[ad_1]

As Cointelegraph reported, Chinese authorities are “actively” cracking down on crypto-related actions. Starting on May 21, when the Vice Premier of China requested to “rectify” Bitcoin mining and trading actions, a sequence of provinces within the nation of billions of individuals have tightened Bitcoin mining actions.

Specifically, ranging from Inner Mongolia after which the provinces of Qinghai, Yunnan and Sichuan are all “strong hands” with mining corporations. Under stress from the federal government, not solely the Bitcoin mining problem decreased by 16% as a result of lower in hashrate resulting in many difficulties for Chinese Bitcoin miners, however Chinese Bitcoin mining corporations moved their whole operations overseas. Even Chinese Bitcoin miners “are not even in the mood to drink anymore”.

The impression of the Chinese regime’s repression this time is immense. One of the obvious penalties is the lower in Bitcoin hashrate, in addition to the redistribution of the worldwide BTC mining market share.

To see how the BTC hashrate has been affected, please examine the info with Coinlive earlier than and after when there may be information of suppression from China!

Hash fee drops

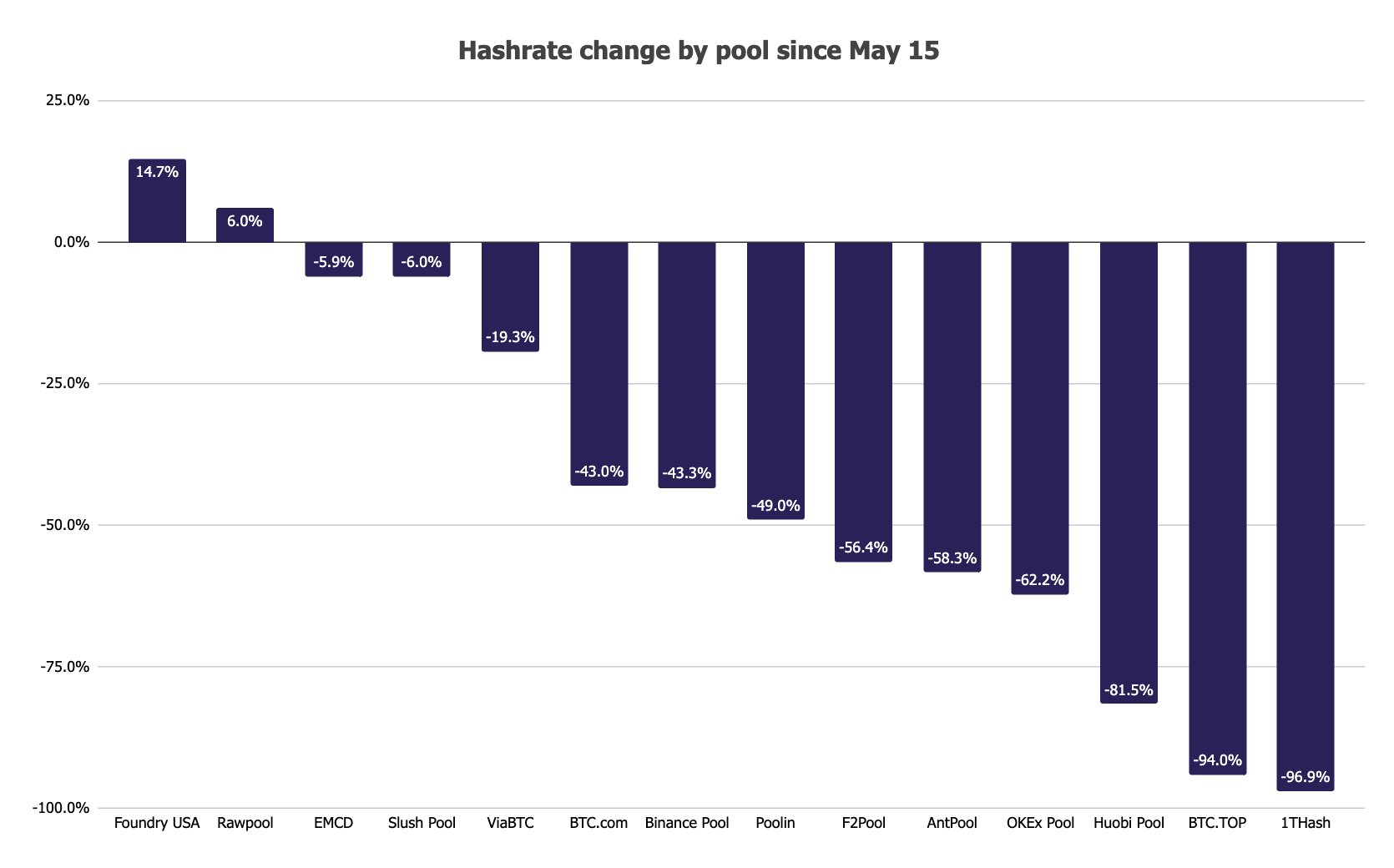

Below is a comparability desk of Bitcoin hashrate of main mining swimming pools on the earth on May 15 (earlier than the Chinese crackdown) and June 23 (after a sequence of provinces swept miners).

As might be seen, the worldwide hashrate has decreased virtually 50% (-48.8%) after this stunning incident. Seen from the desk above, mining swimming pools from China all have a lower >-30%.

Meanwhile, mining swimming pools from the West similar to Foundry USA have a optimistic progress – proving that the worldwide hashrate is step by step “going west”.

Is the affect of Chinese miners reducing?

However, has the affect of Chinese miners actually decreased?

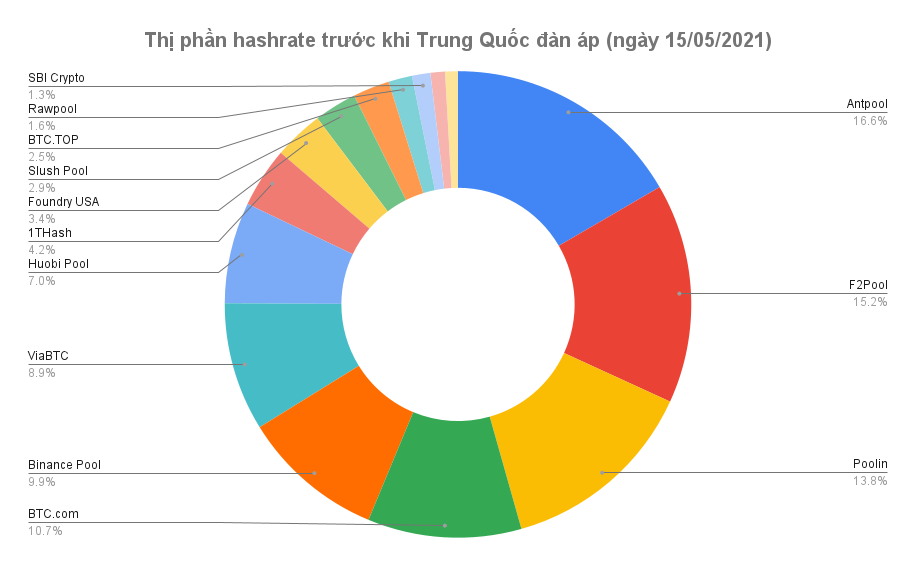

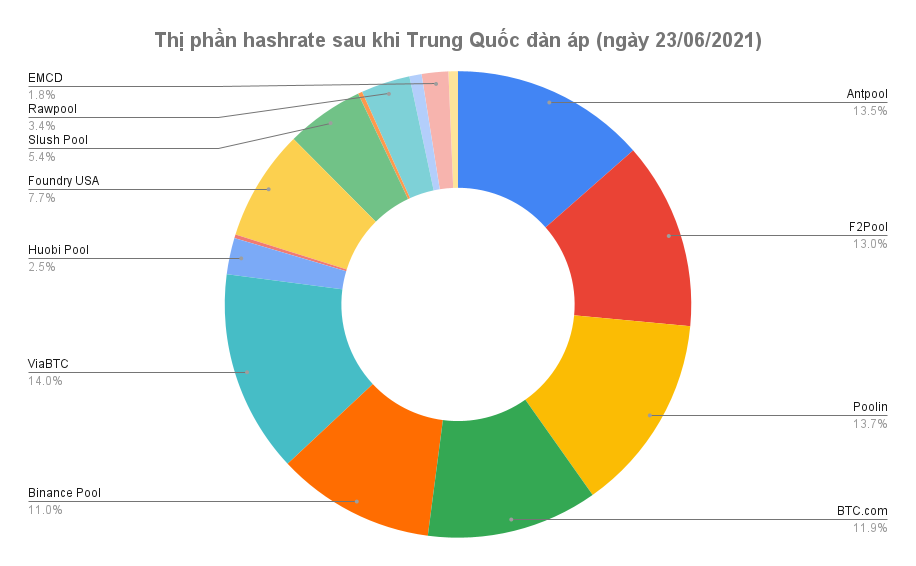

While the worldwide Bitcoin hashrate fell, the hashrate from China additionally fell. But is the affect of Chinese miners over? Let’s check out the earlier than – after market share chart under.

As the 2 charts above have proven, Chinese mining swimming pools regardless of the decline in hashrate, the market share – affect within the mining market nonetheless stays. not a lot decline.

Chinese miners nonetheless account for the majority of the worldwide hashrate, which means that the BTC mining market remains to be underneath the management of the Chinese neighborhood. The state of affairs has not modified a lot in comparison with earlier than the Chinese authorities suppressed.

Ending

Thus, it may be briefly concluded that the Chinese authorities’s management of mining actions has brought on a pointy drop in hashrate from China and globally. This forces miners, mining swimming pools, and mining corporations in China to search out methods to maneuver their operations overseas.

Taking benefit of this example, many different nations have had preferential insurance policies to draw Chinese miners, such because the Mayor of Miami proposing to supply clear nuclear vitality for Chinese Bitcoin miners.

Until the Chinese mining pool was “stable” in its new place, the hashrate continued to develop. Meanwhile, the affect of the Chinese mining pool (or later “of Chinese origin”) remained unchanged.

The Chinese authorities might not be capable to “get a hold” of Bitcoin anymore, however Chinese (from) miners nonetheless management the Bitcoin network because it at all times does.

Jane

Maybe you have an interest:

[ad_2]