Bitcoin is as soon as once more struggling and dropping beneath $35,000 has made buyers hesitant to purchase forward of the present drop. But on-chain knowledge reveals that long-term gamers proceed to build up aggressively.

On June 18, Bitcoin and conventional monetary markets have been confronted with feedback about strain from the United States Federal Reserve (Fed) over the potential of an earlier-than-expected charge hike. resulting in a pointy enhance within the greenback’s value relative to different asset prices.

See extra: After the Fed assembly, what’s Bitcoin and the crypto market?

This resulted in comparatively robust promoting strain over the weekend, dragging Bitcoin value beneath the vital $36,000 help stage, main merchants to forecast $32,500 as the following cease earlier than Bitcoin revisits. The earlier low check space was $30,000.

These technical components mixed with the detrimental information coming from China to close down cryptocurrency miners precipitated the hashrate of Bitcoin miners in China to proceed to say no. The most up-to-date crash of the Iron Finance protocol prompted billionaire Mark Cuban to name for assistance on stablecoin rules, making merchants nervous concerning the present drop within the value of Bitcoin.

See extra: What is the rationale TITAN “dump” strongly to zero? What occurred to TITAN?

Correlating with Greed and Fear index, there isn’t any constructive signal but, persevering with the pattern of utmost concern that began on Black Wednesday May 19 and is at present at index 23.

Bitcoin circulation generally is a cause for Bitcoin’s downtrend. According to Ki Young Yu of CryptoQuant, he thinks that just lately there was loads of Bitcoin pouring into exchanges however the trading quantity remains to be comparatively low. BTC wants extra trading quantity to enhance trade money circulation.

One factor that makes me fearful about $BTC is trade netflows.

There are many Bitcoins are flowing into exchanges recently however the trading quantity remains to be comparatively low. $BTC wants extra trading quantity to digest growing trade inflows.

Data 👉@cryptoquant_com pic.twitter.com/bCFAqmWft6

— Ki Young Ju (@ki_young_ju) June 11, 2021

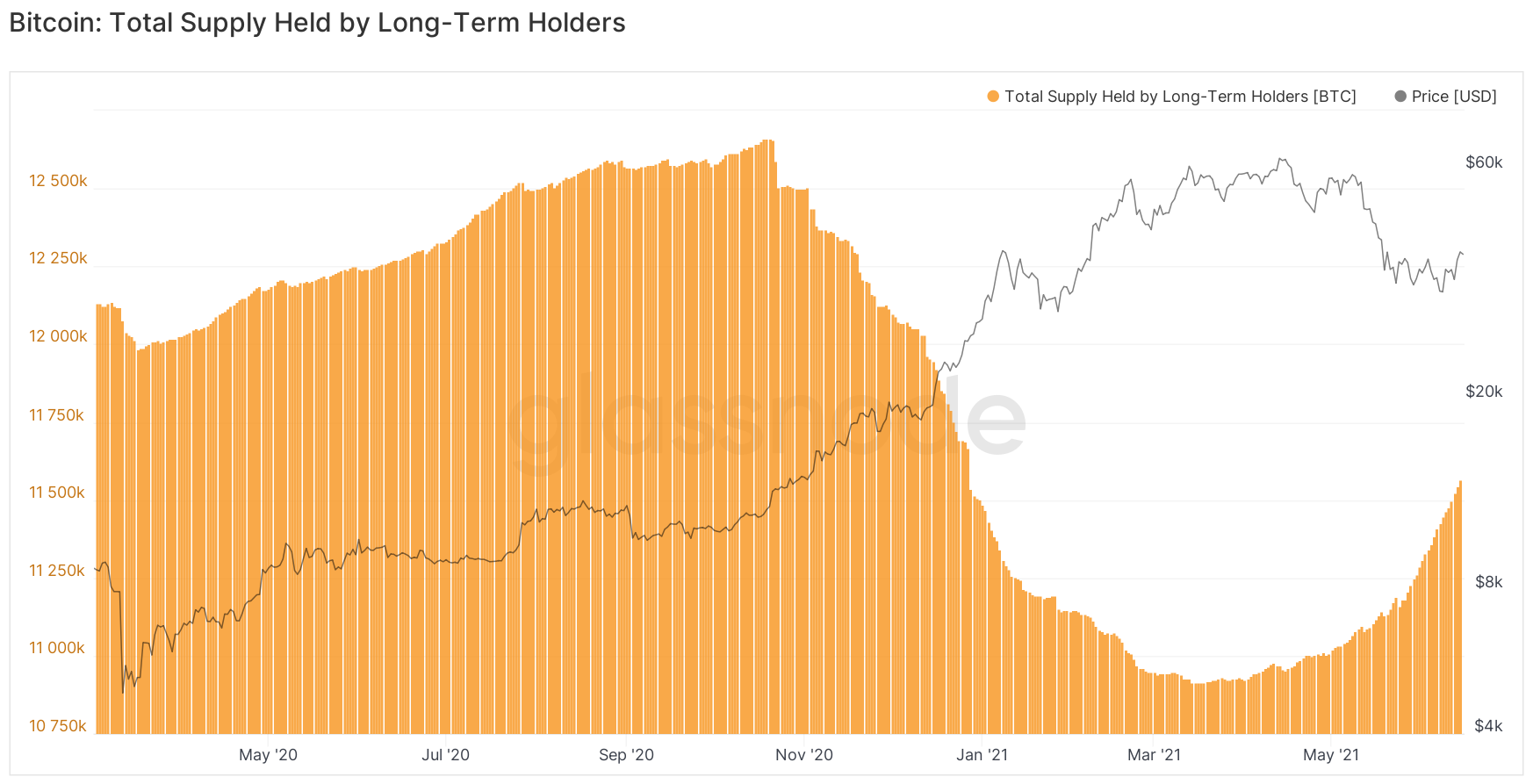

While investor nervousness is rising and a few merchants who purchased in between the March and May highs are promoting at a loss, the whole provide of Bitcoin by long-term holders continues to develop. after hitting a low in mid-May.

See extra: Is this an excellent time to purchase Bitcoin because the panic subsides?

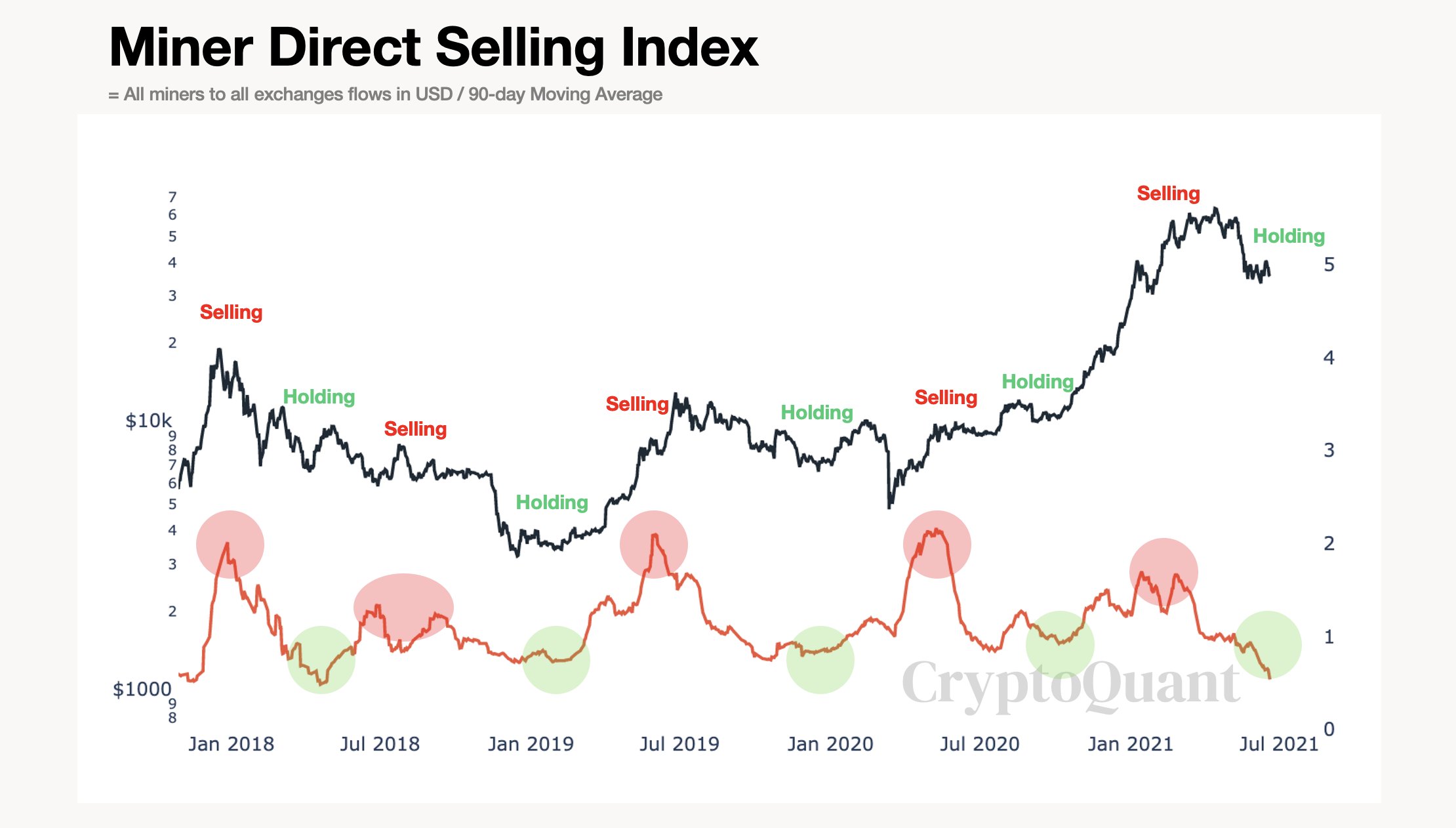

Although the issue is severe in China, the chart above reveals that miners proceed to carry BTC. The variety of Bitcoins despatched periodically to exchanges from miners is reducing. Chinese rules can solely power miners to promote their rigs however not Bitcoin.

Overall, Bitcoin’s short-term future remains to be fraught with dangers, we should take a look at Bitcoin’s value motion within the coming days to higher determine the pattern. On the opposite hand, the long-term knowledge hints at an optimistic future as whale wallets and long-term holders proceed to extend their Bitcoin balances.

Synthetic

Maybe you have an interest: