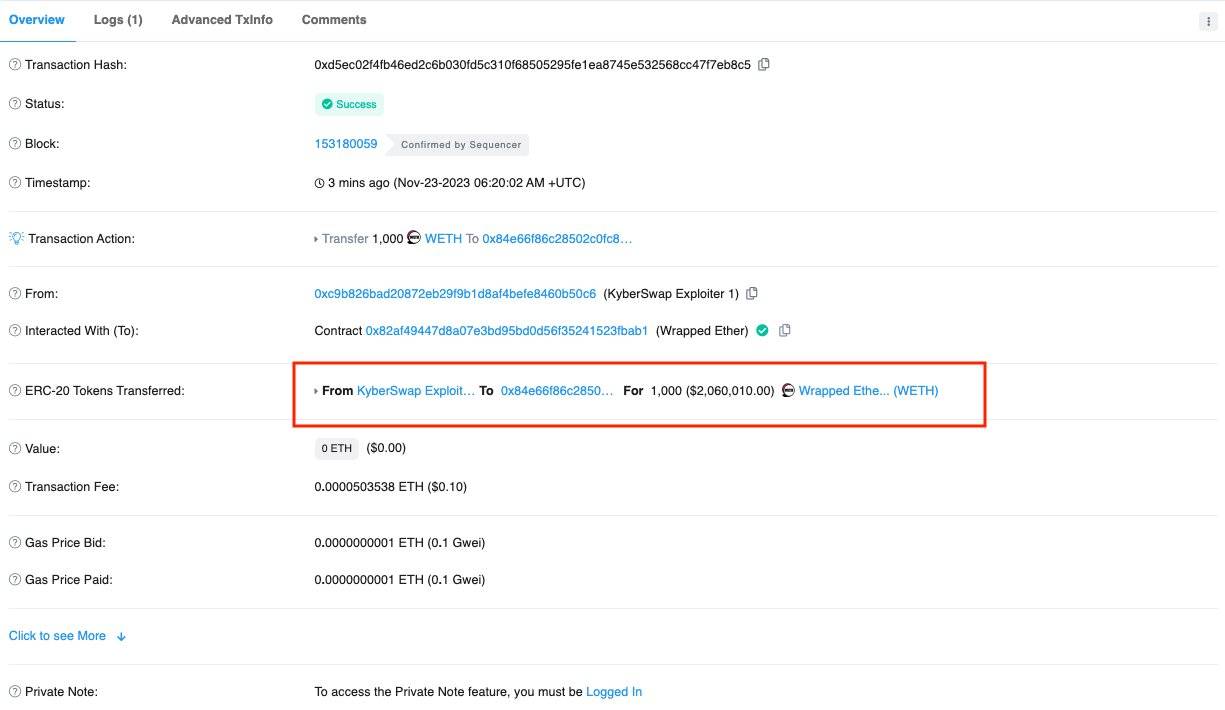

On November 23, the address continued to be transferred from Exploiter 2 0xc9b 1,000 WETH ($2.06 million) at the address 0x84e on the Arbitrum.

ETH Transfers. Source: Etherscan

ETH Transfers. Source: Etherscan

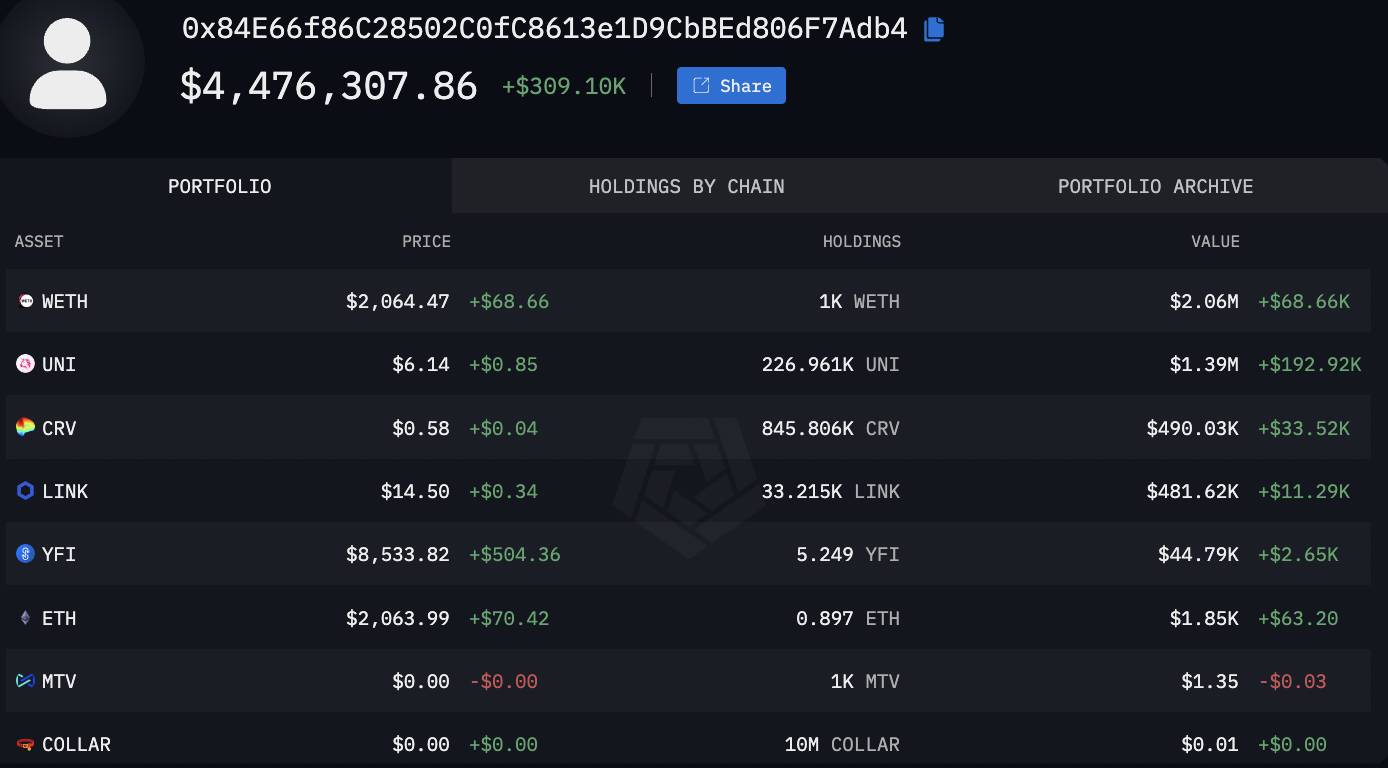

Wallet 0x84E Previously held approx 2.4 million dollars DeFi tokens but they have been dormant for over 2 years.

Resources in the 0x84E wallet. Source: Arkham Intelligence

Resources in the 0x84E wallet. Source: Arkham Intelligence

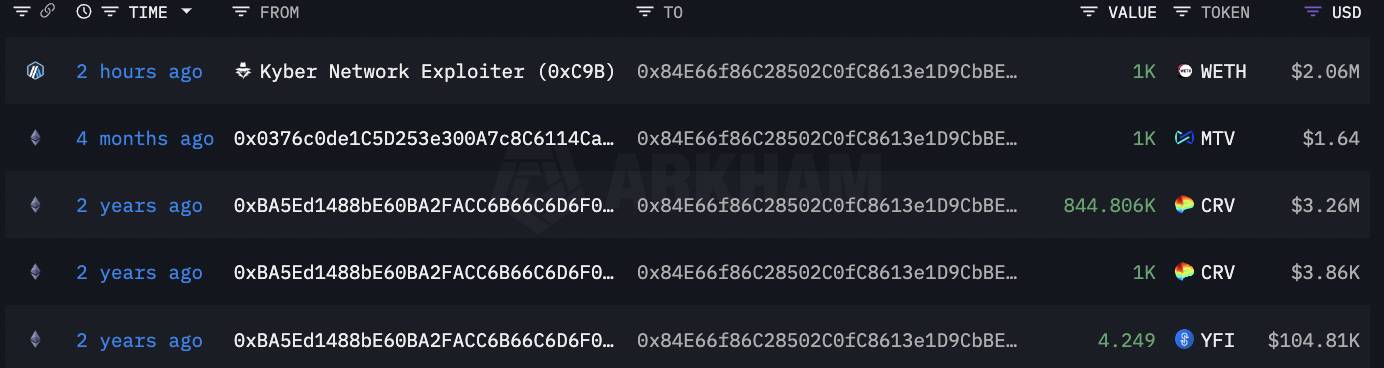

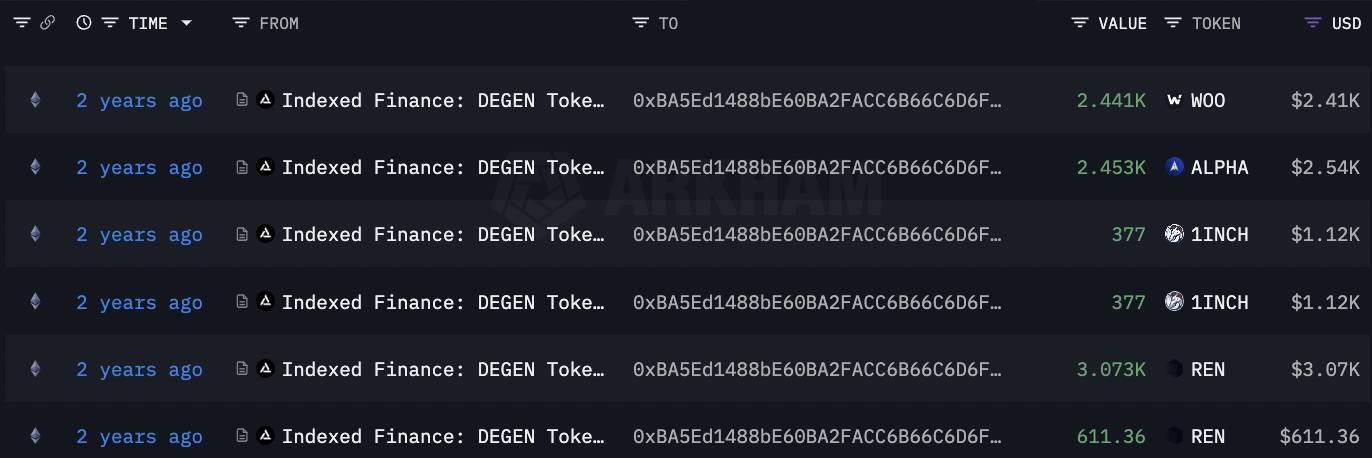

Most of 0x84E’s transactions during operation were just transactions receiving tokens from the wallet 0xBA5.

Transaction of 0x84E with 0xBA5. Source: Arkham Intelligence

Transaction of 0x84E with 0xBA5. Source: Arkham Intelligence

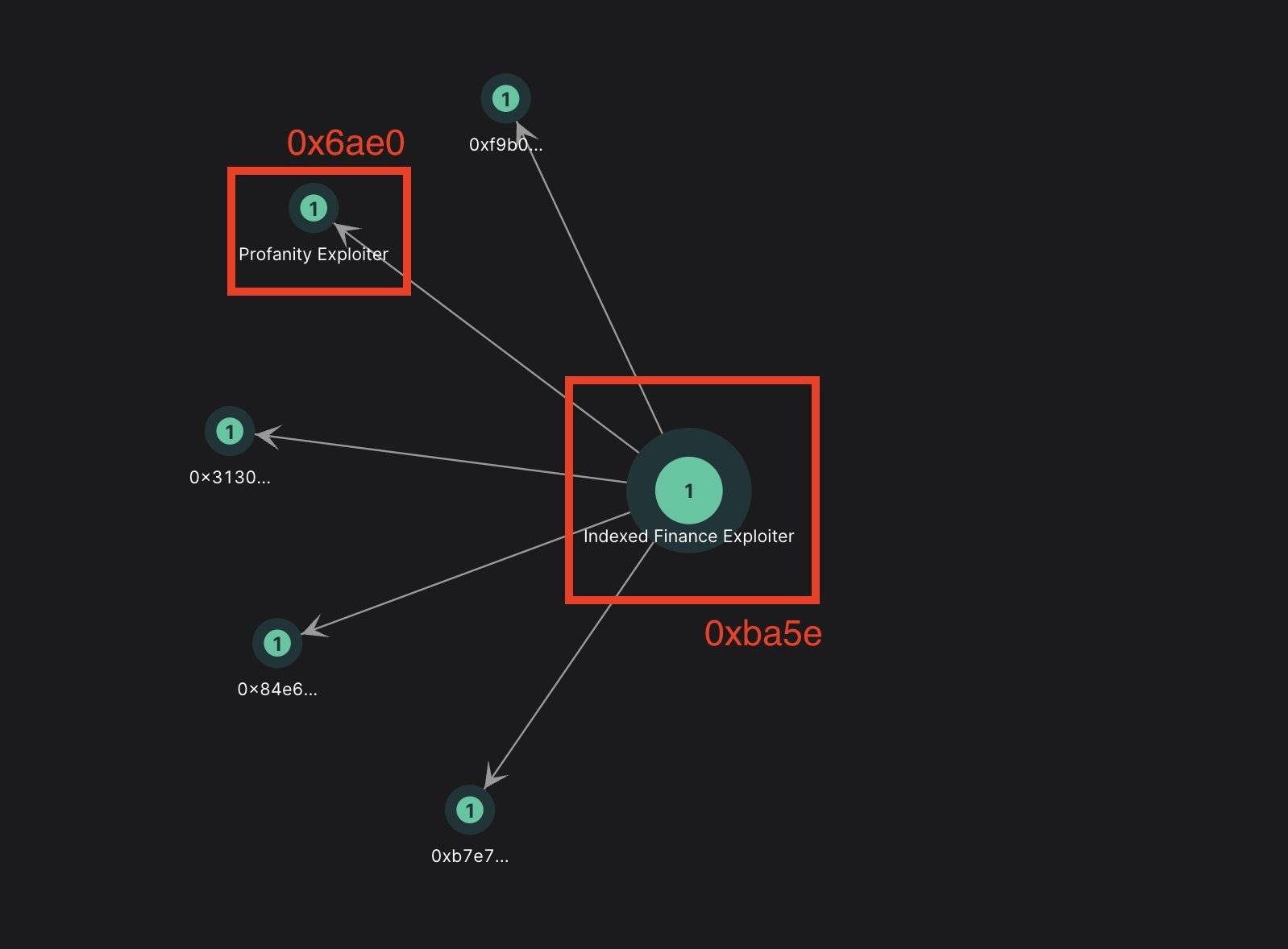

This wallet has a number of transactions related to Vulgarity and Indexed Finance hackers.

The relationship between 0xBA5 and Indexed Finance and Profanity hacker. Source: 0xScopescan

The relationship between 0xBA5 and Indexed Finance and Profanity hacker. Source: 0xScopescan

However, when you check the original source of money received from this wallet, it is not related to any CEX exchange.

Indexed finance trades at 0xBA5. Source: Arkham Intelligence

Indexed finance trades at 0xBA5. Source: Arkham Intelligence

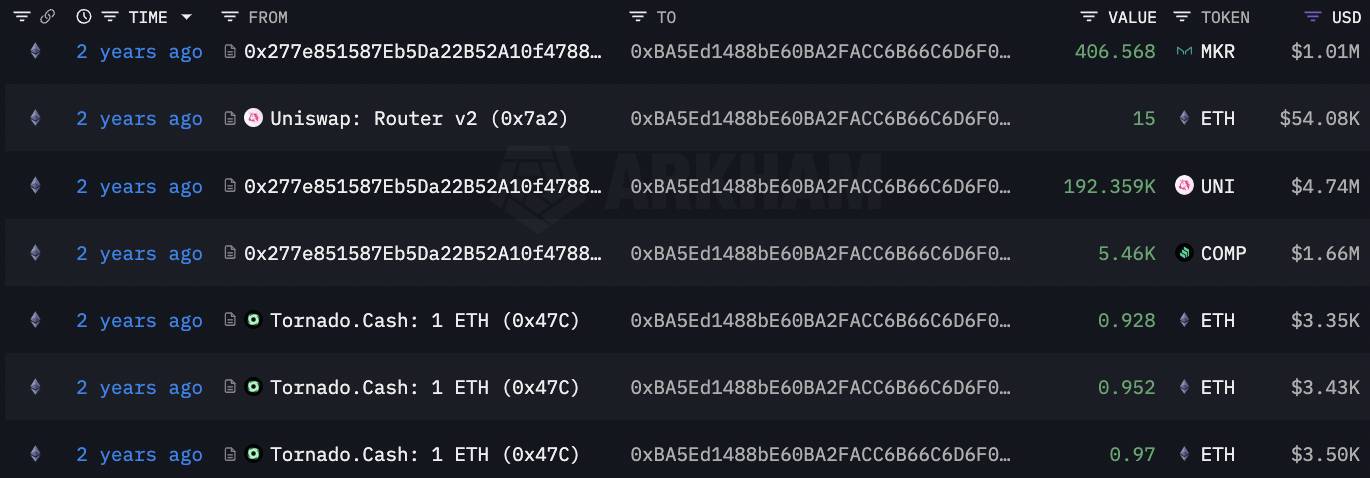

Wallet address 0xBA5 initially received funds from Tornado Cash, and subsequent transactions were made via decentralized platforms.

Trade Tornado Cash for 0xBA5. Source: Arkham Intelligence

Trade Tornado Cash for 0xBA5. Source: Arkham Intelligence

According to data from DefiLlama, KyberSwap’s DeFi products with a TVL of $86 million have dropped to $22 million as of this writing as users have withdrawn funds en masse.

KyberSwap’s TVL decreased after the hack. Source: DefiLlama

KyberSwap’s TVL decreased after the hack. Source: DefiLlama

4. Update FTX

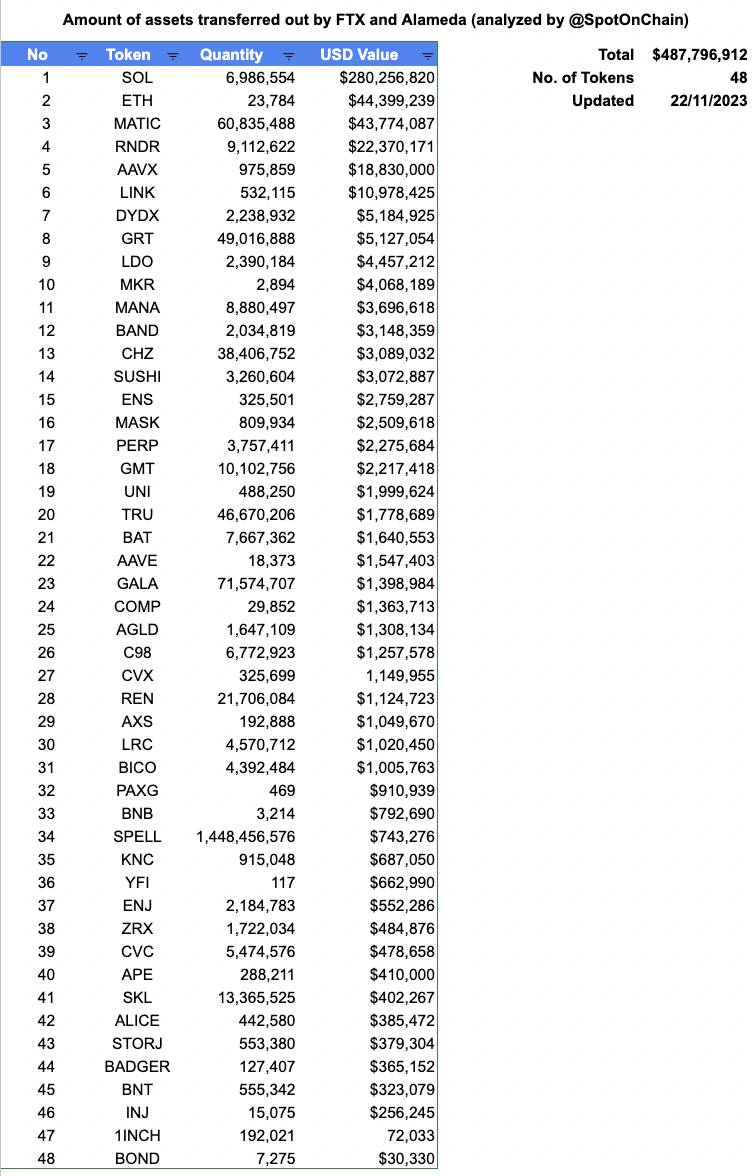

By November 24, FTX and Alameda Research had submitted approx $487 million of 48 token types enter the trading floor.

Statistics on tokens liquidated by FTX. Source: SpotOnChain (November 24, 2023)

Coinlive compiled

Join the discussion on the hottest issues in the DeFi market in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!