2022 is a yr of sturdy growth and a fierce battle among secure coin tasks when $ UST has an unstoppable boom. Stable Coin tokens are attracting local community interest and the ICHI coin is a single of them. However, ICHI coin has unique working model from other secure coins, let us discover about ICHI undertaking with Coinlive to recognize this ICHI coin!

ICHI undertaking overview

What is the ICHI undertaking?

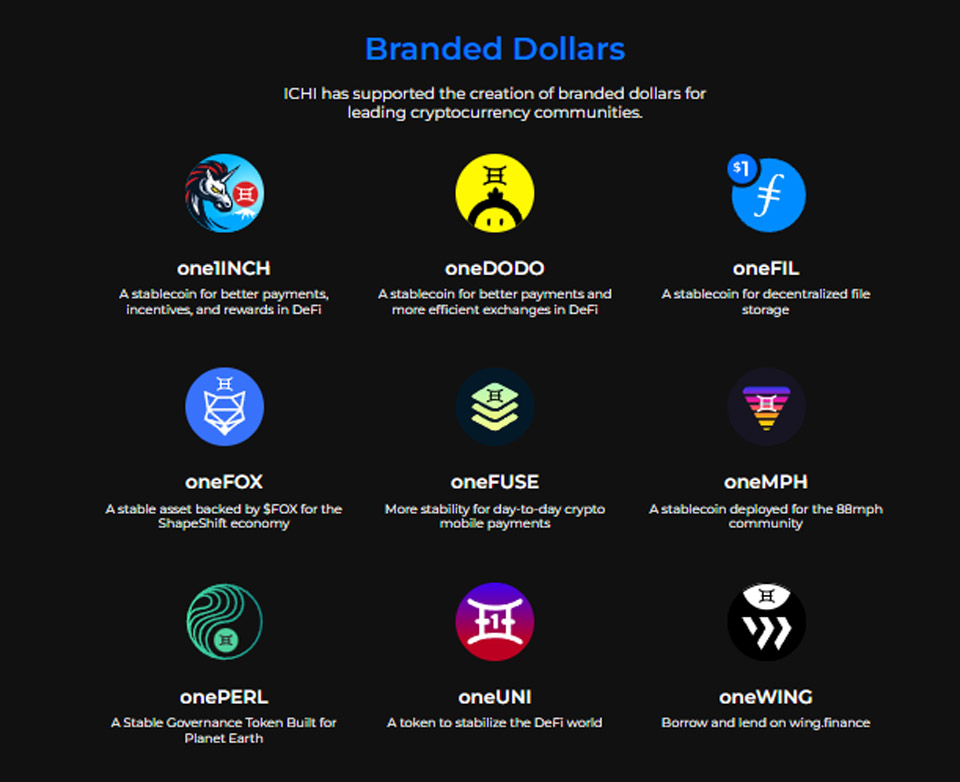

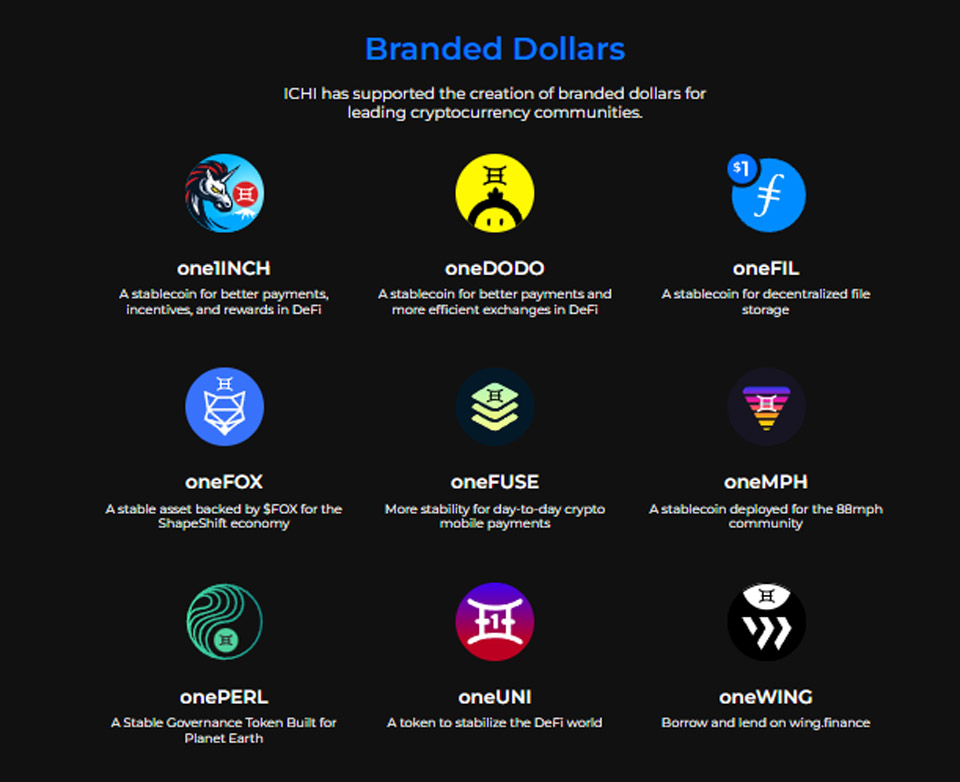

Ichi is a platform that permits third events to concern their personal stablecoin (a singleToken) and, at the very same time, Ichi develops a products to assistance handle that stablecoin, known as the “Decentralized Monetary Authority” (Decentralized Monetary Authority). utilised as a DAO to handle Branded Dollar with a worth of one USD. In the minting course of action Branded Dollar will burn up ICHI tokens, building scarcity and stability in the ecosystem.

The stablecoins minted and redeemed on the Ichi platform are generally assured with a one: one ratio.

Put simply just, Ichi is taking a unique method to stablecoin growth, which is to create stablecoins for ecosystems, alternatively of establishing their personal stablecoins and then developing an ecosystem close to it. This is a rather one of a kind method in today’s marketplace.

Special DMA factors of the ICHI undertaking

Mechanism of the Decentralized Monetary Authority

DMA stands for Decentralized Monetary Authority, which translates to Decentralized Monetary Authority. To place it simply just, DMA is a products that permits a third get together to concern a financial authority into their ecosystem, related to a country’s central financial institution, but this financial institution is decentralized.

Functionality in the DMA mechanism

DMA at present has two key functions:

- Mint and Redeem stablecoin, a stablecoin issued by DMA known as a singleToken. For illustration: one1INCH, oneFIL, oneBTC, and so forth.

- Administration perform: the proprietor of a singleToken has the ideal to administer the method

Operating mechanism of the ICHI undertaking

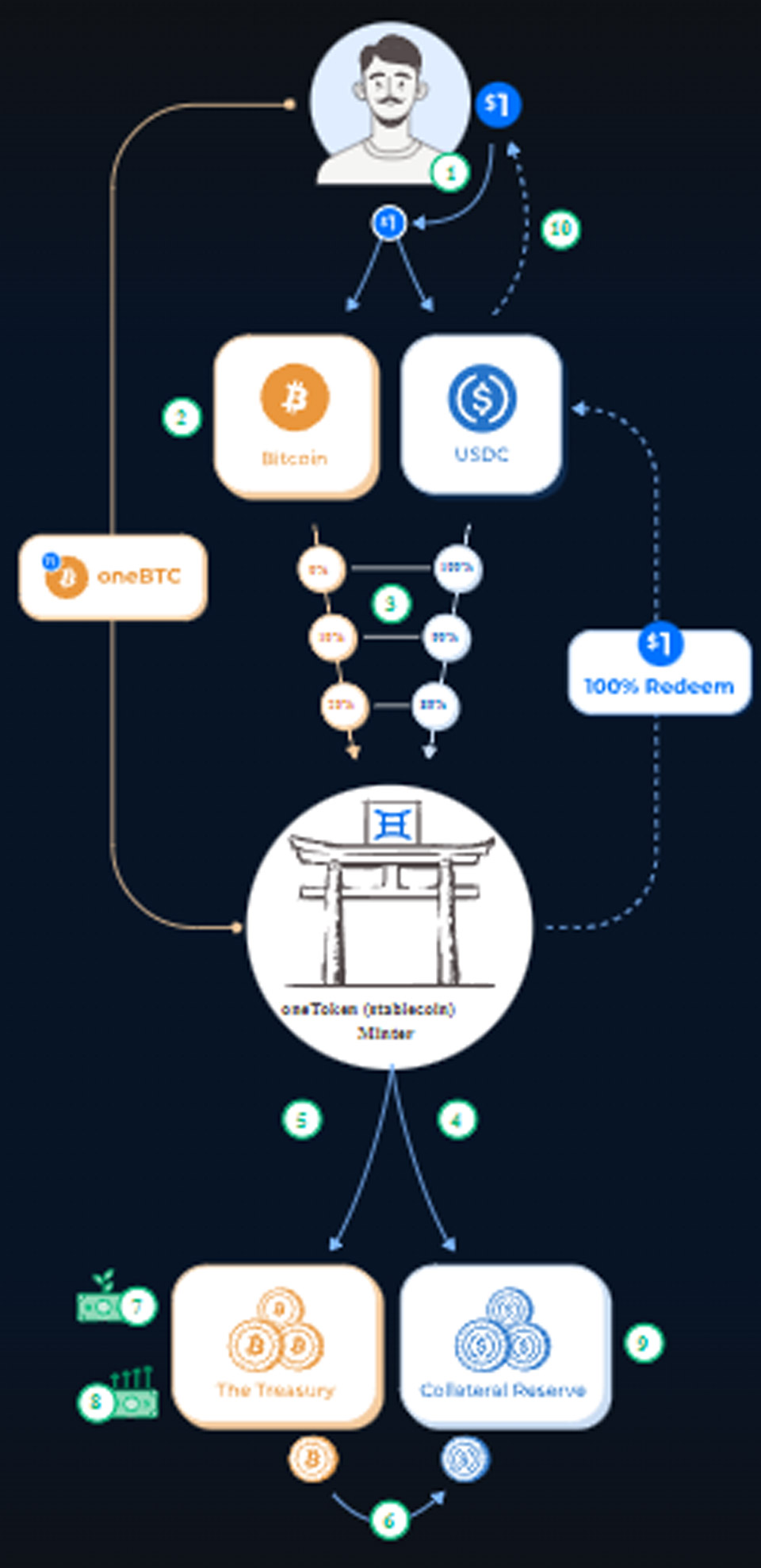

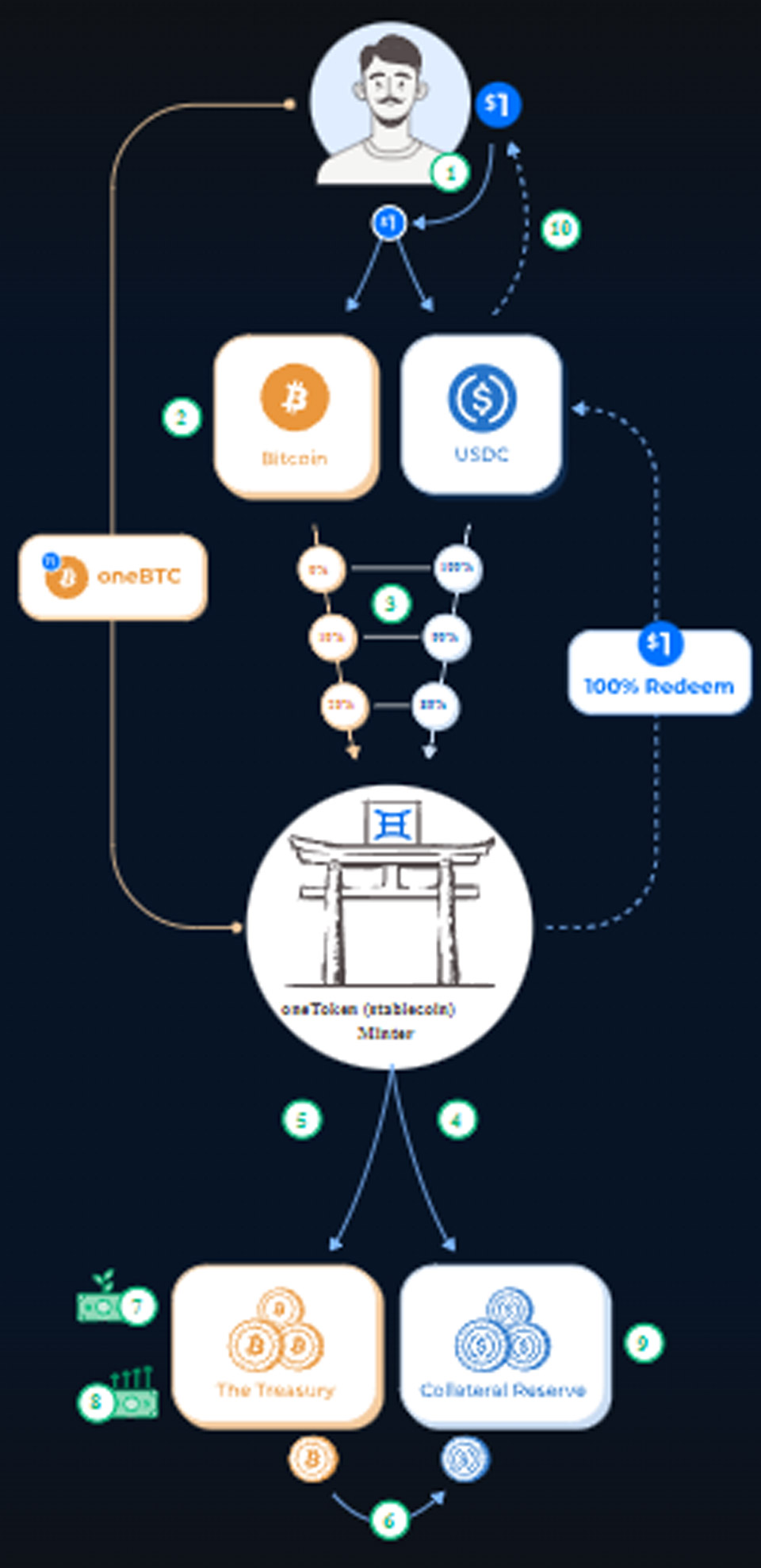

- First, you have to have to deposit two assets such as USDC and Native token of the undertaking with a worth of $ one in the Vault in accordance to the ratio previously established by the undertaking (a hundred: , 95: five, 80:twenty, …). Right now, DMA will be minting a singleToken. For illustration, mint one one1INCH, you have to have to enter $ .eight USDC and $ .two 1INCH.

- The USDA deposited in the Vault is utilised as collateral in the Collateral Reserve. This part will generally be cautiously preserved.

- Native tokens are integrated in the Treasury. Because a singleToken is proprietor-owned and operated. For illustration, one1INCH Treasury is held by the one1INCH holders but not the 1INCH holder. Because this is KNIFE independent so that the undertaking can do lots of items to make much more earnings.

- Profits will be transferred to USDC to make sure excellent liquidity when anyone redeems.

- One of the items the Treasury can do is use native assets like BITC, 1INCH to make a revenue.

- When anyone redeems, the USDA will be withdrawn from the Collateral Reserve. Therefore, the consumer at the time of redemption will certainly get $ one back. The minting and redemption charges will be maintained in this Reserve.

Guarantee reserve

This is a fund that aids make sure that the a singleToken sum is generally redeemed at the cost of $ one. The Guarantee Reserve has a number of crucial capabilities as follows:

- Collateral Reserve money include only stablecoins.

- It can be managed by purses.

- It can adhere to specific ICHI authorized techniques to earn more revenue.

treasure

This is the collateral safety fund for a singleToken. However, there are some use scenarios for consumers to come across earnings for the undertaking. The treasure has a variety of capabilities as follows:

- The fund holds the platform’s ICHI coin.

- It can be utilised for lots of actions this kind of as: marketing USDC stablecoins, earning earnings, incentives for employing stablecoins, awarding prizes, and so forth.

Advantages of DMA

- Stabilization: The a singleToken variety will be minted and redeemed for $ one, no debt protocol generation and no liquidation chance.

- Decentralized: Although it is a cash management platform, ICHI aims for a decentralized local community-governed platform.

- transparent: The information is a hundred% up to date on the chain.

- Guaranteed development for the token: To mint one a singleToken, consumers have to have to have a undertaking native token sum of roughly five% -twenty%.

Other capabilities of the ICHI undertaking

To obtain

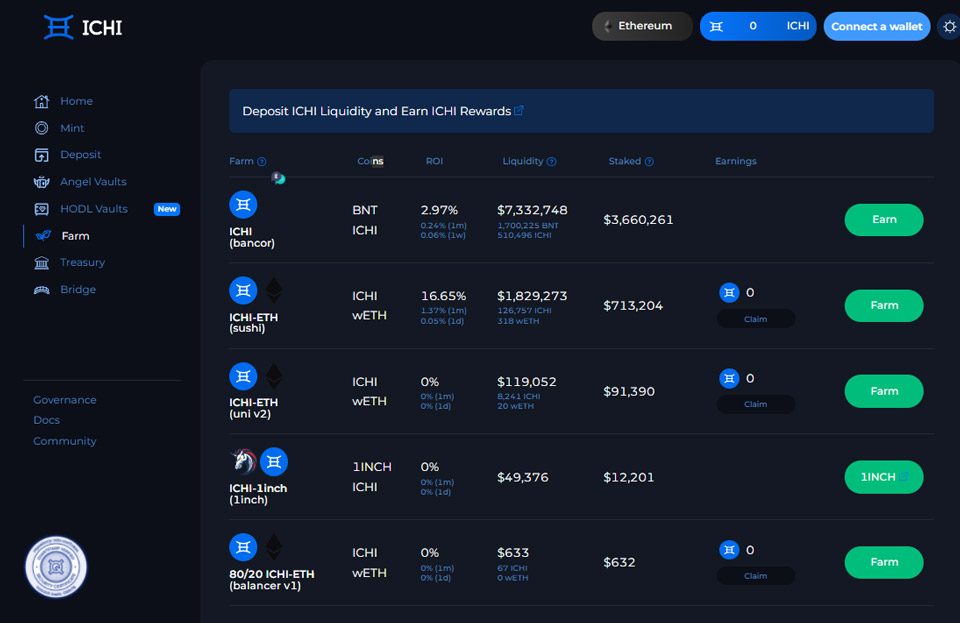

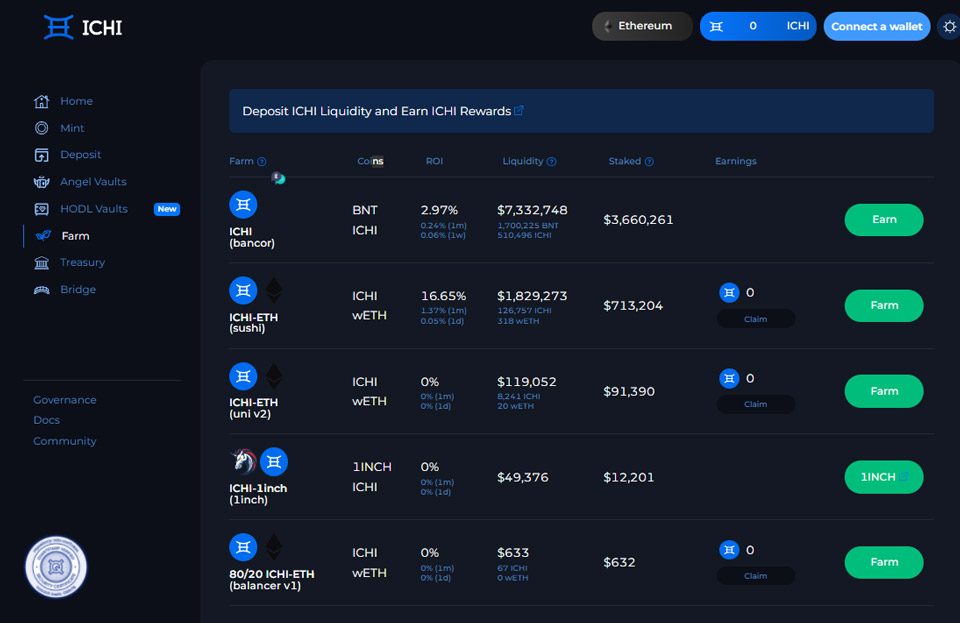

This is the Incentive products that aids ICHI create DMA solutions, such as:

- Deposit: Bet a singleToken to get the ICHI coin.

- Farm: This is ICHI’s unique Liquidity Mining small business.

Profit distribution model of the ICHI undertaking

The revenue of ICHI now goes to the a singleToken Treasury. Specifically, ICHI will gather:

- two% of the worth of the Treasury: Governance management charges.

- twenty% of the Treasury’s earnings: Performance charges.

According to the undertaking, Management Fees and Performance Fees it is calculated primarily based on an indefinite time, dependent on the undertaking and the partners, so in purchase not to get rid of any Rewards, the undertaking encourages consumers to Staking xICHI in the extended run.

Information about the ICHI token of the ICHI undertaking

ICHI token crucial metrics

- Token identify: ICHI.

- Ticker: ICHI.

- Blockchain: Ethereum.

- Token sort: utility token.

- Token common: ERC20.

- To contract: 0x903bef1736cddf2a537176cf3c64579c3867a881

- Circulating provide: four,630,180.

- Total provide: five,000,000.

- Maximum provide: five,000,000 VND

- Market capitalization: $ 578,835,594

ICHI Token Allocation

Updating…

ICHI token use situation

- Used to mint secure currency

- Used for administration

- Agriculture and revenue

Where to purchase, promote and personal ICHI tokens

Storage place

ICHI is an ERC20 token. Therefore, you can securely shop it on supported e-wallets this kind of as: Metamask, Trust Wallet, Coin98 Wallet, …

Place to purchase and promote

Currently, the ICHI coin is listed and supported for trading on a variety of exchanges this kind of as:

The ICHI undertaking growth roadmap

Updating…

The key growth crew of the ICHI undertaking

Updating…

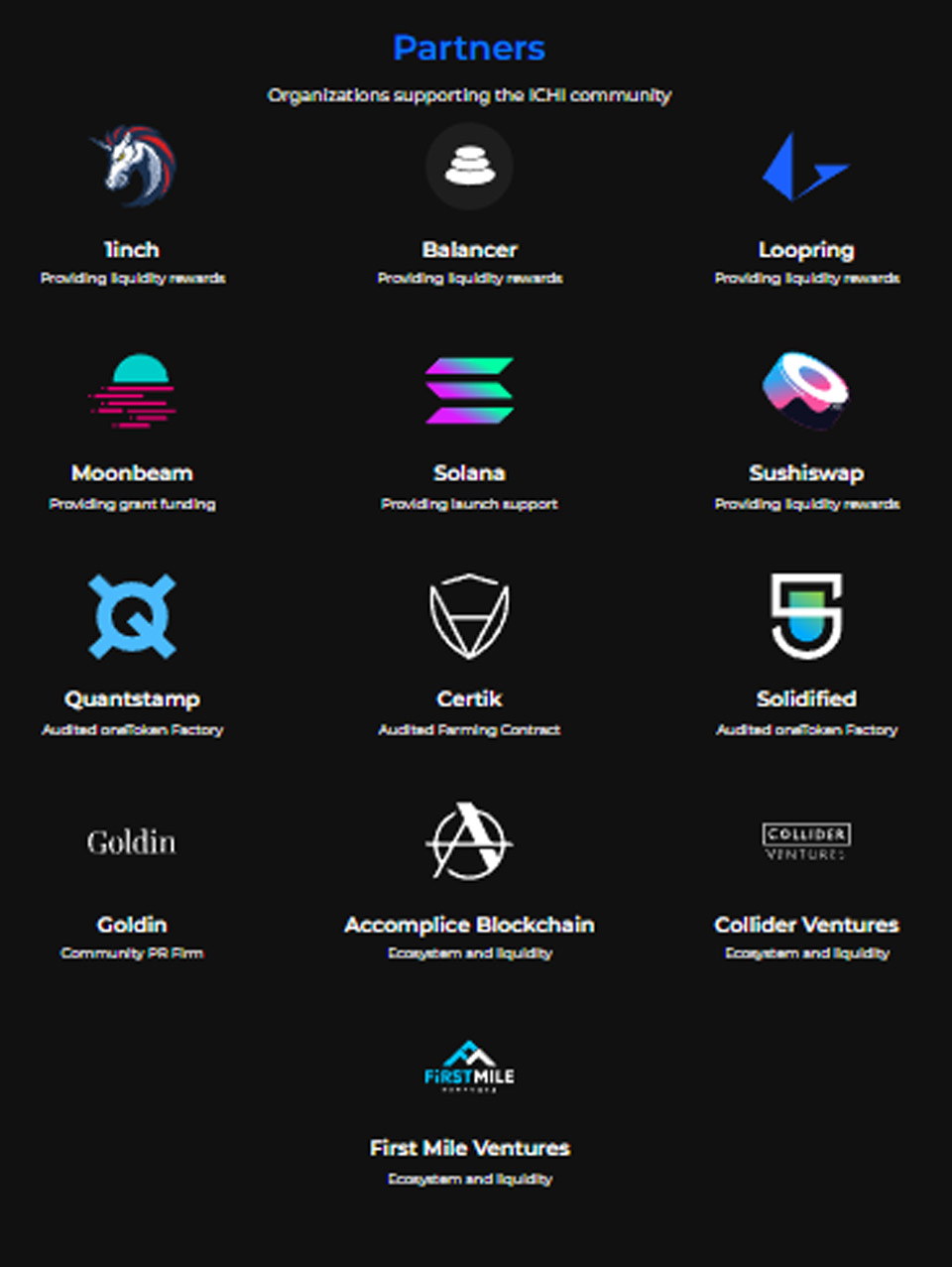

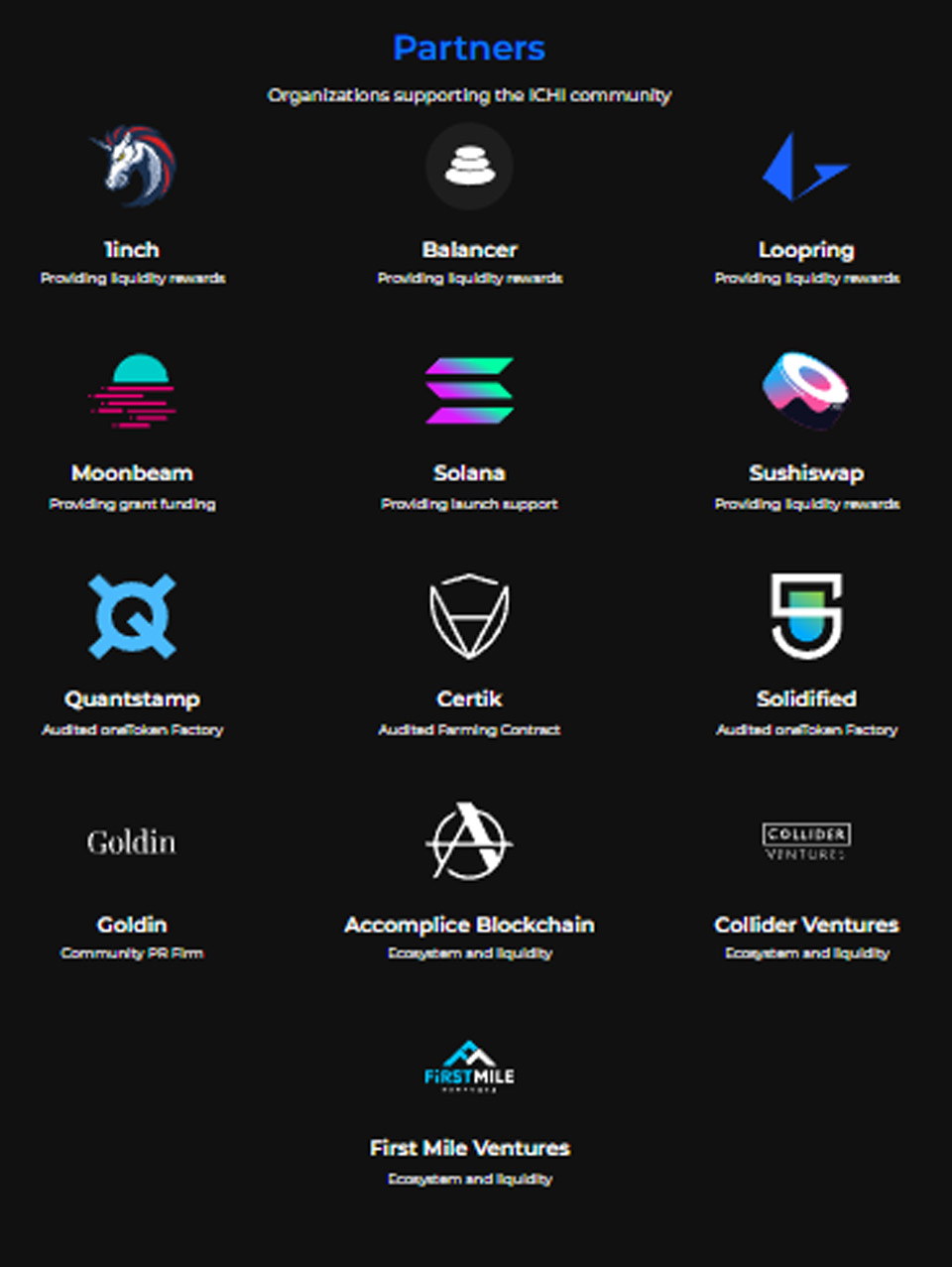

Investors / Supporters of the ICHI undertaking

Projected on the ICHI undertaking, ought to I invest ICHI tokens or not?

At initially glance, the working model of the ICHI undertaking is related to the FRAX undertaking, but alternatively of investing in other tasks, the ICHI undertaking is a area to assistance tasks Another undertaking builds Stable Coin and the worth of that Stable Coin undertaking will be go back to xICHI to enhance the underlying worth.

This report is not investment information, you ought to cautiously think about prior to generating selections when employing your cash. Coinlive is not accountable for any of your investment selections. I want you accomplishment and earn a whole lot from this possible marketplace.

2022 is a yr of sturdy growth and a fierce battle among secure coin tasks when $ UST has an unstoppable boom. Stable Coin tokens are attracting local community interest and the ICHI coin is a single of them. However, ICHI coin has unique working model from other secure coins, let us discover about ICHI undertaking with Coinlive to recognize this ICHI coin!

ICHI undertaking overview

What is the ICHI undertaking?

Ichi is a platform that permits third events to concern their personal stablecoin (a singleToken) and, at the very same time, Ichi develops a products to assistance handle that stablecoin, known as the “Decentralized Monetary Authority” (Decentralized Monetary Authority). utilised as a DAO to handle Branded Dollar with a worth of one USD. In the minting course of action Branded Dollar will burn up ICHI tokens, building scarcity and stability in the ecosystem.

The stablecoins minted and redeemed on the Ichi platform are generally assured with a one: one ratio.

Put simply just, Ichi is taking a unique method to stablecoin growth, which is to create stablecoins for ecosystems, alternatively of establishing their personal stablecoins and then developing an ecosystem close to it. This is a rather one of a kind method in today’s marketplace.

Special DMA factors of the ICHI undertaking

Mechanism of the Decentralized Monetary Authority

DMA stands for Decentralized Monetary Authority, which translates to Decentralized Monetary Authority. To place it simply just, DMA is a products that permits a third get together to concern a financial authority into their ecosystem, related to a country’s central financial institution, but this financial institution is decentralized.

Functionality in the DMA mechanism

DMA at present has two key functions:

- Mint and Redeem stablecoin, a stablecoin issued by DMA known as a singleToken. For illustration: one1INCH, oneFIL, oneBTC, and so forth.

- Administration perform: the proprietor of a singleToken has the ideal to administer the method

Operating mechanism of the ICHI undertaking

- First, you have to have to deposit two assets such as USDC and Native token of the undertaking with a worth of $ one in the Vault in accordance to the ratio previously established by the undertaking (a hundred: , 95: five, 80:twenty, …). Right now, DMA will be minting a singleToken. For illustration, mint one one1INCH, you have to have to enter $ .eight USDC and $ .two 1INCH.

- The USDA deposited in the Vault is utilised as collateral in the Collateral Reserve. This part will generally be cautiously preserved.

- Native tokens are integrated in the Treasury. Because a singleToken is proprietor-owned and operated. For illustration, one1INCH Treasury is held by the one1INCH holders but not the 1INCH holder. Because this is KNIFE independent so that the undertaking can do lots of items to make much more earnings.

- Profits will be transferred to USDC to make sure excellent liquidity when anyone redeems.

- One of the items the Treasury can do is use native assets like BITC, 1INCH to make a revenue.

- When anyone redeems, the USDA will be withdrawn from the Collateral Reserve. Therefore, the consumer at the time of redemption will certainly get $ one back. The minting and redemption charges will be maintained in this Reserve.

Guarantee reserve

This is a fund that aids make sure that the a singleToken sum is generally redeemed at the cost of $ one. The Guarantee Reserve has a number of crucial capabilities as follows:

- Collateral Reserve money include only stablecoins.

- It can be managed by purses.

- It can adhere to specific ICHI authorized techniques to earn more revenue.

treasure

This is the collateral safety fund for a singleToken. However, there are some use scenarios for consumers to come across earnings for the undertaking. The treasure has a variety of capabilities as follows:

- The fund holds the platform’s ICHI coin.

- It can be utilised for lots of actions this kind of as: marketing USDC stablecoins, earning earnings, incentives for employing stablecoins, awarding prizes, and so forth.

Advantages of DMA

- Stabilization: The a singleToken variety will be minted and redeemed for $ one, no debt protocol generation and no liquidation chance.

- Decentralized: Although it is a cash management platform, ICHI aims for a decentralized local community-governed platform.

- transparent: The information is a hundred% up to date on the chain.

- Guaranteed development for the token: To mint one a singleToken, consumers have to have to have a undertaking native token sum of roughly five% -twenty%.

Other capabilities of the ICHI undertaking

To obtain

This is the Incentive products that aids ICHI create DMA solutions, such as:

- Deposit: Bet a singleToken to get the ICHI coin.

- Farm: This is ICHI’s unique Liquidity Mining small business.

Profit distribution model of the ICHI undertaking

The revenue of ICHI now goes to the a singleToken Treasury. Specifically, ICHI will gather:

- two% of the worth of the Treasury: Governance management charges.

- twenty% of the Treasury’s earnings: Performance charges.

According to the undertaking, Management Fees and Performance Fees it is calculated primarily based on an indefinite time, dependent on the undertaking and the partners, so in purchase not to get rid of any Rewards, the undertaking encourages consumers to Staking xICHI in the extended run.

Information about the ICHI token of the ICHI undertaking

ICHI token crucial metrics

- Token identify: ICHI.

- Ticker: ICHI.

- Blockchain: Ethereum.

- Token sort: utility token.

- Token common: ERC20.

- To contract: 0x903bef1736cddf2a537176cf3c64579c3867a881

- Circulating provide: four,630,180.

- Total provide: five,000,000.

- Maximum provide: five,000,000 VND

- Market capitalization: $ 578,835,594

ICHI Token Allocation

Updating…

ICHI token use situation

- Used to mint secure currency

- Used for administration

- Agriculture and revenue

Where to purchase, promote and personal ICHI tokens

Storage place

ICHI is an ERC20 token. Therefore, you can securely shop it on supported e-wallets this kind of as: Metamask, Trust Wallet, Coin98 Wallet, …

Place to purchase and promote

Currently, the ICHI coin is listed and supported for trading on a variety of exchanges this kind of as:

The ICHI undertaking growth roadmap

Updating…

The key growth crew of the ICHI undertaking

Updating…

Investors / Supporters of the ICHI undertaking

Projected on the ICHI undertaking, ought to I invest ICHI tokens or not?

At initially glance, the working model of the ICHI undertaking is related to the FRAX undertaking, but alternatively of investing in other tasks, the ICHI undertaking is a area to assistance tasks Another undertaking builds Stable Coin and the worth of that Stable Coin undertaking will be go back to xICHI to enhance the underlying worth.

This report is not investment information, you ought to cautiously think about prior to generating selections when employing your cash. Coinlive is not accountable for any of your investment selections. I want you accomplishment and earn a whole lot from this possible marketplace.