This afternoon (June sixteen) an Inverse Finance safety hole was attacked. However, it is really worth mentioning the moment once again the sudden response of anteg (the Yearn programmer) and Samczsun (a popular white hat hacker from the local community).

What took place?

As typical, Peckshield is generally an early warning unit for DeFi safety hole tasks. This time close to, the “ringed” identify is Inverse Finance once again.

However, the DeFi local community moved when the banteg (popular programmer from Yearn) tweeted asking Peckshield to delete this tweet.

After becoming questioned by the local community for the “decentralization” of the statement, the banteg mentioned Samczsun had witnessed larger holes. From there, banteg mentioned it was vital to delete the aforementioned tweet for processing and to make certain the safety of consumer sources.

For the request of @bang And @samczsun , we deleted a former tweet. Let’s recap the incident soon after the deal. It is a tough time in the bear market place!

– PeckShield Inc. (@peckshield) June 16, 2022

Incident predictions

Currently, Peckshield’s side has deleted the tweet and confirmed that there will be a Post Mortem report soon after the situation is dealt with.

It would seem @InverseFinance it was exploited for about $ one.two million (53 BTC, $ 100k Tether).https://t.co/Idtx9IisAd pic.twitter.com/oln7Qsh8Rx

– DeFiyst (@DeFiyst) June 16, 2022

The DeFiyst account claims that Inverse suffered a flash loan assault, resulting in a complete reduction of ~ $ one.two million (like 53 BTC and USDT a hundred,000).

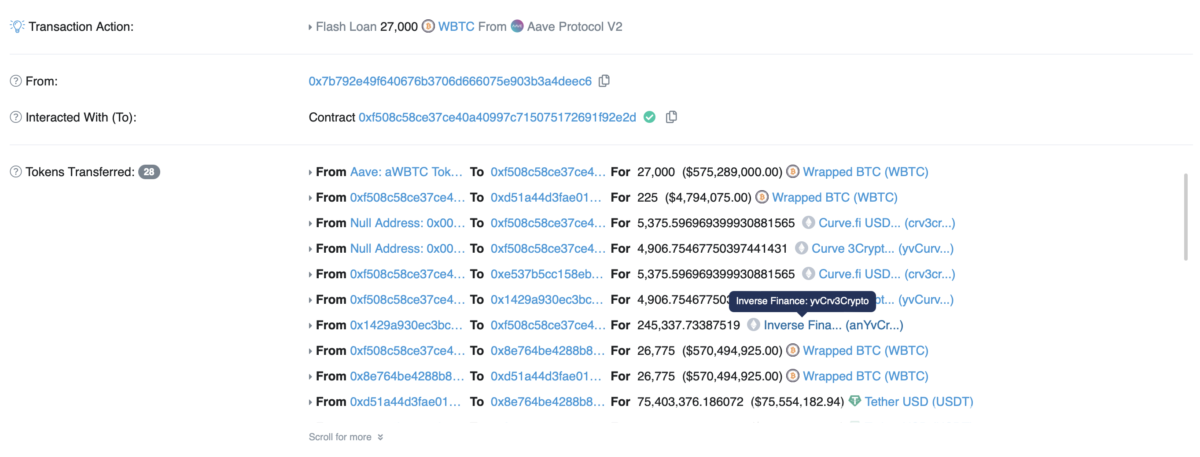

Digging into the transaction with the hash code 0x958…, it can be witnessed that the hacker made use of the wallet 0xf508 to flash a loan of somewhere around 27,000 WBTC from Aave V2. The hacker then exploited a selected vulnerability in Inverse Finance’s yvCRV3Crypto pool.

From there it is probable to withdraw a huge sum of WBTC and USDT from this pool. Currently, Inverse Finance and Yearn have not nevertheless had a comprehensive report on the incident. The banteg request to delete the tweet may perhaps be due to a loophole from Yearn that the crew desires to correct.

In the most recent announcement, Inverse acknowledged the existence of a vulnerability and claimed to have suspended the lending function to investigate the concern.

Inverse temporarily suspended lending following an incident this morning in which DOLA was eliminated from our revenue market place, Frontier. We are investigating the incident, having said that no consumer money have been taken or risked. We are investigating and will give extra specifics quickly.

– Inverse + (@InverseFinance) June 16, 2022

Inverse is named the moment once again

It is acknowledged that this is not the very first time that Inverse Finance has been named. In April 2022, Inverse was also a victim of hackers, with an estimated reduction of $ 15 million at the time.

> See extra: Inverse Finance was exploited for extra than $ 15 million due to an Oracle-associated vulnerability

Synthetic currency 68

Maybe you are interested: