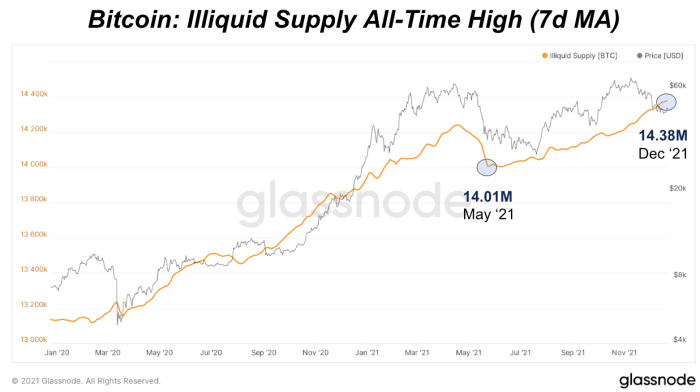

Since the collapse that preceded the Chinese crackdown on May 19, 2021, which plunged the value of Bitcoin to $ thirty,000, the illiquid provide of BTC has grown by just about 371,000 BTC.

Liquidity provide continues to hit multi-12 months highs, including just about 371,000 BTC considering the fact that the May deceleration. Even with latest declines due to protracted liquidation and market place marketing issues, illiquid provide continues to rise, signaling that numerous holders a extended-phrase organizations have been replenishing their positions in latest months.

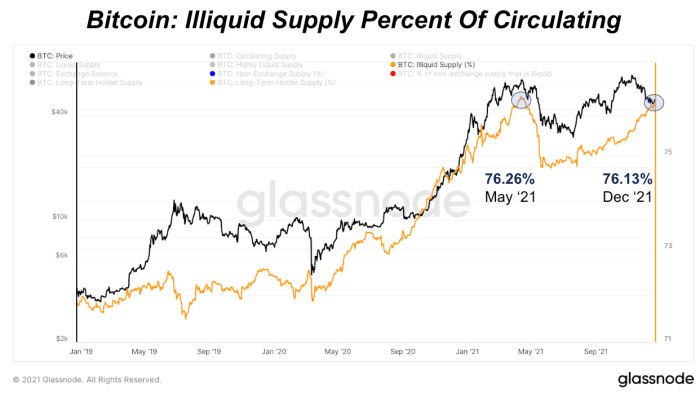

As a percentage of the latest supply, the illiquid supply was 76.13% and under the all-time substantial of 76.26% also recorded in May. 12 months.

The trend in illiquid provide demonstrates that the dump to $ 42,000 in early December was largely driven by the derivatives market place and some things from other significant macro information, not the spot market place. . While most of the on-chain information is in favor of BTC.

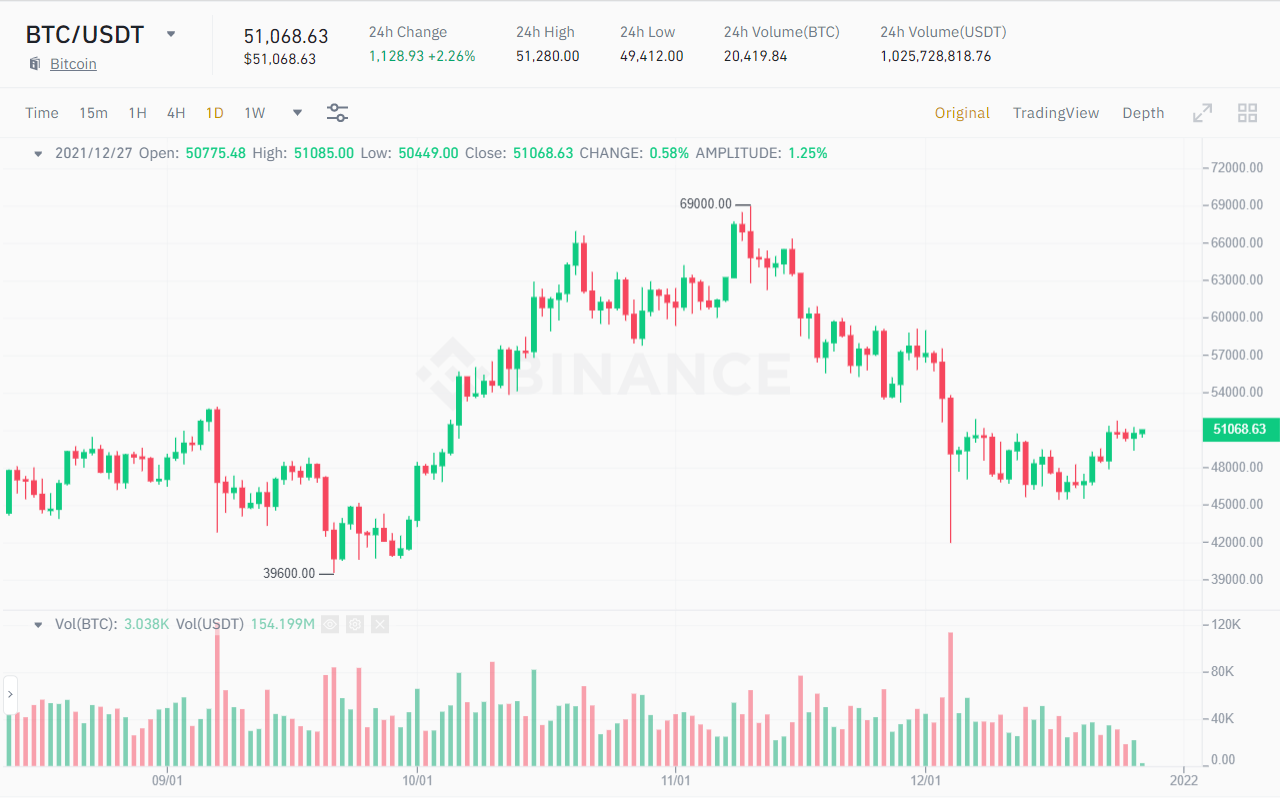

The volume of Bitcoin in reserve on the “reduced” exchange withdrawn from the exchange has improved appreciably, even as 90% of the provide of BTC has been mined. In terms of Bitcoin mining, the market has also completely recovered from the Chinese ban.

Bitcoin miners’ reserves are now at their six-month highs, the trend of net accumulation continues. BTC miners are even now pretty optimistic about Bitcoin. Miners personal extra BTC than when BTC was at ATH of $ 69,000, in reality, miners have yet again additional all the BTC distributed to the market place considering the fact that BTC plummeted from its peak.

#BTC miners are even now pretty optimistic about #Bitcoin, the miners’ stock stability, a “smart money” indicator is shut to the six-month substantial.#Miners they personal extra BTC than they did when BTC was at $ 69k, in reality, they yet again additional all of the net distributed BTC from the $ 69k drop. pic.twitter.com/LQjS03uWgT

– venturefounder (@venturefounder) December 24, 2021

Historically, miners have frequently been viewed as lobbying the market place to promote due to the require to cover working fees. However, the information has now exposed that the habits of these classic sellers has now shifted to getting habits.

Due to the dynamics of provide and demand, a miner’s transition from distributor to accumulator could enhance the scarcity of Bitcoin and favor the value of BTC. As of press time, BTC has recovered somewhat in the previous 24 hrs, trading close to $ 50,989.

Synthetic Currency 68

Maybe you are interested: