Cryptocurrency markets are on the move soon after the US announced far better-than-anticipated October inflation.

At eight:thirty pm on November ten, the U.S. announced its October Consumer Price Index (CPI). On the very same day final yr, CPI hit its highest degree considering that 1990, past all expectations, main straight to Bitcoin and Ethereum co-founder ATH.

According to the most current information launched, the US CPI for October was seven.seven% – brief from Forecast of seven.9% of the analysts. Earlier, throughout the month’s curiosity fee adjustment, the Fed maintained the .75% hike as it has repeatedly confirmed in front of the media. Therefore, the Fed’s continued curiosity fee hikes eventually contained some inflation in the US, which remained at a multi-decade higher for all months of 2022.

The market place really should have been fairly “familiar” with macro information occasions like this, so a lot of men and women anticipate cost movements to not be as well solid. However, just a couple of days in the past, the complete sector witnessed an exceptionally surprising occasion that entirely altered the discipline: Drama Binance – FTX.

Therefore, the recovery degree of the coins is fairly weak, when BTC can only somewhat rise to USD 17,800 to be withdrawn, whilst ETH does far better when it returns to USD one,329.

The currency that has suffered hefty losses in the previous, FTT, did not alter positively even even though it “found the low” at $ two.eight. While SOL jumped temporarily to USD 17.50 when rumors an amount of SOL ready to be canceled the afternoon of eleven/ten passed devoid of leaving an effect.

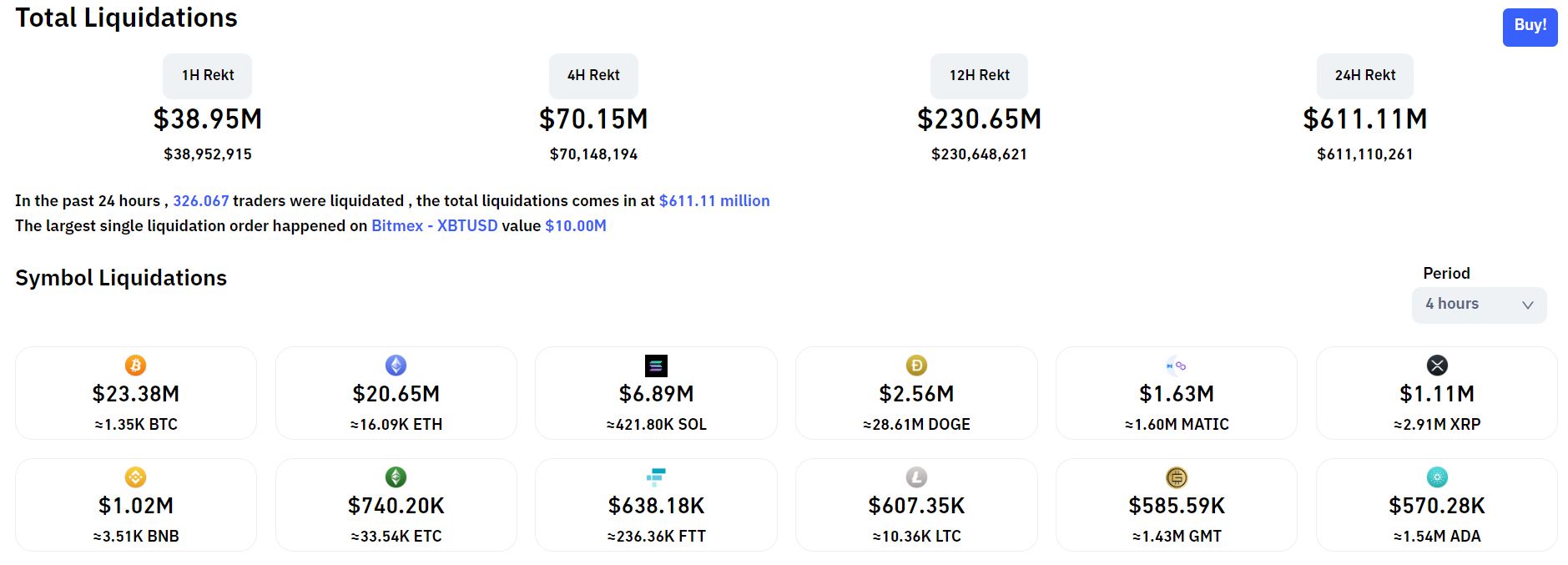

Total derivatives orders cleared in the final four hrs are $ 70 million, with practically 69% brief.

Synthetic currency 68

Maybe you are interested: