Solana is regarded as one particular of the most crucial tasks of the final two many years. With its pros, Solana is regarded as a formidable competitor for the blockchains of outdated and new platforms. However, Solana is definitely “worthy of reality”, what has she finished with respect to her abundant assets?

Standing on the shoulders of giants

Strong fiscal assets

Solana Labs started fundraising in the 2nd quarter of 2018. From April 2018 to July 2019, the workforce mobilized extra than twenty million bucks from numerous Private Sale.

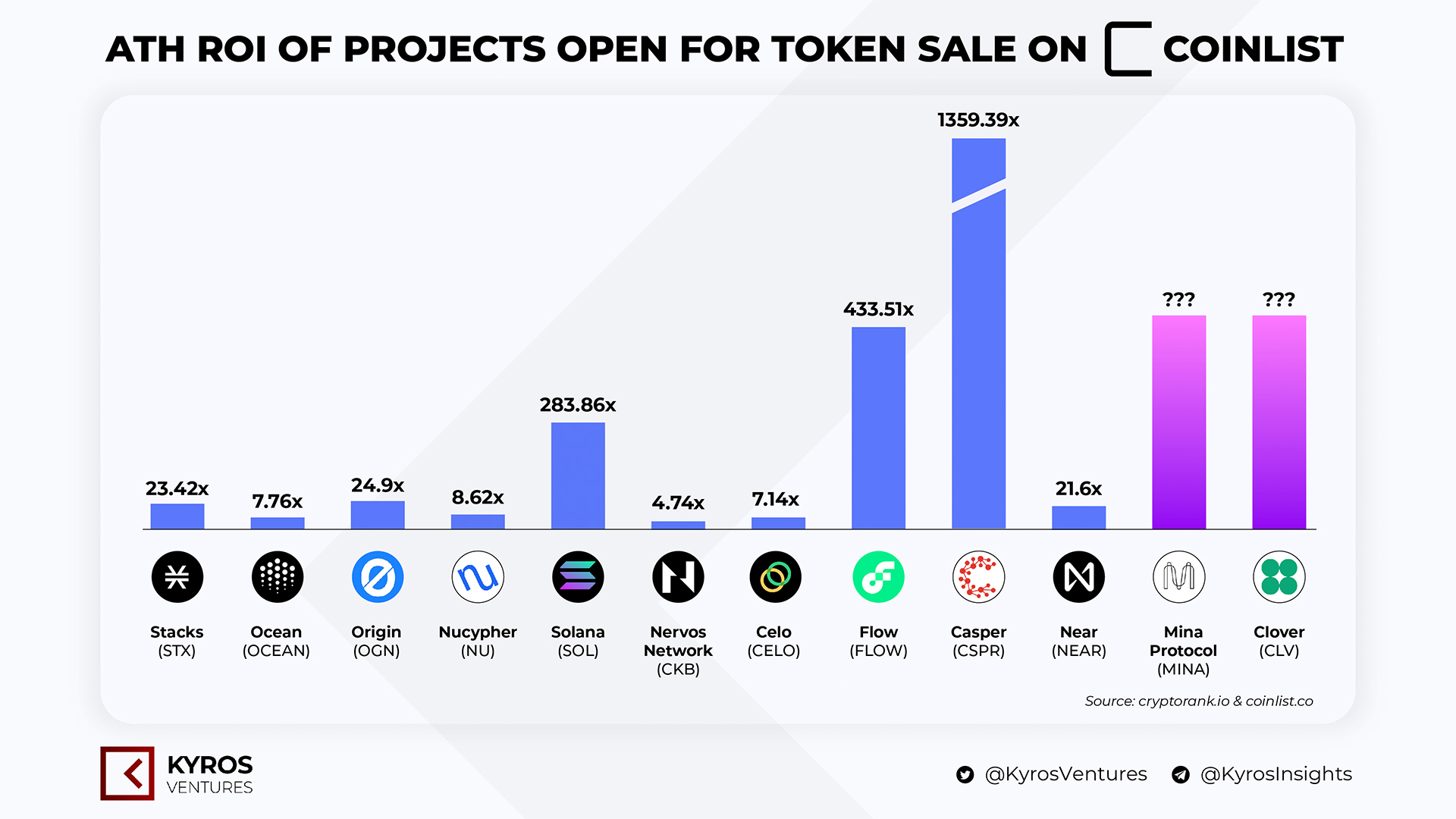

Solana launched on Mainnet Beta in March 2020, instantly following the relaunch one.76 million bucks in a public auction (public auction auction) on CoinList. This is regarded as an extraordinary achievement, when March 2020 is nonetheless a gloomy time period of “crypto winter”.

Specifically, the supply of revenue Solana has earned via funding rounds is:

- Turn of seeds: three.17 million bucks

- Foundation sale: $ twelve.63 million

- Sale of the validator: US $ five.seven million

- Strategic sale: $ two.29 million

- CoinList Auction: $ one.76 million

Big supporters

In addition to the abundant fiscal assets, it is not possible to mention that the “support” for Solana is total of “big ears” in the discipline of cryptocurrencies.

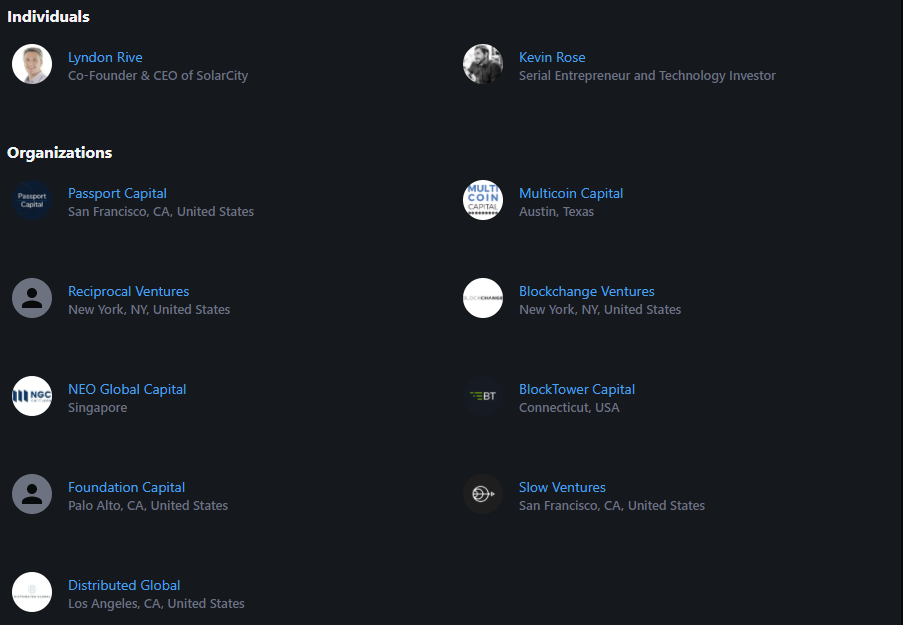

In addition to the “all-star” teaching of substantial-good quality workers who have worked at substantial technological innovation organizations this kind of as Qualcomm, Intel and Dropbox, Solana also receives assistance from personal traders and substantial venture capital money.

Individual

- Lyndon Rive – Co-founder and CEO of SolarCity

- Kevin Rose – Technology investor and start out-up venture chain

Organization

- Capital of the passport

- Multi-currency capital

- Mutual firms

- Blockchange firms

- NEO Global Capital

- Capital Tower Block

- Capital of the Foundation

- Slow down firms

- Globally distributed

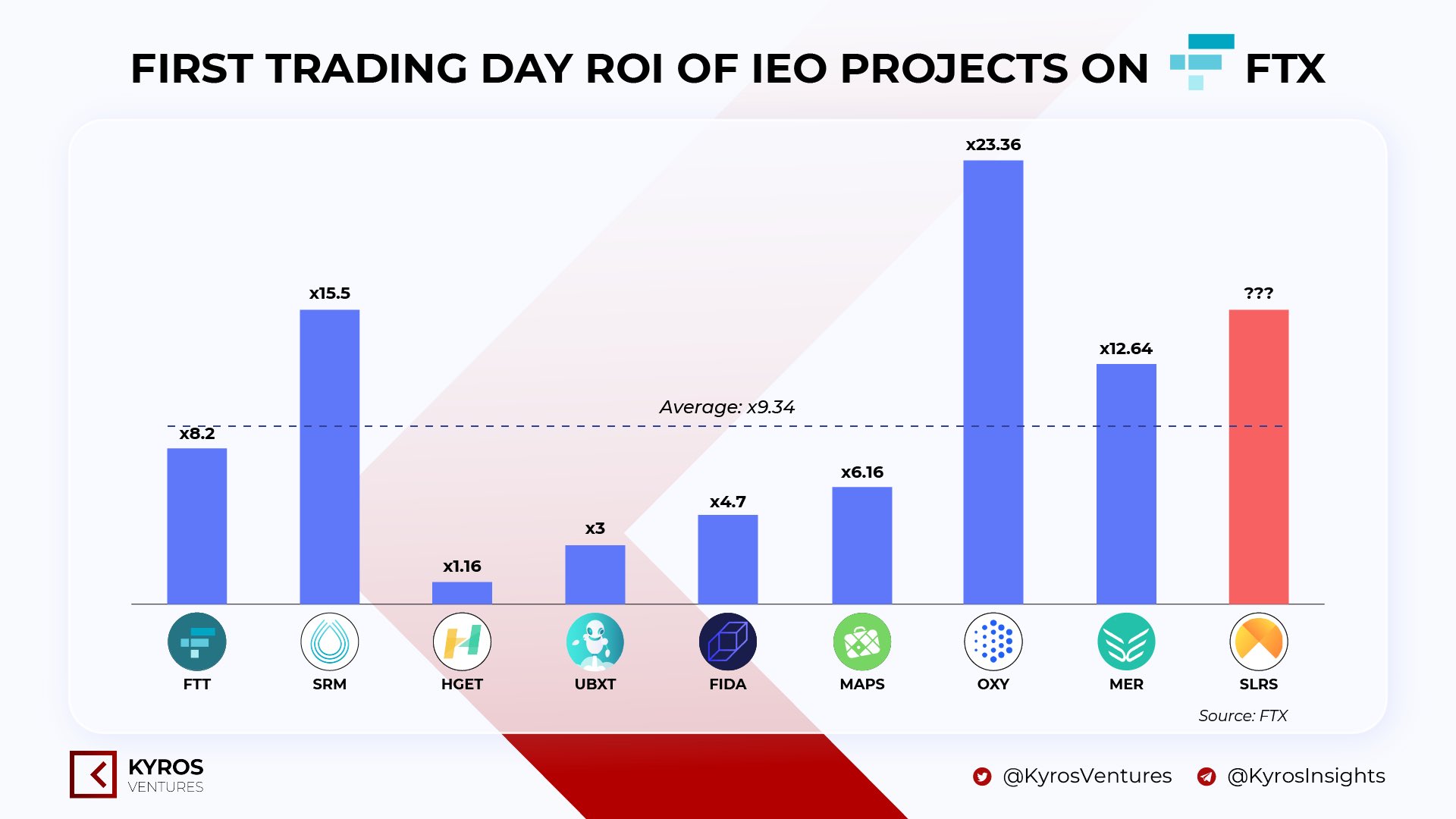

In distinct, the shut romantic relationship involving FTX and Solana was described in Kyros Kompass # one: FTX and Solana – The new “Batman and Robin” duo of the crypto globe.

As can be witnessed in the picture over, it is not tough to see the “provocative” romantic relationship involving Solana and the world’s top derivatives exchange FTX. Many tasks in the Solana ecosystem have FTX or Alameda Research (VC behind FTX) “embedded”.

And in the opposite route, the pending “Solana system” tasks are also virtually “probably” listed on the FTX exchange.

Different blockchain framework

No matter how sturdy the fiscal information is and how large the backer is, with no open factors in the underlying technological innovation, it is tough to survive the gloomy crypto winter of 2018-2020. From that, it can be witnessed, Solana gets a vivid spot. Most of the 2020 cryptocurrency marketplace is due to new advances in technological innovation growth.

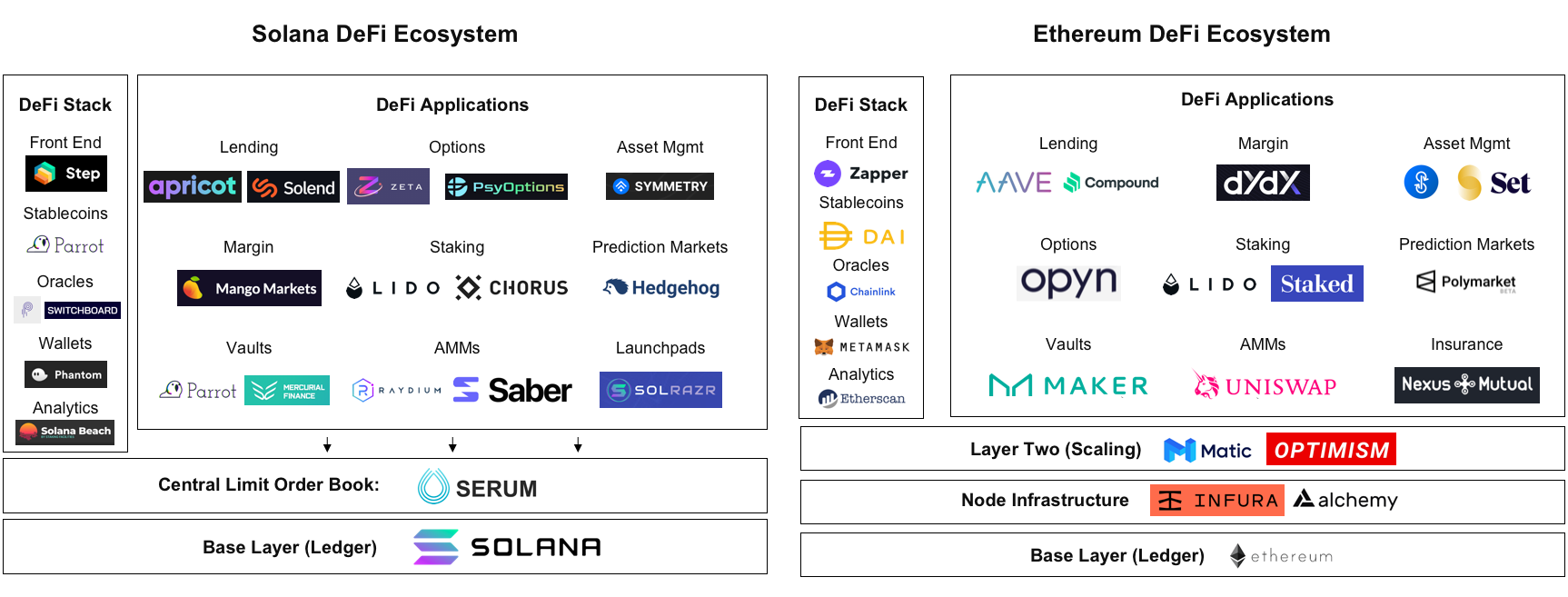

As explained in the posting DeFi 101 – All about the decentralized finance ecosystem, the framework of Solana and Ethereum – the pioneering blockchain in making intelligent contracts and Dapps – is unique.

Regarding the product sales mechanism, the Ethereum framework offers:

- 1st layer (Level one) – Base layer

- System of nodes

- 2nd degree (Level two) – Extended option

- Instruments

While with Solana:

- Base class

- Order portfolio

- Instruments

Additionally, Ethereum makes use of the Solidity programming language, even though Solana makes use of Rust.

Regardless of irrespective of whether this new facility will enable Solana remedy the issues Ethereum is struggling from. But Solana’s building of a new facility, utilizing a new programming language – fully unique from Ethereum, which is so “familiar” with several tasks – has attracted a good deal of curiosity from the crypto local community.

Advantages of lower commissions, substantial pace

And certainly, this new framework gave Solana an edge in excess of Ethereum in terms of transaction costs and processing pace. While Ethereum has been “struggling” with scalability issues for many years, consumers are “waking up” simply because Ethereum’s transaction costs are “expensive”, with Solana – at least for the second – people issues never exist!

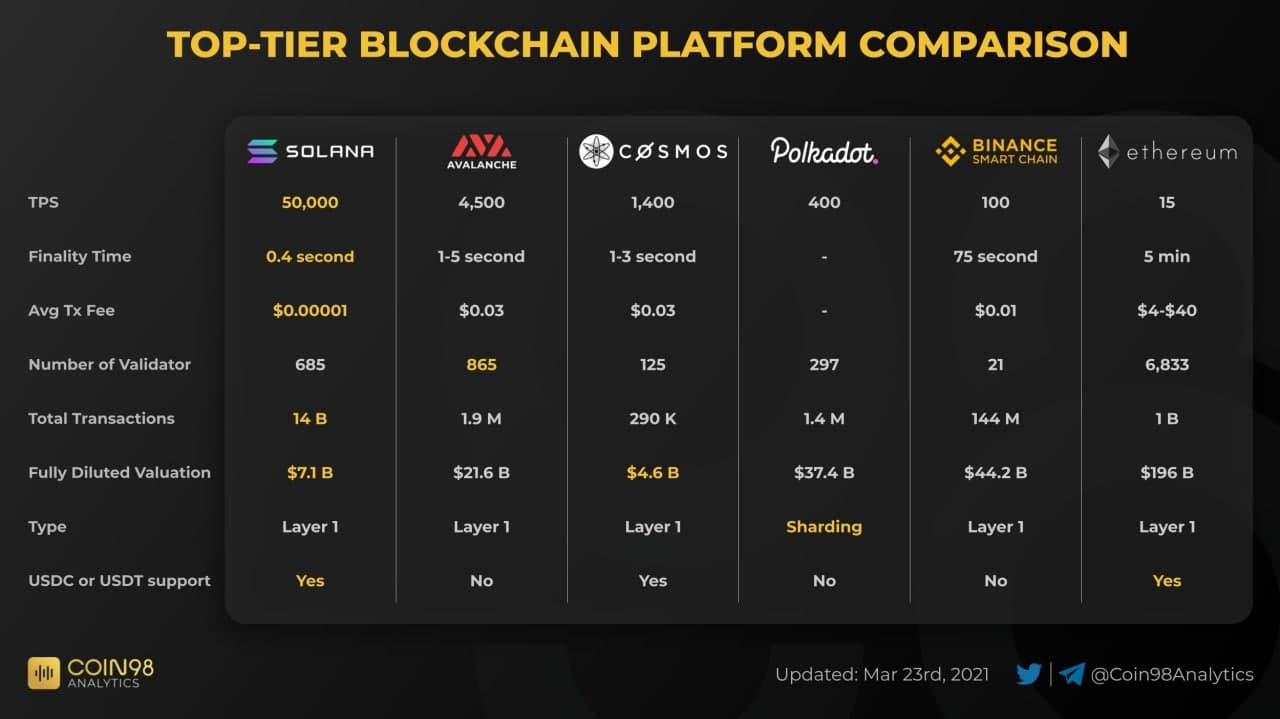

As can be witnessed from the table over, Solana’s most significant benefit is its lower transaction costs: .0001 USD versus $ .01 for Binance Smart Chain or $ four for Ethereum.

Solana’s transaction processing pace, expressed in complete transactions per 2nd (TPS), is also really extraordinary. 50,000 won transaction is processed. Meanwhile, BSC processes one hundred transactions / 2nd. As for Ethereum… five transactions / 2nd.

With all the perks and perks over, it can be understandable that Solana gets a vivid title in the cryptocurrency marketplace. By 2021, Solana has grow to be a “notable force” for emerging blockchains, competing on par with the ecosystems Ethereum, BSC, Polkadot, and so forth. The “built on Solana” label assists several novice tasks. Polka dot”.

However, we frequently say:

“Don’t look at what the project says, look at what the project does.”

Looking at what Solana is executing ideal now, is it achievable that Solana is sporting a coat of fame that is also substantial for her real worth?

The shirt is also large

Solana ecosystem: several but of good quality?

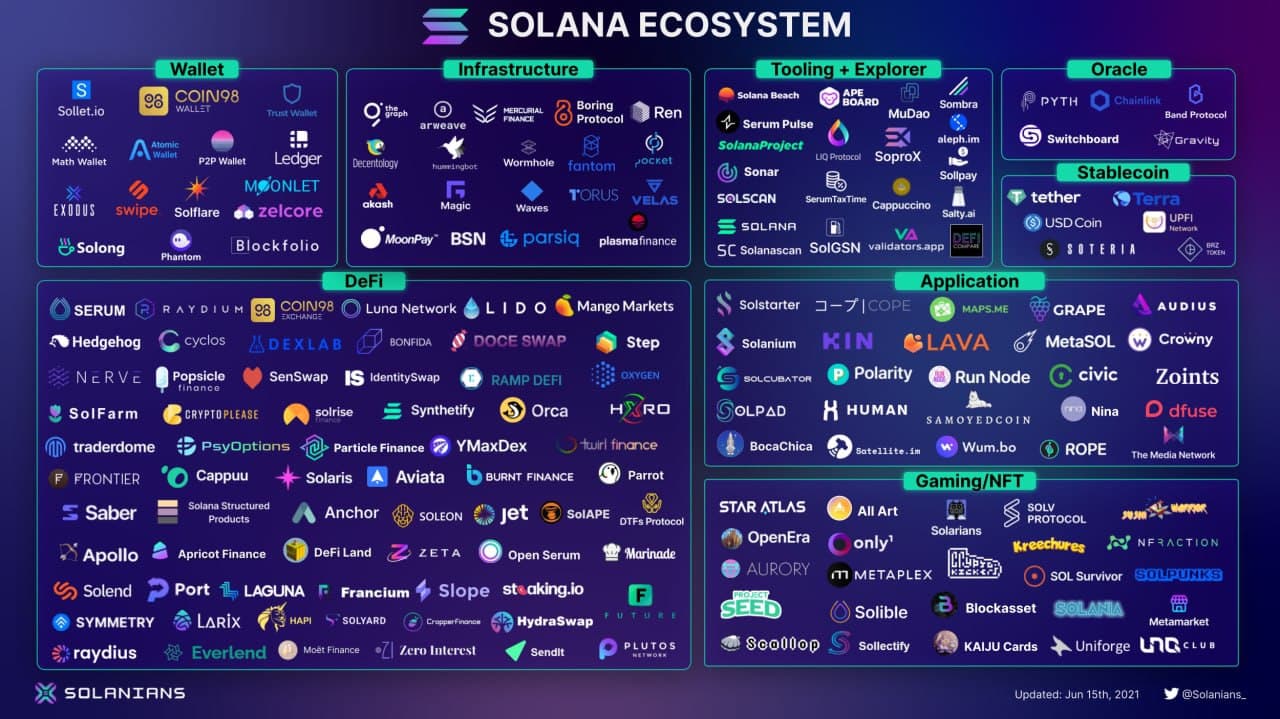

First, let us get a search at what the Solana ecosystem at present has!

This is a good deal! Compared to the Ethereum technique, it is “one nine and ten”!

It can be explained that Solana is one particular of the most varied ecosystems now. Compared to other ecosystems – normally Cardano as in publish one 12 months in the past, has Cardano (ADA) “exploded” as stated by Charles Hoskinson? analyzed – Solana is substantially extra varied and total.

However, as a consumer in the crypto area, can you title any Solana tasks you know? If Ethereum has Uniswap or Sushiswap top the DeFi discipline, BSC has PancakeSwap, what tasks do you try to remember Solana?

A quantity of main DeFi names this kind of as AAVE, Compound, MakerDAO, Curve, and so forth. they all come from Ethereum.

Okay, possibly you are saying that this comparison is also one particular-sided! Ethereum is a leader in the DeFi array not each and every day, bringing a new venture like Solana to an “old” like Ethereum is also lame!

Next, let us move on to the TVL comparison, the on-chain metric that demonstrates the clearest utilization of a venture.

TVL: Where is Solana?

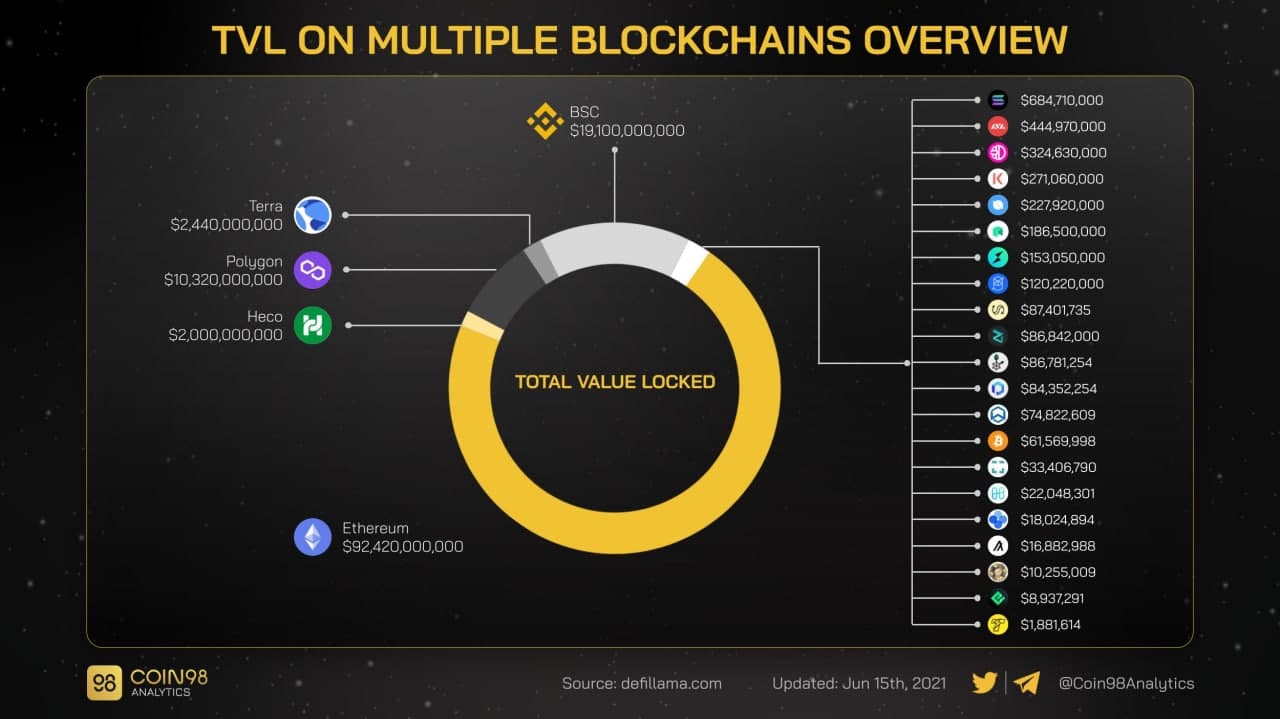

Below are the TVL statistics of present blockchains.

According to information from Defillama, the Ethereum blockchain is nonetheless in the lead with a massive quantity of TVL up to $ 92.42 billion. BSC techniques observe with $ 19.one billion, respectively Polygon, Terra and HECO. And the Solana technique TVL is on the net Friday with a modest figure shut to 648 million bucks. Or extra intuitively, Ethereum’s TVL is 142 occasions that of Solana. And BSC’s TVL is also 29 occasions increased than SOL’s.

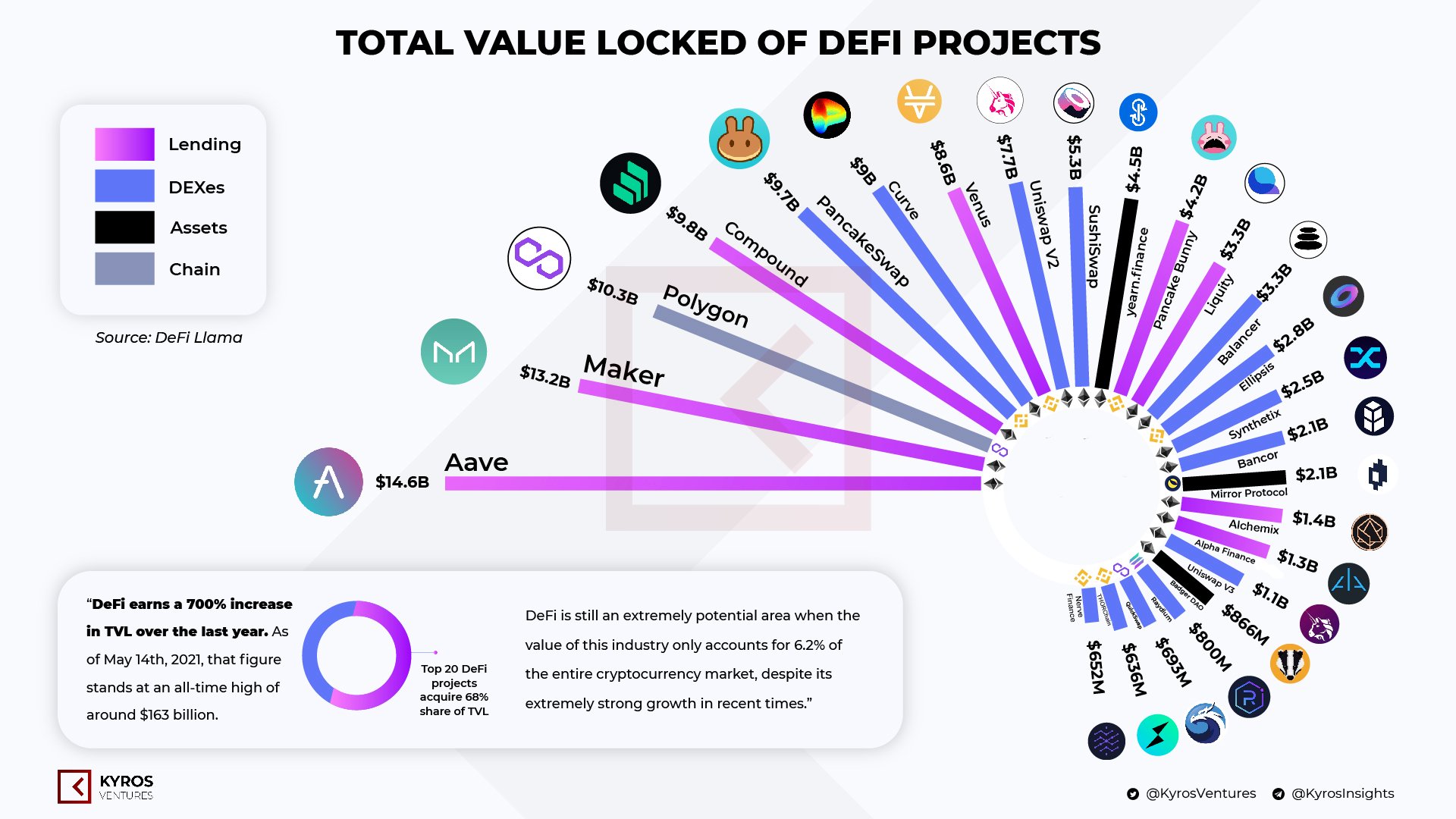

To realize why the Solana technique has this kind of a modest quantity of TVLs, let us get a search at the leading 15 DeFi tasks with the highest TVL now.

From the picture over, it can be witnessed that the present main TVL tasks this kind of as AAVE, MakerDAO, Compound, Curve or Uniswap, SushiSwap are all in the Ethereum technique. Next is Polygon, PancakeSwap or Venus from the BSC technique. In the leading 25 over, there is only one particular venture from the Solana technique, which is occupied by Raydium 800 million bucks TVL.

From the over evaluation it is clear that:

Although Solana’s present ecosystem is really varied, it is just a shell. In truth, there is no design and style that can compete with the excellent styles of other techniques. TVL is the clearest evidence of exactly where the income movement is.

AMM vs. ADM: How “delicious” is AMM Solana?

If picking the most normal design and style for a DeFi ecosystem, it can be certainly AMM. As Mr. Vu Tran – Crypto Instant Noodles Community Administrator – shared in Crypto Lighthouse No. five: “Game of Thrones” involving ecosystems that:

“AMM is like a marketplace in an ecosystem. If you want to know how that ecosystem develops, you have to see how the marketplace develops, how large or little it is, how practical it is … “

With Solana, the principal Mutual is Raydium (RAY). In quick, Raydium is Uniswap or Sushiswap on Solana.

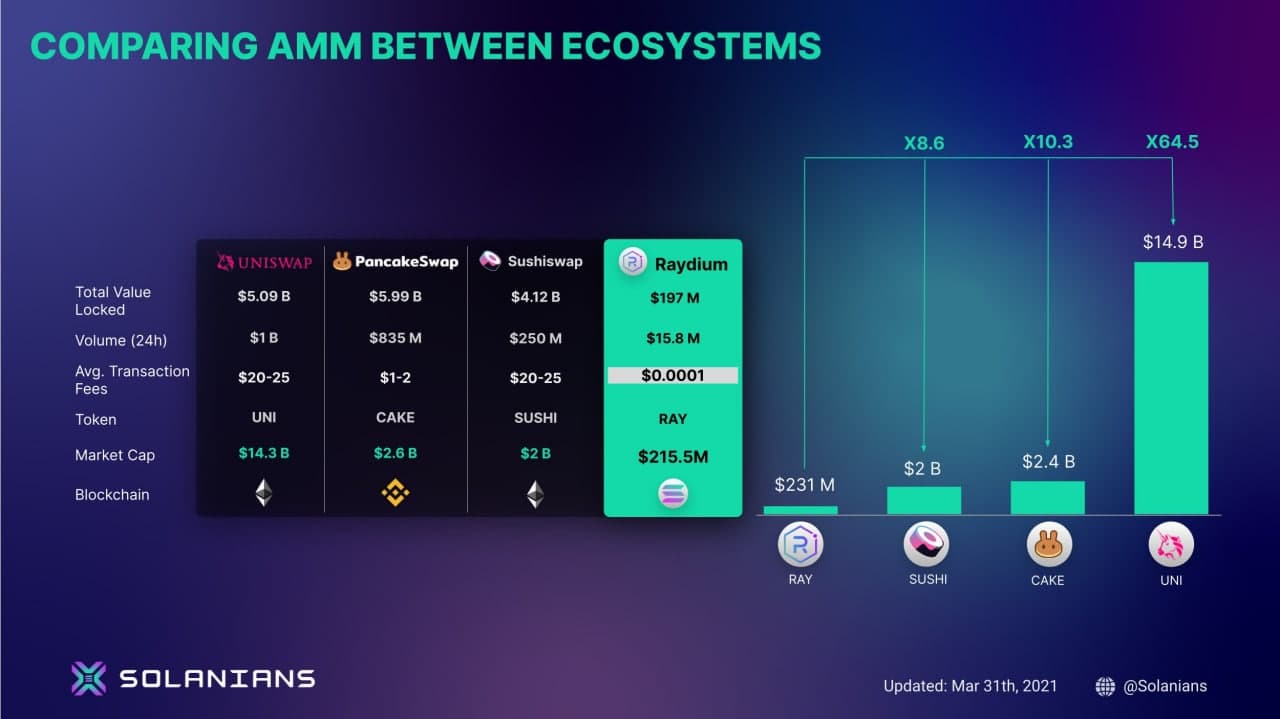

And right here are the benefits of the AMM comparison involving the Solana, Ethereum, BSC techniques:

From the comparison table over, it can be witnessed that Raydium has only one particular benefit, which is the lower transaction costs. And TVL – consumer revenue movement, tasks in AMM – or transaction volume is just like “going up in the bucket” in contrast to Ethereum’s AMM or BSC.

finish

Solana’s most significant promoting level are undeniably lower commissions and rapidly speeds. These two elements alone can “eat” the present blockchain scaling issues.

However, what Solana has finished seems to be also little in contrast to her benefit of “standing on the shoulders of giants”. Abundant capital for what? Do you have fantastic assistance to do? When what the Solana ecosystem can do is nonetheless almost nothing outstanding.

Solana probable. Right! But it can be nonetheless also early for this kind of winged compliments …

Jane

Maybe you are interested: