Recently, Iron Bank, the ecosystem of goods supported by the Yearn Finance group and in certain by godfather Andre Cronje, officially launched the IB token.

What is the iron financial institution?

Those of you who have been following the DeFi marketplace considering the fact that the summertime of 2020 need to have heard of the Iron Bank answer. This is an integrated lending answer, with liquidity from lots of vital tasks in the DeFi marketplace. These tasks will be whitelisted, then credibility will be confirmed, assisting the loan curiosity fee and capital use efficiency will be much more optimum.

However, Iron Bank has a time period of decline in 2021, partly due to the several controversies surrounding Cream Finance, a vital part of this ecosystem.

What tends to make the IB token distinctive?

IB is a token employed to help the movement of worth in the Iron Bank ecosystem. In certain, the method will create an extra veIB coin, which performs the administrative voting position and is the fee for distributing the transaction costs from the product or service to the holders.

veIB will be awarded to CREAM holders. This distribution will be on the Fantom chain and will be blocked for four many years. This can be witnessed as portion of the compensation Andre would like for individuals harmed by the “grains” in the prior Cream Finance product or service.

Furthermore, veIB will quickly be implemented on Fantom to lower transaction costs and facilitate consumer entry.

Token allocation

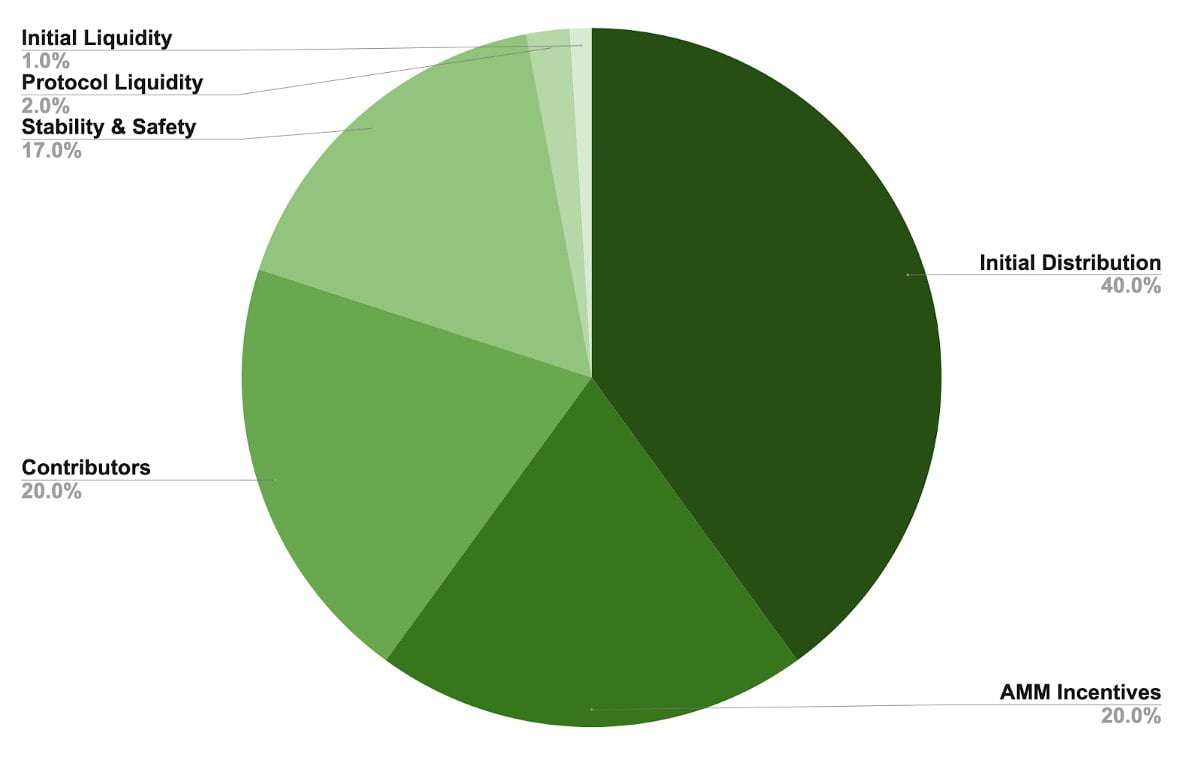

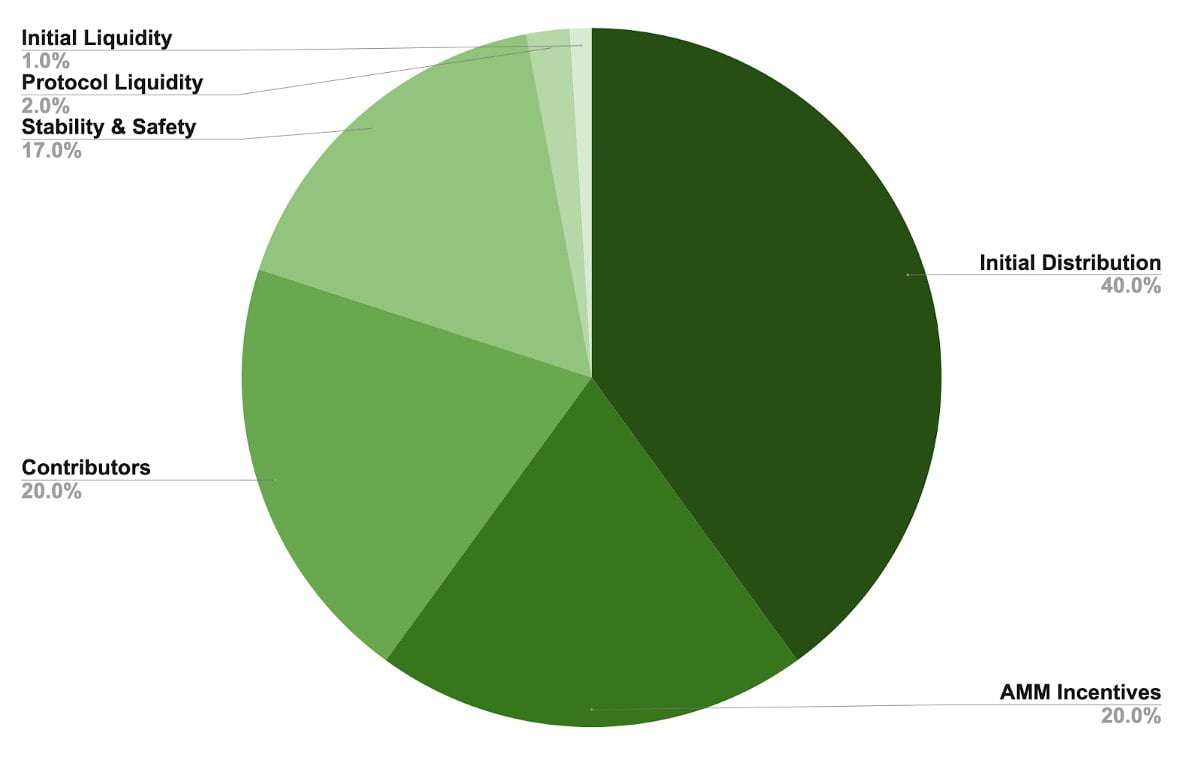

According to the most recent publish, IB Token Allocation will incorporate the following:

- Initial liquidity – one%

- Proprietary liquidity of the protocol (this is a characteristic of the model (three.three) – two%

- Coverage – 17%

- Incentives for AMM – twenty%

- Initial distribution – forty%

- For contributors (locked for four many years and can be thought of very similar to Team allocation in frequent goods) – twenty%

Model Degrees (three.three)

The product or service of this IB token will stick to the ve (three,three) model, which is a versatile blend of Olympus’ bonding LP model and Curve Finance’s voting mechanism. If you are interested, you can stick to the information in the explanation under!

> See much more: What is Andre Cronje’s ve (three,three) and what is so distinctive about it?

In addition to the new model proposed by Andre Cronje, you can also find out much more about the existing incredibly critical tokenomic designs in the podcast under. Have exciting and get a minute to reflect on these worth coordination designs!

> Listen now: DeFi Discussion Ep. 27: Curve Wars – The Mysterious Keyword Behind CRV’s Price Hike

Also, never disregard the most recent updates from the collaboration venture among Andre Cronje and Daniele. After some facts shared by Andre, it is very likely that this venture will distribute tokens to individuals contributing to the Fantom ecosystem, the place Andre Cronje has invested a good deal of work setting up the platform.

Note, the over articles is for informational functions only and need to not be thought of investment tips!

Synthetic currency 68

Maybe you are interested:

Recently, Iron Bank, the ecosystem of goods supported by the Yearn Finance group and in certain by godfather Andre Cronje, officially launched the IB token.

What is the iron financial institution?

Those of you who have been following the DeFi marketplace considering the fact that the summertime of 2020 need to have heard of the Iron Bank answer. This is an integrated lending answer, with liquidity from lots of vital tasks in the DeFi marketplace. These tasks will be whitelisted, then credibility will be confirmed, assisting the loan curiosity fee and capital use efficiency will be much more optimum.

However, Iron Bank has a time period of decline in 2021, partly due to the several controversies surrounding Cream Finance, a vital part of this ecosystem.

What tends to make the IB token distinctive?

IB is a token employed to help the movement of worth in the Iron Bank ecosystem. In certain, the method will create an extra veIB coin, which performs the administrative voting position and is the fee for distributing the transaction costs from the product or service to the holders.

veIB will be awarded to CREAM holders. This distribution will be on the Fantom chain and will be blocked for four many years. This can be witnessed as portion of the compensation Andre would like for individuals harmed by the “grains” in the prior Cream Finance product or service.

Furthermore, veIB will quickly be implemented on Fantom to lower transaction costs and facilitate consumer entry.

Token allocation

According to the most recent publish, IB Token Allocation will incorporate the following:

- Initial liquidity – one%

- Proprietary liquidity of the protocol (this is a characteristic of the model (three.three) – two%

- Coverage – 17%

- Incentives for AMM – twenty%

- Initial distribution – forty%

- For contributors (locked for four many years and can be thought of very similar to Team allocation in frequent goods) – twenty%

Model Degrees (three.three)

The product or service of this IB token will stick to the ve (three,three) model, which is a versatile blend of Olympus’ bonding LP model and Curve Finance’s voting mechanism. If you are interested, you can stick to the information in the explanation under!

> See much more: What is Andre Cronje’s ve (three,three) and what is so distinctive about it?

In addition to the new model proposed by Andre Cronje, you can also find out much more about the existing incredibly critical tokenomic designs in the podcast under. Have exciting and get a minute to reflect on these worth coordination designs!

> Listen now: DeFi Discussion Ep. 27: Curve Wars – The Mysterious Keyword Behind CRV’s Price Hike

Also, never disregard the most recent updates from the collaboration venture among Andre Cronje and Daniele. After some facts shared by Andre, it is very likely that this venture will distribute tokens to individuals contributing to the Fantom ecosystem, the place Andre Cronje has invested a good deal of work setting up the platform.

Note, the over articles is for informational functions only and need to not be thought of investment tips!

Synthetic currency 68

Maybe you are interested: