JPMorgan is establishing a blockchain-based mostly digital currency to pace up and decrease the price of global payments.

JPMorgan develops a new token, utilised to send revenue out of the method. Photo: Reuters

JPMorgan develops a new token, utilised to send revenue out of the method. Photo: Reuters

Second Bloombergthe historic American monetary companies firm JPMorgan Chase & Co. are making a new digital currency, aims to accelerate and optimize transaction costs for buyers.

JPMorgan is in the early phases of exploring a digital escrow token that could be utilised to pace up cross-border payments and settlements https://t.co/GVL54Lj44f

— Bloomberg (@enterprise) September 7, 2023

Unlike JPM Coin, the new token functions very similar to stablecoins and CBDCs, to send revenue to off-method banking institutions or for crypto securities.

Another supply stated JPMorgan has finished most of the infrastructure necessary for the task, like the warehousing facility, but it could not proceed ahead of approval from US authorities. If accredited, the organization could roll out the task to enterprise-degree buyers inside the up coming yr.

This is regarded as an understandable move, as the giant partnered with the Monetary Authority of Singapore final yr to check a deposit token payment method. Umar Farooq, CEO of web3 at JPMorgan Onyx when shared:

“JPMorgan will continue to develop blockchain solutions for financial services and see it as the next step in the evolution of digitization in commercial banking.”

JPMorgan is 1 of the couple of banking institutions that opened up to blockchain early sufficient. From the launch of JPM Coin in 2019, to serving buyers who shell out in euros thanks to the technological innovation of JPM Coin.

The over constructive info is probable the driving force behind Bitcoin cost to recover somewhat this morning (September eight). The king coin jumped to the $26,445 mark, though altcoins did not react obviously.

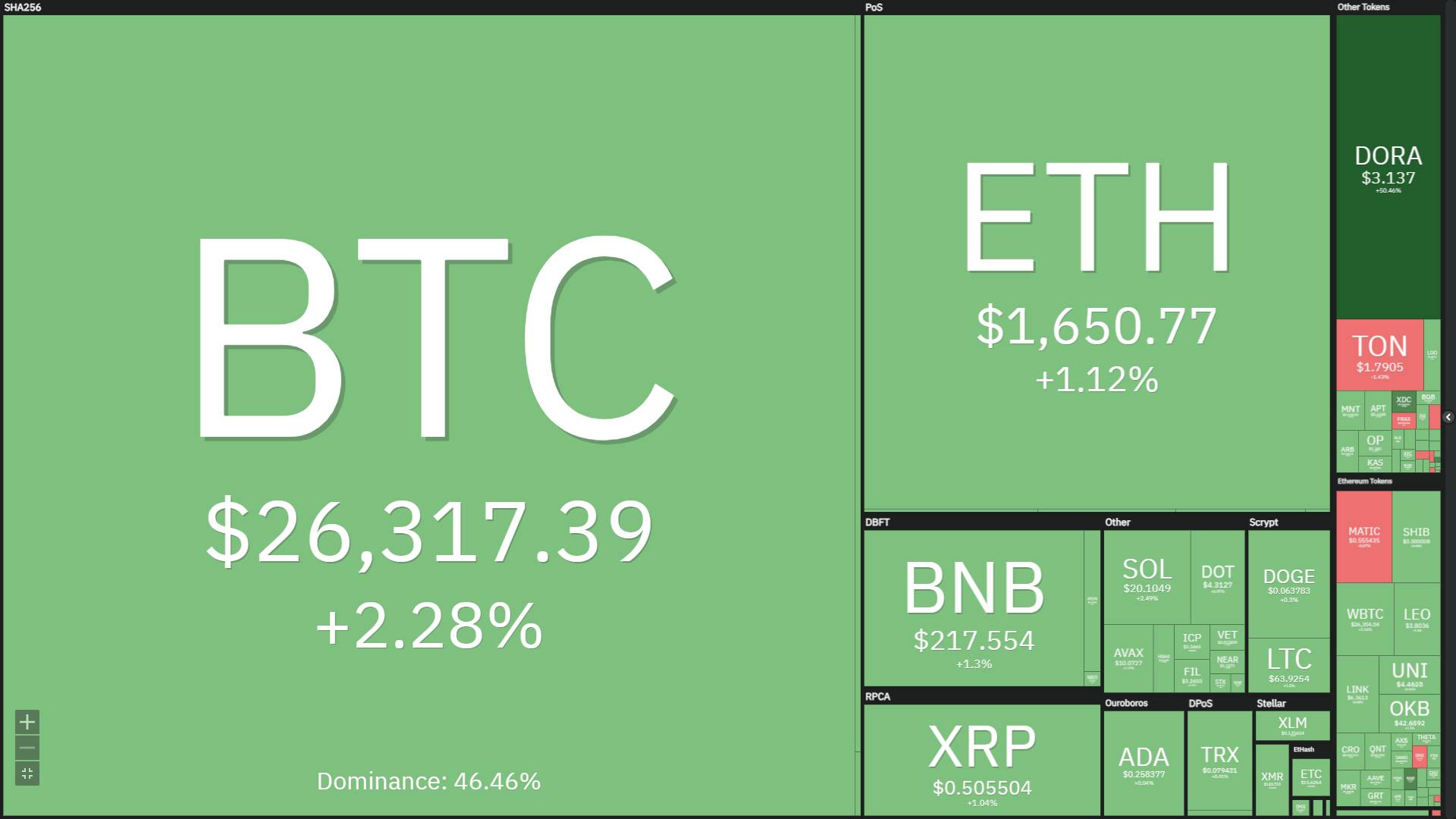

Cryptocurrency marketplace fluctuations at 08:forty on September eight, 2023. Photo: Coin360

Cryptocurrency marketplace fluctuations at 08:forty on September eight, 2023. Photo: Coin360

However, JPMorgan’s new initiative not only expands the blockchain remedy but also increases competitors for stablecoin issuers. Another significant player that has not long ago joined the race is PayPal. The fintech company launched its stablecoin PYUSD in early August, taking on rivals that dominate the US marketplace, this kind of as Circle. And quickly right after, the organization behind USDC expanded the scope of its stablecoin to six new blockchains.

Coinlive compiled

Join the discussion on the HOTTEST difficulties of the DeFi marketplace in the chat group Coinlive Chats with the administrators of Coinlive!!!