News company investigation report Forbes has claimed that Binance may well have exaggerated the good results of its 2017 BNB coin ICO, revealing that the exchange distributed significantly significantly less to traders than advertised.

Second investigative report belongs to Forbes published on October five, 2023, Binance founder and CEO Changpeng Zhao started conceptualizing BNB and the asset’s whitepaper in June 2017.

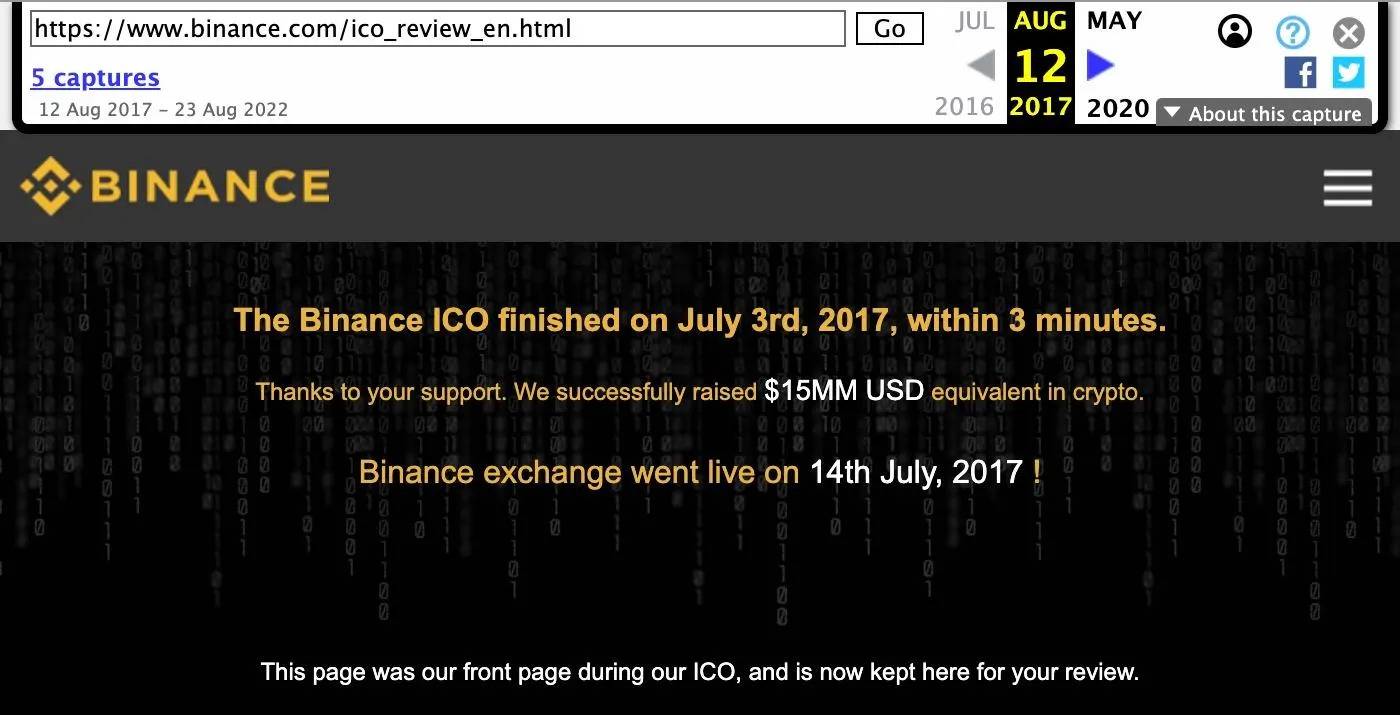

By July 2017, Binance finished the ICO (Initial Coin Offer – the very first issuance of a coin) for BNB. At that time, CZ announced that the providing was profitable with raising $15 million, the common price tag of one BNB at that time was $.15.

A @ForbesCrypto evaluation driven by @eltrade of Binance’s BNB wallets demonstrates that although one hundred million BNB tokens had been earmarked for Binance’s ICO, traders acquired no extra than ten.eight million in assets. In contrast, angels obtained forty.one million, double the anticipated volume: https://t.co/Hl6JLMApKy

— ForbesCrypto (@ForbesCrypto) October 5, 2023

Binance’s whitepaper announced that the complete quantity of BNB minted is 200 million tokens, of which:

- 80 million BNB to Binance and its executives

- twenty million BNB for angel traders

- one hundred million BNB for ICO traders.

However, in accordance to the survey, the real assignment is a unique story. As a consequence, ICO traders obtained right after one particular 12 months ten.78 million BNB as an alternative of one hundred million BNB – somewhere around one/ten of the volume of BNB they need to have obtained in accordance to the announcement.

Since then, it has been recommended that Binance only raised $five million for the ICO, as an alternative of $15 million.

On the other hand, angel traders obtained double the allocation: forty million BNB as an alternative of the twenty million BNB announced.

In summary, report Forbes raises suspicion that Binance may well hold a massive volume of BNB, which include unallocated tokens plus 80 million of its personal BNB:

“All the suspected Binance wallets we have listed hold 63.one million BNB well worth $15.seven billion. Combined with the acknowledged wallets, Binance controls 116.9 million tokens well worth $27.three billion of bucks.”

Forbes analyst Gray Wolf concluded:

“The discrepancy between what is stated in the white paper and actual on-chain trading volume, combined with conflicting documentation on the ICO timeline, paints a confusing picture.”

New revelations about Binance’s ICO are raising inquiries about the accuracy and completeness of massive organizations’ corporate reporting. At the identical time, it highlights the important function of blockchain technological innovation in enhancing transparency and trustworthy accountability in the cryptocurrency market.

Readers can read through the thorough investigation report from Forbes Here.

BNB has a marketplace capitalization of $33 billion and is the fourth biggest cryptocurrency in the globe right after BTC, ETH and USDT. The coin is priced at 211 USD, total not also impacted by the report.

Binance declined to reply to Forbes’ investigation.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!