Information that FTX is getting ready to liquidate $three.four billion in cryptocurrencies is complicated the neighborhood. Below is some details on FTX’s $685 million stake in Solana (SOL).

The court will problem a determination approving FTX’s liquidation program on September 13

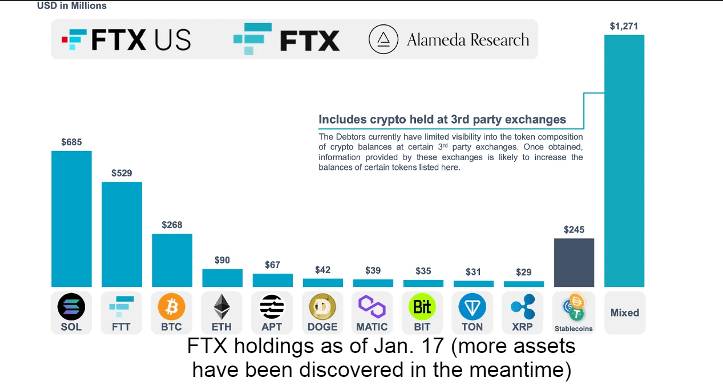

According to the pre-organized routine, September 13 (US time) will be the day the court approves FTX’s program to promote and liquidate a substantial volume of cryptocurrency assets. Total assets held by FTX at the time of filing for bankruptcy (November eleven, 2022) volume to $three.two billion, which include 17 various currencies.

Big marketing stress could arrive upcoming week🚨

FTX will very likely get approval to liquidate its assets in September. 13.

FTX had $three.four billion in cryptocurrencies as of April. The proposed program is to promote assets really worth up to $200 million per week. pic.twitter.com/4aHnhOVKP1

— The DeFi Investor 🔎 (@TheDeFinvestor) September 9, 2023

However, hold in thoughts that the over asset statistics are calculated primarily based on the exchange price on the date of bankruptcy, so it is does not completely reflect recent marketplace worth.

The volume of SOL might have to adhere to the unlock routine

In the holding portfolio Solana (SOL) represents the highest share with 685 million bucks. When FTX/Alameda Research initially bought SOL from the Solana Foundation in August 2020, it committed to unlocking about 50.five million SOL each and every month from buy by 2027-2028.

Similar to the agreement amongst FTX/Alameda and Solana Labs, about seven.five million SOL will be completely unlocked in May 2025.

Solana Labs covers FTX/Alameda

In brief, acquiring to respect the pre-established unlocking calendar, The situation in which FTX will liquidate 685 million USD SOL at the similar time will not come to fruition.

However, this details nonetheless induced the psychology of the neighborhood to endure, creating the worth of SOL to drop from USD twenty to USD 18 more than the weekend.

FTX “gathers assets” to put together a liquidation sale program

As Coinlive reported final week that FTX’s wallet was identified to be “consolidating assets” and started transferring $ten million from Solana to Ethereum. FTX Account X also confirmed that this was a planning action for the liquidation income program.

Previously, at the finish of August, FTX had sent intention to promote crypto assets Go to court to wait for approval. The bankrupt unit taking more than the exchange needs to convert the recovered cryptocurrency assets into income to stay clear of the possibility of decline in worth due to marketplace fluctuations.

The weekly liquidation worth of the floor will be amongst $one hundred million and $200 million, will take location by means of the Galaxy Digital housing unit. This will stay clear of the “earthquake” if FTX sells all $three.two billion really worth of cryptocurrencies on the marketplace at the similar time. Additionally, FTX stated it will notify the court and creditors in advance ahead of carrying out the token sale. .

Meanwhile, Solana founder Anatoly Yakovenko referred to as on FTX to return SOL to shoppers as a substitute of picking out to liquidate the coin on the marketplace.

See also https://t.co/5w4sTdkviX [unlocks tab] for a routine of all unlocks (not just FTX) pic.twitter.com/kc5OJ9qDYA

— ashpool (@solanobahn) August 31, 2023

In common, on the other hand, this is a movement of occasions that traders want to check and update, primarily if they hold assets on the record.

Coinlive compiled

Join the discussion on the hottest troubles in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!