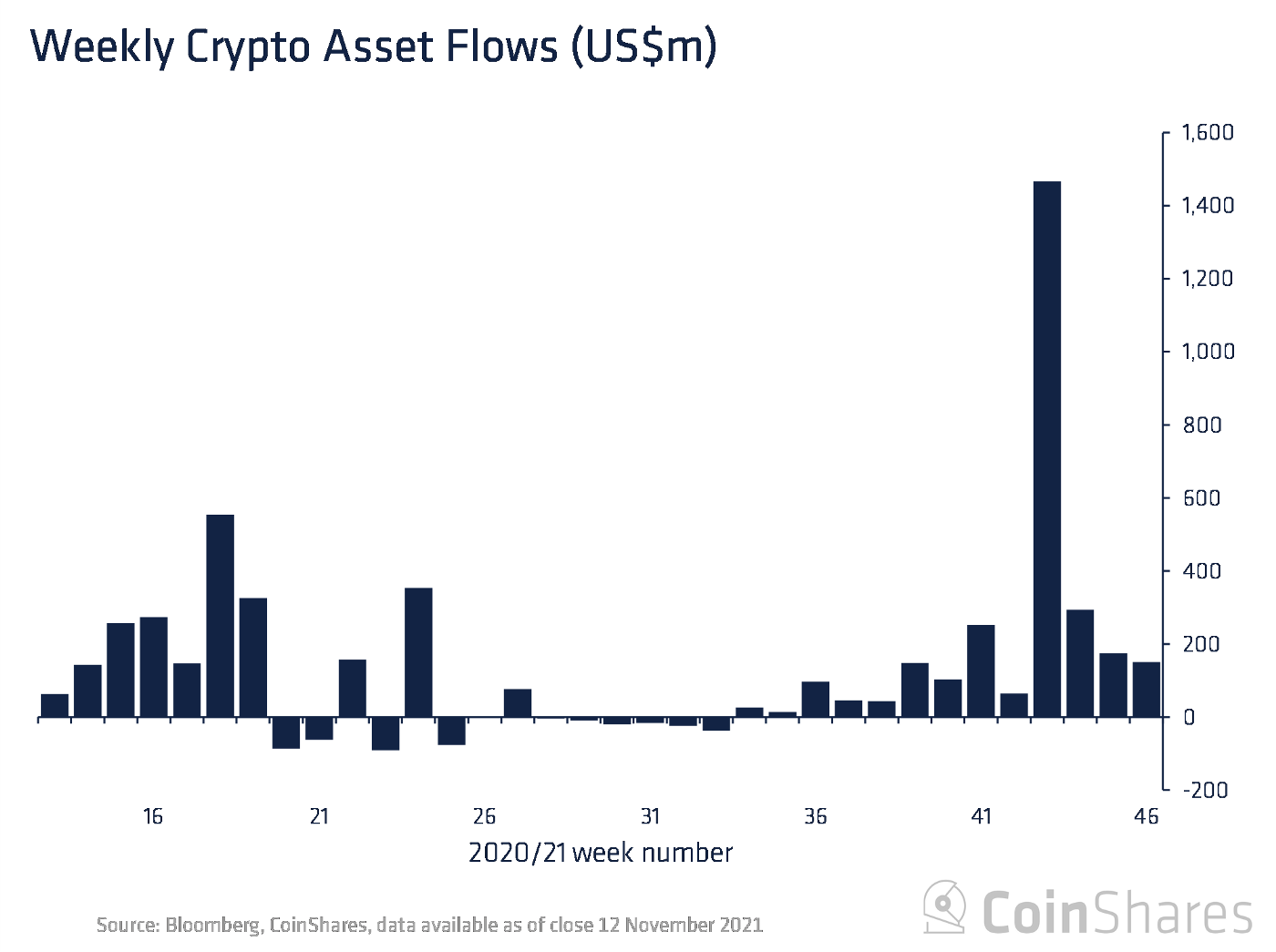

Cryptocurrency investment solutions noticed inflows of up to $ 151 million final week, this is the thirteenth consecutive week of development for the index, demonstrating that significant institutions are not still “moving away” with Bitcoin.

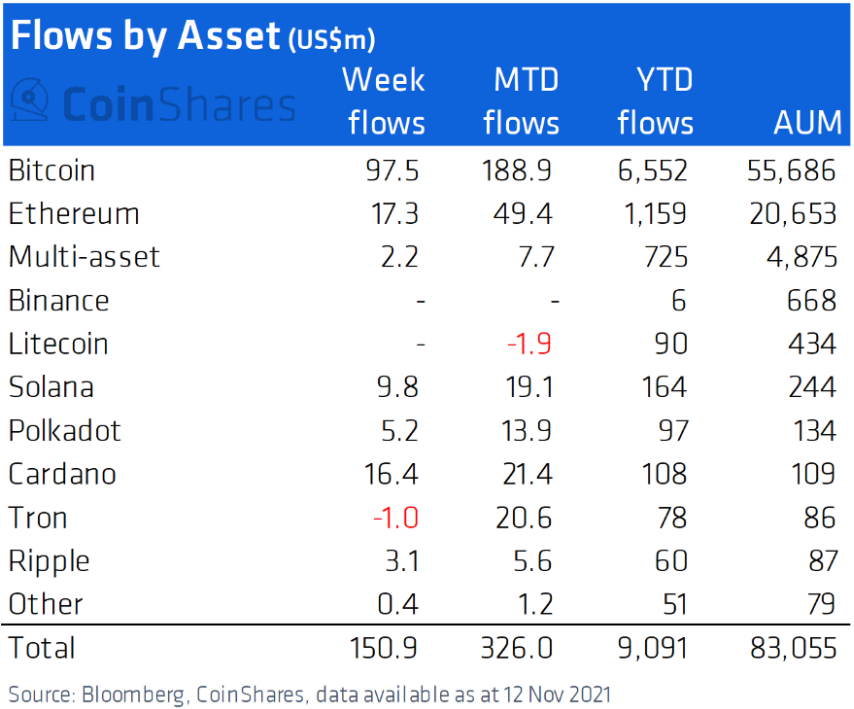

According to a report launched by CoinShares, Bitcoin (BTC) is accountable for the bulk of institutional inflows, bringing in $ 98 million a week, assisting to drive assets below management (AUM) to $ 56 billion.

After Bitcoin, Ethereum (ETH), the 2nd greatest cryptocurrency by industry capitalization, earned $ 17 million, pushing ETH’s complete assets past $ 21 billion for the 1st time. Cardano (ADA) arrives at no. three with $ sixteen.four million primarily due to developing good investor sentiment in direction of the platform. Solana (SOL) is the following representative, with a complete investment of $ 9.eight million.

Overall, the opening of the significant gamers has brought the complete worth of investments in crypto solutions to 9 billion bucks, bringing the AUM to a record increased than 83 billion bucks. When counted in October alone, institutional traders paid up to $ two billion to get Bitcoin, a substantial driving force for BTC’s selling price to create a new ATH. SOL and ADA the two impressed as complete investment flows for the yr reached $ 164 million and $ 108, respectively.

– See additional: Cardano founder “reveals” what will come about in the ADA improvement roadmap via 2025

Although Bitcoin returned to the $ 60,000 assistance degree earlier in the week, there was also a time when BTC “plummeted” into the $ 58,000 area quickly right after China warned state-owned enterprises to prevent. Bitcoin mining, revenue flowed. some assistance from significant investment money for BTC’s upside prospective in the potential.

The Bitcoin ETF occasion is even now a booming trend in the United States as a amount of investment money submitted proposals to the SEC with the ambition of opening a fund. In reality, the SEC rejected a spot Bitcoin ETF but accepted a third Bitcoin futures ETF in the US, which was listed on November sixteen, potentially the street to a Bitcoin-based mostly ETF item. Direct physics is not a dead finish still. “.

Combined with the weekly closing selling price of the highest candle in historical past and the scarcity of amount when only twelve.9% of the provide of Bitcoin (BTC) stays on the exchanges, it can be mentioned at the minute. BTC is essential right after a time period of a “hot” recovery for the industry to develop into additional balanced, setting the stage for a surge by the finish of the yr.

Synthetic Currency 68

Maybe you are interested: