During the week of November 13-19, 2023, the cryptocurrency market place noticed $176 million well worth of capital inflows, led by investments in Bitcoin and Solana.

Investment capital flows into cryptocurrencies have grown for eight consecutive weeks

Investment capital flows into cryptocurrencies have grown for eight consecutive weeks

According to the most up-to-date report from CoinShares, final week the cryptocurrency market place noticed an more capital inflow of $176 million from investment money this kind of as CoinShares, Bitwise, Grayscale, ProShares and 21Shares. This is the eighth consecutive week of development.

🟢 Digital asset investment merchandise recorded an eighth consecutive week of inflows!

👉 Week 47 inflows: $176 million.

🔗 https://t.co/PgcIrIGcCM📊ETP share of complete cryptocurrency volume: eleven%.

👉 This worth is over the prolonged-phrase historical regular of three.four%

👉 This worth is larger than the averages observed in… pic.twitter.com/I8eHbz4VaP— CoinShares (@CoinSharesCo) November 20, 2023

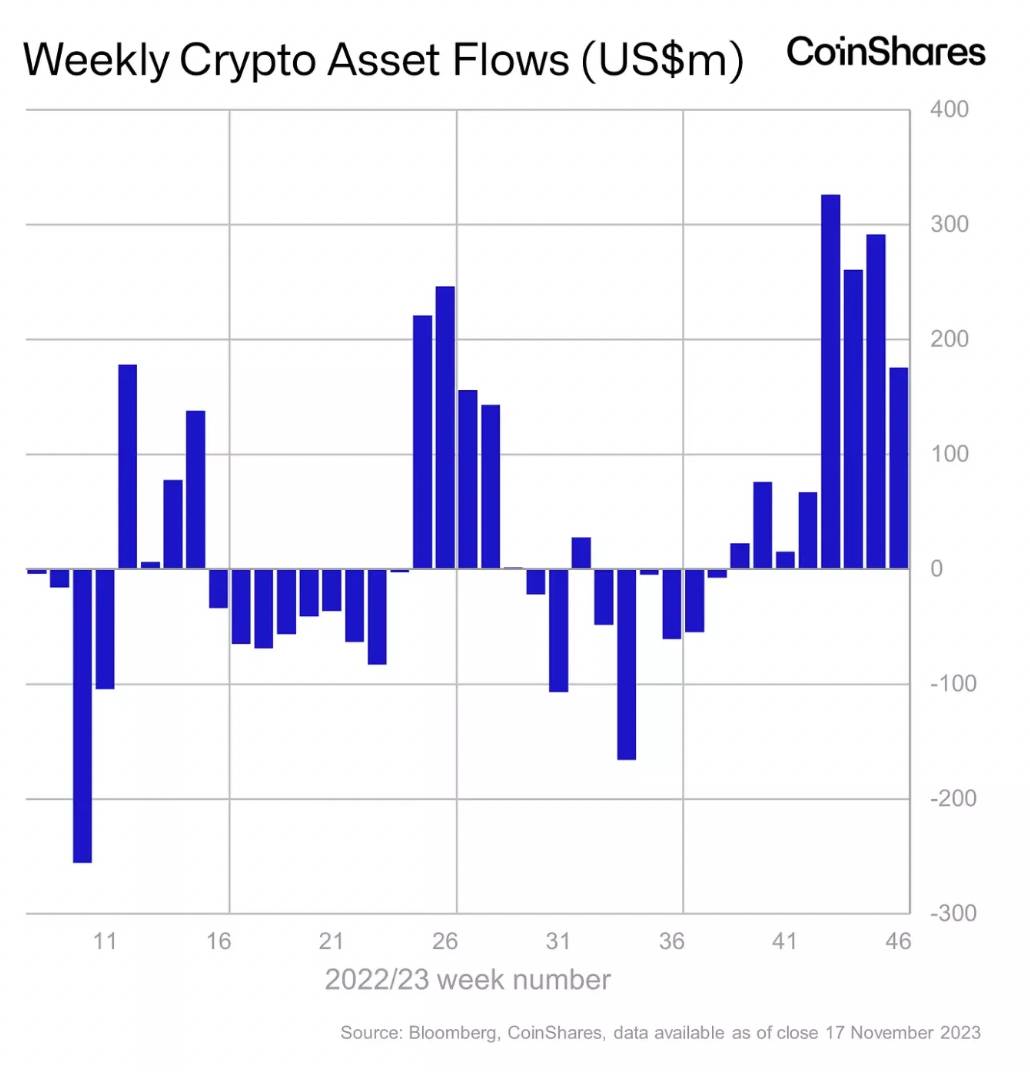

Net capital flows invested in crypto merchandise by week. Source: CoinShares

Net capital flows invested in crypto merchandise by week. Source: CoinShares

Recent capital flows have greater the complete investment share in the market place to $one.32 billion. Trading volume is at this time about $three billion a week, double this year’s weekly regular, stated James Butterfill, head of analysis at CoinShares.

However, in spite of the maximize in transaction volume, in terms of capital inflows this 12 months, it is nevertheless far behind the $ten.seven billion in 2021 and $six.six billion in 2020, the researcher mentioned .

Bitcoin and Solana had been the two primary networks in attracting capital flows final week. Specifically, Bitcoin is well worth up to $155 million, amid optimism more than the US SEC-authorized Bitcoin spot ETF. Solana with $13.six million, extra modest Ethereum with $three.three million, and Avalanche with $one.eight million.

On the other hand, in accordance to Bitcoin statistics, Bitcoin also knowledgeable a capital outflow of $eight.five million final week. CoinShares.

Regionally, Canada, Germany and Switzerland led capital inflows with $98 million, $63 million and $35 million, respectively. In contrast, the United States recorded a money outflow of $19 million amid a tense legal surroundings.

Additionally, November 2023 also noticed a lot of huge and tiny capital calls for crypto tasks, common examples consist of:

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!