According to on-chain information recorded by Glassnode, institutional traders are returning to Bitcoin in spite of quite a few ongoing regulatory tensions. This is also deemed to be the driving force behind the current rise in the price tag of Bitcoin (BTC).

In current occasions, lawmakers and regulators have elevated their management more than the cryptocurrency marketplace. The most current is the debate on imposing a cryptocurrency tax on the Infrastructure Bill. Although a prevalent compromise was observed, it was not accepted at the final minute.

See a lot more: The cryptocurrency tax law in the United States collapses at the final minute

Furthermore, in accordance to information from Glassnode, these moves can only fool retail traders. Large institutions are even now energetic in the cryptocurrency marketplace.

According to Glassnode, large traders – in substantial-worth transactions – have led Bitcoin’s almost twenty% achieve given that final week. As a consequence, some analysts say the trend is displaying that institutions are even now targeted on the vivid side of cryptocurrencies rather than possible headwinds.

“Investors are looking for the positives of regulation rather than the negatives,” explained the infrastructure bill that wants even more clarification. – explained Joel Kruger, crypto strategist of LMAX Digital.

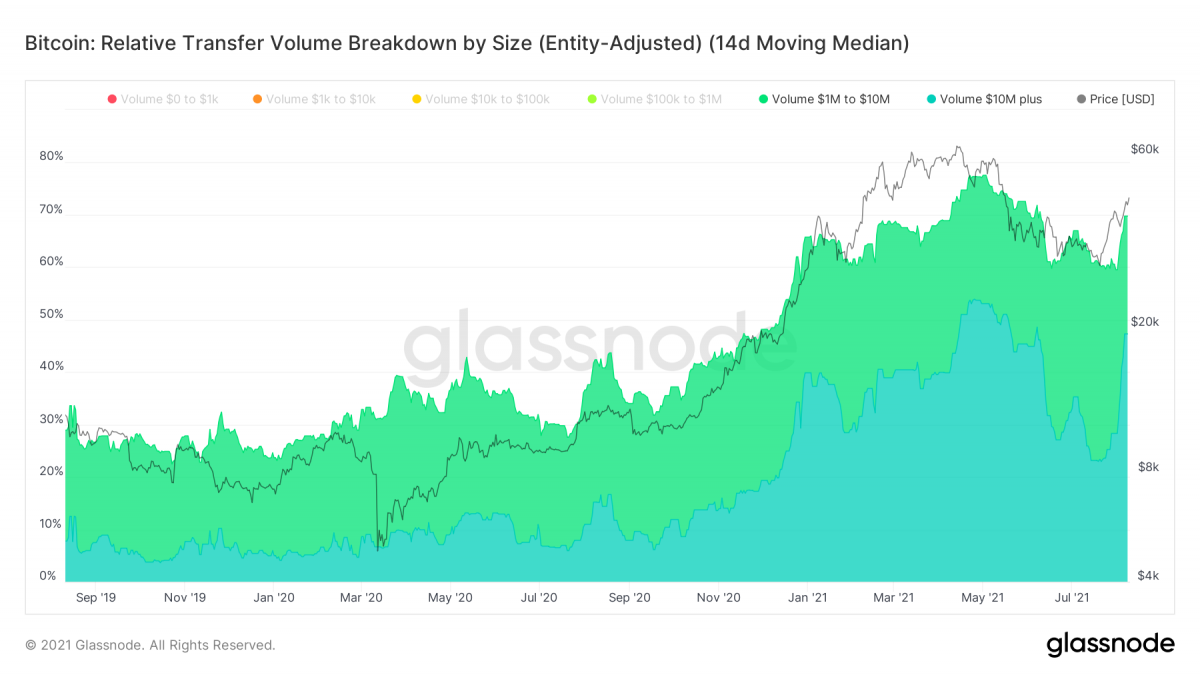

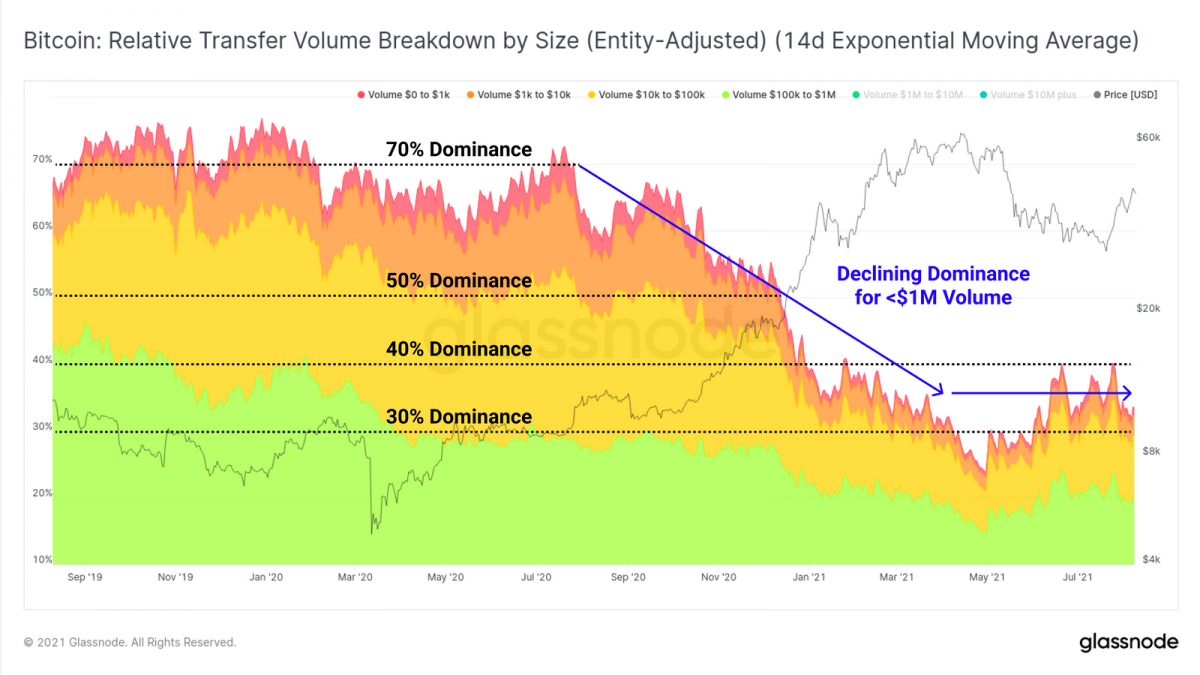

Bitcoin’s on-chain transaction volume with a worth of at least $ one million has elevated ten% given that the starting of August this 12 months. At the similar time, this volume also accounts for almost 70% of the complete transferred worth. This blockchain index represents the increasing institutional exercise on the Bitcoin network.

The explanation provided by Check Mate, a blockchain analyst at Glassnode, is that “retail investors rarely move transactions (worth at least $ 1 million) on a scale to create units.”

“The increase in domain is also related to the huge volume of transactions on Coinbase since December 2020, which we also assign to institutions potentially in the United States”. – Check Mate additional.

On the other hand, compact-scale transactions have decreased as a percentage of the complete marketplace, as proven in the picture under. Transactions well worth significantly less than $ one million have decreased from 70% to all-around thirty-forty% of complete marketplace transactions given that July 2020.

The bullish move by institutional traders comes as the cryptocurrency marketplace moves hand in hand with several political developments and other regulatory stresses. Typically, the $ 28 billion fiscal report for the White House infrastructure bill is “the center of attention.” Additionally, there are a amount of crackdown lawsuits from Europe and a handful of other areas towards Binance, at present the greatest cryptocurrency exchange in the globe by trading volume.

According to market industry experts and analysts, institutional traders are even now optimistic about Bitcoin’s potential in spite of rigorous regulatory scrutiny. Andrew Tu, CEO of quantitative trading company Efficient Frontier, explained:

“Overall, organizations are in favor of clear and honest rules. The current price tag hike more than the previous week has proven that the marketplace is not reacting strongly to regulatory worries, contrary to the real passage of legislation. “

Additionally, in the most current improvement of the Infrastructure Bill on August 9, Senator Richard Shelby lodged an objection to the compromise amendment to the cryptocurrency declaration provision. In it, the amendment exempts cryptocurrency transaction validators from the expanded definition of “broker”. According to Kruger, elevated regulation provides the cryptocurrency market higher leverage.

“This means the industry is being recognized and this ultimately helps with adoption and adoption.” Kruger explained.

Others also argue that the cryptocurrency marketplace is utilised to information from regulators.

“The cryptocurrency market is already very familiar with regulatory concerns, especially OG (long-standing holders) cryptocurrency sellers. These are witnessing many cycles of regulatory uncertainty,” explained Andrew Tu.

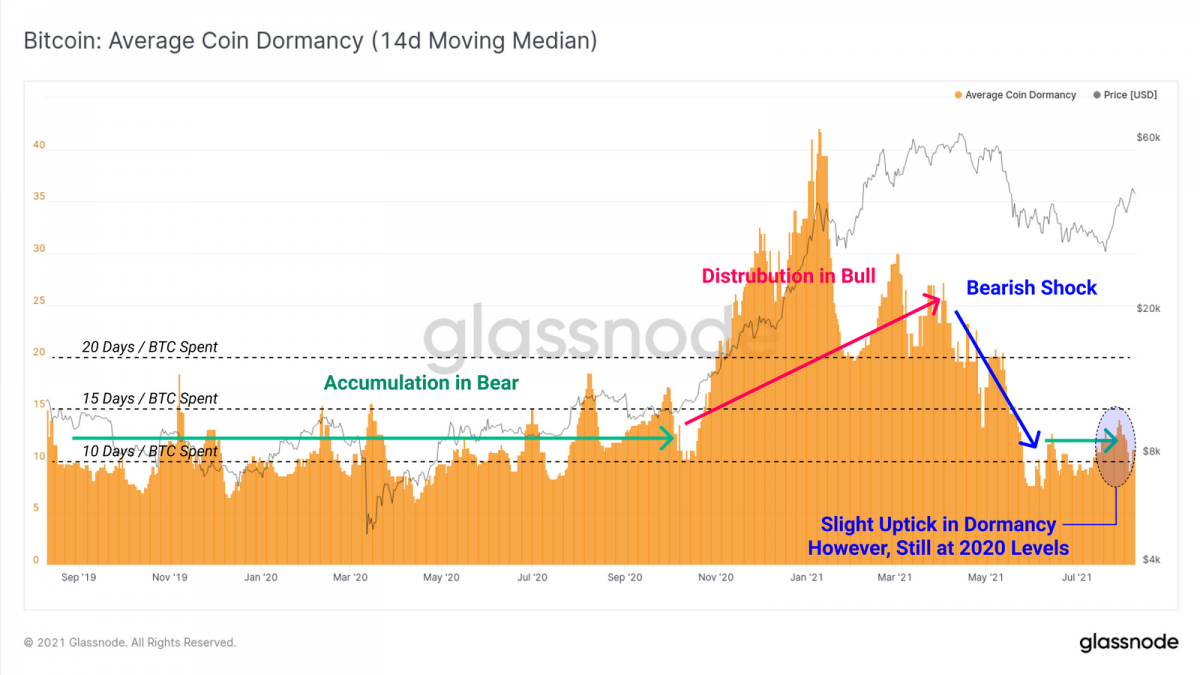

In truth, on an typical basis of 14 days – the typical amount of days every single BTC is trading in a non-volatile state – it has somewhat elevated to all-around ten days from seven days. According to Glassnode, this indicates that some bitcoins of “many old investors” have been not liquid throughout this time period.

Market fundamentals have develop into more powerful and more healthy

Instead of focusing on regulatory uncertainties, institutional traders highlighted some of the increasing fundamentals of the Bitcoin marketplace. This serves as a enhance to their optimism. Noelle Acheson, Head of Market Insights at Genesis, explained:

“Regulatory concerns are not affecting bitcoin here as much as other cryptocurrencies and the sentiment behind bitcoin has shown signs of change in recent weeks.”

Additionally, the illiquid supplying of Bitcoin, or balances held by illiquid entities, hit a current record substantial. This indicates that the older cryptocurrency has a weak provide.

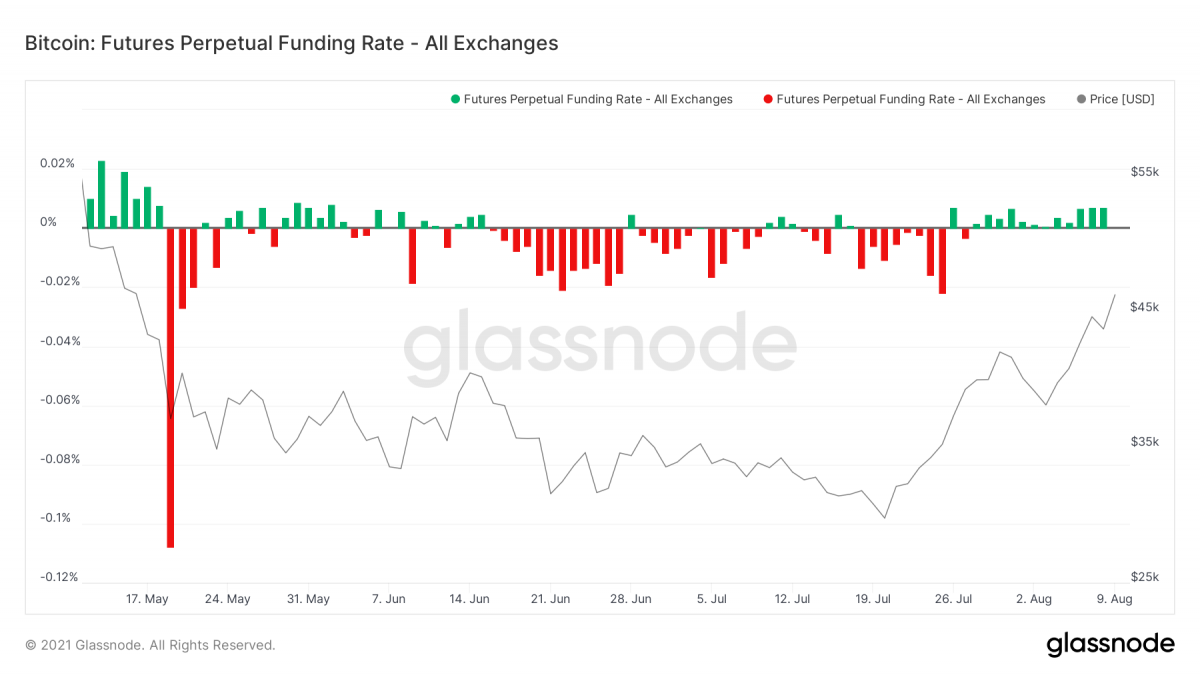

The funding charge of the perpetual derivatives marketplace turned constructive. Whereas ahead of, the funding charge was in pretty much a “negative” state for most of June and July of this 12 months.

Calculated every single eight hrs, the financing charge (financing charge) refers to the value of keeping a place prolonged quick on the perpetual marketplace of Bitcoin, i.e. futures contracts without the need of futures. This metric is populated by exchanges that deliver perpetual rates to stability the marketplace and perpetual price tag path at spot rates.

- A constructive funding charge indicates the get together prolonged they spend quick to preserve open positions and identify that the marketplace is getting into an uptrend.

- Meanwhile, a damaging funding charge implies a bearish marketplace positioning and a downside short will spend shortly to preserve purchase.

Synthetic Currency 68

Maybe you are interested: