The Juno blockchain (JUNO) venture developed on the Cosmos platform is starting to be a scorching subject in the cryptocurrency local community due to the new phase of “self-destruction”.

Drama among Juno and the Japanese “whale”

Juno (JUNO) is a clever contract development protocol for the Cosmos ecosystem, launched in 2021.

In February 2022, Juno performed an airdrop of his JUNO token to the holders of the Cosmos ATOM token. Specifically, people who stake ATOM tokens on Cosmos Hub will acquire JUNO with a ratio of one: one. The Juno advancement staff has set the greatest airdrop restrict for every single wallet at 50,000 JUNO to avoid the token from currently being centralized by a couple of consumers.

However, Juno’s staff did not consider into account the truth that a “whale” with several wallets could acquire a huge sum of tokens. This is specifically what occurred when Takumi Asano, a 24-12 months-previous Japanese cryptocurrency investor, obtained an airdrop of much more than ten% of JUNO’s complete provide, well worth in excess of $ 120 million at the time.

Most notably, Asano is the head of CCN, a Japanese cryptocurrency investment local community with in excess of 50 ATOM staking portfolios by members. Answer the interview CoinDesk, Asano claims he obtained a believe in from his local community for the ATOM web site and split it into 50 wallets “for security reasons”. He announced that he would distribute JUNO to members primarily based on their contribution price.

Realizing that their fledgling network would quickly be concentrated in the hands of the “whales”, the local community of Juno in March initiated Proposition sixteen, a proposal that necessary the confiscation of Asano’s money and the reduction of only 50,000 JUNO in the portfolio of this investor equals the greatest you can acquire. Juno then authorized the proposal with forty.85% in favor, 33.75% towards, 21.79% abstention and three.59% towards with a veto.

What occurred subsequent manufactured the problem even much more puzzling. Also in March, the Juno network was attacked and blocked for quite a few days, resulting in the rate of JUNO to drop by much more than 60%. Asano then claimed that it was Juno’s advancement staff that launched the token to reduce the rate in buy to divert interest from his proposal to confiscate the token.

【The principal lead to of Juno’s rate drop just after Prop16】

Why did Juno’s rate drop from Prop sixteen?

Is it simply because CCN is marketing?

– No, we did not even promote one JUNO from Prop sixteen.So who sells?

– @wolfcontract .https://t.co/Lki8PTzrX9– Takumi Asano (朝野 巧 己) | GAME ⚛️ | Juno Whale🐳 (@takumiasano_jp) April 27, 2022

However, on April thirty, the local community of Juno continued to approve Proposition twenty, identifying the time to confiscate the Juno of Asano on May five, 2022, with mind-boggling help of up to 70%.

Proposal twenty stated that just after negotiating with Takumi Asano, Juno’s staff recognized that the nature of CCN is a cryptocurrency services and not an investment fund, so it does not meet the problems to acquire the airdrop. The proposal for that reason closed the likelihood of confiscating all tokens in Asano, leaving only 50,000 JUNOs.

The story of the blockchain really hard fork reverses transactions

The blockchain really hard fork to cancel a transaction is not unusual, the most well-known currently being the 2016 Ethereum (ETH) The DAO Hack occasion. At that time, the Ethereum DAO contract was breached and taken by hackers, investing three.six million ETH, equivalent to 31% of the ETH of the DAO organization. That ETH is now well worth much more than $ eleven billion. Because the injury was so fantastic, Ethereum made a decision to really hard fork the blockchain to reverse the transaction and get the income back from the hacker.

However, portion of the local community disagrees with the over technique, stating that “The code is law” and are not able to be transformed as this kind of, top to the birth of Ethereum Classic (And so on), the blockchain on which The DAO Hack occasions nonetheless take place. The identity of the hacker was not exposed till 2022.

Asano declares that his act of obtaining the tokens is totally legitimate and states that CCN is a actual local community, the project’s lure to the local community to consider away his tokens is an abuse of electrical power when in actuality all his actions do not violate any legislation and also do not assault the venture. Therefore, this “whale” threatens to consider legal action dependent on the subsequent move of the venture.

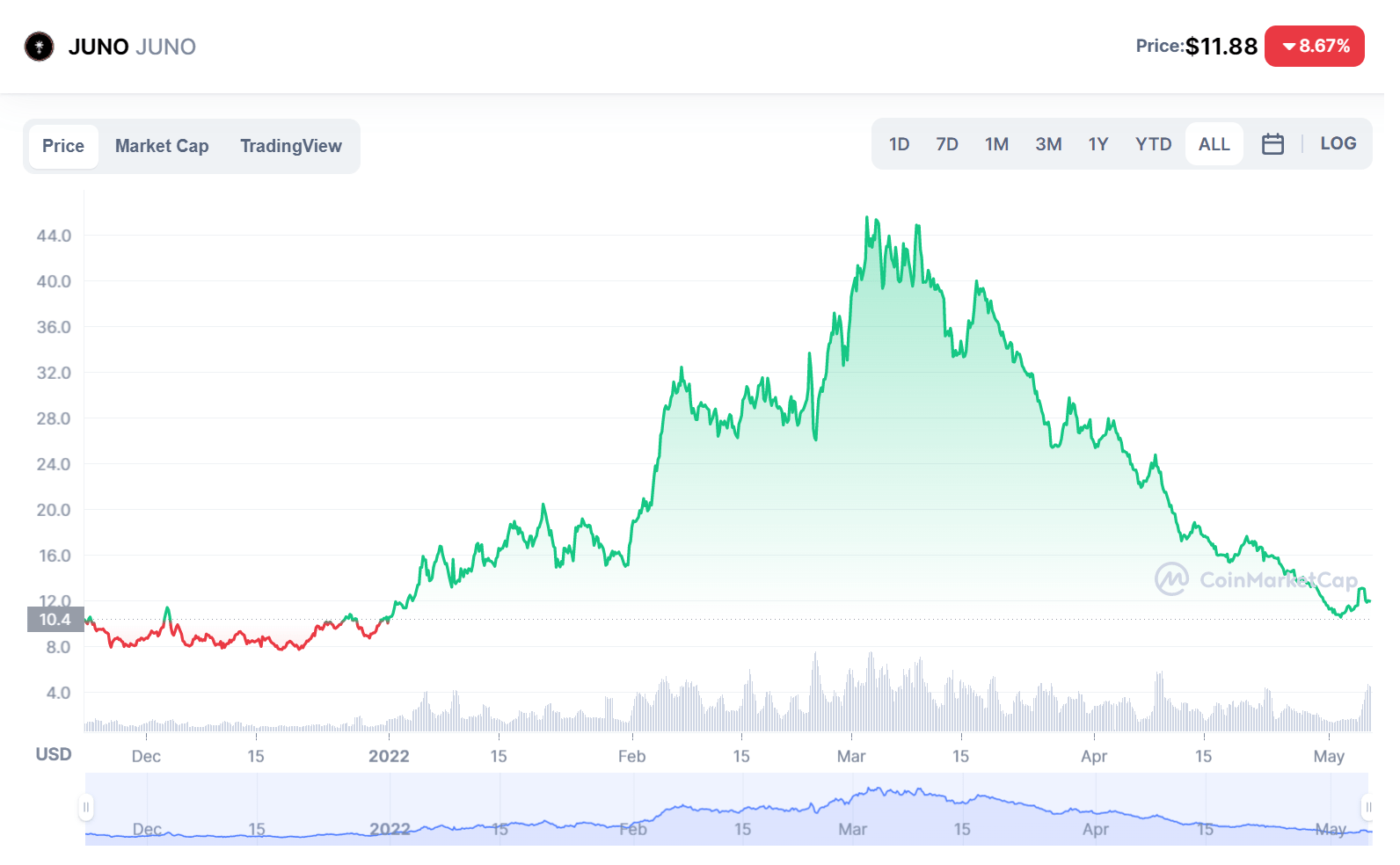

During that time, JUNO’s rate continued to drop from a peak of $ 45 to all over $ eleven at press time, and the $ 120 million Asano token is now only well worth all over $ 36 million.

Copy-paste error manufactured $ 36 million JUNO “go underground”

I believed a good deal of drama was sufficient, but the Juno local community nonetheless knew how to produce much more highlights.

After approving the selection to confiscate the token, the venture performed a blockchain really hard fork on May five. However, just after the update was implemented, the advancement staff did not see the income from Asano’s wallets transferred to the handle they specified, whilst Asano’s wallet had currently been deducted.

After some checking, they had been shocked when they observed that rather of copying and pasting the obtaining wallet handle into the update code, they pasted the incorrect transaction hash. As a consequence, the other $ 36 million well worth of tokens was sent to “nothing”.

– Takumi Asano (朝野 巧 己) | GAME ⚛️ | Juno Whale🐳 (@takumiasano_jp) May 5, 2022

Specifically, the Juno network has up to 120 validators, which are accountable for verifying transactions and checking for updates this kind of as Proposition twenty, but none identified this vulnerability till it was also late.

Daniel Hwang, the head of Stakefish, 1 of Juno’s validators, offers an interview CoinDesk:

“We made an unacceptable mistake. It is true that programmers may have faulty code, but in the end it is the validators who are responsible for verifying the lines of code we launch ourselves ”.

However, rather of agreeing to “burn” the aforementioned token, Juno’s advancement staff speedily ready Proposition 21, a really hard fork blockchain the moment once more to reverse the transaction by sending income into thin air to the project’s wallet.

Synthetic currency 68

Maybe you are interested: