Japan grew to become the very first financial powerhouse to introduce particular laws and necessities for stablecoins, highlighting the investor safety factor.

To stick to BloombergThe Japanese National Assembly on the morning of June three authorized a bill to clarify the legal standing of stablecoins, basically recognizing them as digital currencies. The law necessitates that stablecoins issued in the land of the growing sun be backed by Japanese yen or one more legal currency and offers holders the proper to be redeemed at encounter worth. The law will enter into force one yr from the date of its adoption.

BREAKING: Japan approves a bill that clarifies the legal standing of stablecoins and enshrines investor protections, one particular of the very first significant economies to do https://t.co/Hn2YydGip5 pic.twitter.com/UX3fW4o8F6

– Bloomberg Crypto (@crypto) June 3, 2022

The definition over signifies that stablecoins can only be issued by licensed banking institutions, income transfer institutions and money believe in organizations.

However, the law does not mention any of the well-known stablecoins on the cryptocurrency market place nowadays this kind of as USDT, USDC, or algorithmic stablecoins. Even existing Japanese cryptocurrency exchanges do not listing these stablecoins.

The Japan Financial Services Agency, the country’s money regulator, is also anticipated to introduce laws governing stablecoin issuers in the coming months. Currently, only the biggest Japanese financial institution, Mitsubishi UFJ, has announced ideas to produce a stablecoin to encourage solvency.

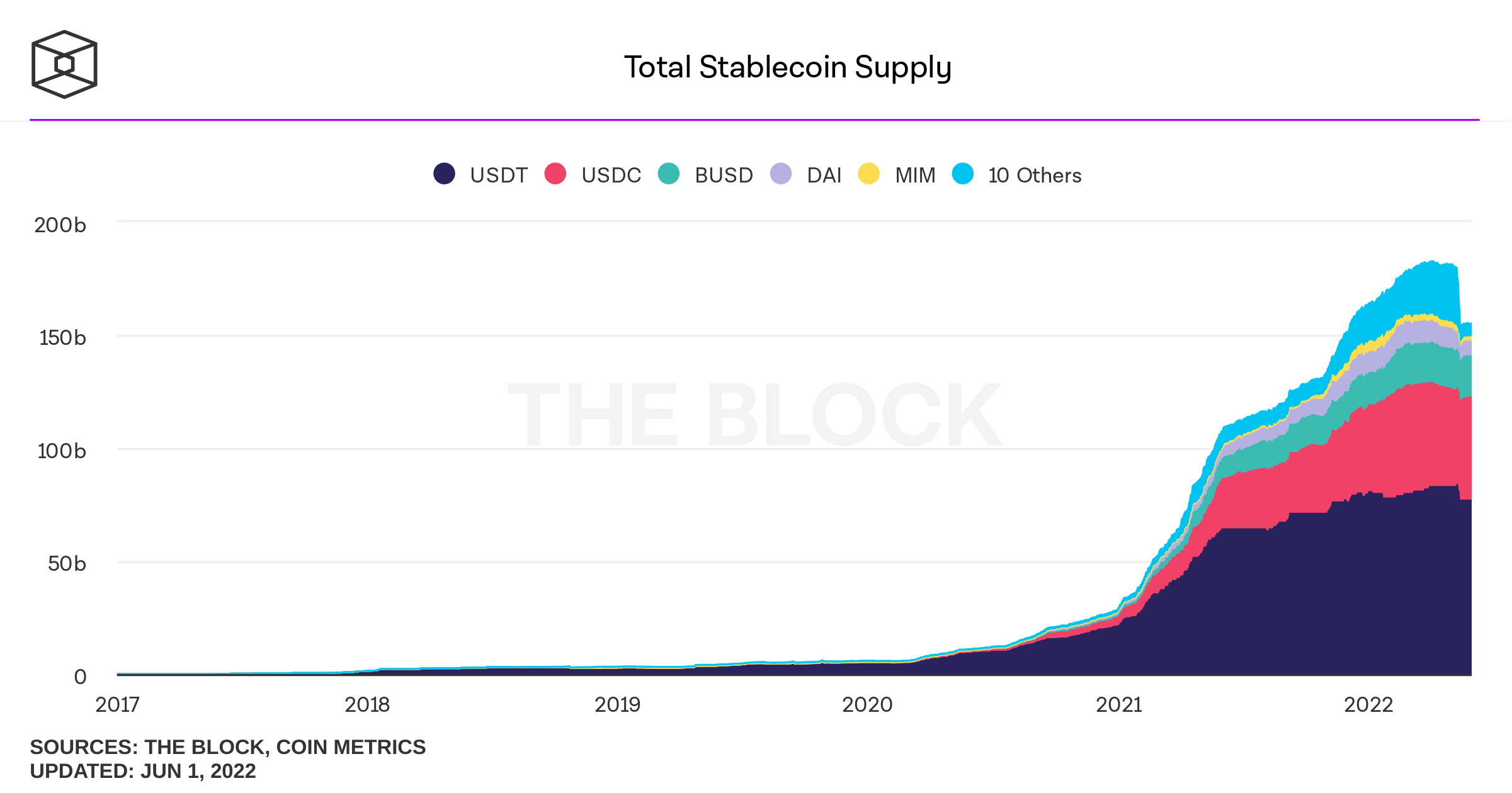

Governments in a lot of nations about the planet are paying out a lot more and a lot more interest to the development of the stablecoin sector, which has excellent threat possible, most evident as a result of the collapse of the TerraUSD (UST) algorithmic stablecoin in May, building a symbiotic impact on a lot of other tasks. of steady currencies and leading to hefty losses to a significant variety of traders.

At the starting of May, prior to the UST collapse, the complete capitalization of the stablecoin array was more than $ 181 billion, but as of June two, only $ 155 billion remained.

Synthetic currency 68

Maybe you are interested: