Institutional cryptocurrencies at this time have all-around $ 62.five billion in assets underneath management by the finish of 2021, with Bitcoin (BTC) at its core.

The institutional crypto fund attracted record funding in 2021, as solid demand for well known crypto market place assets this kind of as Bitcoin (BTC) and Ethereum (ETH), continued to show its superior functionality above classic investment assets this kind of as stocks or gold. .

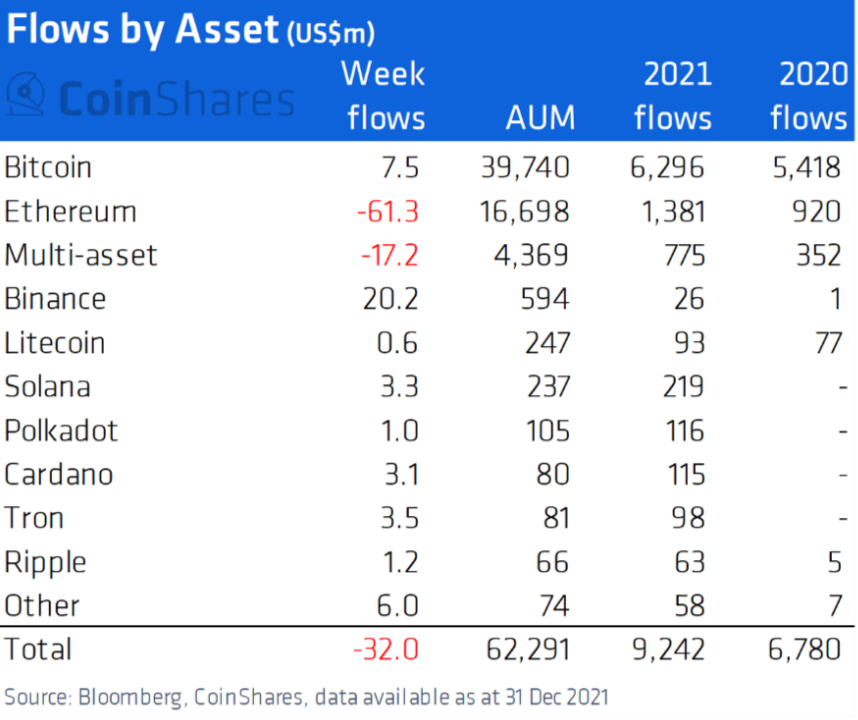

In specific, investment flows are anticipated to attain $ 9.three billion in 2021, an raise of 36% in contrast to 2020. While in contrast to the raise from 2019 to 2020, 2021 is considerably larger than 806%. Total Assets Under Management (AUM) ended the 12 months at $ 62.five billion, absolutely exceeding $ two.eight billion at the finish of 2019.

The complete amount of coins in the type of investment merchandise has gone from 9 to 15. Another 37 investment merchandise are launched in 2021 in contrast to 24 in 2020 and now the complete has reached 132. This helps make it even clearer. explosion and ubiquity of cryptographic assets.

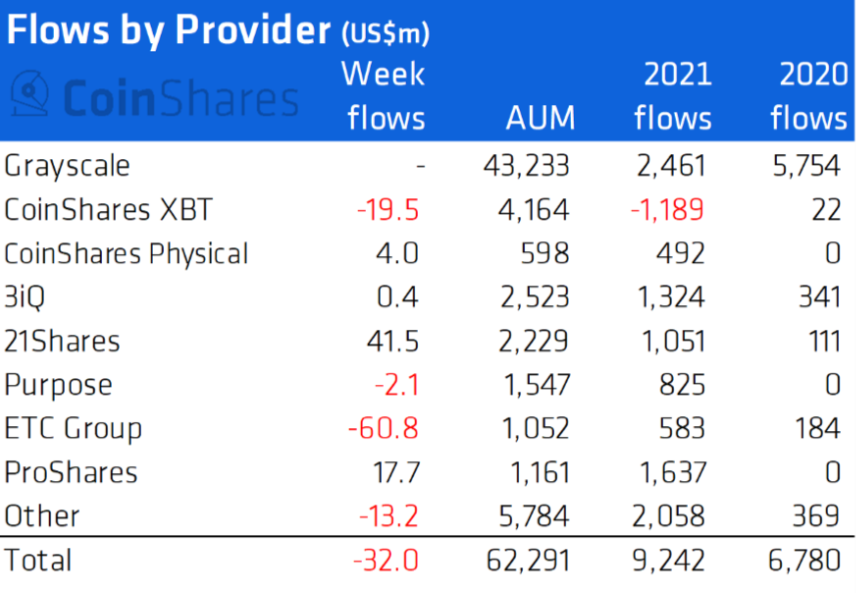

The final week of 2021 noticed a retracement of $ 32 million, continuing a downward trend immediately after establishing a record weekly outflow in mid-December. three-week complete losses are now at $ 260 million, or .four % of AUM.

Grayscale stays the greatest hedge fund with $ 43.four billion in assets underneath management as of Jan. four, in spite of the fund’s cryptocurrency worth falling $ 17 billion in just two months. Below are other important multi-billion dollar wealth managers together with 3iQ, 21Shares, And so on Group, Purpose and ProfessionalShares.

UPDATE 01/22/01: Net Assets Under Management, Holdings per Share and Market Price per Share for our investment merchandise.

Total AUM: $ 43.four billion$ BTC $ BAT $ BCH $ LINK $ MANA $ ETH $ ETC $ FIL $ ZEN $ LTC $ LPT $ XLM $ ZEC $ UNI $ AAVE $ COMP $ CRV $ MKR $ SUHI $ SNX $ YFI $ ADA $ SOL $ AMP pic.twitter.com/91BTC3OeID

– Grayscale (@ Grayscale) January 4, 2022

Despite the tremendous volatility, cryptocurrencies are undeniably gaining wider recognition in 2021, with the two institutional and retail traders coming into the market place. 2021 is the 12 months cryptocurrencies turn into a trillion dollar asset class, culminating with complete market place capitalization reaching above $ three trillion for the to start with time in November, assisting cryptocurrencies turn into the target of lots of classic fiscal giants.

On the way to conquer 2021, a amount of Bitcoin ETF merchandise have appeared in lots of nations, together with Purpose ETF Bitcoin (BTCC-B.TO) in Canada, Brazil Bitcoin ETF with ticker (BITH11). First time in the US, the principal driver of Bitcoin’s ATH at $ 69,000 was VanEck’s ProfessionalShares Bitcoin Strategy ETF (BITO), The Valkyrie Bitcoin Strategy ETF (BTF), and Bitcoin.

Synthetic Currency 68

Maybe you are interested: