Although it has only been a month due to the fact The Merge update, the effect of this update on Ethereum (ETH) supplying is obviously noticeable.

The merger Probably the most crucial update in Ethereum historical past up to this level.

The purpose is mainly because it altered the consensus algorithm of the world’s 2nd biggest cryptocurrency network from Proof-of-Work to Proof-of-Stake. This usually means that Ethereum will no longer require miners, decreasing vitality consumption by up to 99% and decreasing the block reward for miners.

Without stopping there, the yearly inflation charge of the reward for validators below the Proof-of-Stake mechanism will also drop to only .03%, rather of far more than three.six% in contrast to the Proof miner.-of reward. -Work.

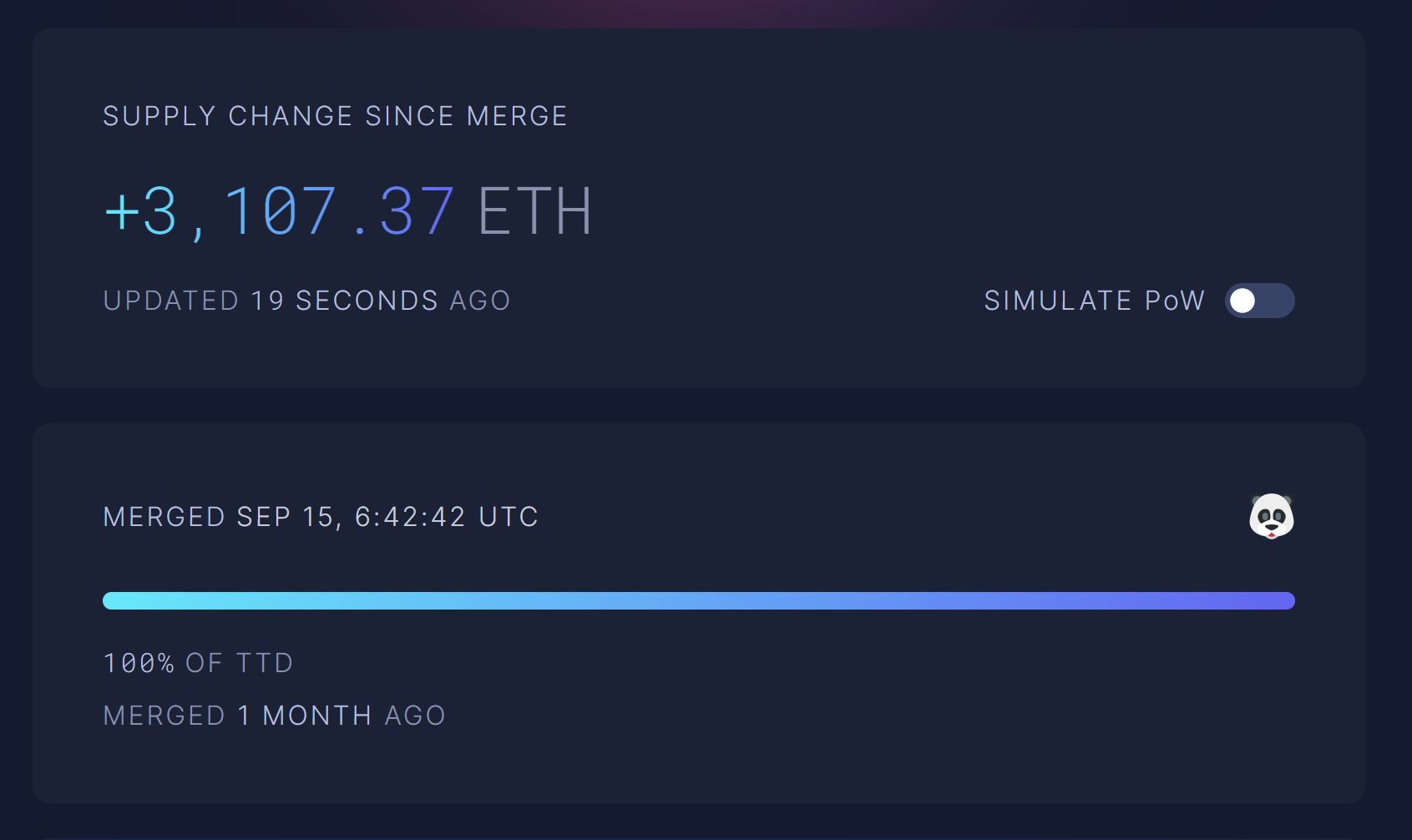

According to information from the statistics webpage Ultrasound. Money, due to the fact The Merge was effective on Sept. 15, the newly developed sum of ETH is three,112 ETH, just about 138 occasions much less than the 428,327 ETH that need to have been pumped into the network as a mining reward for Proof-of-Work miners. This alone is adequate to demonstrate the big effect The Merge has in assisting to decrease ETH’s yearly inflation charge.

Ethereum supporters say that when mixed with the EIP-1559 charge burn up mechanism, the network can even attain a state of deflation, exactly where the sum of ETH burned per day is much less than the sum produced.

Over the previous thirty days, Ethereum has burned more than 50,223 ETH from transaction costs, with the most important contribution even now coming from DEX exchanges this kind of as Uniswap, 1inch NFT applications this kind of as OpenSea, ENS stablecoin transactions and classic ETH transfers.

However, as Ethereum’s business enterprise has just lately declined appreciably, the sum of costs employed is also not higher, leaving the network even now not reaching the sought after deflationary effect. However, more than the previous thirty days, the development in ETH provide has been adverse, indicating that the effect has begun to happen.

The cost of Ethereum just after The Merge fell deeply due to the adverse influence of the cryptocurrency industry.

Synthetic currency 68

Maybe you are interested: